Characteristics of the currency pair EURUSD

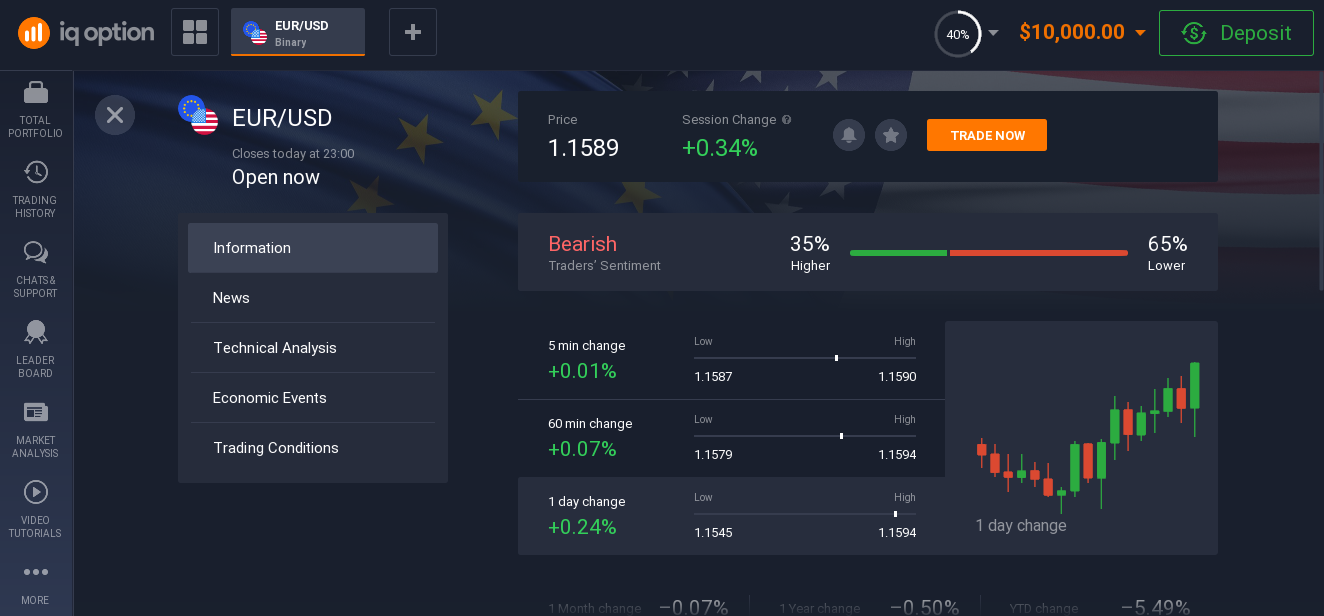

The EUR/USD currency pair is the most popular among traders, including when working with binary options. The convenience of working with EURUSD is due to the excellent accessibility to all news that somehow affect the current quotes.

This pair accounts for 30% of all transactions in the foreign exchange market. And this is natural, since the economies of countries directly related to these currencies are large-scale and transparent for market participants.

In the EUR/USD currency pair, the euro acts as the base currency, and the dollar is considered quoted in relation to the base currency. The rate of this currency pair is the amount of dollars that must be exchanged for 1 euro. For example, if the rate of the pair is 1.34, then for 1 euro you need to pay 1.33 dollars.

What are currency pairs?

A currency pair is a quote and pricing structure for currencies traded in the foreign exchange market in which the value of one currency is expressed through another currency. The first currency in a currency pair is called the "base currency" and the second is called the "quote currency".

For example, when buying a EUR/USD pair, a trader performs 2 operations at once, he sells the dollar and buys the euro. When a pair is sold, everything happens the other way around, the euro is sold and the dollar is bought.

The concept of a currency pair was born from exchange transactions in our time, which have developed in the world currency market. Indeed, the very essence of an exchange operation involves the purchase of one currency for another and, therefore, it is more convenient to immediately represent the quotes as the ratio of these two currencies, i.e. in the form of a currency pair.

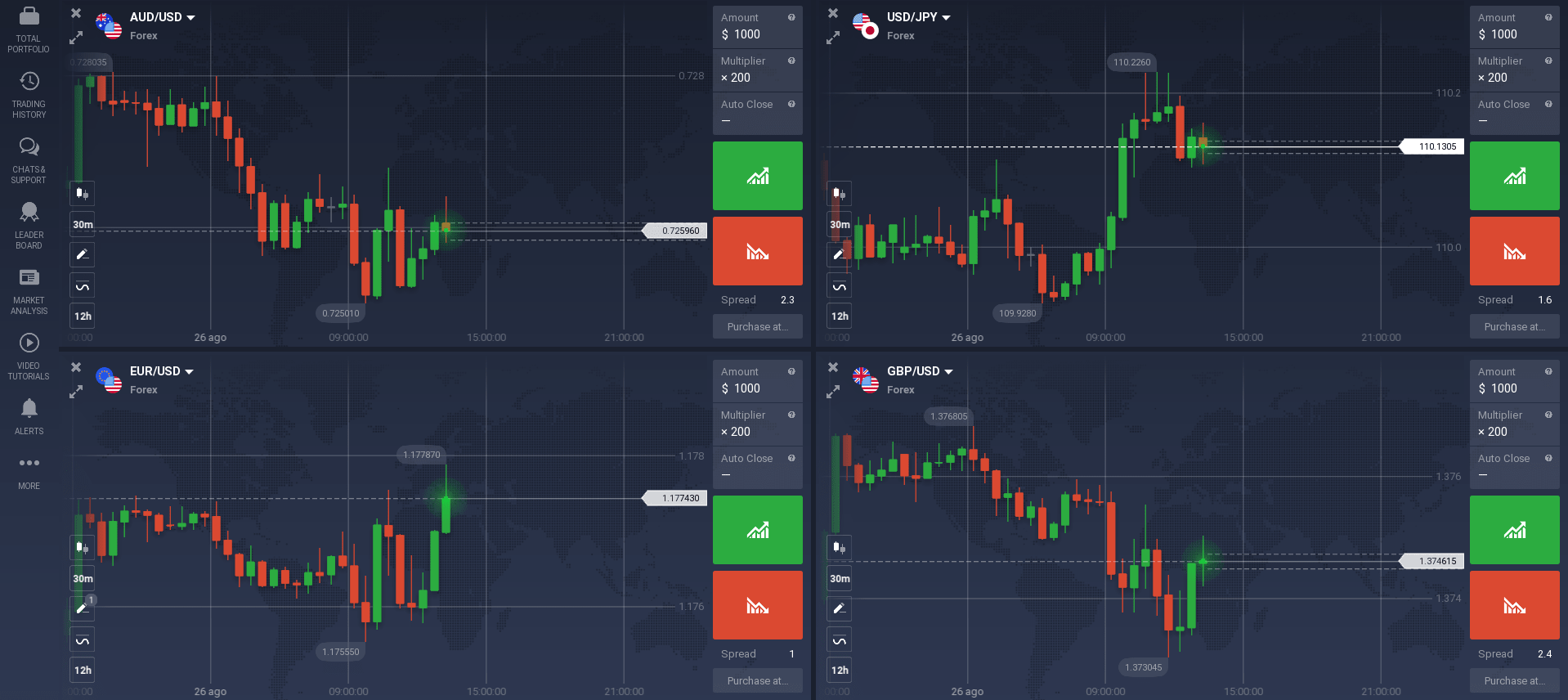

Trading currency pairs is the most popular way to increase income among traders, since you can open several transactions at once on one position.

Currency exchange rates

The exchange rate is the value of the currencies of some countries in relation to the currencies of other countries. For example, how many dollars the euro will cost.

The price of a currency, like any other commodity, is determined by supply and demand. For example, production is developing in the country, entrepreneurs need money, and they are ready to offer investors a good income. If foreign investors want to invest in these projects, they will need the local currency of the country. The demand for it will grow, which means that the exchange rate will grow.

It also happens vice versa. For example, the government turns on the printing press to pay off its domestic debts. The country's currency becomes too much, and its price - the exchange rate against other currencies - falls.

Do not forget that the exchange price (its rate) depends on many factors. It is even influenced by various news information. But the exchange rate regime chosen by a particular country depends on whether it changes at all and to what extent.

The exchange rate affects the growth of the general level of prices in the country, but the effect can be different, up to the opposite. A depreciation in the exchange rate can accelerate the growth of the general price level in the short term and contribute to its depreciation in the medium term. With the weakening of the national currency, imported goods become more expensive. It becomes expensive to buy equipment or raw materials abroad. Consequently, the price of the final product also rises. This is how the depreciation of the exchange rate accelerates the rise in the general price level (inflation).

Trading sessions

A trading session is the time of exchange trading on a specific exchange or exchange sites in one region. For any exchange in the world, there are established opening hours - this is the period of the main trading session during which official trades are held. The exchanges are open every day from Monday to Friday; the days of official holidays, like Saturday and Sunday, are days off. The trading session on the New York Stock Exchange lasts from 9-30 to 16-00 local time.

The top session on trading platforms lasts 24 hours a day. One of the terders takes into account the hours of the main trading sessions of the world exchanges, since this affects the volatility of the instruments associated with a specific region.

So during the European session, currency pairs are most actively traded with the Euro and the pound of sterling, while the Pacific and Asian - with the Japanese.

Trading timeframes

This is a time interval on the chart that the price passes, equal to one bar or candle. This is a time interval displayed in the trading terminal and is one of the main characteristics of a trading strategy.

Types of timeframes:

- 1 minute (M1)

- 5 minutes (M5)

- 1 hour (H1)

- 1 day (D1)

- 1 month (МN)

Intermediate intervals may also occur (M15 - 15 minutes, M30 - 30 minutes, H4 - 4 hours, W1 - 1 week).

The choice of a timeframe in the market is an important component of successful trading. A suitable time period is selected taking into account the peculiarities of the trader's own trading, his trading system, and the size of the deposit.

Strategy trading

A trading strategy is a predetermined set of rules that a trader has developed to govern his or her trade. Developing a trading strategy gives the trader its own advantages.

A trading strategy includes a trading and investment plan that outlines the investment objectives, risk tolerance, tax implications and time horizon. Ideas and best practices need to be learned and accepted and then adhered to. Trade planning involves developing methods for buying or selling currency pairs.

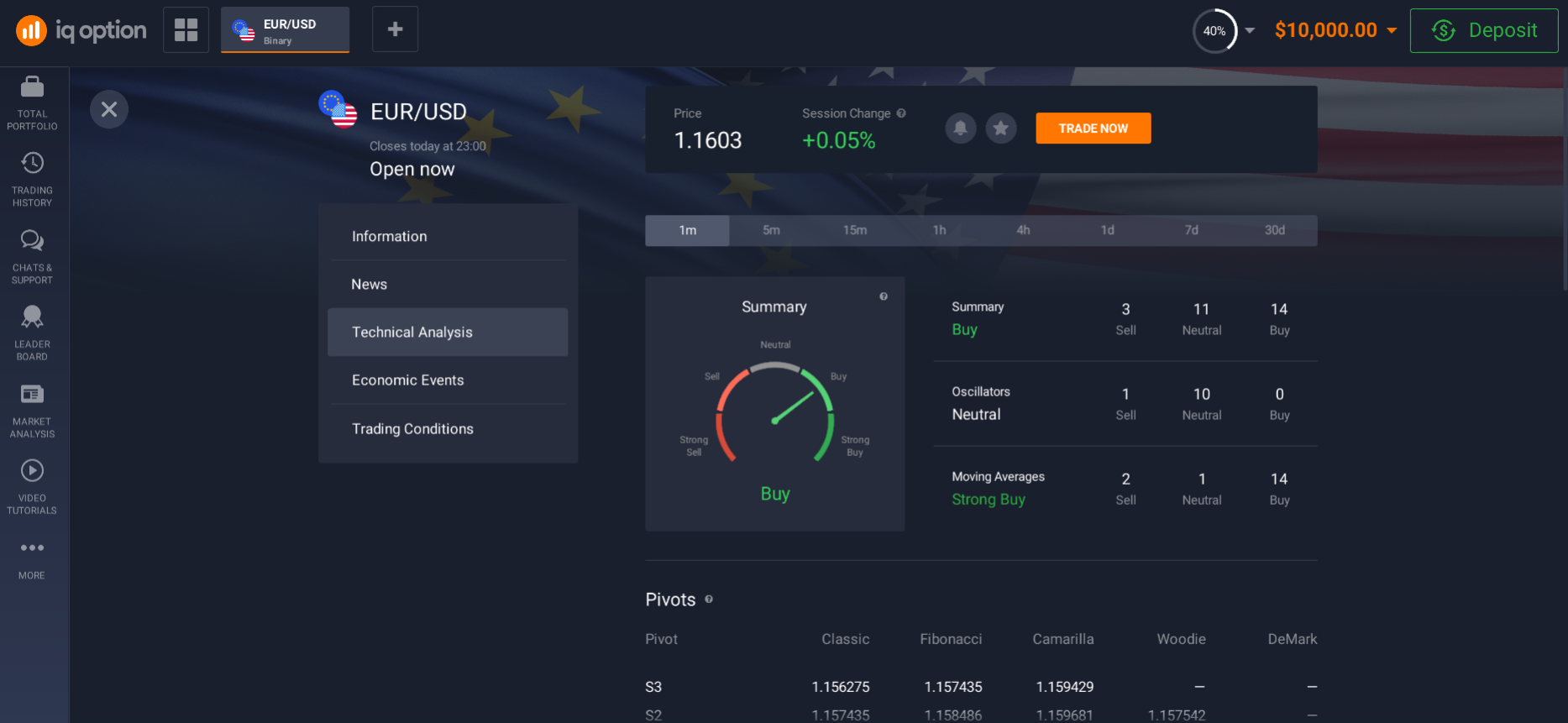

There are many types of trading strategies, but they are mostly based on either technical or fundamental principles. A common feature is that both rely on quantifiable information that can be verified for accuracy.

Technical analysis strategies rely on functions and indicators to generate trading signals, as well as charts that represent price movement. Traders using this method assume that all information is contained in the price and that it moves in accordance with the trend.

Fundamental trading strategies take fundamental factors into account. For example, an investor might have a set of selection criteria to create a list of opportunities. These criteria are developed based on an analysis of factors such as income growth and profitability.

Features of the EURUSD currency pair

EURUSD is the most important pair in terms of daily trading volume, accounting for about 29% of the world's total currency trading. This is primarily due to the fact that the economies of countries associated with these currencies are considered the largest in the world.

If the EUR / USD exchange rate appreciates, it indicates that the euro is strengthening against the US dollar, and more dollars will be needed to buy one euro. If the rate of this financial instrument falls, it indicates the strengthening of the US dollar and the loss of the euro. Based on this, you can make assumptions about other pairs that include these currencies.

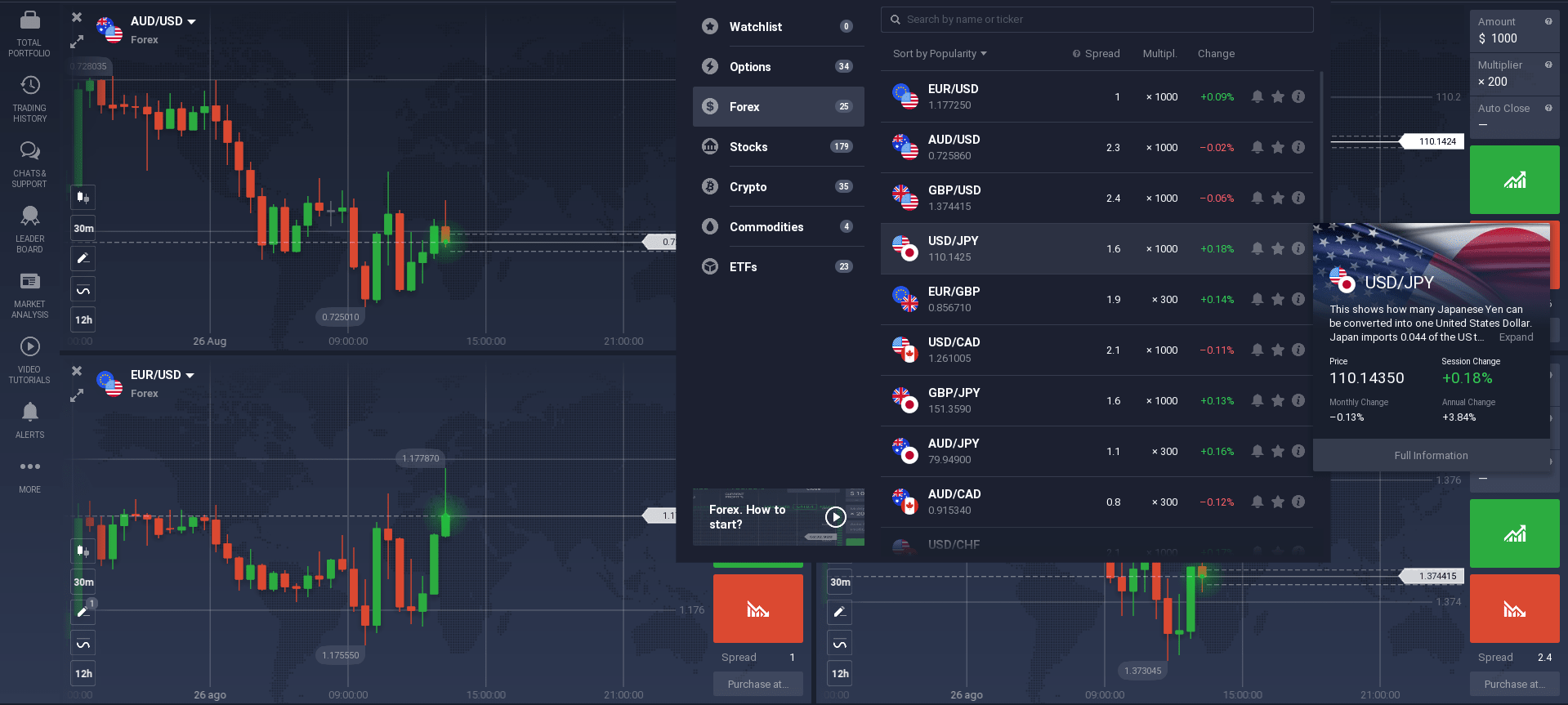

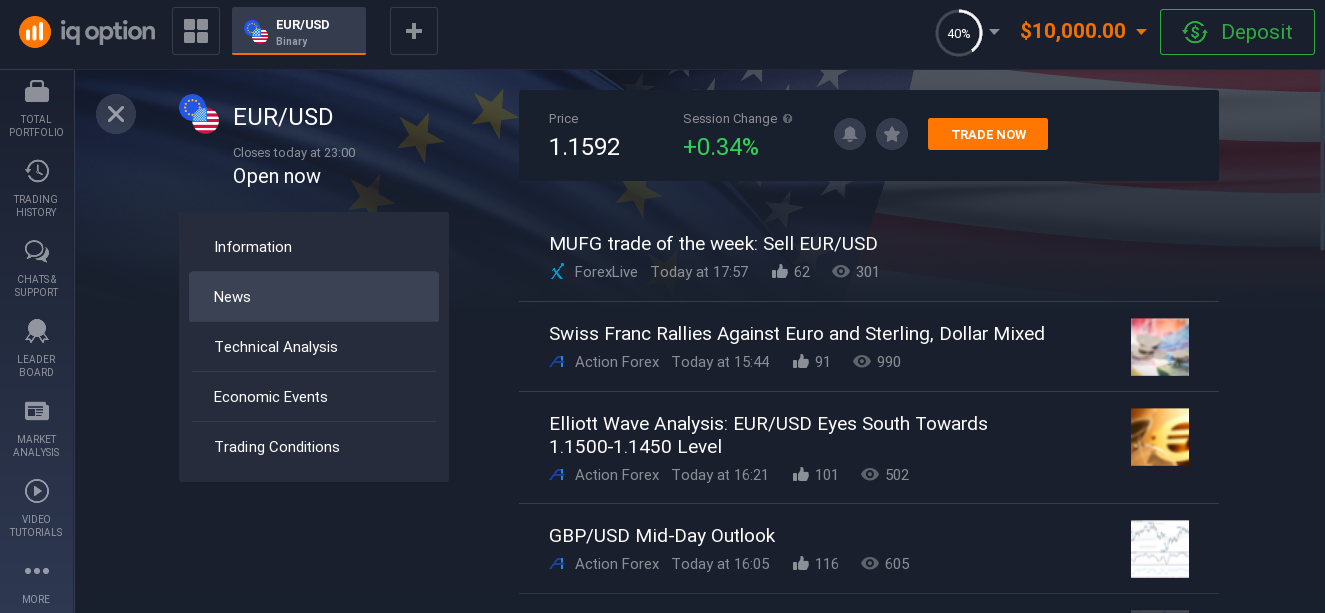

How to start trading EURUSD in Pakistan

To trade the EURUSD currency pair, you need to decide on a trading platform. To choose the right one, the trader will need to use the Internet. You will need to read reviews from other traders and make sure that the site is not a scam. It is also necessary to familiarize yourself with the site itself, and make sure that it will be convenient and simple to work with it. This helps to improve the efficiency of trading.

After you familiarize yourself with all the bonuses that the platform offers, they can be very useful at the beginning of a trader's career. It is also important to familiarize yourself with the initial payment. It varies depending on the site that the trader chooses, from $ 10 to $ 1,000.

Once the trader is familiar with all the important aspects and has chosen the platform that suits him, he can start the registration process and start trading.

Registration at the sites should not be difficult, it usually consists of two stages: the registration itself and verification. At the time of registration, a trader indicates an email address, his name and comes up with a password. Then, when verification is in progress, the online broker may request some documents to confirm the age of the trader and clarify some data.

Trading is considered to be a profitable passive income, which makes it very popular in real time. Now people have a simpler attitude to making money on the stock exchange, because it is really profitable and contributes to self-development.

After registration, you need to make an initial deposit, only after that, the trader will be able to trade. Then the platform opens and the trader looks for a pair of currencies, which he prefers in trading.

When a trader fulfills all the instructions and is serious about his business, then there is a possibility that the trade will be successful immediately, so go ahead and try and your result will definitely exceed expectations.

Related pages

Characteristics of the currency pair GBP/USD