Best binary options trading platform with demo account

What are Binary Options? Binary options trading refers to financial instruments that use binary options as one of their primary strategies to create a return on investment (ROI). Binary options refer to any derivative financial instrument, the value of which depends on the price movements of the underlying assets on which they are based, rather than giving you ownership of them. This may seem like an incredibly complicated concept, but it's actually quite simple. For example, suppose you are interested in taking a position on the Dow Jones Industrial Average. If the Dow Jones Industrial Average starts to lose value, it would be called a "bet against" that move.

Now, when it comes to binary options, what it means to "own" the assets that you are betting against is not really clear at first glance. However, the reason many people choose these options is because it is a fairly easy way to invest money without having to own anything directly. As an example, let's say you decide to invest in binary options because you want to build a conservative portfolio for tax purposes. You would first buy 100 shares of stock and then invest it in cash or dividends. The problem with this approach is that you won't actually have a stake in these companies, and therefore your portfolio may shrink over time due to losses.

One of the biggest advantages of binary options trading is that it allows you to trade with very little risk, if any at all. This makes it a great form of trading for new investors who have little or no experience with financial instruments. However, many novice traders make the mistake of rushing into binary options trading without prior research. The problem with doing research is that you get involved in too many trades and lose your money. This is why it is so important to do your research and choose a trading strategy that is appropriate for your financial instrument.

Binary options can be used with a number of different financial instruments, including stocks, derivatives, commodities, currencies and commodities. This versatility makes them popular with traders. It also has the advantage, in most cases, of allowing traders to participate in the trade without having to own the underlying asset. For example, if you are interested in investing in a particular stock but do not have access to the stock itself, using binary options trading means that you can speculate on its price without actually buying it. This makes this form of trading very attractive to novice traders, as they do not have to worry about buying the stock itself. Instead, they can speculate on its price and make a profit if they guess correctly.

Another advantage of binary options contracts is the speed at which trades are made. Since each bet is only a fraction of a penny, it can easily be completed within seconds. This means that for most traders it's fast enough to make their trades, and for other investors it's fast enough to catch up with them. This is an important factor if you want to get in and out of trends quickly, or even if you want to get out of them quickly depending on which direction they are moving in.

Another important advantage of binary options is that they offer flexibility in terms of payouts. Since there is no physical commodity, payouts can vary greatly between different assets. This means that traders can vary the risk/reward ratio of their trading portfolio, allowing them to adjust the payout accordingly.

These contracts allow traders to profit from the volatility of asset markets, which has been the cause of recent developments in finance. However, because of the volatility, in some cases, there is a risk of excessive losses. To reduce this risk, it is very important to understand the mechanics of the contract and apply a well thought out trading strategy. A detailed understanding of the underlying asset markets and technical analysis of the trading market are critical to success. The ability to spot trends and identify trading opportunities also helps.

What are binary options? The answer to this question is more complex than it appears at first glance. Binary options are not the same as traditional options. Traditional options trading strategies rely on analyzing fundamental data to predict the movements of the underlying asset over time. This information is available to financial planners and investment managers, but is difficult for the average investor to obtain.

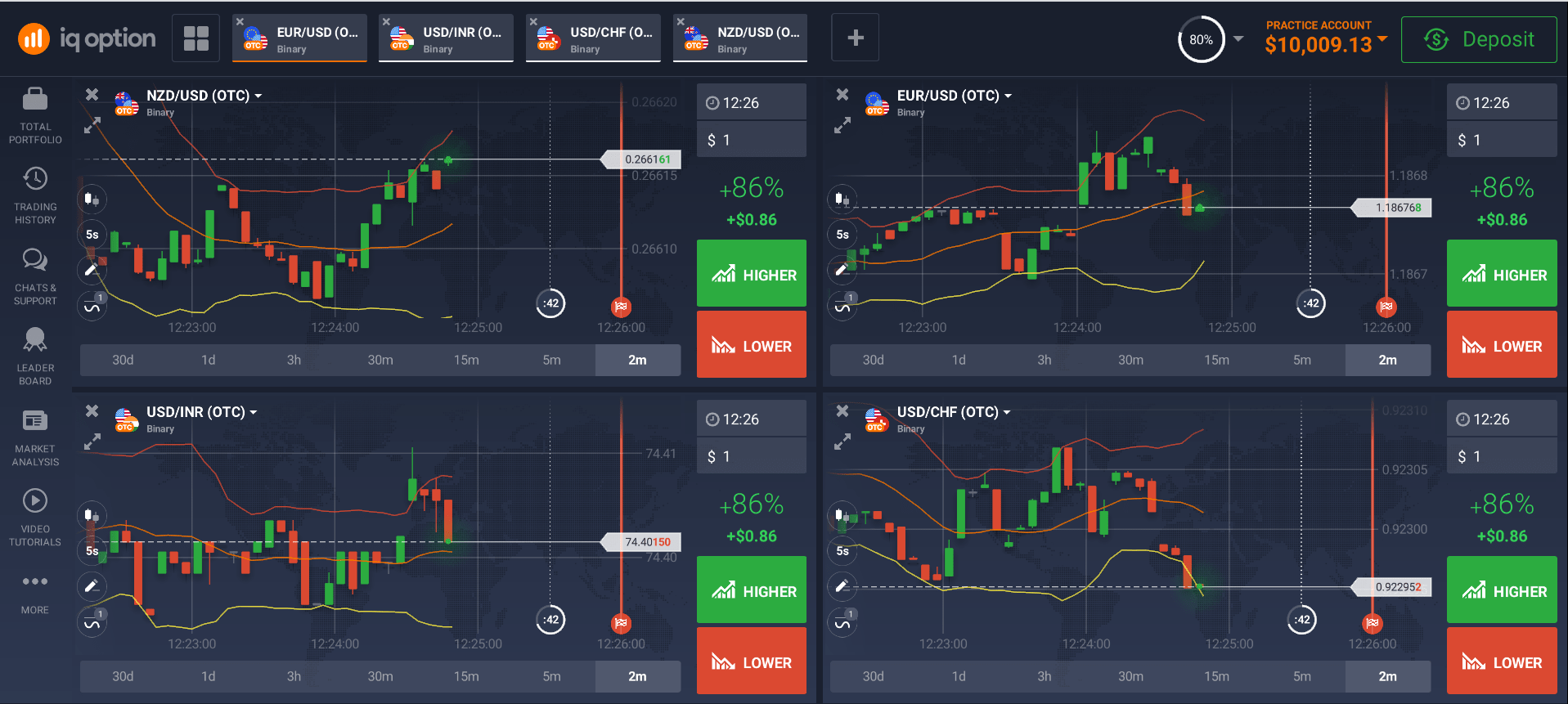

Binary options trading platform

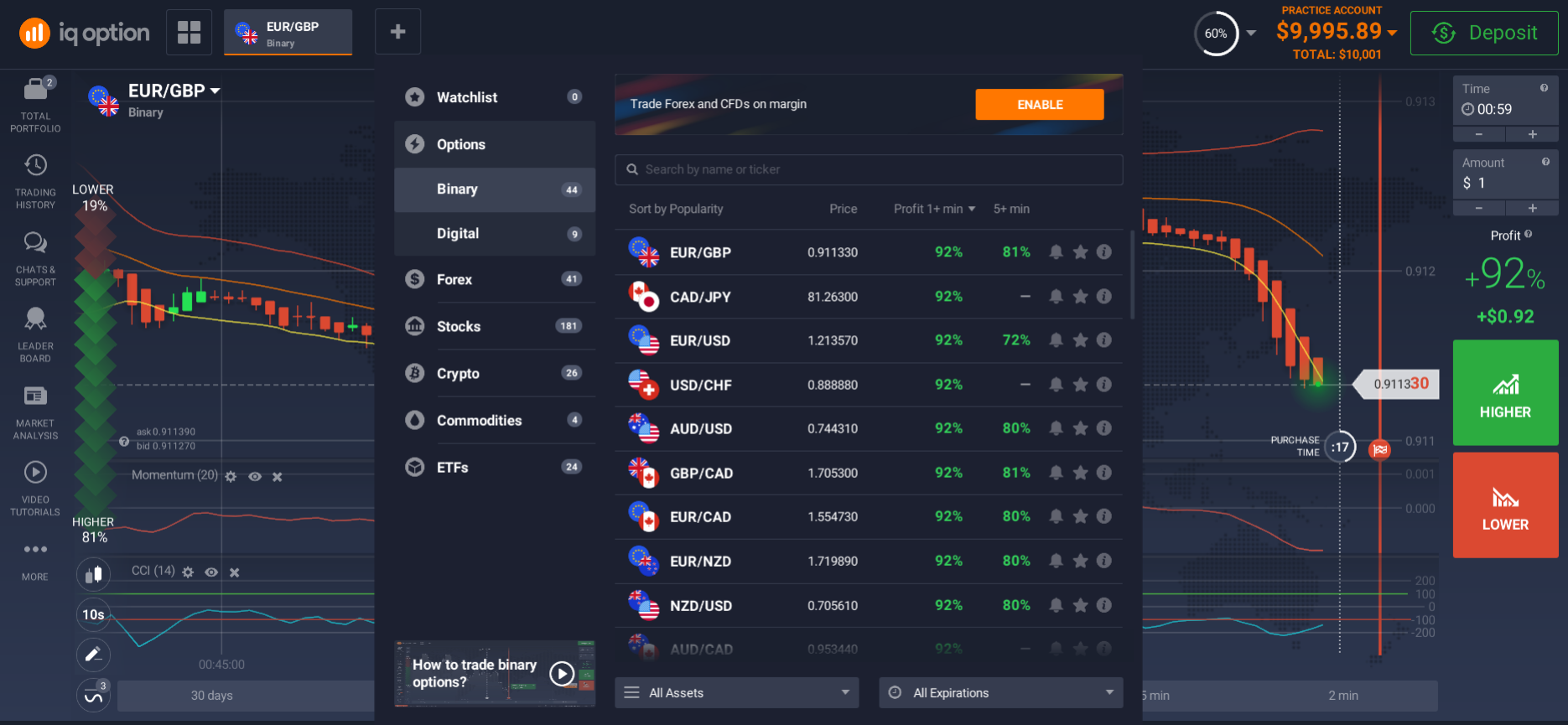

Trading platforms for binary options differ depending on the type of binary option you are trading. However, all platforms have some things in common. Trading platforms are easy to understand and easy to use, even for someone who has very little knowledge about trading. Platforms are recommended if you want to trade binary options online from the comfort of your home or office.

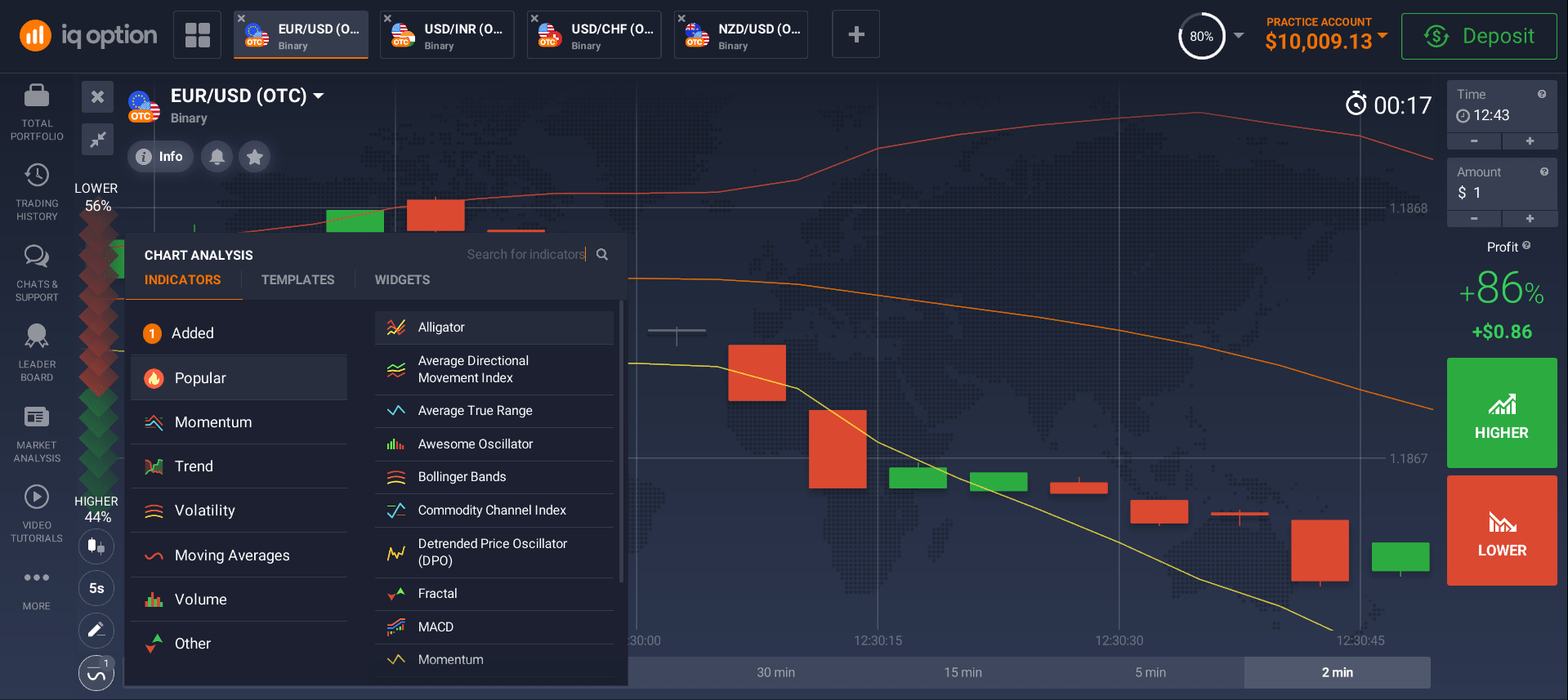

Some trading platforms have a demo account option, where you can practice all the trading operations without using real money. You can try out all the strategies and find out how they work. This demo account is usually provided free of charge along with the trading platform you choose. Another type of platform is a copying platform. Copying means that you don't need to download anything to your computer or laptop, instead you can simply copy a file from your desktop or USB drive to the trading platform.

The mobile trading platform allows traders to trade options using their cell phones. With a mobile trading platform, you can start trading in just a few minutes. You don't even have to visit your broker's office, as it is always with you.

Whether you're at home or traveling, you can trade in just minutes with these platforms. These are also risk-free trades, so you don't have to worry about incurring any losses. With risk-free trades, new traders will also learn how to properly manage their capital. Traders can open their trading account either in a demo account or in a real account once they have gained enough experience.

There are several trading strategies that can be used. Most often, traders use a buy and hold strategy. This strategy consists of buying options that expire. This way you use all your capital until a certain time, when the expiring options will be worth less than when they were bought. After the option expires, if prices return to their original levels, the trader sells the contracts and receives the difference, less his commissions.

However, before any option is bought or sold, it must first be placed on the market. The selling prices of binary options are determined by three factors - strike price, time period and volatility index. Once these factors are met, you can buy assets representing one of the parties. If the strike price is higher than the strike price of the underlying assets, then the trader makes a profit as he receives a premium, which is calculated as the difference between these two values.

When the binary options contract is concluded and the buyer wins, he gets back his premium that he paid. The difference between the purchase price and the seller's price is also called the spread. This is the reason why most people invest in binary options contracts in order to make a profit as quickly as possible. However, it is important for the trader to understand that no investment will guarantee him a win every time he chooses this type of trading. There are certain systems and strategies developed by experts that help traders win more often, even if they lose money the first few times.

How to choose a trading platform?

To choose the best platform for trading binary options you need to be very attentive to details.

- Read the reviews of traders who have been using the platform for more than a year, also find information about its license, this can be done through the Internet.

- An important plus is that the platform has a mobile app, so you can check your portfolio and current trades at any time. You can also use the mobile app to trade while travelling or taking a walk.

- The system of the platform must be easy and clear to use.

- The trading platform should be multi-purpose and have up-to-date data on all assets.

- Having 24/7 technical support available in all world languages is also a major plus.

What is a demo account and how to use it

What exactly is a demo account? A demo account is a kind of virtual account, accessible through several trading platforms, which is supported by fake currency, allowing a potential new customer to test various trading functions and their features without investing their own money. They are usually supported by an online interface that allows users to use trading tools as well as make changes to their positions. Once a person gets used to trading and using these tools, they can start making real money transactions.

With so many brokerage accounts online these days, it has become quite easy for people to open binary options trading platform demo account and start practicing their trading strategies. This is important because many people take risks in this market, which can lead to big losses if not prepared properly. Most people prefer to start with a demo account because it gives them the opportunity to try out the trading strategies they have learned. Trading platforms usually provide such demo accounts for free, and so it is easier for prospective clients to learn and practice their trading strategies.

Some of the online brokerage sites also offer demo accounts to potential clients. In fact, some of these platforms offer free demo accounts to new clients so that they can learn more about the trading platforms and their functionality before they start real trading.

There are many reasons traders use demo accounts to learn and practice their trading strategies. First, trading platforms like demo accounts are easier to use. These online trading platforms are usually user-friendly and do not require much experience from traders to use them. In addition, these trading platforms offer free advice, so traders can learn from the advice of a real trading account without having to pay for anything. Many of these online brokers also offer demo accounts to prospective clients as a means of introducing new clients to their services.

So all you need to do in order to start using a demo account is to register on the trading platform and select the demo account function.

How to register a demo account in Pakistan

The first step on the way to register a demo account in Pakistan is to visit the website of the broker you want to register with. Usually, users are required to enter their details such as first name, last name, email address and come up with a password. After that, you will receive an email with a link to confirm the registration, all you have to do is to click on it.

Then you need to pass the verification, which would confirm your identity. To do this, the broker may ask you for scans of your documents. This process is carried out for your personal data to be safe and not to fall into the hands of fraudsters.

Then the trading platform system will offer you a choice between a real and a demo account. You should not start with the real account, train on the demo account, work off your skills and when you are confident in your abilities, start trading with real money.