Buy AbbVie shares in Pakistan

AbbVie, a global health and wellness company, is led by an innovative management team. John Whitacre is chief executive officer. He was an executive at pharmaceutical company AstraZeneca and has a combined MBA and MS in pharmaceuticals. Bruce Blum is CEO of AbbVie. He has also held positions at Merck & Company and J.P. Gates.

AbbVie's primary driving forces are broad growth opportunities in markets around the world. AbbVie develops its products based on the latest advances in nutritional science and uses a number of strategies to achieve results. The company derives most of its revenue from the sale of products and services, and the rest from the firm's recognition and proven track record in nutritional supplements and health care. AbbVie continually makes adjustments to improve profitability.

In terms of breakeven, AbbVie offers moderate to strong profit potential. The company offers five different products. Each product has its own sales channel, which helps drive sales through multiple channels. The company has a solid portfolio of marketable products and is successfully developing new products in the food and supplement groups. Although the growth prospects for these products are modest, AbbVie intends to maintain its leadership position in the industry.

How to invest in AbbVie shares in Pakistan?

Let's start at the beginning and understand what a stock is and what its purpose is. Why invest in company stock and what is the difference between an investor and a shareholder?

Stocks are securities that give their owner the right to a stake in a business. If a stock rises in value, the income that can be earned from its sale increases. A shareholder, in turn, is the owner of the stock; the person who owns the stock and enjoys all the rights arising from it.

Investment is the investment of funds in any object in order to obtain a commercial profit. Investors, on the other hand, are people who invest their own or borrowed money in a project under their entrepreneurial responsibility.

As you may already know, there are many options for investors who want to participate in foreign equities. However, if you are looking for an opportunity that will not require you to travel abroad, you should consider investing in AbbVie stock in Pakistan. The reason for this is that Pakistan has a well-developed financial system that offers many opportunities for foreign investors. While it is true that many investors have made money investing in AbbVie stock in Pakistan in the past, the country itself offers great potential for investors who want to make their money work harder. This is especially true because many stocks in Pakistan are influenced by the country's economy.

Like many other countries around the world, the cost of doing business in Pakistan can be quite high. The problem with doing business here is that government taxes are quite high, and it will take a long time for an investor to make a significant profit. This is why you need to do some serious research before you decide how you want to invest. You should think about short-term investments and what those investments can lead to. Fortunately, if you are educated, you should have no trouble developing the right investment strategy.

If you are going to invest money in stocks, you need to know how to read stock market charts. You need to learn how to interpret and evaluate stock charts, especially if you are new to the market. This is especially true when it comes to investing in AbbVie stock in Pakistan. When you learn how to read and analyze stock movements, you will be able to spot trends and market developments. You will also be able to determine when the company is ready to make major changes to its balance sheet and publish its earnings results.

Regardless of how to invest in AbbVie shares in Pakistan, you should understand that this type of investment is a lot like other types of investments. You will need to do your research and understand what the market has to offer you, as well as how to interpret the trends you see on the screen. This is an opportunity for you to gain financial freedom through an effective stock market investing strategy. You must use the information you receive to determine how you will proceed with the stocks and bonds you choose.

All this undoubtedly sounds very complicated, but don't get upset early, because if you choose to invest with an online broker (trading platform), things will become much easier for you to understand.

How to choose the right online broker?

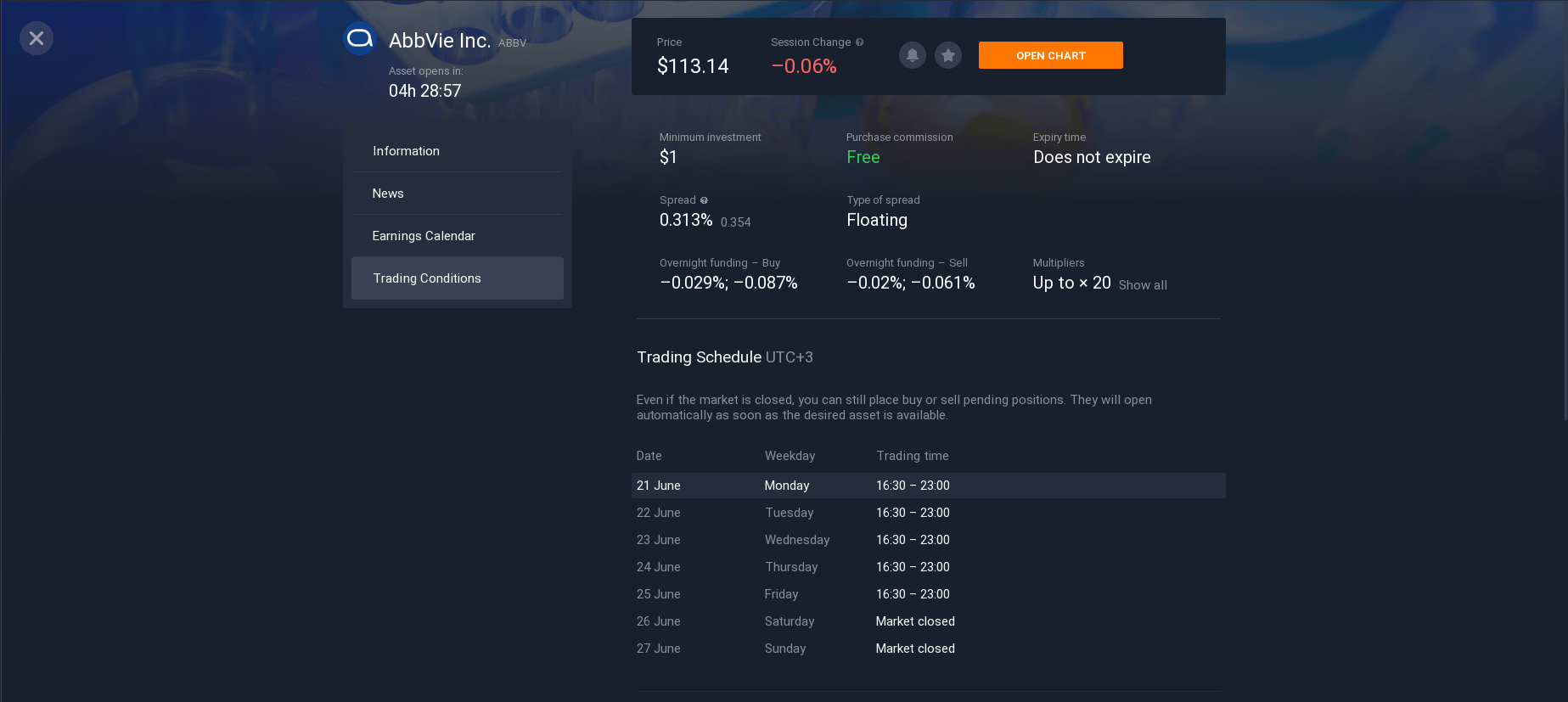

The choice of the online broker should be very responsible, because the safety of your funds in the future will depend on it. The first thing you should pay attention to is how long the platform exists, because as a rule, the longer the online broker exists, the more recommendations you can find from its customers. It's important to know that people who have already tried the platform trust it and use it for a long time.

Registration on the platform shouldn't be difficult either, you'll need to fill in the fields for your first and last name, as well as provide an email address where you'll receive a confirmation of registration. This is enough until you decide to fund your account, then you will need to follow the prompts of the system to complete the registration.

It is worth paying attention to the functionality of the platform, as your peace of mind while trading will depend on its convenience. Normally, all platforms offer you to open a demo account first, and this is very important, because the funds you are given as a demo are fictitious, you cannot deposit or withdraw them.

You will be able to use these funds in your own trading, and the advantage is that you will not have to pay them back. The purpose of a demo account is to show a new trader how the platform works. You will have unlimited time to understand the functionality of the platform and learn how to trade. That is, when you are confident in yourself and your own you can switch to a real account.

To switch to a real account you will need to make an initial deposit, every broker has a different minimum deposit amount, but it usually starts at $5. Remember that you have to start with an amount, at the loss of which, you will not feel financial difficulties in life.

You can replenish your account using any payment system, transfers from bank cards, online wallets. It's so easy, and no different from the normal transfers you make almost every day.

How to buy AbbVie shares in Pakistan?

Looking for tips on how to buy AbbVie stock in Pakistan? Want to know where to buy AbbVie stock at the lowest prices? Want to know how to start trading AbbVie stock and make a profit in no time? Now we're going to tell you everything you need to know about how to buy AbbVie stock in Pakistan and take advantage of cheap prices to increase your profits.

You already know about trading platforms, but you don't understand how to invest safely in stocks. Let's take a look at the types of analysis that will keep you from losing your funds in real accounts.

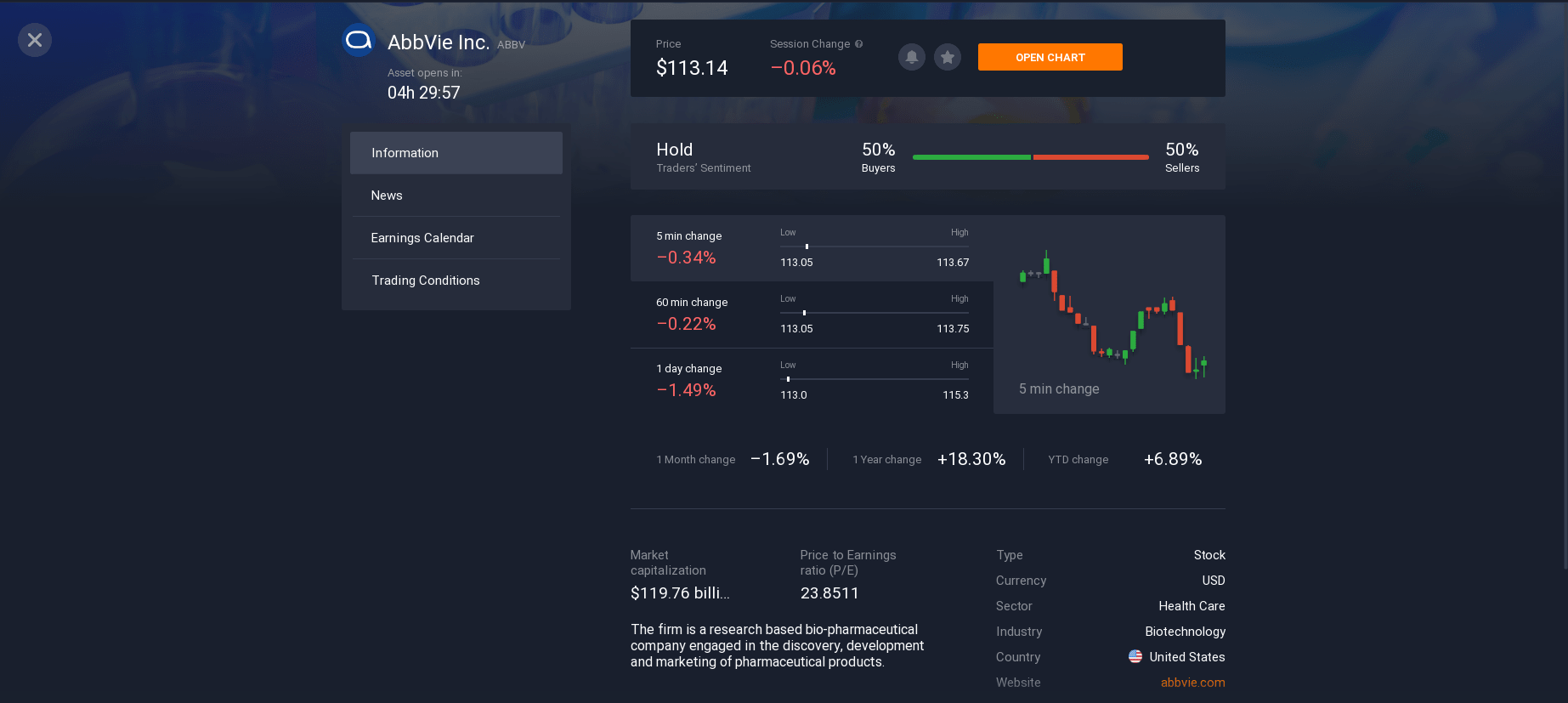

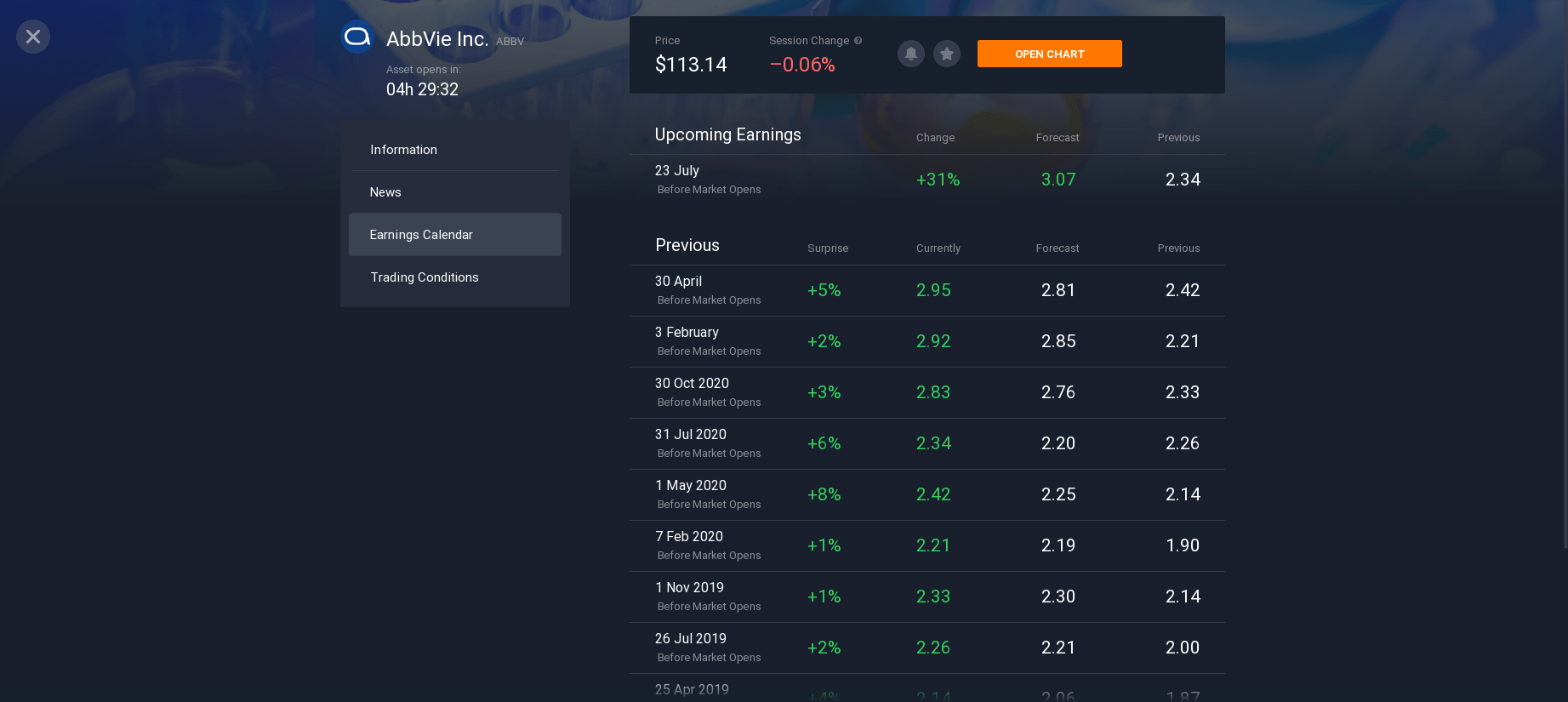

Fundamental analysis of the market is an analysis that includes studying the company's earnings information, studying news sources for financial and economic news related to AbbVie.

As of now, according to AbbVie's fundamental analysis, the company is expected to continue to generate earnings. AbbVie's fundamental analysis does not focus on the financial aspects of the business and focuses on the economics of the business as a whole. Fundamental analysis does not make assumptions or projections about changes in the company's revenues and profit margins. Essentially, it provides a fairly comprehensive overview of an organization's current operations. This includes sales and gross profit, ancillary revenues such as cost of sales, and net income, including the impact of foreign exchange rates.

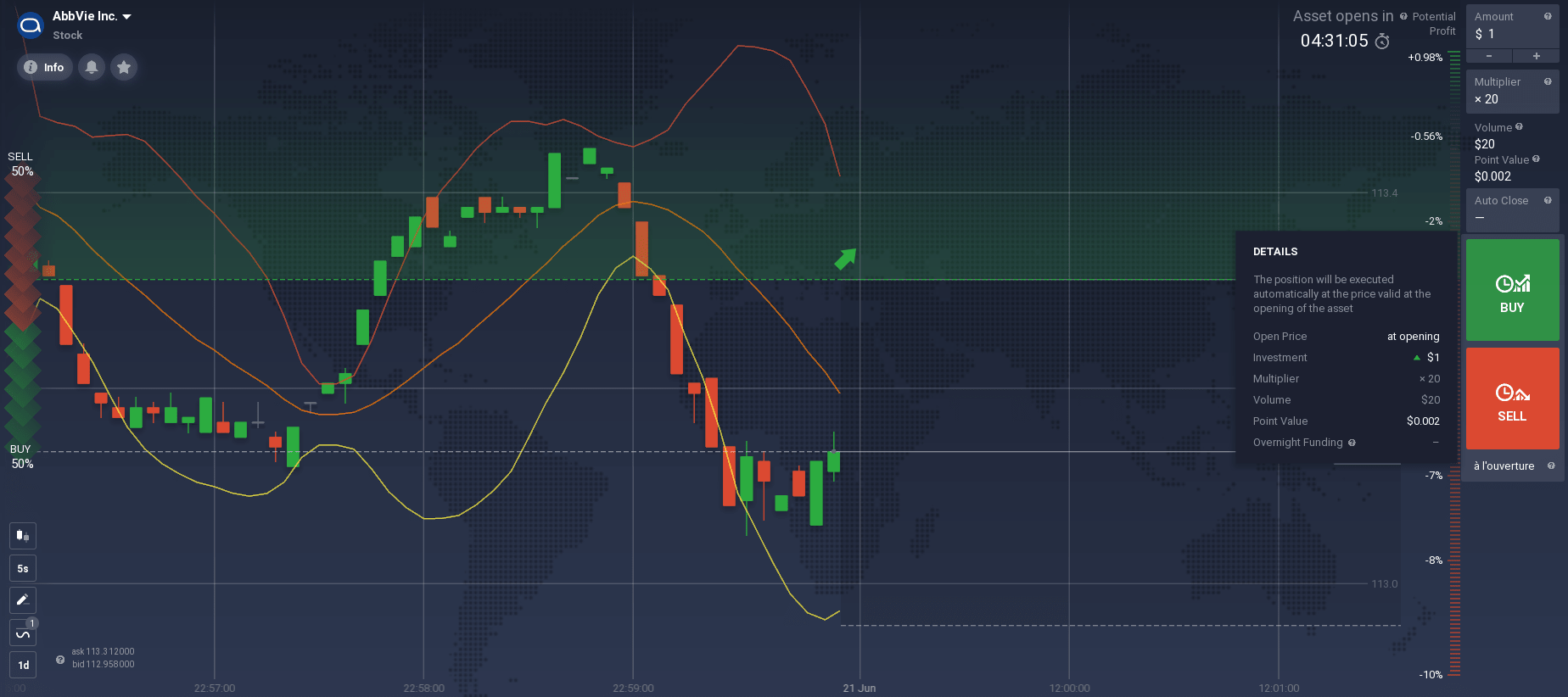

Technical Market Analysis - The study of the values that you see on your trading platform, this includes charts, indicators, etc. In general it is a set of tools that predict the probable change of price rise or fall.

Indicators are algorithms, which give an indication of future prices, using data about the quotes for a certain period of time. Indicators that are better suited for stocks are: Moving Averages, MACD, Bollinger Bands, Stochastic, RSI.

Technical and fundamental analysis aside, it is up to you to choose which type of investing suits you best:

Long-term investing is when you buy a stock and hold it for a long time. The idea is to make a profit from the sale, when prices rise. This method requires patience, because one such investment can take a year or more.

Short-term investing is the price difference between buying and selling. That is, you buy a stock and at the time of a sharp jump in price you sell it in order to get a small difference, such transactions can be made an unlimited number of times during the trading day. That is usually the first place to start investing for a first-time trader.

On the platform you can also find training videos and a lot of educational material on trading. If you are interested in other promotions, you can read the relevant articles from the online broker. So go ahead and try your hand at this new business! Include your head and trade, you will definitely succeed!