Best stock trading platform in Pakistan

Innovation and modern technology are constantly changing the world. Whereas just a few decades ago, simply communicating online was an unusual novelty, now we study online, work online, order flowers, food, taxis, etc. online, book hotels and do business online.

Innovation has affected all areas, including investing. The modern investment model eliminates the need to visit the stock exchange, the offices of the company in which we plan to invest, and the need for endless face-to-face meetings with a broker, each of which is time-consuming and forces us to reconcile our schedule with the schedule of the intermediary.

Instead, the modern investment model is a very convenient online investment platform, which is provided to you by your online broker. You also have the option of choosing your broker online. With online investing, you get the completeness and accessibility of information about the company you are considering for investment: current stock price, price fluctuation charts and so on - no need to make any official requests for such information now, you will have access to it at any time of the day or night. Online platforms allow you to analyse the market by company, selecting any time period for analysis, and open up many new markets for investing that were not available before, such as the cryptocurrency market or the ETF market.

What is an online trading platform? It is a fully digital product, a software that gives you full access to the stock market online and through which you can trade online from wherever and whenever you like.

Trading is now extremely popular around the world, so competing brokerage firms providing their intermediary services online are practically competing with each other for clients by providing a convenient service and a wide range of trading tools.

Market experts highlight several key points to look out for when choosing an online stock trading platform. These include:

- Uncomplicated registration process;

- The possibility of using a demo account for training purposes;

- Availability of free video tutorials;

- Access to complete and up-to-date information on current asset prices;

- Intuitive interface;

- Availability of tools for analysis;

- Trading tools;

- Access to historical data;

- Mobile version of the platform;

- Commission rate and transaction limits;

- Availability of technical support.

Let's elaborate on some of the points and consider how to choose the best equity trading platform in Pakistan.

Simple registration process on the platform

Despite the complex tools and operations that the online platform allows, the registration process is very simple and easy. You have probably registered many times on different internet sites - it could be social networking sites, or online shops, or perhaps some educational or informational online resources. Registering on an online trading platform is almost no different from registering on similar sites. You simply go to the homepage of the official website of the brokerage company you have chosen as your broker, click "register" and enter the minimum data requested by the system. These are usually your username and email. Once you have entered these details and checked the "I agree to the privacy terms" box, click on "Next". The system will send you a registration confirmation request to the email you specified earlier. Confirm your registration by clicking on the link provided in the email. That is all. You can now use your account.

Demo account availability

As soon as you register on the online platform, the system will ask you to open an account, a demo account or a live account.

What is a demo account? A demo account is a practice copy of a real account, a practice account into which the system automatically credits dummy funds. You can use this fictitious money for any training transactions on the platform.

Demo accounts are used to train and test your skills. If you are new to trading and have not traded before, you may find it especially useful and even necessary to try out a demo account for training and learning purposes. If you are an experienced investor and this is not your first time working with the stock market, but this is your first time using the platform - you will also find it useful to start with a demo account to get familiar with the new interface of the platform and get used to some of the operations on it.

You can use this account for as long as you like, and you can restore the amount of dummy funds in your demo account as many times as you like. A demo account is completely free of charge.

Having a practice account on the platform is a significant advantage, as the value of a demo account can hardly be overestimated, as you are practising your skills, learning, but not risking your money.

Of course, these funds are fictitious, so you will not be able to withdraw them.

When you feel ready to make real trades and take real risks, you will need to use a real account. A real account is real money, so such an account is activated by funding it with at least the minimum amount. Generally, initial deposit limits are very low, which means that even someone with a minimum starting capital will be able to try their hand at trading.

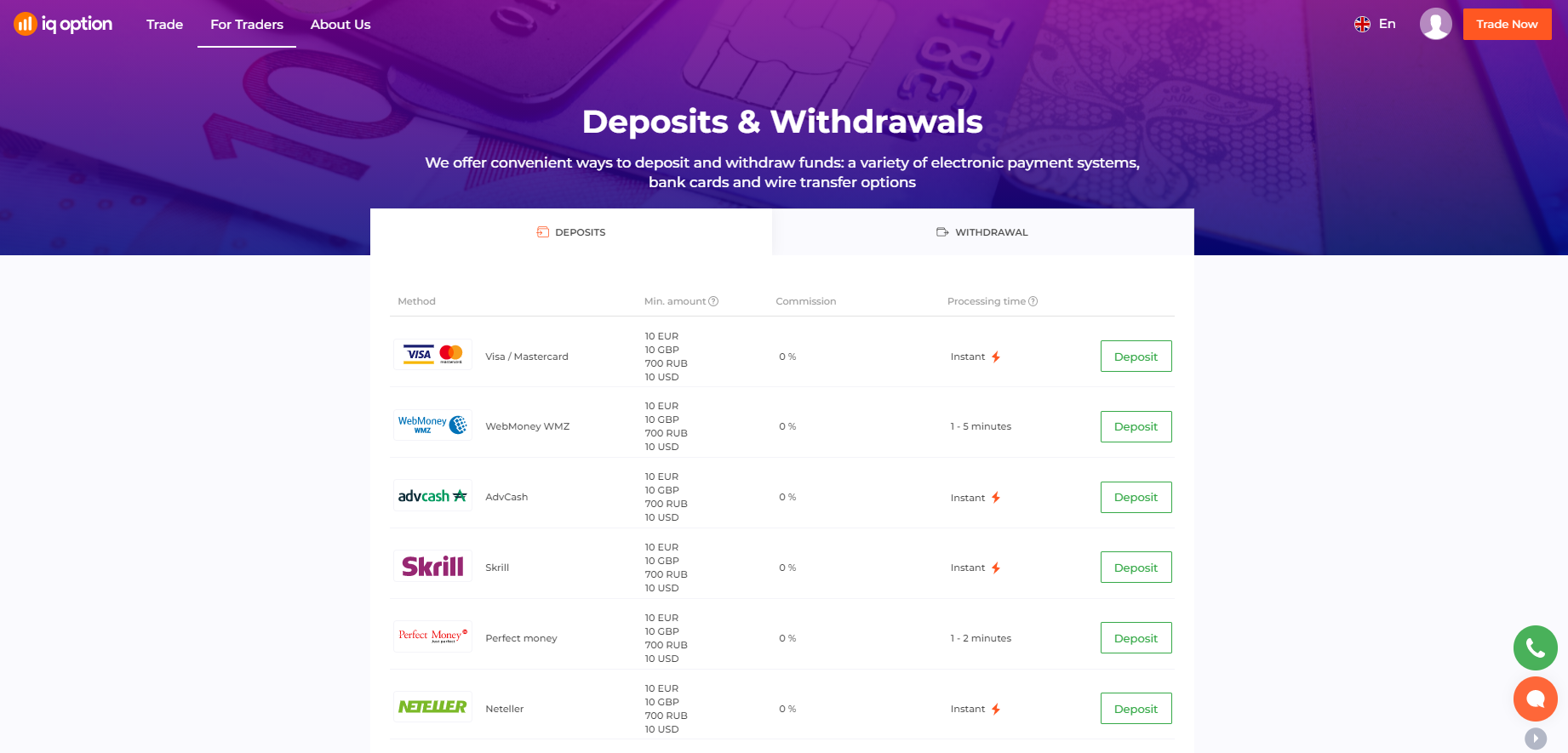

You can deposit money online, simply click on the "Deposit Funds" option and the system will automatically redirect you to the deposit section, where you will see a list of available options. The most popular way is to deposit by bank card, but you can also use popular online payment systems. Funds are almost always credited instantly, but in some cases it can take up to five banking days to be credited.

Information value

In the past, to get up-to-date information about the stock market and news about the companies in which you plan to invest, you had to constantly follow the news or visit the stock exchange, make certain requests to companies to provide access to information and study a bunch of documents. Now, thanks to a modern online platform, you have access to any data that interests you around the clock and without visiting a stock exchange or company office.

In addition to the general obligatory information on asset price, trading schedule, trading conditions, etc., the platform has a 'news' tab where you will find links to the latest news on the stock market and market participants.

The platform only provides links to verified sources of information, so these articles are worth your attention.

On the more informative side, there is also an important learning section. The platform contains a number of video tutorials, which explain and show in detail how the system works. Here you will find lessons on how to use sophisticated indicators and functions, as well as basic lessons for beginners.

Another special feature of the platform is the online chat, where you can chat with other market participants - you can either write openly or use a nickname, which is automatically generated by the system when you click on the appropriate option.

Of course, it's important to have online support - it should be available 24 hours a day so that you can get the advice you need right away in case of technical problems.

Easy to use and functional

Modern trading platforms have an extremely simple user interface, so you will immediately understand how to use them. The dashboard contains all the information available on the platform - your portfolio, trading history, online chat, news, video tutorials, etc. You can easily find the section or option you need.

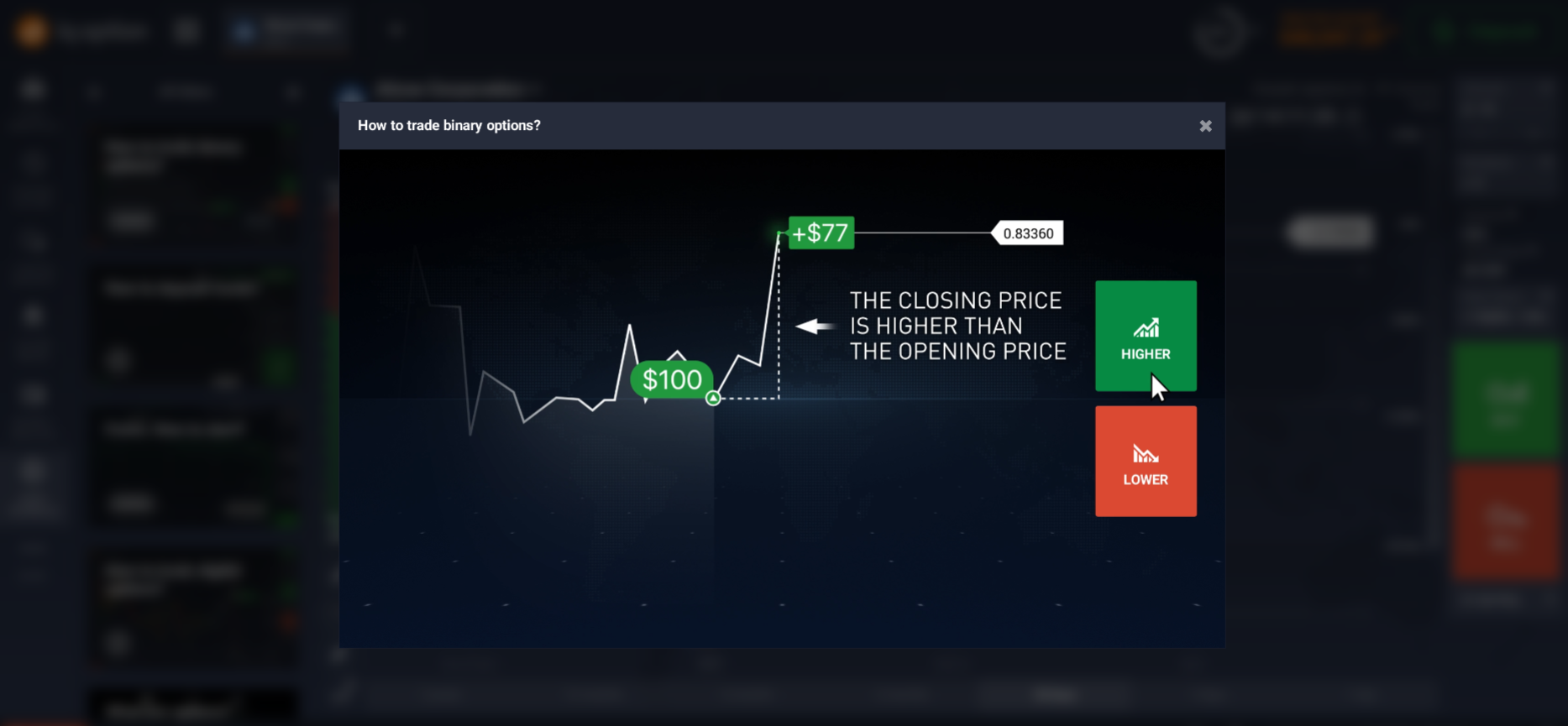

The main trading functions - buy and sell, deposits, as well as the multiplier function to connect the leverage and stop loss function to automatically close a trade, etc. are usually highlighted in bright colours for better readability.

In almost all interfaces the top bar accommodates an "assets" section for selecting an investment direction. A drop-down list helps you choose the type of financial market and the company, currency or commodity.

The tools for analysis are almost always placed on the bottom panel, for trader's convenience. You will be able to choose the time frame for the analysis - there is an option to choose from several minutes to several years, which is especially valuable. The ability to use indicators helps you perform correct technical analysis, calculating the possible profit or loss of a deal. Using indicators on the platform is very handy, because when you choose a certain indicator, the curve of this indicator is superimposed on the chart of the fluctuation of the price of the asset, and you can clearly see the trend.

So, we can see that the simplicity of use does not affect the functionality of the system. Modern systems for online trading are convenient, functional and informative.

Quality online investment platforms also offer mobile versions of the platform, so you will have convenient access to all your transactions, wherever you are. This is extremely convenient - in effect, it's like having your own 'stock exchange in your pocket'.

Choose the best trading platform for stock trading in Pakistan, experience all the benefits of online investing and make your transactions a success!

Related pages