Characteristics of the currency pair GBP/USD

What are currency pairs?

A currency pair is a reference to the ratio of the traded currency to the quoted currency. Thus, the term currency pair is always used to refer to two currencies, with the ratio deciphered as the amount of quoted currency that can be bought for one unit of the base currency or called a quote.

As a rule, the term currency pair is used in the banking sphere and trading at the Forex market. Historically, the major world currencies are paired with the American dollar and make up their value to the American currency. In other words, they reflect how much currency can be bought for one American dollar.

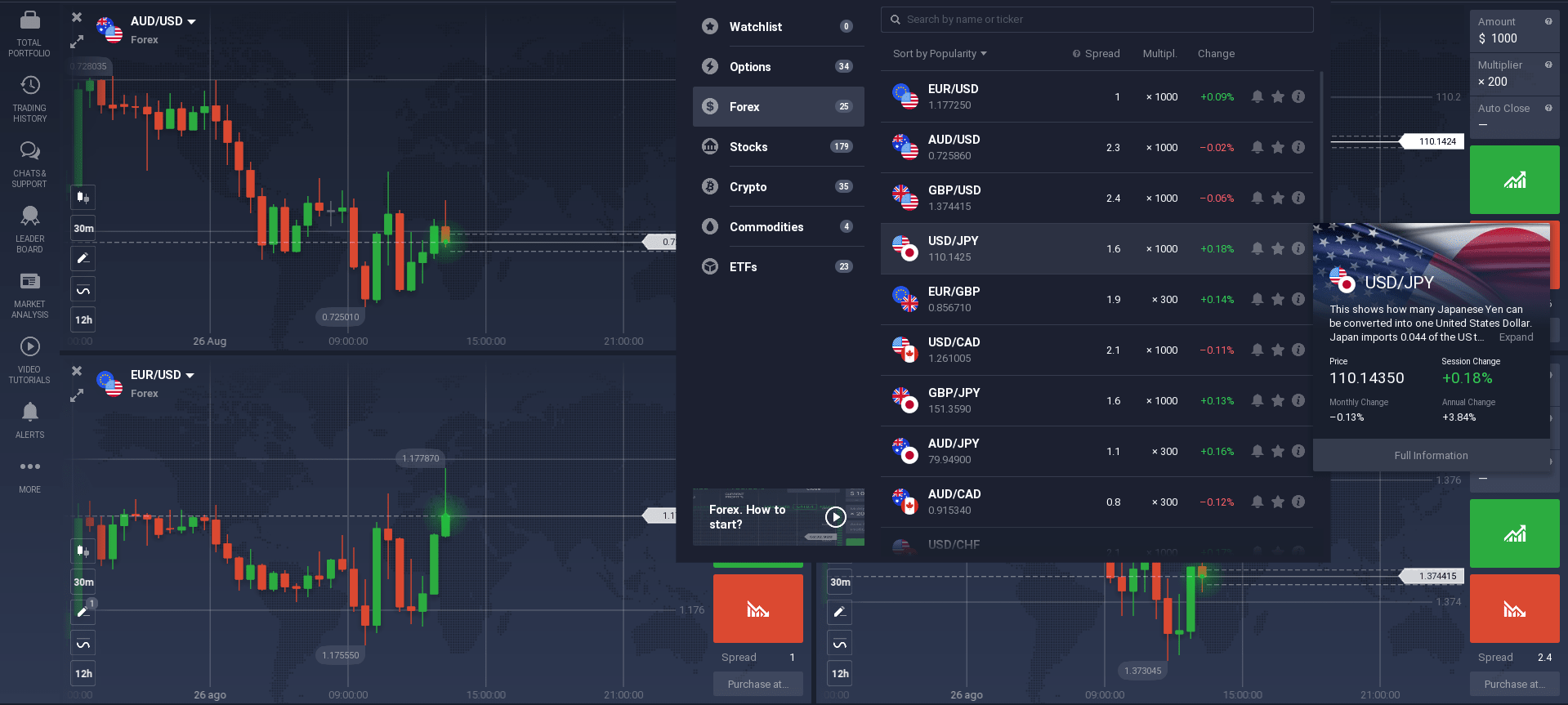

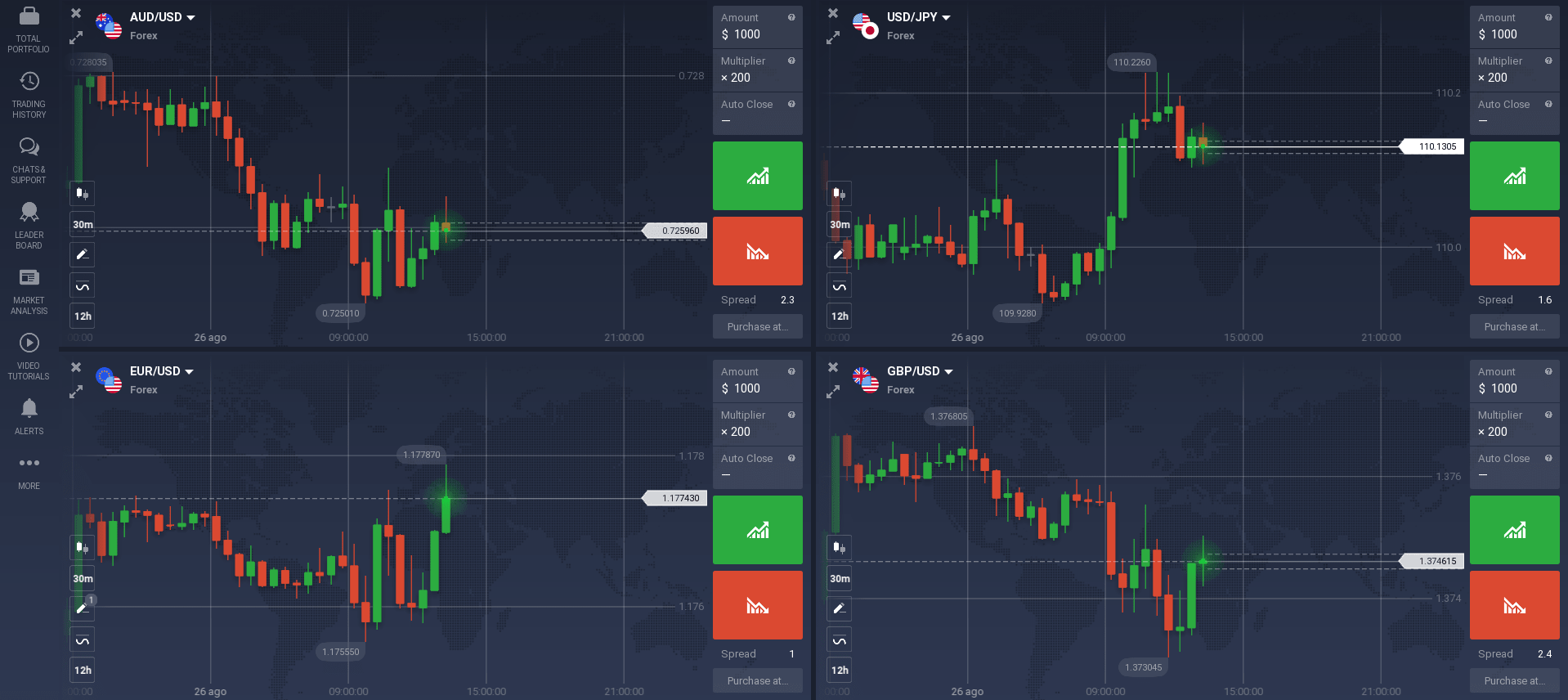

To date, there are many notations of currency pairs, which traders use in trading. Examples include the Euro/Dollar (EUR/USD), Dollar/Swiss Franc (USD/CHF), Dollar/JPY (USD/JPY), British Pound/Dollar (GBP/USD) and others.

It appears that a Currency Pair is a financial instrument for trading in the forex market. Two currencies - the base currency and the quoted currency - form the currency pair. The most liquid currency pairs in the Forex market are EUR/USD, GBP/USD, USD/CHF, USD/JPY, USD/CAD, AUD/USD, NZD/USD.

Types of currency pairs

Nowadays, almost all known currencies are used for forex trading, which is assembled into pairs. Historically, currency pairs have been divided into three subgroups: popularity, liquidity value, trading volume and activity, and other values.

1. Major. Major is the smallest but the most critical group. Major pairs or simply majors have the highest and most significant liquidity, frequency of use, total trading volume and turnover on the global currency arena.

These are the most popular instruments used by everyone from beginners to seasoned traders. In addition, these pairs have the lowest spreads.

Major currencies include the currencies of the world's leading economies. These include the European Union, USA, Canada, UK, Switzerland, Japan, Australia and New Zealand.

A complete list of major pairs:

- AUD/USD.

- EUR/USD.

- USD/JPY.

- GBP/USD.

- USD/CHF.

- USD/CAD.

- NZD/USD.

All majors have the US dollar as the US dollar is the largest currency in the forex market.

2. Crosses.

This group contains all the different combinations of the major currencies listed above but does not include the US dollar. This group is called secondary (minor) currency pairs. In the traders' environment, they are called cross rates, cross pairs or crosses.

These pairs also have high liquidity but are in less demand due to higher spreads than the majors.

The major crosses include:

- AUD/CAD.

- AUD/CHF.

- AUD/JPY.

- AUD/NZD.

- CAD/JPY.

- CHF/JPY.

- EUR/AUD.

- EUR/CAD.

- EUR/CHF.

- EUR/GBP.

- EUR/JPY.

- EUR/NZD.

- GBP/AUD.

- GBP/CHF.

- GBP/JPY.

- NZD/JPY.

3. Exotics currency pairs.

The third group is called Exotics (exotic currency pairs). This currency group contains all currencies which are not included in previous groups. These are currencies of weak and emerging economies, currencies of small countries, etc.

The base currency in such pairs is, as a rule, the currency of a major group. Thus, there are practically no very exotic variants where both currencies are not majors.

There are plenty of such pairs. It would be impractical to list them all. Here are just a few examples:

- USD/RUB.

- USD/MXN.

- EUR/DKK.

Currency prices

Every beginner trader probably knows this feeling of confusion and lack of understanding when you have your trading terminal open. There is a currency pair chart with some sticks, rectangles, curved multi-coloured lines on it, and the price chart is moving up and down. It seems impossible to understand how and why currency quotes are changing their direction, so you can rely on your luck, hoping that the rate will go in the direction you want when you open the deal.

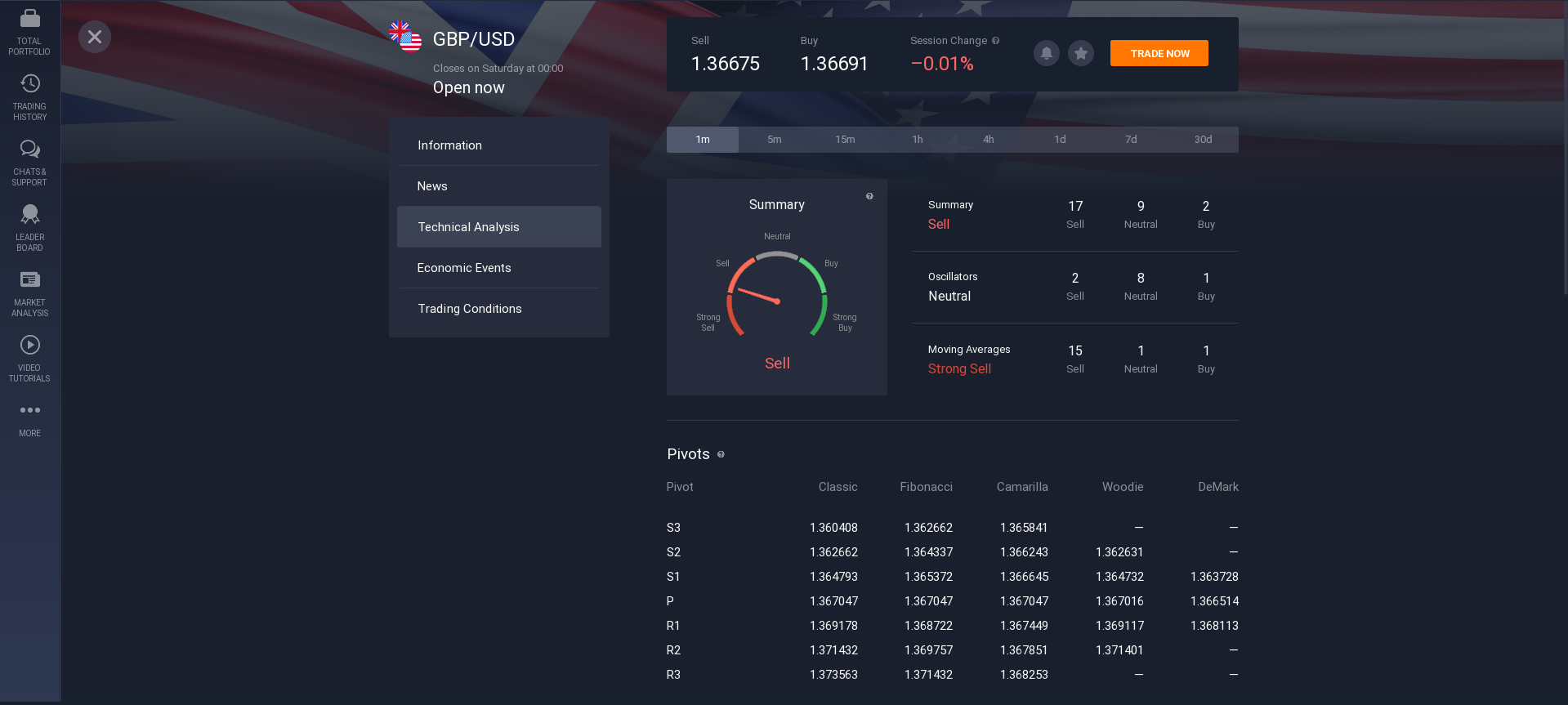

In reality, of course, the quotes are not as unpredictable and confusing as they seem at first sight. A lot of things in the Forex market you can explain. You are using methods of fundamental and technical market analysis. When you learn about the market, you will realise that the price movement on Forex is not chaotic. It depends on different reasons.

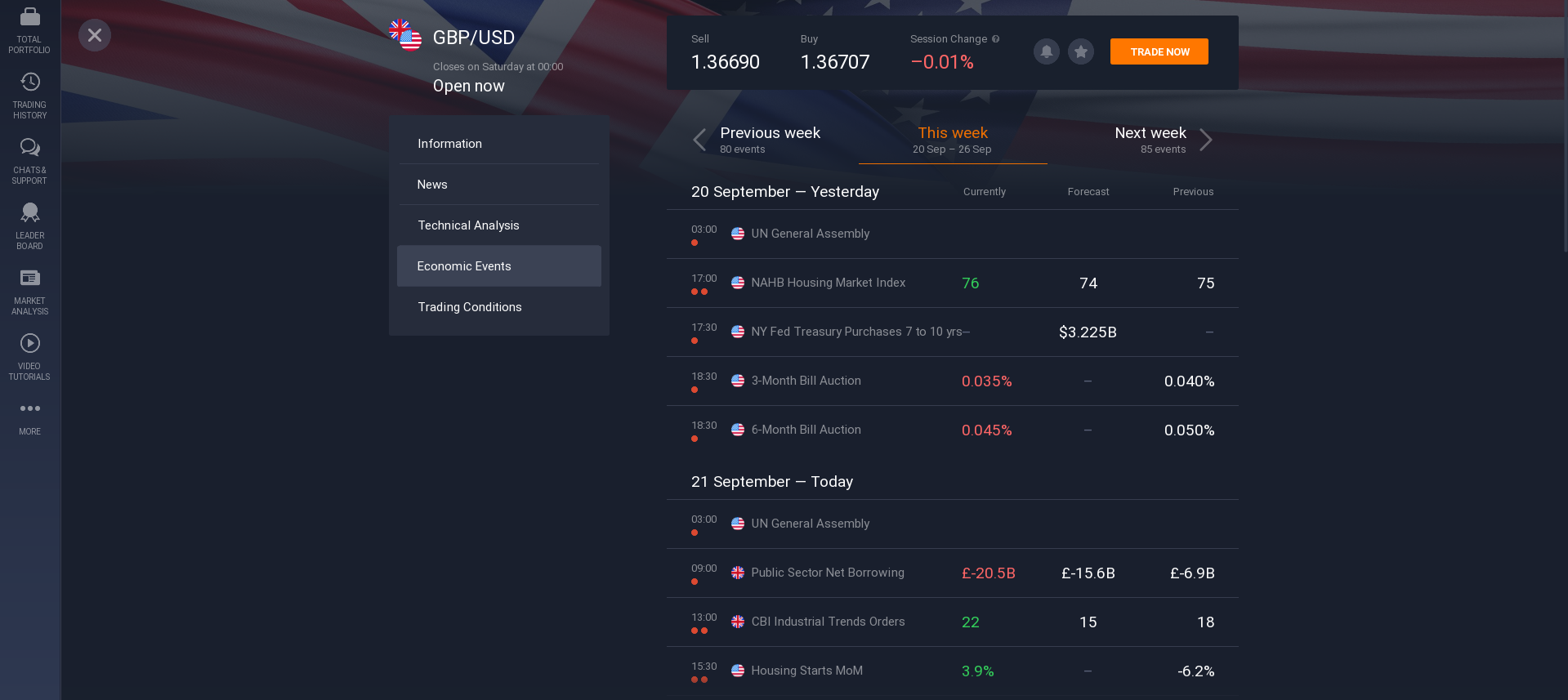

Fundamental factors are mainly economic news, statistics about the financial situation of a particular country, region or the world. All such data is displayed in an economic calendar. Thus, if you know in advance about the publication of some vital information, you will predict the direction the exchange rate will go.

Suppose that you trade the currency pair British pound/dollar. This means that you should pay special attention to the economic indicators from the UK and the US. For example, you look at the economic calendar on the internet and see that the UK unemployment data is due in 2 hours. You realise that if the number of jobs goes up, the pound will strengthen and if the unemployment rate goes up, the pound will weaken. So you have to wait for the news to be released, see if the market reacts correctly, and open a trade in the direction the price moved after the report.

There are also reasons of technical nature. The simplest example is the support and resistance lines. If you look at a chart and take time on that chart, the currency pair's price will have several lows and highs in that period. When you draw a line between at least two highs in that interval, it will be a resistance line, and a line between the lows will be a support line.

A resistance line protects currency quotes from further rises: when the price reaches this level, it usually turns around and goes in the opposite direction. On the other hand, the support line prevents the price from falling too low: when it is reached, the cost of the currency breaks away from this level and goes upwards. As a rule, support and resistance levels are based on "round" figures. The market is an aggregate of many participants, i.e. people, and people usually like flat statistics better. When the price reaches such a psychological level, traders stop their activity and the trend changes.

Of course, this is not all the reasons why forex prices change and how quotes move. To understand this, you need to study Forex and improve your knowledge and skills all the time.

Trading sessions

Every trader knows: you can work in the forex market 24 hours a day, five days a week. But, of course, such a busy schedule is not for everyone. And there is probably no trader who would spend 24 hours in front of the monitor monitoring the price changes and opening orders.

However, there is no such vital necessity. The activity of each currency pair varies during the trading day. And the forex trading sessions have the most significant influence on it. So let's look at what these are and how vital the trading hours of one exchange or another are.

Main sessions

There are three main trading sessions: Asian, London (European) and New York.

You should pay attention to their working hours when planning your work on Forex. However, some traders determine the fourth session - Australian/Pacific (Sydney). But because its hours are slightly different from the Asian session, not many traders pay attention to it. Nevertheless, it is worth knowing.

The main thing to remember is that the activity of a currency pair usually matches with the start of a concrete trading session.

Trading time frames

The time frame is of fundamental importance in the strategy. There are market moments when the price can go through a long interval in a few minutes and return (high volatility).

Scalping strategies allow earning on such moments, but a trader should see the price change for the shortest possible period for market analysis. That is why M1 (1 minute) is set. Logically, no minute changes will be visible on the hourly interval.

It is impossible to say which of the time frames is the most optimal, profitable or convenient. The time frame is a setting that a trader selects individually. First of all, the choice of time frame depends on what trading style a market participant uses in his work.

Three main styles of trading

There are three main styles of trading, each of which will require a different timeframe.

1. The first style is day trading or intraday trading.

With this strategy, a market participant needs a few minutes to a few hours to execute trades. All trades are completed within a single trading day, without rollover.

This kind of trading is the most common for forex traders as it is real-time trading. For example, you can follow news releases and react to them instantly, thus increasing your profits. In addition, making short-term forecasts is times easier, which increases the efficiency of trading.

Time Frames between M1 and H1 are suitable for this style of trading.

2. The second style - medium term trading.

In contrast to day-trading, it will require a few days for making a deal. This style is more secure and does not require watching the news releases, enabling the trader to devote less time to the activity. Medium-term trading is much less stressful and has one significant drawback: it is not suitable for beginners.

You need to have a lot of knowledge and build up a trading strategy, which is something only experienced traders can do.

The time frame for such trading is between H1 and D1.

3. The third style, correspondingly, is long term trading.

But in practice, such a style is more like investing because it may last from a few weeks to months, and it is based on securities or commodity assets instead of currency pairs. One more specific feature of this style is safety and minimal risk.

The trader has practically no need to keep abreast of the market events and devote much time to trading. Therefore, long-term trading is most often used as semi-passive income. However, to get considerable profit, a trader must be experienced in fundamental analysis, have suitable market orientations and total capital. Therefore it is not safe to consider this variant for beginners - wrongly set trading vectors can cause loss-making orders even in all its safety.

The time frames between D1 and Y1 are used for long-term trading.

It is necessary to understand that to select the most effective time frame. It is not enough just one theory. It is worth testing a few different timeframes to find the most suitable one. Moreover, you can always change the time frame in your trading platform.

Features of the currency pair GBP/USD

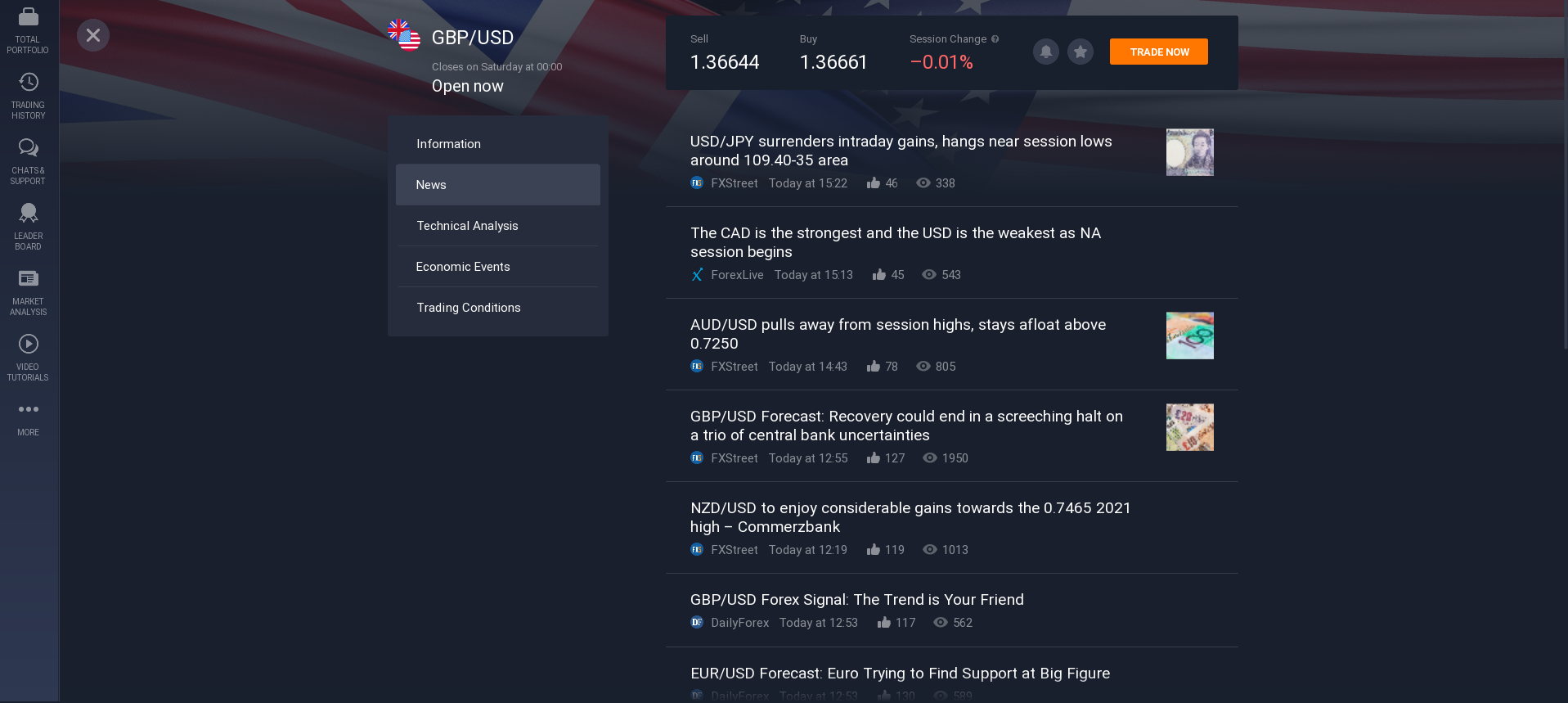

GBP/USD quote - what does it show?

The pound is the base currency, and the dollar is the quoted currency. Thus, the commonly recognised symbol, GBPUSD, stands for the value of one British currency unit in American dollars.

Characteristics of the GBP/USD currency pair

This is one of the four major currency pairs with a long history and stable popularity among traders.

GBP/USD is an effective tool for both experienced participants and beginners in their investment portfolios.

The currency pair unites two significant economies of the world. Volatility and an intelligent approach ensure the most comfortable trading.

What does the GBP/USD exchange rate depend on?

The quoted price is proportional to the currency pair: it goes up if the GBP exchange rate goes up or down, and vice versa. The exchange rate is influenced by some EU countries, the US and the UK.

The high importance of the pound (in third place after the dollar and the euro) is explained by the fact that the country has a virtually independent economy and a large amount of capital is concentrated in London, one of the world's largest centres.

It is also home to the London Stock Exchange.

How to start trade GBP/USD in Pakistan?

If you want to get started in trading, the currency pair GBPUSD is a great place to start.

Working with multiple pairs is for experienced traders. For beginners, we recommend focusing on one particular currency pair.

Registration

The registration process is quick and easy. First, you need to fill in the blank fields on the registration page. The platforms usually ask for personal information so that you can be identified.

Demo account

Do not try to grasp everything. You don't have to try your hand at everything. Instead, try to understand the algorithms of the movement. Study history to understand the reason for a particular price movement. Take your first steps on a demo account without losing money.

A narrow specialisation on one instrument is always better than a lot of knowledge about nothing on the whole terminal. A trader is, first of all, a professional in a narrow specialty, and only then - a specialist in many instruments.

Real account

After experimenting with the demo account, you can start to open a real account. To do that, you need to make a minimum deposit of $10.

Deposit and withdrawal

You can deposit or withdraw money by any convenient way, such as credit or debit card, e-wallet or bank wire transfer.

Related pages

IQ Option 4.0 Investment Software