Cryptocurrency trading strategy

A cryptocurrency is an encrypted, unregulated digital asset used as a counterpart to currency in exchange transactions. Cryptocurrency has no physical form; it exists only on an electronic network in the form of data. The cryptocurrency market is evolving rapidly, with new currencies constantly appearing and old ones disappearing. It should be noted that we are talking about an asset with high volatility, which entails risks, so before you start trading, you should take the time and study in detail all the aspects and this article will help you to understand it.

What is cryptocurrency trading?

Cryptocurrency trading is one of the best ways to earn passive income. Crypto trading has been phenomenal over the past few years as many traders have been able to make huge amounts of money and become rich. They are different cryptocurrencies to invest in which have brought more profit over the past few years.

A strong strategy is the best way to maximize profits and reduce losses. Traders must have a strong cryptocurrency trading strategy and strictly follow the rules of manipulation.

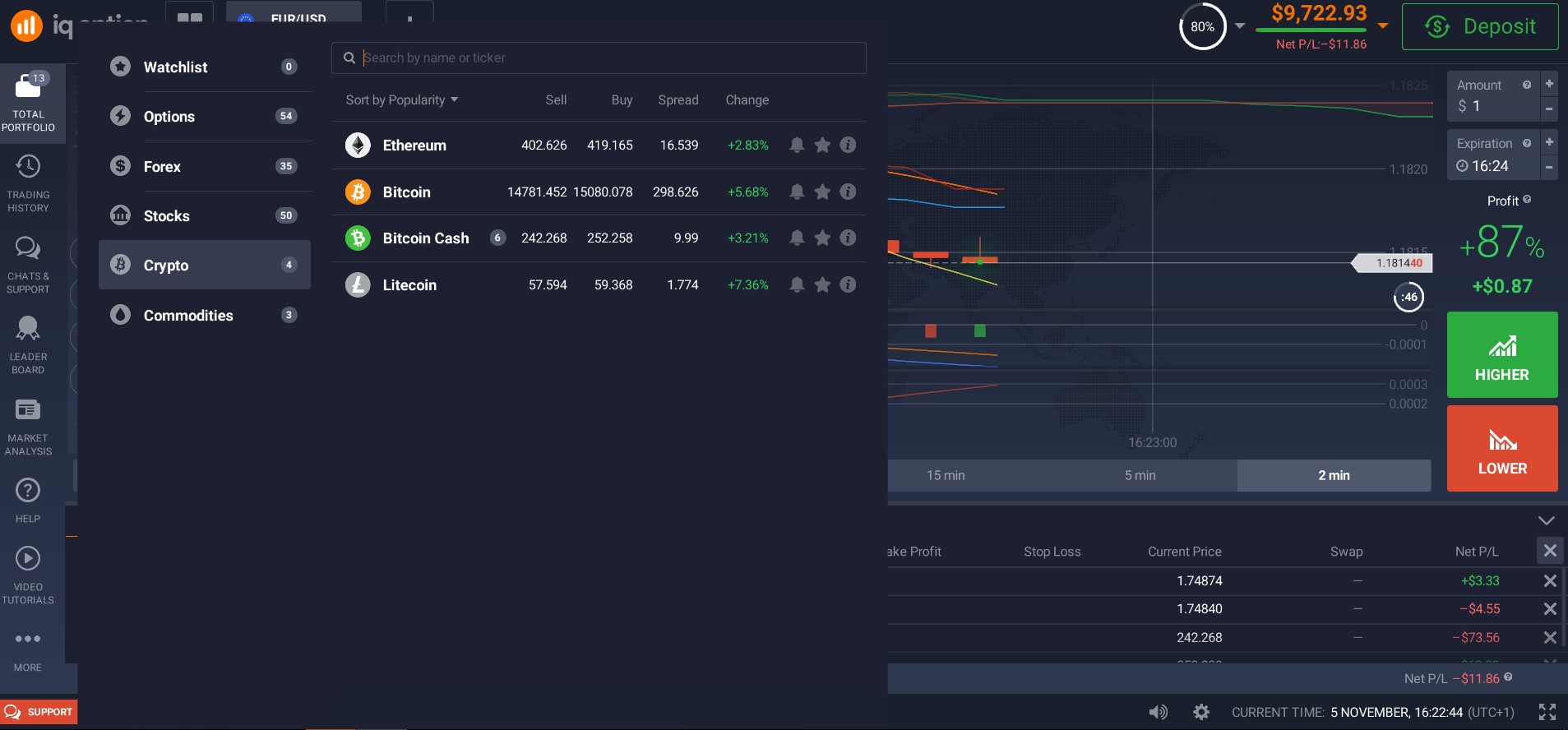

We will consider options for trading strategies and market analysis methods later, but now we will consider the main instruments that can be traded on the cryptocurrency market.

Notable cryptocurrencies

The hype around digital currency has been growing at an incredible rate lately. An impressive number of traders around the world want to experience first hand what is so unique about trading cryptocurrencies and whether it is really possible to make serious amounts of money in a short time.

But not all traders have tried trading this group of assets, especially for beginners in financial markets.

In addition, there are already several hundred varieties of cryptocurrencies in circulation, so first you need to find out which cryptocurrency is better to trade and why.

To date, several hundred such financial instruments can be found on the Web. This indicator is growing every year, because many specialists want to create their own unique currency.

But the vast majority of traders still trade the most famous cryptocurrencies, which include: Bitcoin, Ethereum; Litecoin; Ripple, Cardano, IOTA, NEO, Monero, etc.

Types of cryptocurrency trading analysis

Trading cryptocurrencies is not much different from trading traditional assets, so standard methods are used to analyze the market:

- technical analysis

- fundamental analysis

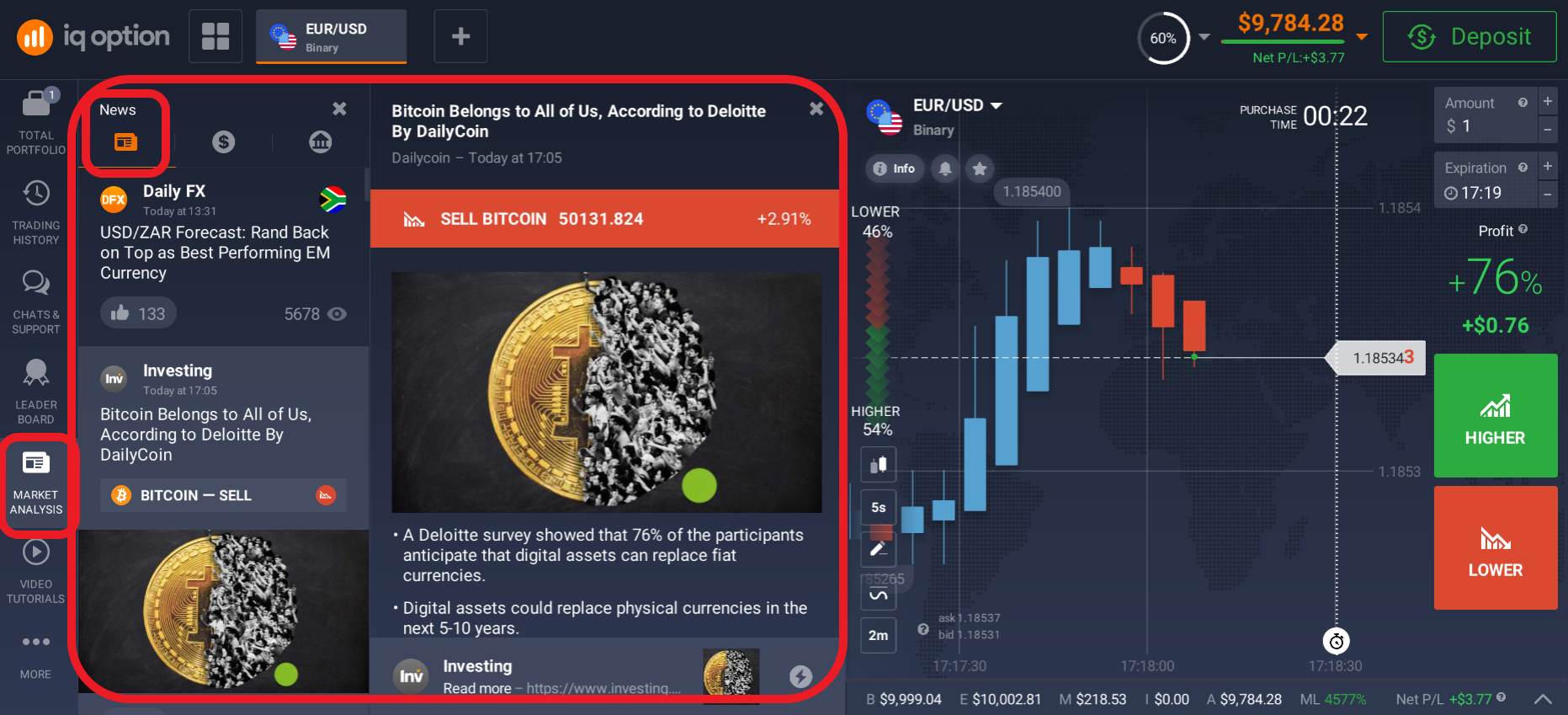

Fundamental analysis is a methodology used by investors that evaluates the real value of an investment and then compares it to the speculative price in the financial markets to assess the potential for future price increases or losses.

It is based on the assumption that the short-term price may differ greatly from the underlying value due to the nature of the financial markets, but over the longer term, they will tend to converge. Therefore, investors can benefit by using this methodology to find out if something is undervalued or overvalued and then buy or sell accordingly.

For traditional investments such as stocks, fundamental analysis involves evaluating the financial health and viability of a company in relation to its financial statements. If the numbers look good, we can be sure that the company has good fundamentals and therefore we can invest in it. However, the fundamental analysis of cryptocurrencies is radically different as there are no financial reports.

When considering whether to enter into a trade, it is not recommended to rely solely on technical analysis. Especially in the field of cryptocurrencies, when news is often generated, there are fundamental factors that have a significant impact on the market (rules, ETF certificates, hashes of hashes and others).

Technical analysis ignores and cannot predict these factors, so it is recommended to combine technical and fundamental analysis to make sound investment decisions. An analyst who decides to buy a certain coin for fundamental reasons can get technical support or find a good technical entry point and thereby strengthen the profitability of trading.

List of main technical indicators

Technical analysis of price charts for trading in order to make faster profits in the crypto market will not take as much time as you might imagine. Key metrics are incredibly useful.

Trendlines, fractals, RSI, stochastics, MACD and simple and exponential moving averages are some of the main indicators that can be used to measure support/resistance, momentum and direction of price movement.

One simple indicator will probably not be reliable for a complete trading strategy, but if a trader pays attention to 2 or 3 indicators, then it can give insight into the trend, notification of possible breakouts, and even entry / exit points for profitable trades.

Basic cryptocurrency trading strategies

During a period of slight price fluctuations in the crypto market, the effectiveness of trading depends on the trading strategy. The main task in this case is to choose an effective strategy for trading. When choosing a strategy, the situation on the market, the size of the deposit, the timeframe, the personal characteristics of the trader and other factors are important. Let's consider some of them in more detail.

The size of the deposit is one of the main, if not the main factor in choosing a strategy. Significant financial capabilities of the trader allow you to carry out a sufficient number of transactions with good volumes and in any time period, without fear of zeroing the account. Also, a large deposit allows you to conduct a long-term cryptocurrency trading strategy, with transactions in months and years.

A small deposit allows you to rely only on trading on short time periods and requires constant monitoring of price dynamics. The trader does not have reserves to compensate for an unsuccessful trade and change the strategy. And it is obvious that trading with a small deposit is more stressful and requires the trader to know the market and at the same time react quickly. In cryptocurrencies with a small deposit, you should not implement any strategies with bitcoin and other very expensive coins. It is also best to avoid periods of particularly high volatility.

Equally important for the implementation of any strategy is the possession of the necessary knowledge by the trader (everything about learning to trade cryptocurrencies is here). Experience in trading allows you to achieve profit even with a relatively small deposit. The problem is that crypto trading began to develop relatively recently, there are few specialized and high-quality courses, books, video tutorials and other things, almost every trader learns right away in real conditions. This is not the best option.

To mitigate the consequences of such learning, traders choose simple strategies on small time frames during a well-defined trend. But it still won’t save you from losses at first, you need to be prepared for this. Only after obtaining certain knowledge, you can choose some more complex strategies.

Having a sufficient deposit and certain trading skills, a trader can choose a strategy and trade according to it, taking into account the factors that are discussed below. The trader must consider:

- How much free time does he have for trading, if this is not the main activity

- What time transactions can be opened taking into account the deposit

- What part of the deposit can be lost without prejudice to further work

- What instruments will be used to trade

You also need to take into account psychological characteristics - emotional stability, stress resistance, risk-taking or analytical activity, and so on. The listed factors can be called fundamental when choosing a strategy, and they will also determine the individual characteristics of cryptocurrency trading.

Trading should not start “from nowhere” and end with “nothing”, so that each new trading period starts from scratch: the trader must somehow fix the course of trading, the results and features of trading, the situation on the market, the impact of news, and so on. The trader can write down this information or fill in the table at the end of the trading period, illustrating it with screenshots. Any information about each transaction must be stored and analyzed.

During trading, one should not deviate from the chosen strategy, unless a completely unpredictable situation develops on the market - in this case, the trader should have a fallback option. Having received the first profit, many crypto traders consider it right to withdraw it into more significant assets, into fiat. Also, taking into account the volatility of the crypto market, it is necessary to have a reserve and replenish it regularly.

Diversification of assets in the crypto market is very desirable, you need to create a portfolio of different coins. They differ not so much in behavior as in cost and technical features. The most expensive coins are more often used as investments, smaller coins are more convenient to trade and losses are not so great in case of sharp price changes.

Below we will briefly review a few strategies that can be applied in the cryptocurrency market.

Swing trading. This is primarily a cryptocurrency trading strategy for experts. Swing trading is for traders who buy but do not want to hold cryptocurrencies for a long time. This strategy involves the use of technical analysis, candlestick patterns, etc. Traders using this method mostly use technical tricks when trading.

Buy and hold strategy. The buy and hold strategy is probably the most commonly used, as it requires little or no technical requirements. The buy and hold method is also one of the most profitable ways to trade cryptocurrencies because most digital coins are not too far from their all-time highs and will move up to gain new price points.

Traders, buy who owned digital assets and held them for a long time over the past few years, have received their profits. However, traders who have used long trading strategies (buy) may currently suffer losses. Therefore, this strategy should be used with caution.

Cryptocurrency trading strategy support and resistance. To know the trend of the market price of a digital asset, it is necessary to identify critical peaks and lows. Critical highs are reached in areas of resistance, and troughs are reached in areas of support.

You should be aware that when old resistance becomes new support, you have a great buying opportunity in a sustained trend.

In addition, support and resistance lines help to know the entry and exit levels of a trade within the current price action. Before placing trades, it is necessary to obtain potential trading ranges projected by support and resistance levels.

Creating a cryptocurrency trading strategy

Before starting the technical implementation of building a trading strategy, a trader must clearly understand what timeframes it is more convenient for him to trade and how often to make transactions in order to feel psychologically comfortable.

The choice of appropriate trading instruments depends on the answers to these questions. These nuances are very important, as many novice traders want to develop a short-term trading technique, not realizing that this is a huge amount of work. The bottom line is that in this case you have to constantly be at the workplace.

Moreover, any system will have to be adapted to a constantly changing market, and for this it will be necessary to “connect” psychologically with your trading system to some extent. If a trader has received a ready-made TS and from time to time begins to make transactions on it, without paying due attention to its adaptation, then after a while this TS will become unusable.

The next important question, which many put in the first place in importance, what is the main hypothesis of the trading strategy? You should know that any trading system is based on one or another hypothesis. This may be an assumption that after the sideways breakout, a powerful impulse movement will begin, which will be much larger than the width of the broken flat.

There can be a lot of such hypotheses, but the hypothesis itself does not bring money, it needs to be covered with a technical shell, that is, a set of clear rules and techniques on the basis of which the trader makes his transactions.

Actually, this technical shell is often perceived by beginners as a trading strategy - that is, a clearly formalized set of rules for implementation. An example is the price crossing the moving average indicator (if the price crosses the MA from the bottom up, and the MA has an upward slope, a buy is made. If the price crosses the MA from the top down, and the MA has a downward slope, sell).

That is, the hypothesis of such a system is that if the current price is above its average value, then an uptrend is most likely to begin, and if the price is below its average value, then there is more chance of a downtrend. The technical embodiment is implemented in the rules for making transactions when the price crosses the MA line.

Armed with all the knowledge you have gained, you can register on the platform and start earning right now. Good luck!

FAQ

What is the best strategy for crypto trading?

There are no ideal systems suitable for all traders. It is up to you to determine which strategy suits you best.

What percentage of the deposit can I risk?

It all depends on your strategy and money management rules.

What lot size should I trade?

The lot size is determined based on the size of your deposit and the percentage of risk laid down in the money management rules.

How to determine measurement objective target (potential profit)?

The goal is determined based on the rules of your trading strategy.

Related pages

Where to trade binary options in Pakistan?