Characteristics of the currency pair USD/JPY

USD/JPY is currently the most popular currency pair in the world. It trades more actively than any other major currency in the world. Due to low demand and attractive liquidity, trading USD/JPY is a popular option for trading major currencies. In addition, its attractive features and stable prices make it attractive to beginners and experienced investors alike. If you're planning on investing in USD/JPY, you should know about its characteristics and features as well as how to trade in this market.

USD/JPY is traded at the USD level on the foreign exchange market. USD is the currency that is used on the BOP trading floor and is traded in units equal to 1 USD. USD is the currency traded on the Electronic Quotation System or EFT. The main components of the USD/JPY are the prime rate, the rate of change of the prime rate, the current value of the rate, the net asset value of the foreign exchange market and the forward rate of the foreign currency. In addition, a variety of other financial costs are involved, including the fair market value of assets held by the bank.

USD/JPY is the most liquid of all major currency pairs in the electronic market. USD is the most easily affected of all major currency pairs because of its close association with the United States. Thus, USD/JPY is the most easily manipulated of all the major pairs in the electronic market. This means that a person can make trades with large profits if he can manipulate USD/JPY in his favor.

What are currency pairs?

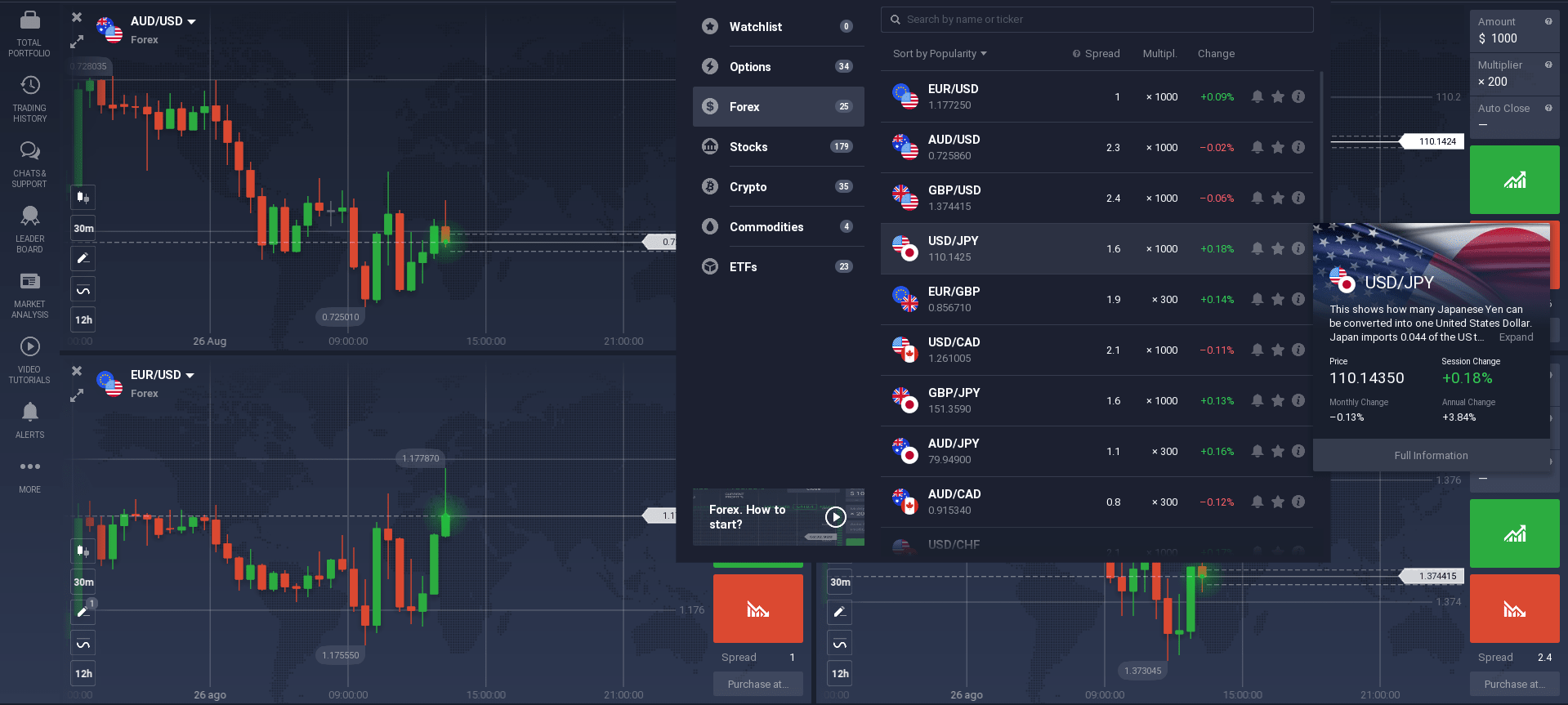

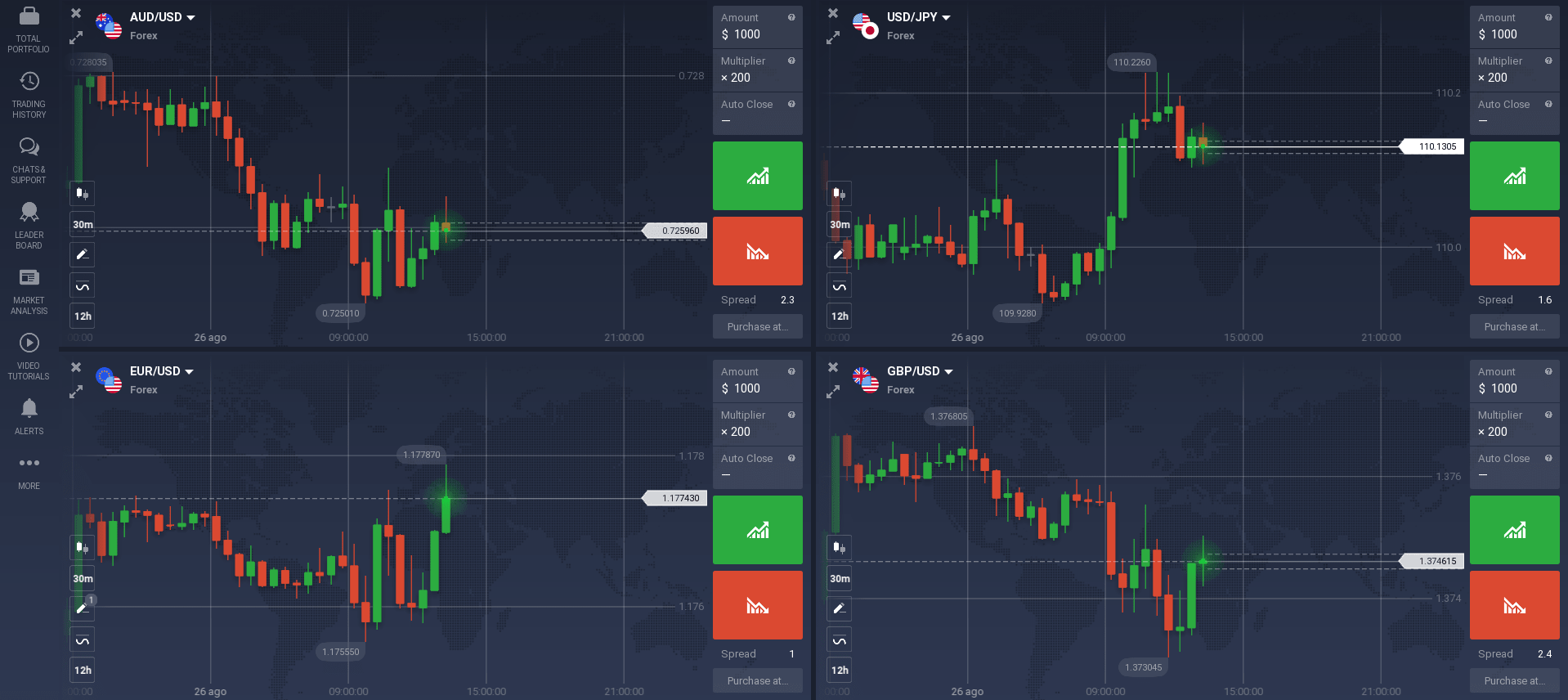

What are currency pairs? Simply put, a currency pair is a specific dyadic quotation of the international price of a unit of a particular currency relative to the price of another currency on the world currency market. The base currency is usually the currency with the highest exchange rate. Traders usually buy one currency with the intention of selling it later at a profit. Most traders use some indicator to determine if they should buy or sell a particular currency.

The most popular (and easiest to understand) types of currency pairs to quote in the market are USD/JPY (USDJPY), USD/CHF (USDCHF), and USD/EUR (USDEUR). These are the most popular pairs on the market. It is easy to understand why. With this simple list of names, you can quickly see how many times each of these currency pairs occurs throughout the day. These are the so-called "major currencies".

Currency speculators need to know a little bit about how the currency market works if they want to play it effectively. However, most beginners in currency trading find it difficult to understand the structure of various pairs and how they affect each other's price. For those who have mastered this area and have some experience under their belt, trading multiple pairs at the same time should not be difficult. Like everything in life, practice makes perfect and with experience the number of currency pairs a trader wants to trade should increase as he becomes a more experienced and confident trader.

Currency Prices

For those who trade currency pairs, you need to keep an eye on currency prices. This is because you will know the value of your assets and liabilities after you have converted them from your home currency to another. Exchange rate fluctuations can create problems for you, especially when you need to transfer your assets from one currency to another.

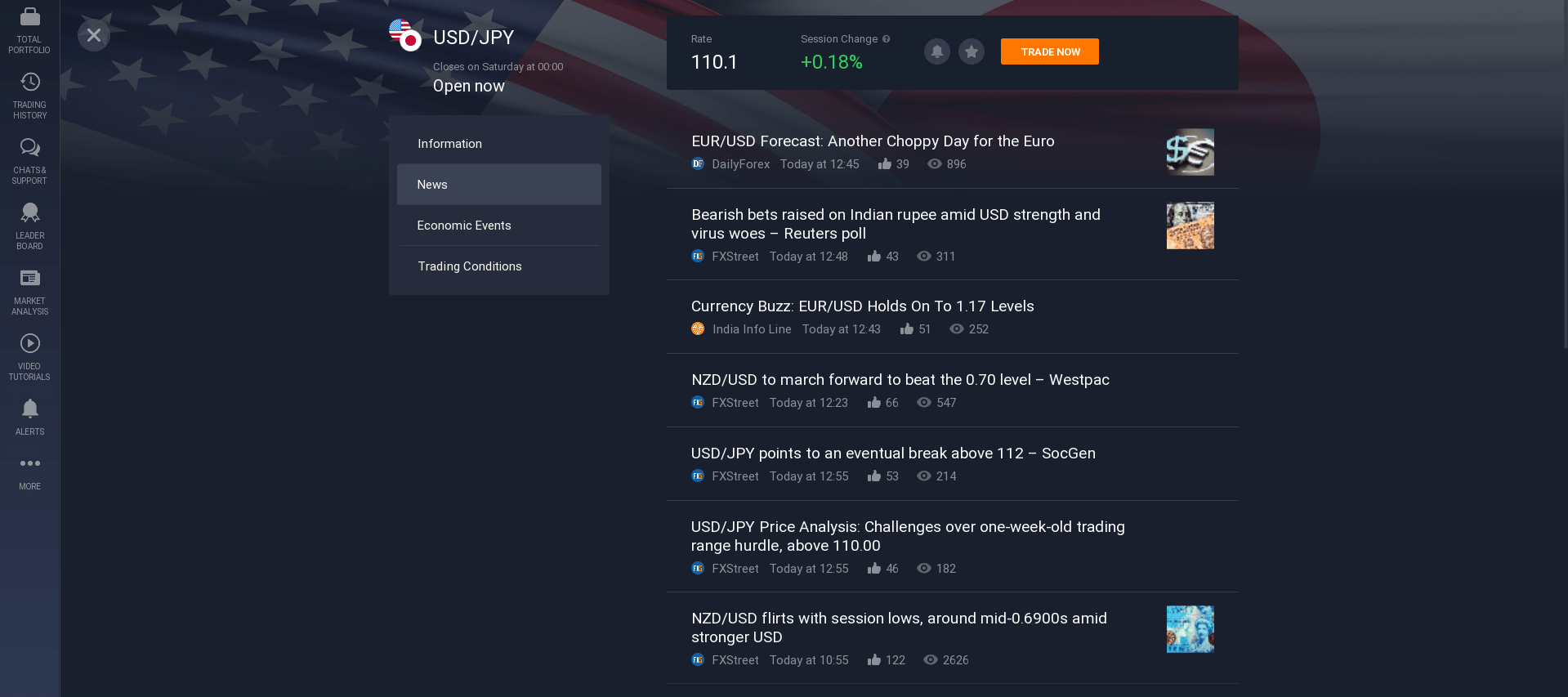

The main thing you need to do is to identify the market situation and keep a close eye on it. The first thing you need to keep track of is the exchange rate between two specific currencies. More often than not, you can get information about price movements from various sources. You can also track movement through various news portals or financial institutions that provide spread information.

Most often, information about currency prices is provided by financial institutions that provide you with the base currency. They do this through their interbank dealers, who have access to the country's prime rate. There are other traders who follow these events more actively. Some traders use technical analysis to determine the possible short-term and long-term trend of exchange rates.

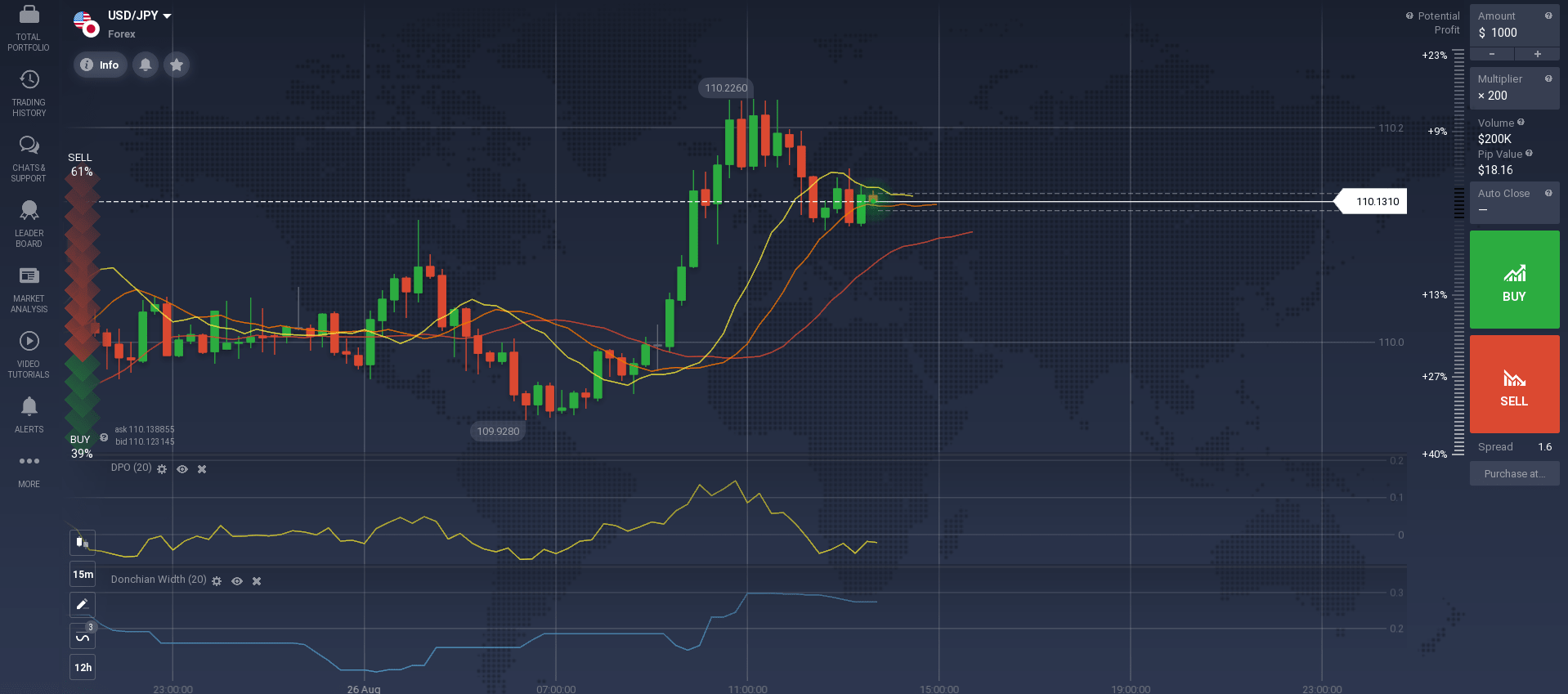

One way to monitor exchange rates is to use your trading platforms. Brokers usually have an application where you can monitor the base currency in relation to the requested price. Usually the requested price refers to the money spot in the broker's platform. If the currencies are paired, it means that the market makers made a successful trade denominated in the specified base currency.

You can also use other tools, such as special brokerage fees, to get real-time currency rate data. While some brokers will let you see rates on a website, others may require you to download software to your computer. You can use the software to find foreign currencies by using "quotes" for comparison. This means that you will need to enter the prices of the currencies you want to compare in the quote field.

The ability to track different foreign currency rates and even get information from your online brokers about any fluctuations is what makes flexible exchange rates so important. In fact, most FX investors would agree that such services make it much easier for them to track their investments and make informed decisions. If you're considering investing in foreign exchange markets, you should definitely keep in mind the importance of flexible exchange rates to help keep your costs down.

Trading Sessions

A trading session is the total time during which the market is open for trading a particular security or asset.

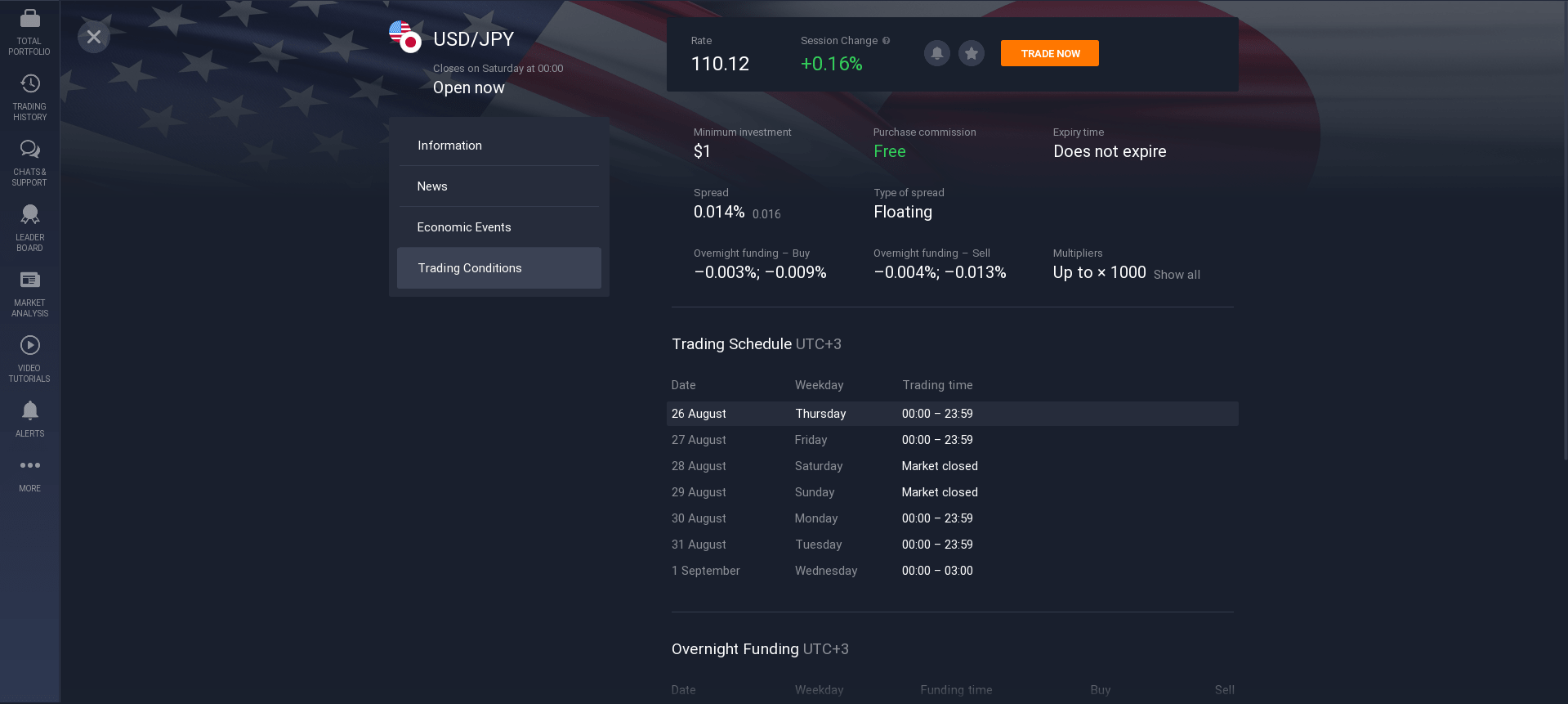

For example, during the daily European trading hours, stock trading stops at 4:00 p.m. Different factors determine different trading sessions for stocks, bonds, commodities, oil and securities. These include the length of the trading day, closing prices for traded assets or securities, average closing price during the trading day, opening prices for securities, the number of traders for each security or instrument during the trading day, minimum and maximum trading limits and other factors. The three main trading sessions by geographic region include the North American session, the European session and the Asian session.

Trading hours are defined as the period of time from the opening of the markets to the closing of each trading session. Most trading sessions last between one and four hours, with an average of about two hours. The opening and closing prices of quoted securities or instruments during the trading session are also taken into account. This information is used by traders to determine the most favorable trading opportunities. Traders can buy and sell securities, currencies or commodities during these trading hours, depending on the circumstances. They can enter and exit the market as they see fit and may stay in the market for hours or days.

Traders must carefully develop a trading strategy before engaging in any asset or instrument trading. During the daily trading sessions, they may buy or sell certain assets or securities according to their trading strategy. They must carefully analyze the behavior of major currency pairs during these trading sessions. The key to successful trading is to know the real value of the relevant currencies at that time. Traders should notice price movements in currencies that indicate changes in investor interest in these assets and securities.

Most major currencies have their unique features during trading sessions that traders should be aware of. Currencies that trade during the same hours tend to move in similar patterns. These include the U.S. dollar, Canadian dollar, Australian dollar, British pound, Swiss franc, Japanese yen, euro and Swiss franc. Trading sessions are separated by intervals ranging from two days to four days, and traders have to observe the different characteristics of these currencies during these intervals.

The major currencies are the most traded markets in the world, and they follow different trading sessions that allow new investors and traders to see the different characteristics of these assets. One of the best ways to study the movements of any currency is to observe the major trading hours. During these periods, the major markets around the world trade their monetary value, which allows investors to watch the market for signals that indicate prices are about to change.

Trading the market is a complex activity. It may seem like a daunting task to understand, but it is necessary for success in this field. Trading platforms are the largest markets in the world, providing opportunities for people from anywhere in the world to trade. Some of these traders choose to trade from home, while others choose to travel. Regardless of which way traders choose to trade, they must observe all of the different characteristics of the currency markets during their trading sessions to get the information they need to make informed decisions.

Trading timeframes

Market trading timeframes can be divided into many categories. Let's break down a few of them for understanding: D1, H4 and M15. They are defined by the number of ticks or minutes it takes to complete a trade. The term D stands for the daily change in the price of the world currency, while the term H indicates the opening and closing for each hour of the trading day. M stands for the minute change in price.

Short-term trading timeframes allow traders to enter trades quickly, but are also known for their high volatility. They can also trade on short time frames if they prefer a smaller profit margin. Trading on H4 provides a higher level of security compared to shorter time frames, as large orders do not need to be held overnight, and smaller trades do not require large buy and sell orders. Some of the most common H4 time frames are the Eurozone session, the Asian session, the U.S. session, and the European session.

D1 trades occur during open hours and are designed to close the market on the first day of the following week. Traders can choose to go long or short depending on which direction they want the market to move. A trader can make both long and short trades within a single D1 trade. The best time to enter this type of trade is Friday morning, since the market is closed for the weekend.

A swing trade is a scalping strategy that involves short selling a currency in a trade and then buying it back within a day or two, depending on the price action.

Traders may adopt a short-term trading strategy lasting just one day, where they buy and sell the currency back for a small profit before moving on to the next target. However, a longer-term trading strategy may also be adopted, where they trade over a longer time frame over several days.

Traders must understand technical analysis and the time factors associated with it, including support and resistance levels, before they can benefit from this type of technical analysis. Some of the most popular time frame trades include the U.S. dollar index, the Dow Jones index, the euro and the Japanese yen. Traders should have an idea of what the various charts look like, including breakouts, support and resistance levels, and time frame averages. This information can then be used to determine which of the available trading strategies will give them the best chance of success.

When choosing a strategy to make a trade, a trader should choose one that fits their trading abilities, their trading timeframe, and their personality. Some traders may find support and resistance indicators useful, while others prefer to work in the market alone and build their own charts. However, among all the charting packages available on the Internet, there are many free options that will allow novice traders to learn the ropes and expand their knowledge and skills without much expense.

Learning how to trade the market is not a difficult task. A few months of diligent study and lots of practice is all it takes to become an expert at trading the market. However, the decision to start trading the market is a choice that only experienced traders can make for themselves. As with any other activity, it is important to start slowly and acquire the necessary skills so that the trader does not waste precious time and capital on a useless strategy.

Trading Strategy

A trading strategy, also known as a trading system, is a general system used to buy and sell in the stock markets.

A trading strategy can be simple or complex and include various considerations including investment style (e.g., price vs. profit), risk appetite, market size, indicators used to determine entry and exit, trading rules (e.g., swing and position), type of exchange (x, long, short, price, commodity), time frame, market liquidity.

As you can see, there are many different considerations involved in determining the strategy to use in the market. This is why it is crucial for a trader to develop and use a trading strategy in order to become a successful trader.

Developing a trading strategy that will work best for you requires consideration of a number of factors. These factors include your personality, market experience, preferences, goals and knowledge. It is also important to consider the fact that different people have different trading styles. Some traders prefer to buy and sell in smaller time frames, while others prefer larger time frames and more volatile markets.

Traders with any level of experience often make the mistake of rushing into the market too quickly without developing and understanding their own strategies. The most experienced traders tend to invest large sums of money without taking the time to learn their own strategies and systems. When traders make the mistake of entering the market too early, they often get burned because they miss out on profit opportunities while waiting for the market to stabilize. Unfortunately, some day traders become testy and have no patience for it. These same traders, unfortunately, usually fail to sustain losses and suffer huge financial losses.

When learning new trading strategies, it is important to develop the discipline to follow them. Day traders who stick to their trading strategies, even when the markets move against them, can become very successful. If a trader is disciplined enough to stick to their trading strategies, success is only a matter of time. However, without discipline in following a trading strategy, a day trader has no way of avoiding losses if the market moves against him.

Nurturing discipline begins with finding a reliable and profitable trading strategy. Once a trader finds a profitable strategy, he or she can begin to develop a trading system that works best for him or her. Many traders prefer to build their trading strategy around existing trading strategies using automated programs. These programs also allow the trader to track his or her progress and decide if adjustments need to be made to the strategy.

When developing a trading plan, it is important to consider your risk tolerance. Different traders have different risk preferences. A trader with a high risk tolerance may not be interested in a long time horizon, while a trader with a lower risk tolerance may not need one. Some traders have very strict risk preferences; others may be more flexible. Once you determine your risk tolerance level, then you'll be ready to develop a trading strategy that will help you reach your risk tolerance level. Once you have a trading strategy, you're ready to start trading!

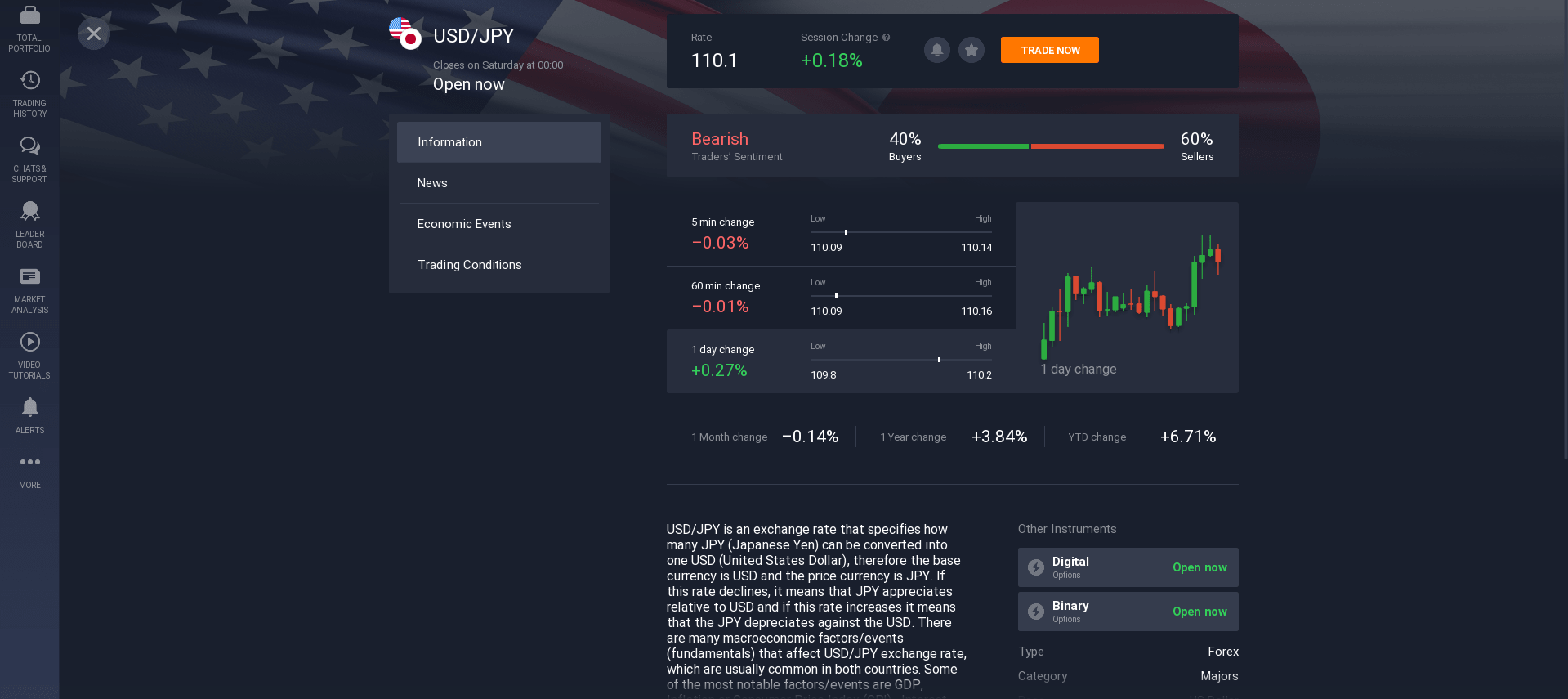

Features of the currency pair USD/JPY

In economics, a feature of the currency pair USD/JPY is that it is a closed currency market with large and small market makers. Its closed nature means that the price changes infrequently during the trading session. On the other hand, the Japanese stock market is constantly changing the price of its shares under the influence of various factors, such as GFL (Government Flow Forecasting) reports and central bank statements. Thus, the main factor that affects the trading price of USD/JPY is the economic and political developments in Japan. There are four features that mainly affect the market price of this currency pair.

The main and common feature is the daily range readings of the Japanese yen. The daily range in the Japanese Yen indicates the movement of the Japanese economy. Economic and political news affecting the Japanese economy affects the value of USD/JPY on the market. Two of the most important daily range indicators for the currency pair are the Purchasing Managers Index (PMI) and the Producer Price Index (PPI). These two indicators help to understand the direction of market price movements.

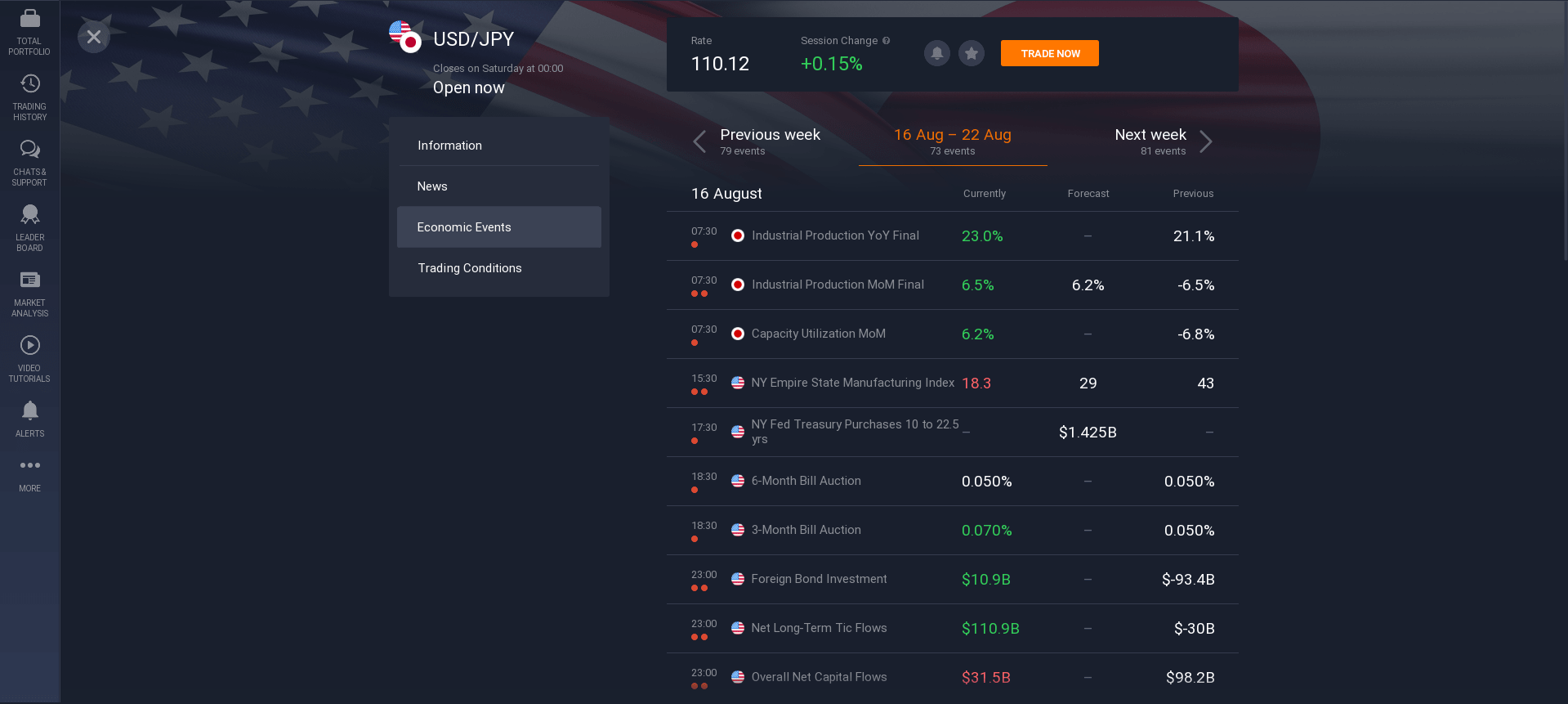

A major economic event or change is characterized by a major press release issued by a government or institution. Economic changes and economic data releases affect the USD/JPY trading price. When a country's central bank raises interest rates, it has a direct impact on the USD/JPY in the market. Similarly, when the bank lowers interest rates, it will affect the currency pair. For a detailed explanation of these types of economic changes, you need to visit some financial websites online.

Another characteristic of a currency pair is its daily range. This is the difference between the opening and closing prices of the pair in one day. The daily range is necessary for traders to determine the direction of the market price movement. For the beginner, you can use the daily range indicators to determine the direction of the trade.

Important economic or financial news also has serious implications for the Forex market. For example, over the past two months, the U.S. Federal Reserve surprised the markets by cutting monetary policy. This news had a strong impact on the USD/JPY pair, which was accompanied by a massive sale of the currency pair. Such economic news can have a huge impact on currency pairs in the market. You can check the news of the day on the USD/JPY daily range indicators.

The market is very volatile. Its movement is influenced by various economic and news factors, which affect the dynamics of the market. Understanding these features can help you make better decisions about currency values. You can use these tips to increase your chances of making huge profits from trading the market.

How to start trading USDJPY in Pakistan

Finding out how to start trading USDJPY in Pakistan is not difficult. Like almost everyone else in the world, you can get all the information you need from the World Wide Web. However, before you open an account, you should familiarize yourself with some basic rules and regulations. If you are new to trading, then follow these tips to overcome the first difficulties.

- First, choose your broker wisely. Get reviews and listen to what other traders have to say. The best online broker is a proven broker, among its traders.

- The second step, go through the full registration process, confirm it through your email. That way, you can be sure that your personal data is safe.

- Third, and most importantly, replenish your account starting with small investments. Do not rush to start trading with huge funds, gain experience at your own pace, using the minimum deposits.

You can only make money when you are ready to learn how to trade USDJPY in Pakistan. After getting an account, you should take the next step - learn trading techniques. This will help you to implement your plans smoothly in the future. You can also find information about trading in the market on websites dedicated to this topic.

Related pages