Advanced trading platform in Pakistan

The 21st century will go down in history as a period of technological boom. The introduction of new technologies and the rapid development of the internet is opening up new models of information exchange and new options for cooperation.

Technology has penetrated every sphere of life. Online shopping, online ordering, online courses and schools have appeared, offline communication has replaced online communication by two thirds.

It has also become possible to invest online. Trading has opened the door to the big world of investing to everyone, making it possible to start with a minimum amount and to make all investment transactions from the comfort of your home.

To invest online, you need an online trading platform.

Modern trading platforms are not just programs with the ability to buy or sell an asset. As brokers compete for trading clients, they are constantly improving the trading software they offer and adding more and more options and features.

A modern advanced trading platform is an entire online system, which gives you full access to all possible financial instruments and also provides powerful and convenient tools for market analysis and trading operations.

For beginners, such trading platforms allow you to learn online, providing access to free video lessons as well as free practice on a demo account.

Consider all the benefits of working on an advanced trading platform in Pakistan.

Choose an advanced trading platform

A trading platform is trading software developed by a brokerage company and made available for you to use. So when choosing a platform, you should first choose a broker. Do your research on the brokerage market in Pakistan and read the reviews of experienced traders. Choose only among licensed brokerage companies with good experience in the online investment market and impeccable business reputation.

Familiarize yourself with the platform's offered functions and the range of instruments, and inquire about the assets the broker operates with and the limits on transactions. Ask about the size of the commissions. If the trading platform suits you, register and begin a detailed study of the platform. Below is a step-by-step guide on how to register and open demo and live accounts. We will also look at why certain features are important and what advanced platforms offer extra options.

Create a user profile

Creating a user profile is identical on almost all trading platforms. To do so, you should visit the broker's website, activate the "register" button and fill in a simple questionnaire. The questionnaire contains just a few lines, asking for your username and your e-mail address. Fill in your details, sign the agreement in the special field to confirm you are 18 years old and agree to the Terms & Conditions and Order Execution Policy, select your country and click "Open a free account". The system will automatically send you an email with a link to confirm your registration. Follow the instructions in the email, and confirm your registration on the platform.

Creating a profile is quick and easy, does not require much technical knowledge and does not take much time.

You can use your browser or you can download an app to trade. If you register through your browser, you should register only through the official broker's website. If you download the application to your device, use only the official playmarket on your device or the link to install the programme from the official website of the broker. Do not use links from unknown websites and internet pages to avoid fraud by third parties.

When registering, make sure you have entered your country correctly as it is important for the correct crediting of funds to your account.

Advanced trading platforms also allow you to register using your social media profile. You will find the relevant registration shortcuts at the bottom of the registration page.

Open a training account

After logging in, the system will prompt you to open two account options, a real account and a demo account. A demo account is a training version of a real account, with which you can practice trading for free by making test transactions. For this purpose, the demo account will be credited with a certain amount of dummy funds, which you can safely use for test operations. Of course, you will not be able to withdraw this money, but you will not have to give it back if a test transaction is unsuccessful.

Try to buy this or that asset, open an option deal, use different tools for trading, try to connect an indicator or several indicators, enable the leverage function and so on.

Make test operations, analyze the obtained results, draw your own conclusions.

Demo account helps to get acquainted with all the functions of the platform in action, and to develop your own trading strategy.

Advanced trading platforms have allowed full access to all functions of the platform from the demo account, as well as the display of real quotes, which allows you to get real experience in test transactions. There is no time limit on using the demo account. Moreover, you can use the demo account in parallel with the real one, simply by switching between accounts. This is handy when you want to try a new trading method or invest in a new financial market.

Activate a real account

Real account - real trades. Therefore, you will need real money to fund your real account in order to activate it. How to fund your account?

Advanced trading platforms offer several options for funding your account, with the most popular method being the use of a bank payment card. Also, you will be able to use one of the available online payment systems.

If you have not found the desired payment system in the offered list, please check in your profile settings, if your country is correct. This is important to see the available payment systems correctly. If the country is incorrect, please contact the technical support chat, asking to correct it.

Advanced Trading Platforms cooperate with reputable and reliable payment systems, providing you with good service, fast processing and ensuring the safety of your funds.

Study the list of available assets

By choosing an advanced trading platform, you will gain access to trading a variety of financial instruments. Modern trading terminals provide access to such financial markets :

- Stock market. Speculate on the share values of the world's most renowned companies by trading CFDs;

- Currency market. Forex is the most volatile market that allows you to trade 24/7;

- Crypto-currency market. Invest in new generation currency by choosing well-known crypto assets;

- Binary options. Predict asset price movements and make up to 90% profit on every trade;

- Commodities. Invest in gold, oil, platinum;

- Diversify your profits by investing in ETF funds.

Advanced trading platforms provide complete and up-to-date information about each asset, as well as the ability to open multiple trades by selecting one or more different financial instruments. The handy platform menu has a "total portfolio" tab, which you can activate to see all your active trades. Also, thanks to the flexible settings of today's advanced trading platforms, you can view multiple trades simultaneously by opening as many windows as you like on your desktop.

Analyse the market using advanced trading platform tools

In fact, a trader's main task is always to correctly predict how prices will behave in the market.

Advanced trading platforms offer quality analysis tools, which help traders to understand major trends and possible trends. Traders use both fundamental analysis and technical analysis, or sometimes a combination of both.

Fundamental analysis covers all of the factors that influence the value of a particular asset. It takes into account the latest news, financial statements, management structure (if it is a stock), industry and more. The goal is to determine the factors that influence the value of the asset and to understand whether the asset is over- or under-valued. It is most often resorted to by investors in long-term positions.

Technical analysis uses price charts, patterns, indicators and trends to predict how an asset will move in the near or distant future.

The value of stock assets changes constantly during trading sessions, so an understanding of upcoming price movements is essential to profit. Traders use both types of analysis to identify trends and predict future price movements.

Advanced trading platforms offer built-in indicators for technical analysis, as well as a newsfeed and economic calendar for fundamental analysis. You can use one or more indicators in any combination - the program's easy to use settings allow for this. You can also customise the display of the news feed on the desktop to ensure that you don't miss important events affecting asset prices.

Use convenient trading tools

Advanced trading platforms offer convenient trading tools for quality trading.

Stop orders are particularly popular with traders.

A stop order (or stop bar) is an instruction to the broker to automatically close a trade when certain price limits are reached.

You determine and set these limits yourself based on your trading strategy. Once these limits are reached, your trade will be closed automatically.

The most commonly used types of stop orders are stop loss and take profit. Stop Loss is used to indicate the lower price level at which you wish to close the trade. Using a stop loss order protects your trade from too large a loss in case the price of an asset drops. Take Profit is used to indicate the upper limit of the operation, i.e. the maximum value of the asset, at which the transaction will be closed. Take Profit helps to "catch" the forecasted short-term jump in the price of the asset and, thus, not to miss a profit.

Advanced trading platforms are also equipped with a multiplier feature, which includes a leverage action. All you have to do is select the multiplier factor and activate it. Using leverage increases the amount of your investment and helps increase your profit potential. But, at the same time, there is an increase in risk, so make sure you understand exactly how leverage works before using this option.

Additional benefits of advanced trading platforms

Among other things, advanced trading platforms offer flexible settings which allow you to easily customise the trading software to your needs by choosing the screen colour, the type of charts, the number of windows displayed on the screen, the types of alerts, the sections displayed on the screen and even the keyboard shortcuts for quick execution of certain commands.

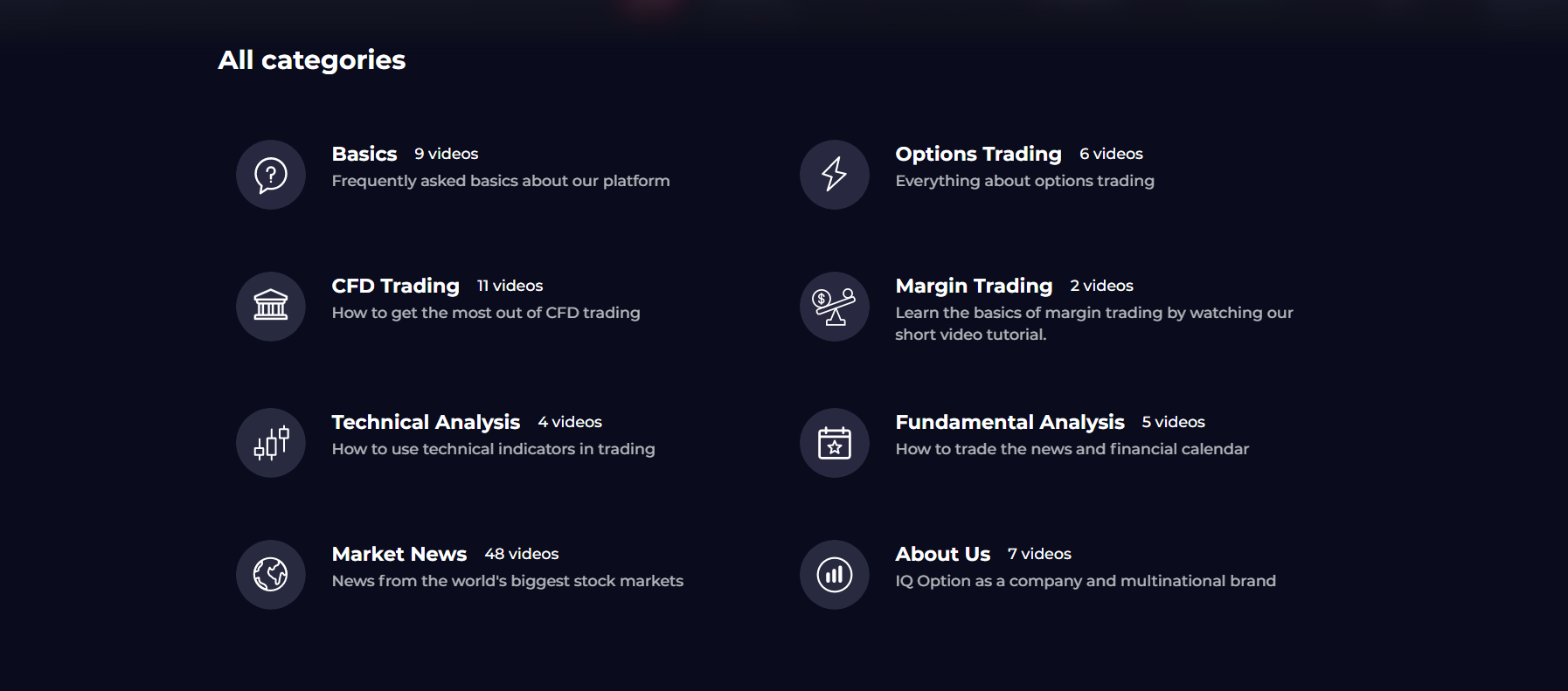

Advanced trading platforms can also help you learn, as on these platforms you will find entire sections with tutorial videos. You should study these lessons and test the theory on a live demo account. This will help you understand the ins and outs of online trading faster.

On advanced platforms, there's an online chat room, where you can chat with other market participants. Sharing practical information, tips on trading will be useful for every trader, especially for beginners.

Of course, the technical support service on such platforms is available 24/7 and there is an opportunity to choose a comfortable language.

If you choose an advanced trading platform, you are opting for a comfortable working environment, security and a guarantee of easy withdrawals in case of successful trades.

Sign up for an advanced trading platform in Pakistan, open a demo account and experience the benefits of high quality online trading!