Best options trading platform in Pakistan

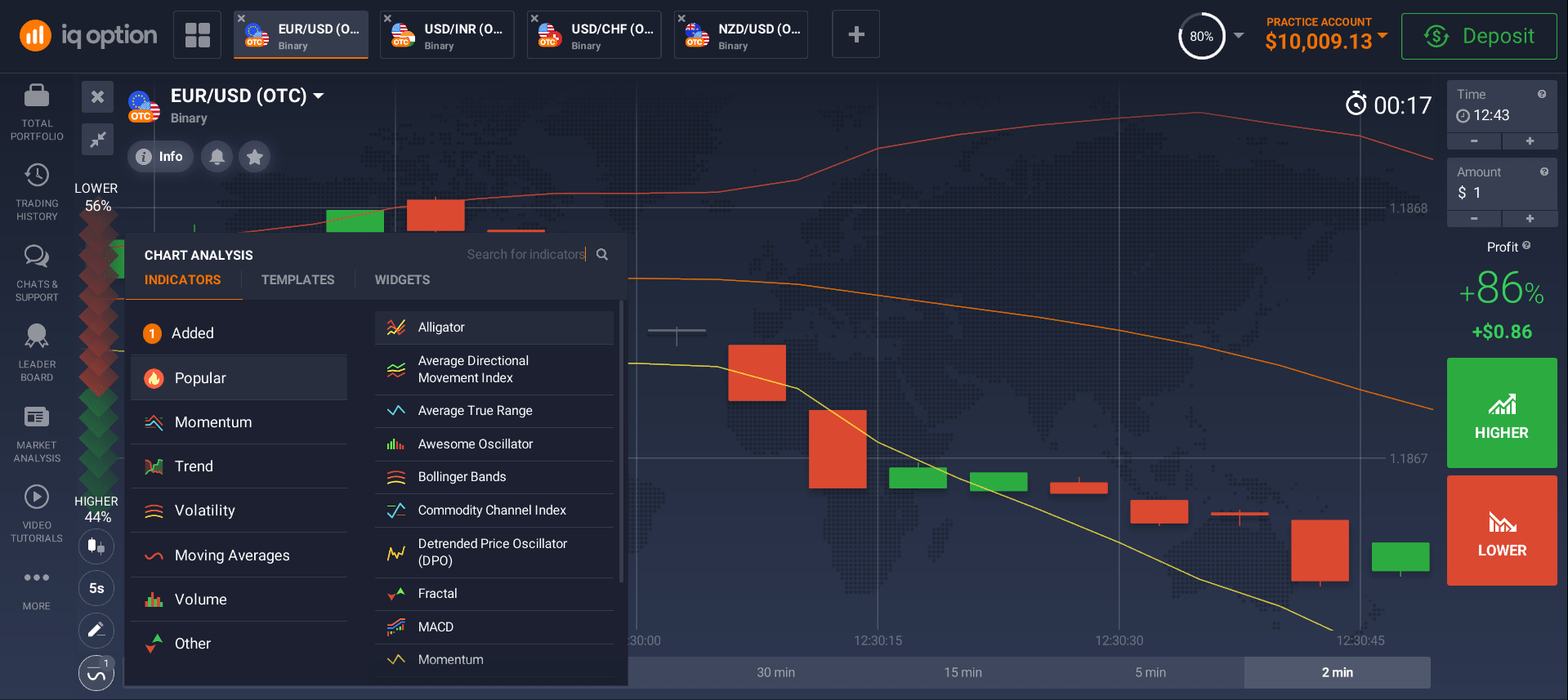

An excellent trading platform is essential for every dealer. An online trading system should be user-friendly. This should allow the trader to define their entry and exit points for each individual trade. To make things easier, an options dealer must use a trading platform that provides the best indicators for trading options. The best indicators for trading options are moving averages and trend lines. Our platform is intuitive and allows you to conveniently use these tools.

An option is a contract that gives a buyer the right, but not an obligation, to buy or sell a specified asset at a specified price or by a specified date.

That is, an option is a contract in which not the asset itself becomes the subject of bargaining, but the right of its preemptive sale or purchase.

Indicators are just one of the auxiliary tools for working with exchange-traded assets; they do not guarantee positive trading results. In order to understand the use of indicators, you need a trading terminal.

Moving averages help traders identify market trends by calculating the optimal moving average (MA). A trending market will tend to move smoothly and continuously over a period of time. But during a bull market, the MA will show a sharp rise and will most likely continue to rise until the bear market replaces it. This is known as the "bearish stage". A moving average indicates that the options market has entered a bull market and contracts tend to have higher values.

As you might have guessed, a bullish trend is a period when the main trend in the market is upward. Bulls push prices, there are more of them than sellers and the price chart moves up as prices rise. Synonyms: uptrend, bull market.

Well, a bearish trend is a period of falling prices, when the main trend on the chart is downtrend. There are more sellers than buyers, therefore, according to the law of the market, prices fall down, which means that we should also sell. Synonyms: bear market, downtrend.

A trend is the main direction of the price. Most analysts and professional traders advise opening positions along the trend, that is, in the direction of the main price movement. From them, you can often hear the terms "bullish trend" and "bearish trend".

There is also an oscillating indicator MACD (Moving Average Convergence Divergence). It is used in the following way - the trader looks to see if the lines on the histogram are above or below zero under the price movement chart of the exchange asset. If the lines are above zero for a significant time, this signals an uptrend, and vice versa. Accordingly, signals to buy or sell a specific asset are the crossing of zero lines in the corresponding direction.

An effective alternative trading platform should have some sort of limit or stop loss function built into its system. This will help you determine how much money you will lose if the market suddenly changes. If you inadvertently exceed your loss limit, you will need to sell your assets. So, stop loss, or stop limit, is a conditional order that allows you to automatically sell an asset at a price below the current market price if it drops to a specified level.

The options trading platform also allows the consumer to determine what type of securities he wants to trade. Often times, people choose to trade options based on the level of risk and reward they are willing to tolerate. Option contracts are either put or call options. Using a reliable alternative trading platform can greatly simplify the learning curve for buying and selling options on futures and stocks.

A Call option gives the option holder the right to purchase an asset at a specified price for a specified period of time.

A put gives the option buyer the right to sell the asset at a specified price within a specified period of time.

By using the best options trading platform, an investor can not only learn to buy and sell options more efficiently, but also increase their chances of making a profit from options trading. Our platform has been designed specifically for investors with very little experience, which also makes it incredibly easy to use and understand. In addition, we have a large section of training and information for novice traders. Video tutorials that will be available to you after free registration will answer many of your questions!

An effective trading platform should provide the user with a wide range of options information and tools. These tools include detailed charts, charts, and educational articles to help the buyer become more knowledgeable about the market.

Types of binary options ?

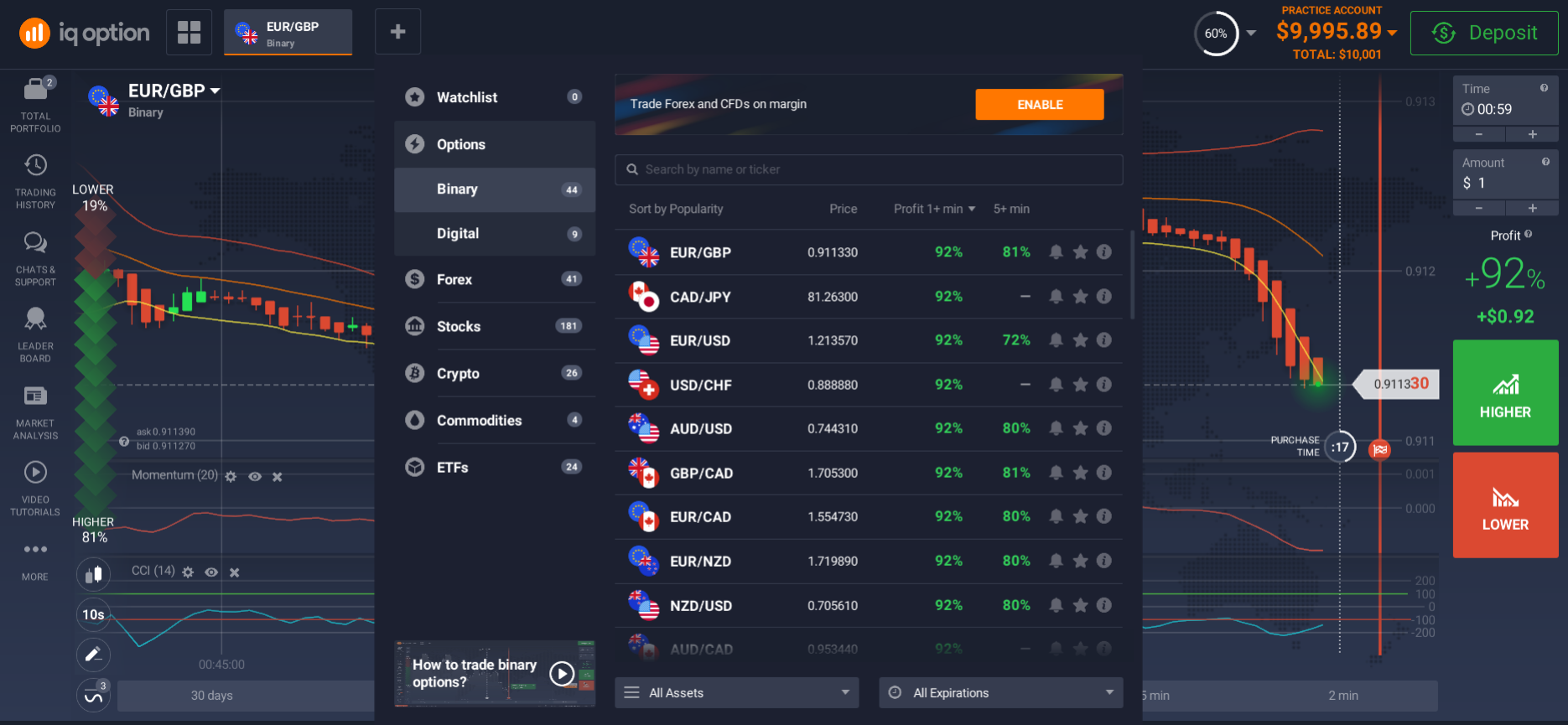

Binary options have become a separate type of options. Traders profit from price movements in the foreign exchange markets using binary options contracts, which means that if a trader guesses the direction of price movement, he receives his premium.

A binary option is a type of futures market contract. It differs from classic transactions on the exchange in fixed conditions.

An option contract has a fixed profit and loss percentage. If the forecast turned out to be correct, then the trader receives income; in case of an error, the invested funds are not returned. The percentage of profit does not depend on how far the price has traveled on the chart from the moment of opening a trade to expiration. This is the binary nature of contracts of this type, which is why they got this name.

Traders who use binary options contracts are required to set an expiration date at the beginning of each semester. This is called expiration. That is, a binary option has an expiration date and, as a rule, it occurs after a short period of time. Since the binary option can be more attributed to the short market. The binary options trading platform provides a sufficient choice of expiration for comfortable trading. This indicator determines the moment in time when the result of the transaction will be fixed. The most popular and offered by most platforms are intervals: 60 seconds, 2 minutes, 5 minutes, 15 minutes, 30 minutes, 1,2,3,4 hours, one day, one week, one month.

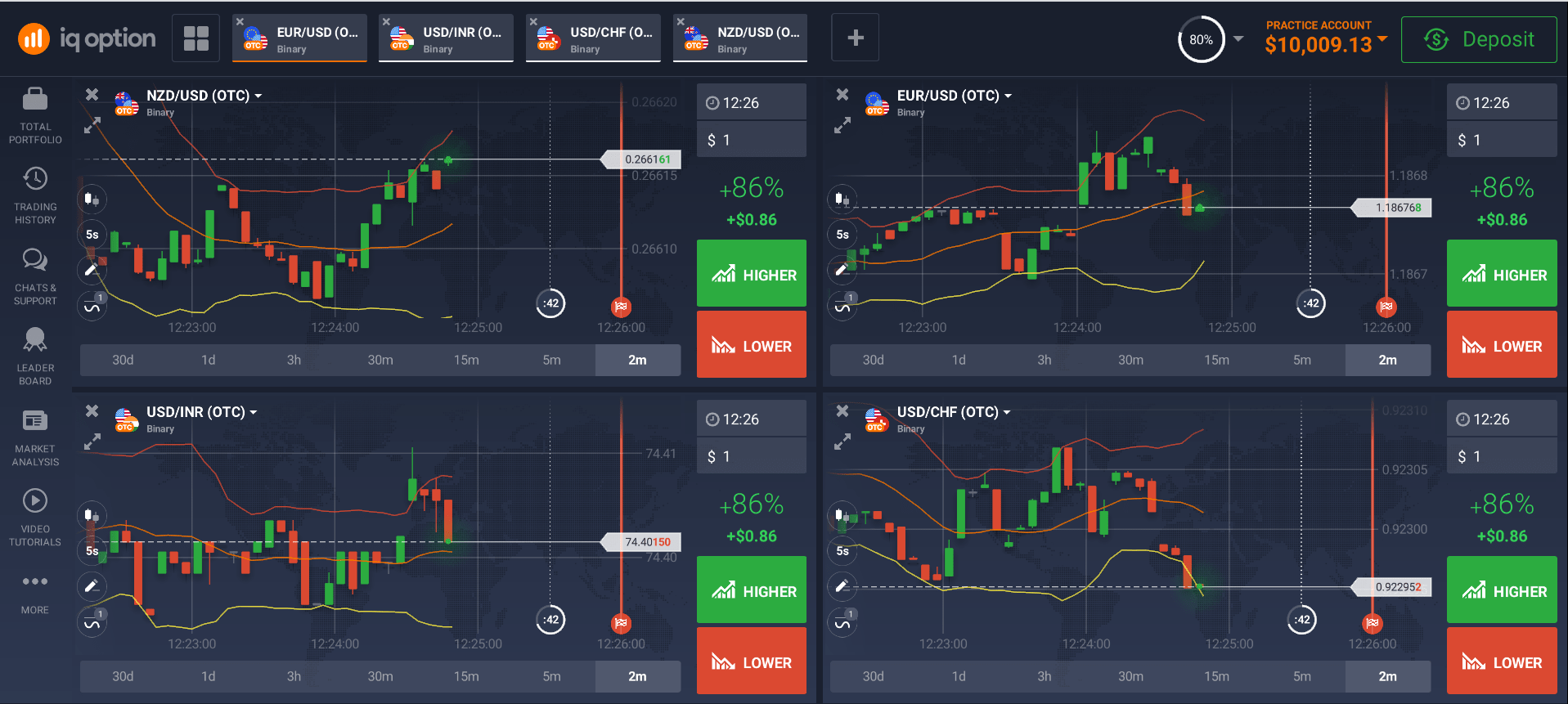

The reason many traders decide to trade binary options is the ability to create many trades at the same time.

Let's analyze the most popular type of binary options without which no investor (trader) can do.

- In the slang "higher-lower" Hi-Low or "increase-decrease", Call-Put. This is the basis of the entire concept of binary options, all subsequent developments are built on it (hence the name). And of all types, it is the most effective. Its principle is simple - to indicate the direction of the price for the asset "Up" or "Down" when opening a deal. That is why trading such options has become so popular, there is no need to understand the financial markets thoroughly.

- Options "One touch". The main condition of one touch is the overcoming or touching by the price of the level set in its condition. For example, you predict that the price of an asset will touch the $100 level at least once before expiration. If that happens, you win. Accordingly, there is an option "No touch", and here the situation is the opposite. You need to predict that the price will not touch a certain level.

- Option "Range". This is an option in which investors use channel trading, where, in order to fix a profit, the price of an asset must remain in a given channel (range), or outside it, depending on the conditions of the order.

- Turbo options "60 seconds". In such options, the time of one expiration ranges from 1 to 2 minutes. It is very suitable for those traders who simply cannot sit still and require constant movement. In 1-1.5 hours, you can make about 60-70 transactions, if the profitability is 60-70%, then you can calculate the profit yourself.

These are the main types of binary options that you can find from different brokers. Someone gives simple up / down, someone offers all options at once. We advise you to start with simple ones and after understanding the essence and whether this type of trading suits you, try others.

How to start trading options in Pakistan?

There are different types of trading decisions. You can open a demo account for trading. This will give you the opportunity to practice trading options without risking your actual money.

Choose the best options trading platform in Pakistan and open a demo account. For this, we provide you with $10,000. This is a virtual amount of money with which you will practice your trading. Remember that you cannot withdraw profits from this account. This is just a training session. You will have the opportunity to practice various trading options. This includes trading options, stocks, commodities and currency pairs.

You can open a real trading account right away and start with just $10. This is the minimum amount you can open an account with. If you open a live account, you will need to provide some of your financial details.

If you need help, you can always log on to the World Wide Web for more information on securities trading. You can also contact our hotline around the clock if you have any questions. Our site is professionally designed and has really useful video materials, as well as beautiful and understandable graphics, this is a great option for you.

You can find some interesting articles on how best to start trading. You can read about the tips to use when entering the current market, how to check the profitability of a position, and how to place orders. There is no shortage of literature that teaches you the basics of market trading. To get information from everywhere it is very interesting, and with the right strategy, it is also very profitable!

Your first step to success is choosing one or two assets. You need to focus on one thing, one sector, the market in order to understand it better.

For example, you have chosen oil. Explore all the factors influencing oil, see the latest oil reserves in key countries, the latest agreements and upcoming events. See how the market reacted to some changes before.

The mistake of many is the simultaneous opening of transactions in different assets without proper analysis, without real understanding. If you want to start trading binary options from scratch, you need to know as much information as possible about your asset. This is the only way you can make an adequate forecast and decide whether the price will be HIGHER or BELOW.