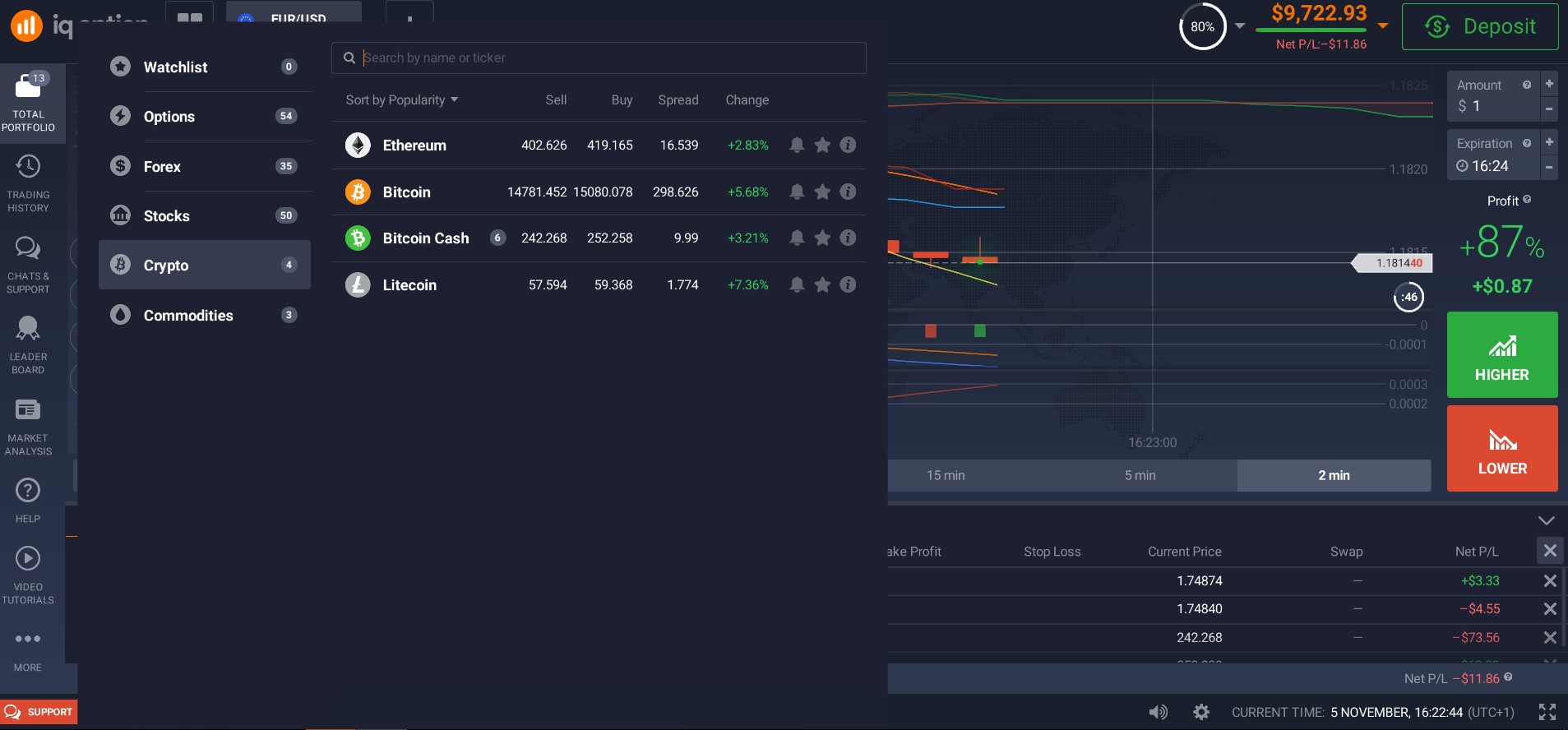

Start trading cryptocurrency

What is a cryptocurrency and the history of its creation?

Cryptocurrency is a digital monetary unit that is an alternative to fiat money and currencies. Any digital unit, bitcoin or altcoins, is mined using special technology in the digital space. Cryptocurrency, although it has its own denomination and is tied to the exchange rate, does not have a serial number and series, as well as other attributes inherent in real money.

By themselves, bitcoin and altcoins are a complex digital product with its own crypto code and encrypted record. To get the status of money, albeit digital, it needs to go through a complex mechanism of transformation and processing through special technologies. A digital record becomes a cryptocurrency only if there is a certain demand for it. When it is possible to exchange a digital product for fiat money, then it acquires the position of a cryptocurrency and can be freely converted.

The history of the creation of cryptocurrencies began with the birth of bitcoin - the №1 crypto currency. Satoshi Nakamoto on January 3, 2009 completed the development of the first cryptocurrency - the bitcoin program code. On this day, the first block was generated and the first 50 bitcoins were mined. This is how the world learned about blockchain technology, which is now used not only in digital money.

To date, there are already more than 1,500 different cryptocurrencies. If there is a significant demand for a cryptocurrency, it instantly rises in price.

There are several ways to get cryptocurrency. The main way to earn digital money is through mining, that is, by getting a reward for combining transactions into blocks and calculating the right key to seal the block. You can do this on your own equipment, you can use someone else's, which is provided for rent and may even be located on another continent. This type of mining is called cloud mining. You can mine most of the existing currencies.

Another option is to buy the desired cryptocurrency in an exchanger, of which a sufficient number have appeared on the network or on the exchange. To do this, you will have to go through the process of identity verification, that is, send your personal data.

What is cryptocurrency trading?

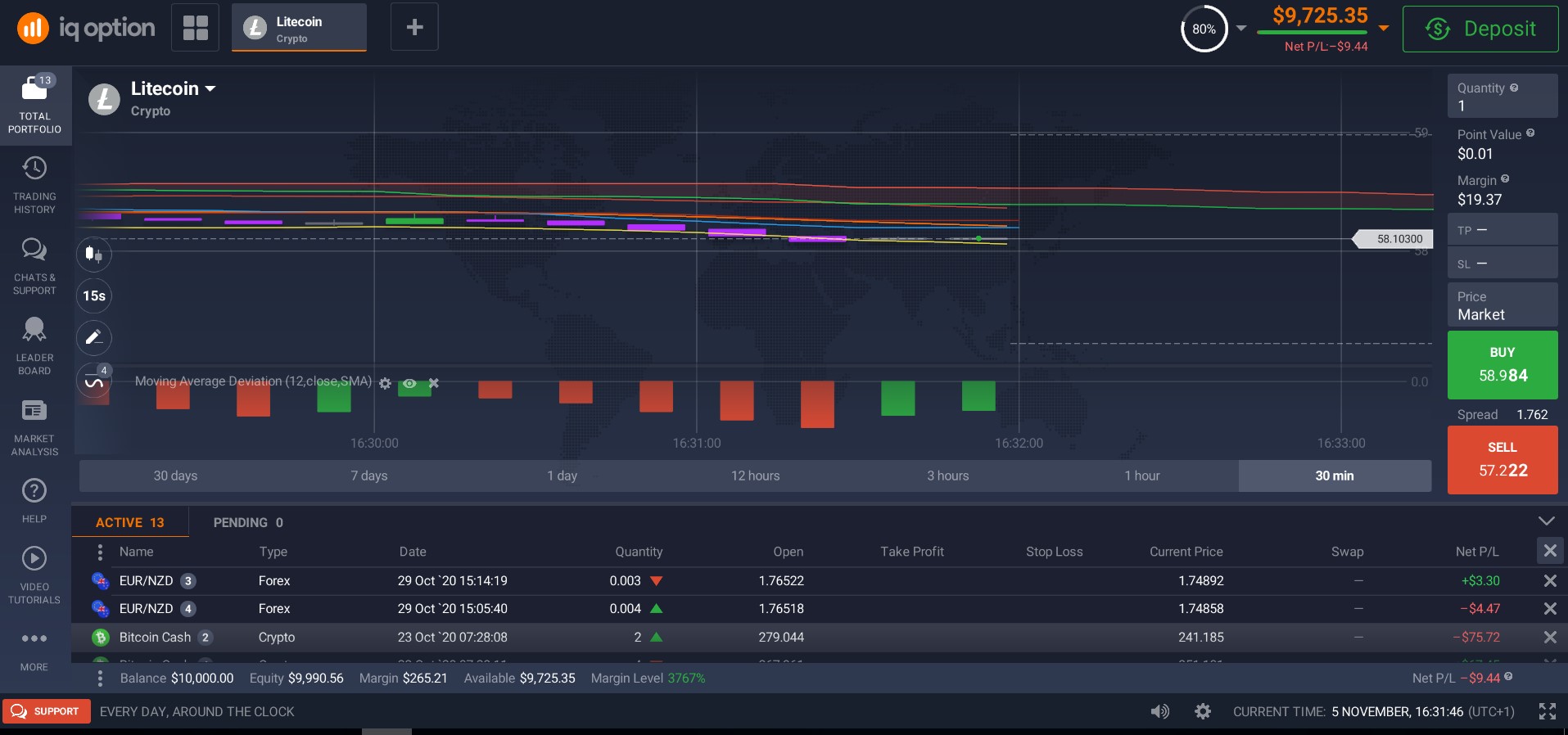

The main feature of cryptocurrency trading is that it takes time. The cryptocurrency market lives 24 hours a day, 365 days a year. Therefore, in order to effectively respond to any market changes, you need to almost continuously monitor the market situation.

There are tools that automate trading a bit, such as Stop Loss, Take Profit, or other more advanced ones. However, it is impossible to trade without understanding what is happening in the market. This requires training.

Cryptocurrency trading is buying and selling cryptocurrencies at the most appropriate time and at the most appropriate prices.

How do you know when this moment has come? You never know 100% about it. However, it is possible to conduct an analysis, on the basis of which it can be found that now is a good time. However, this requires some experience, knowledge of technical analysis and forecasting market sentiment.

It is possible to properly start trading cryptocurrency in Pakistan if you already know several aspects of trading. The first step is to create an account on the cryptocurrency exchange, learn how the exchange works, and also study the issues of technical analysis.

How to start trading cryptocurrency in Pakistan? Before you start trading on the exchange, it is recommended to look at real reviews about the exchange. Next, you should study the control panel of the crypto exchange itself. For basic actions, you will need to place Buy-Limit and Sell-Limit buy and sell orders, set Stop-Loss.

Next, you can make a few test transactions by buying a cryptocurrency that you think might rise in price in the near future. Remember, do not invest significant capital until you gain knowledge and experience.

What do you need to trade cryptocurrency?

The best way to start trading cryptocurrencies in Pakistan is through an exchange. On it, the client can sell or buy cryptocurrency at any time, as well as use additional options. For example, leverage, which can be used to manage additional capital. However, this is risky, as there is a possibility of losing all funds very quickly.

On some exchanges, you can also make a deposit in cryptocurrency or use the staking feature. It allows you to receive passive income for holding coins. However, holding funds on trading floors is risky.

When the choice is made, it remains only to purchase the cryptocurrency itself. Large trading platforms allow you to do this through payment systems, as well as using bank cards.

Cryptocurrency can also be bought through exchangers, and then transferred to an exchange or a cold wallet.

Trading digital assets is an extremely risky business. The price of cryptocurrencies is volatile, it can fluctuate by 10-20% per day, sometimes by 50% or more. In this regard, inexperienced users may get the impression that trading can bring huge profits. However, practice shows the opposite.

For this reason, it is better to start trading cryptocurrency from a practice account. You can create an account with a virtual balance. This will allow you to get acquainted with the market and the structure of the trading platform, to practice.

Then you can deposit a small amount on the exchange. This is an essential step in becoming a trader. In addition, it is necessary to refer to the theory. For example, read scientific literature on trading, listen to lectures on this topic, take relevant courses, get acquainted with technical and fundamental analysis. All this will help not only to see ups and downs in asset prices on the charts, but also to try to predict them.

By studying the literature and experience of other traders and investors, you can also master various trading strategies. One of these is averaging. It involves dividing the capital into several parts and investing in the asset in small amounts. This method will help you find the optimal point for acquiring an asset.

Main traded cryptocurrency

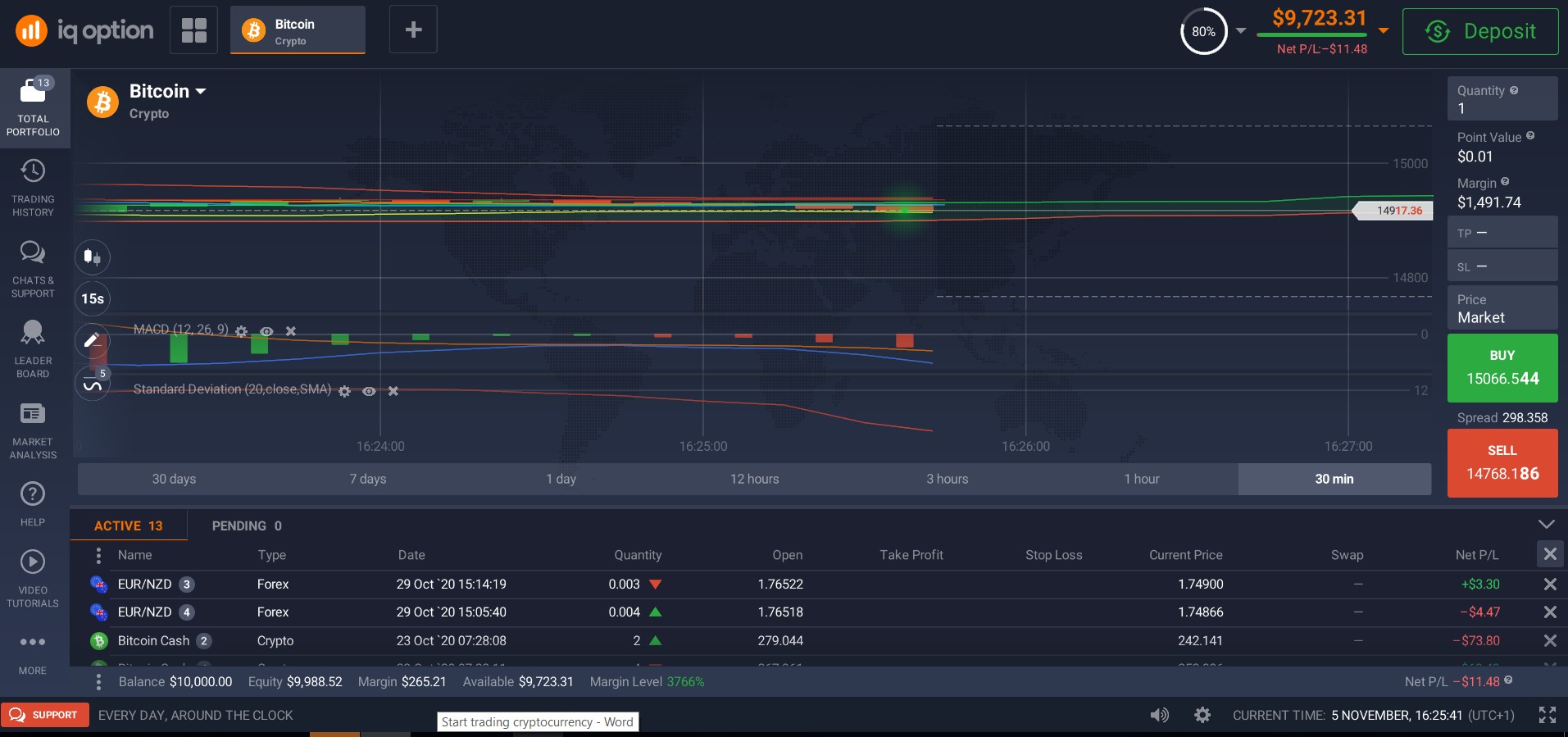

The rating of the most popular cryptocurrencies is headed by the bitcoin cryptocurrency, which is known to many users, and which is mined by most of the miners. He has the highest exchange rate against the dollar. This is the most capitalized digital product, which is often called digital gold.

Next comes Ethereum (ETH), created for decentralized online services. Ethereum enjoys significant popularity and demand.

Third place for a long time was assigned to the stablecoin Tether (USDT), issued in 2015 by Tether Limited. As the name implies, the exchange rate of this digital currency is stabilized by being linked to a fiat currency, in this case, the US dollar. Of this top three, the third place goes to different cryptocurrencies, but USDT more often than others manages to take this position.

Why has bitcoin gained immense popularity? You already know about the high exchange rate for №1 cryptocurrency and its efficient technology, but it is also important to write about the fact that the original bitcoin has many copies. At first, the network was divided into two independent chains - Bitcoin and Bitcoin Cash (in August 2017), in November 2018 another Bitcoin SV fork appeared. In the future, their number only increased.

How to analyze cryptocurrencies?

Before buying digital coins, cryptocurrency investors want to be sure that the transaction will be profitable.

How beginners learn to see crypto market signals and use them to find entry points will be discussed further.

Successful investments are daily painstaking work, studying market trends, monitoring specialized forums, analyzing technical analysis and correctly compiling a portfolio.

Technical analysis relies on historical market data, because history develops in a circle and repeats itself. It includes an overview of past pricing trends. Technical analysis aims to identify recurring patterns and make calculated forecasts for rising or falling trends.

The underlying assumption here is that prices are not random and can be foreseen by looking into the past. While technical analysis done right can be quite useful and effective, it doesn't always work. In most cases, the success of technical analytics depends on the person doing the research. This is why some prefer fundamental analysis.

Fundamental analysis aims to capture a broader picture than technical analysis. It takes into account both qualitative and quantitative factors that can affect value in order to understand whether an asset is overpriced or undervalued compared to its current market price. Since there are no auditable public financial statements for the cryptocurrency market, doing this type of analysis is more difficult, especially for beginners. Consideration should be given to the volume of transactions, user activity, the unique features of the cryptocurrency, and even some global economic events that can significantly affect the cryptocurrency market.

It is better for a beginner to learn how to use both methods.

Bollinger Bands

Bollinger Bands is a versatile technical analysis indicator widely used by traders. John Bollinger developed this indicator as a solution for finding relative highs and lows in dynamic markets. The indicator itself consists of an upper band, a lower band and a moving average MA line.

When the price fluctuates between the upper and lower boundaries of the indicator, Bollinger Bands become an excellent tool for assessing volatility. When the bands contract, there is relatively low volatility in the market, which is an excellent setting for a range trading strategy. Similarly, Bollinger Bands widen as the market becomes more volatile. During such periods, traders can use a breakout trading strategy or apply trend trading rules.

Trade planning

In crypto trading for beginners, the following general provisions can be distinguished:

- Cryptocurrency is an extremely volatile asset. Therefore, investing all your savings in bitcoin at once is a bad idea.

- Try to look at everything in the long term. Sharp drops in the rate for the crypto market are a common thing. Therefore, do not worry if you invested in a promising, in your opinion, cryptocurrency, and its value sank during the day.

- Remember that the outlook for the entire crypto market as a whole affects the demand for altcoins. When bitcoin starts to explode, the season of altcoins begins - their price pulls up next. And vice versa: when bitcoin falls, altcoins fall after it.

- Use market orders. The exchange makes it possible to place stop orders, which means that an order to buy or sell a cryptocurrency will be executed as soon as its value reaches the level you set. So you can immediately determine how much you are willing to lose. There are also automatic trading systems, which are also called "trading robots". They allow you to automate trading as much as possible.

- Follow the news of cryptocurrencies and follow the global agenda. The rates of bitcoin and ether, in particular, were affected by such major events as trade wars or the onset of a pandemic. At the same time, it is important to understand that it is very difficult to predict the movement of the cryptocurrency rate against the background of the news, so rely on the forecasts of several analysts at once.

General Trading Strategies

Trading strategies act as a framework with rules to facilitate investment or trading in any specific markets with specific intentions. These rules help reduce risk and trade effectively based on rules, not emotions. Active and passive cryptocurrency trading strategies help investors to clearly define their intentions in order to profit from strategic investments. These trading strategies help investors avoid speculative, random and unsystematic trades.

In cryptocurrency trading, you cannot rely on chance. To effectively open positions and earn income in the future, you need to have a clear strategy. Let's look at simple trading strategies that even beginners can follow:

- Trend trading. Asset quotes always move according to the trend, which can be up or down. A trader can open positions in the direction of the trend, i.e. buy when the trend is up and sell when the trend is down. The most difficult moment for novice investors is the definition of a trend, for this it is necessary to at least determine the key local lows and highs. For an uptrend, each next point must be higher than the previous one, and for a downtrend, local highs and lows must be lower than the previous ones.

- Trend change. This method is more complex and requires basic knowledge in technical analysis. A trend reversal can be used to open new trades, but the difficulty of such a strategy lies in correctly identifying a possible reversal. To do this, it is recommended to use several indicators. The first tools are the moving average (MA - Moving Average) and the exponential moving average (EMA - Exponential Moving Average). These indicators determine the current trend from previous values. The next tool is the Relative Strength Index (RSI), which shows the strength of the current trend. The main signals are the intersection of lines with overbought and oversold zones, i.e. values close to the upper or lower limit. The closer the RSI line is to 0, the more the downtrend weakens, and the closer it is to 100, the less the price growth strength. One of the most common among novice traders is the MACD moving average convergence/divergence indicator. The main thing to know about this indicator is that it tells you where the market is likely to go next. To correctly recognize the convergence / divergence of moving averages, you need to open two lines on the chart of a trading pair - a signal line and a MACD line. When the MACD crosses the signal line from below, it forms a bullish crossover, and when it crosses from above, it forms a bearish crossover.

- Scalping is one of the fastest active cryptocurrency trading strategies that involves the repeated use of various price gaps. When scalping, traders take advantage of small price fluctuations, including spread between buyers, order flows, and market inefficiencies. Scalpers do not hold their positions for a long time and do not trade in large volumes. Instead, scalpers are more likely to trade small volumes and small movements in order to exploit small differences multiple times during the day. Scalpers often trade higher liquidity markets to get in and out of positions quickly.

- Purchase in equal installments. The easiest way to start investing in cryptocurrency is the long-term accumulation of digital coins with regular purchases in equal parts. You can invest a fixed amount in bitcoin every month. The advantage of this strategy is that you can buy an asset regardless of the market situation. If the price of a cryptocurrency starts to fall, then subsequent purchases at a lower cost can average the entry point. This strategy works for those investors who have a long-term vision for the growth of the asset.

Cryptocurrency trading or trading in financial markets opens up unlimited opportunities for earning. Profit can be received both on the growth and on the decline of quotes.

If you are going to plunge into the world of digital money, follow all the industry news and start trading cryptocurrency today.

Related pages

Binance crypto futures trading in Pakistan