Buy YFI (Yearn Finance)

There are now more than 2,000 cryptocurrencies. While many were created by individual developers, now, thanks to their technological potential, huge corporations and large banks are entering cryptocurrency, intending to create their own cryptocurrencies.

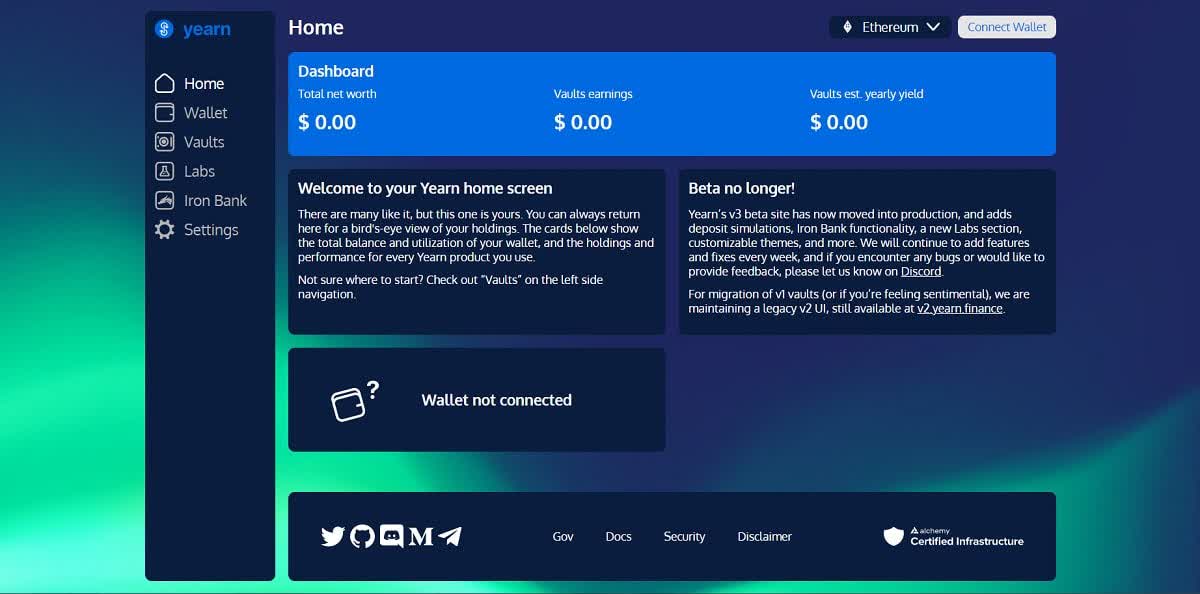

Yearn.finance is a decentralised finance (Defi) project that allows users to maximise their profits from growing crops. The protocol was founded by André Cronje in February 2020.

How do I purchase Yearn Finance (YFI)?

Where to buy Yearn Finance?

So, are you ready to dive into the world of cryptocurrencies and wondering where to buy YFI in Pakistan? We can recommend you choose the most reliable and safe exchanges. We can recommend you to buy YFI from reliable exchanges:

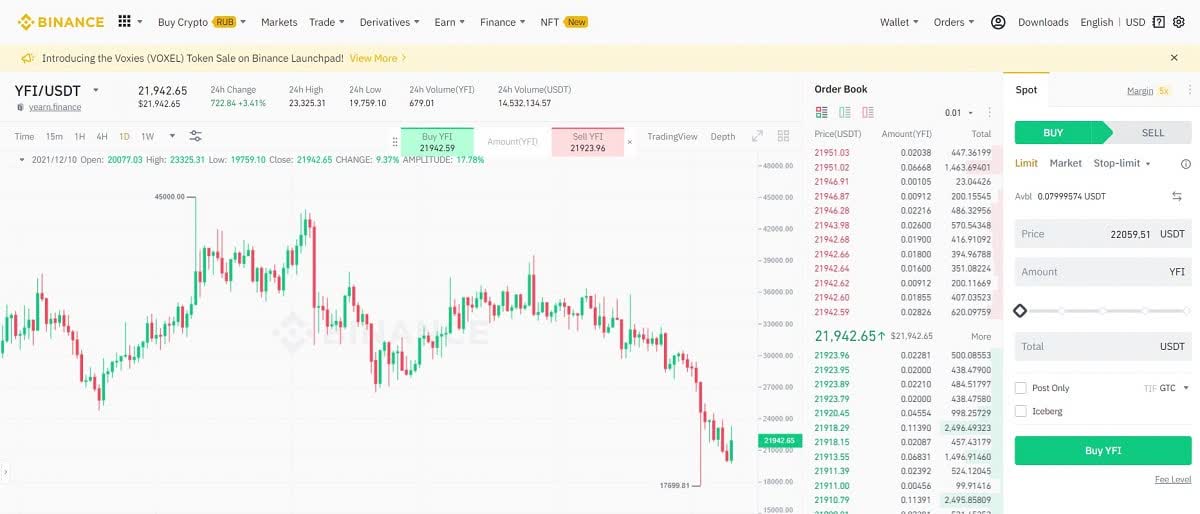

1. Binance,

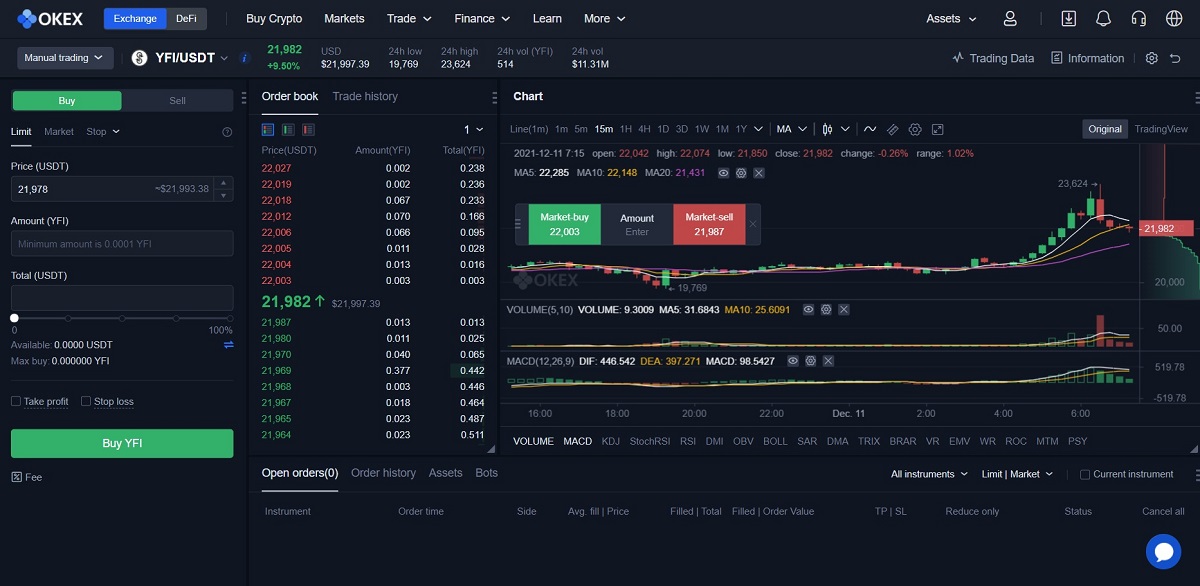

2. OKEx,

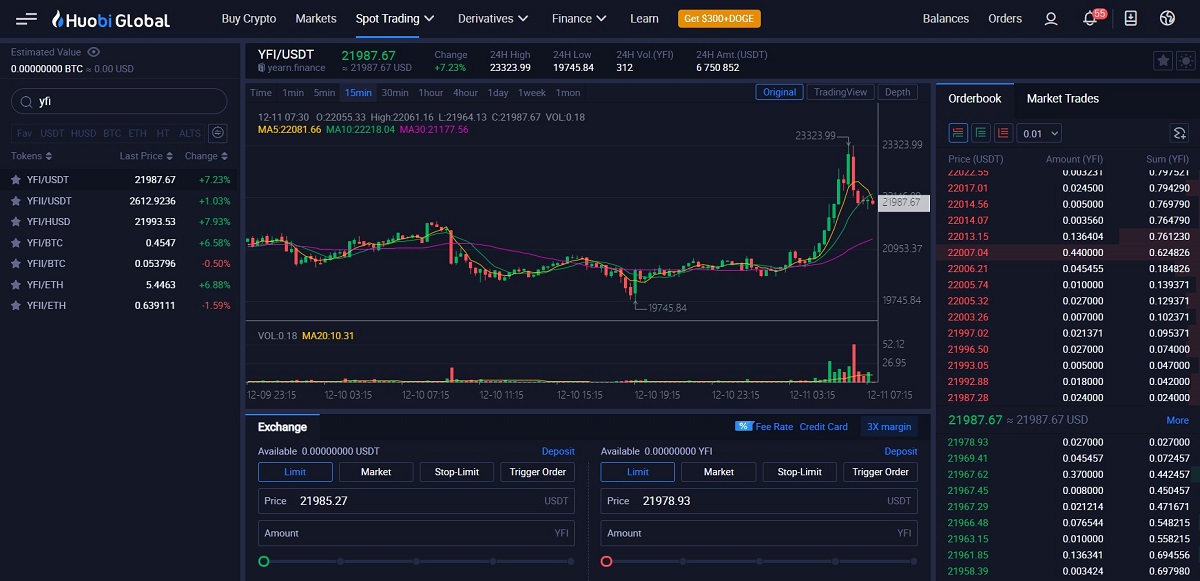

3. Huobi Global.

Yearn Finance Cryptocurrency (YFI)

Yearn Finance cryptocurrency (YFI) is an Ethereum-based token used to manage protocols within the defi1 platform. Yearn Finance platform allows participating in income farming (Yield farming) by interacting with defi-protocols. According to the official website - it is a yield aggregator for lending platforms, which performs rebalancing for maximum yield while interacting with the contract". In other words, this project is an aggregator of loans from other platforms.

The platform allows trading various tokens with up to 1000x leverage with an initial upfront fee or with up to 250x leverage without any upfront fee.

Once users transfer crypto-assets to the platform's contract addresses, they are converted into local tokens, which are then used in other services that provide interest income on deposits.

Yearn Finance users can also receive YFI through a multi-token betting mechanism. A YFI is a native token that allows the project to participate in its management.

YFI does not provide any interest remuneration but allows you to vote on issues important to Yearn Finance. All management is done by the holders of the YFIs, who receive them as a reward for providing liquidity.

Features and capabilities

The Yearn Finance ecosystem includes the following products that allow you to invest in YFI in Pakistan:

- Yearn Finance allows you to earn passive income by investing in investment pools. ETH and 10+ ERC20 tokens are supported. Features include:

1. Zap (feeds Stablecoins into Curve Finance pool),

2. Vault ("vault" allowing you to convert your tokens into yTokens and then withdraw them back if needed). - Ytrade.finance. A decentralised exchange for trading stablecoins with up to 1000x leverage.

- Yliquidate.finance. Automated liquidations for Aave (not working at the moment).

- Yswap.exchange. Service for instant exchange between supported tokens.

- Yborrow.finance. Stablecoin loans secured by ETH and ERC20 tokens.

In this way, the ecosystem is a kind of aggregator of credit platforms that automatically creates an optimal balance for maximum returns. Everything works based on smart contracts without human intervention.

Supported Stablecoins: DAI, USDC, USDT, TUSD, sUSD.

Supported DeFi projects: Compound, dYdX, Aave, Fulcrum, DDEX (the last two are temporarily disabled).

All interest rates on loans and deposits and exchange fees are dynamic, i.e. depend on market supply and demand for a particular token.

YFI token

What can be said about this incredible system's main "product"? The system has a native YFI token that is only distributed to users who provide pool liquidity via certain types of tokens. A single team originally developed the ecosystem, then control of the YFI tokens was transferred to a multisig wallet, and any changes require the consent of 6 of the 9 members of the platform.

Noteworthy is the fact that the token increased in value by 600% in the first week after being listed on the exchange.

What factors can affect the price of YFIs?

Because the cryptocurrency market is so volatile, many external factors can affect the price of assets, such as Yearn Finance. These include:

Social media mentions.

Social media plays a massive role in the cryptocurrency market. Whether it's Elon Musk tweeting about Dogecoin or a well-known crypto analyst announcing a new prediction. It's not the big banks that determine the price of digital assets, but Twitter, Reddit and Quora.

According to Santiment, Yearn Finance received a record 157 social media mentions after May 10-11, when the cryptocurrency's price rose to $88,277.36. Although Elon Musk soon interrupted this rise with his infamous bitcoin statement, it still shows how closely social media is linked to the asset's value.

Decentralised finance.

The introduction of decentralised finance is also one of the most important factors to consider when answering "is Yearn Finance a good investment?" Like Compound (COMP) and Aave (AAVE), Yearn Finance was one of the first blockchain protocols in the DeFi space.

According to data published by FX Street, the total value, assets on DeFi, rose from $1bn to $9.83bn between June and September 2020. That's about an 800% increase in just four months.

How to invest appropriately in the DeFi sector

Why does everyone talk about DeFi and how to invest wisely?

Lucrative investing is about building a diversified portfolio of projects within individual systemically essential sub-sectors of the DeFi ecosystem.

The idea is that it is a medium to long term investment horizon, i.e. investing for more than six months. It is possible to gain diversified exposure in DeFi by allocating funds between the following areas:

- Blockchain.

- Decentralised exchange.

- Loan and credit project.

- A platform for decentralised derivatives.

Portfolio project selection is based on finding undervalued assets.

Financial analysts say decentralised exchanges are very popular in the cryptocurrency community, as evidenced by the high volume of trading. Uniswap and Sushiswap are leaders in the segment, which has caused their tokens to rise in value. The trend may continue, but we need to keep an eye on bitcoin.

Cryptocurrencies in the decentralised finance sector have shown multiple gains despite bitcoin's decline. The trend continues, but buying should always be taken seriously and responsibly.

How is Yearn Finance managed?

The management of this project depends on the holders of the YFI token. Therefore, to say that this protocol is a reasonable interpretation of decentralisation would not be an understatement.

At least 33% of users must agree for any proposal to be put forward for consideration when it comes to significant changes for the Yearn Finance ecosystem. If 25% of users are opposed, the decision could be vetoed. And the consent of more than half of the token holders is required for a proposal to be accepted.

The protocol also relies on independent developers to maintain and support its operations.

Risks

Of course, cryptocurrency and investments involve risk. You should consider that factor if you want to invest in YFI. The ability to take risks is a resource that 1% of the world's population possesses. Therefore, developing the ability to take risks is a core capability of any successful entrepreneur. Nevertheless, even the bravest person must always calculate the risks.

The portfolio generated is a concentrated exposure to the DeFi sector, which already carries significant risk. This idea needs to be considered in the context of an investor's complete portfolio, their level of understanding of the crypto industry and willingness to take a risk. Accordingly, depending on an investor's level of conservatism/aggressiveness, the proportion of DeFi in an investor's portfolio should also vary.

Yearn Finance project outlook

The DeFi sector is showing unprecedented growth. As recently as the beginning of June, it had accumulated $2 billion. It is now over four billion. And this area shows no signs of slowing down. On the wave of excitement around income farming, projects like YFI are gaining instant popularity among those wishing to earn their dollars quickly.

Yearn Finance's slogan sounds enticing. It has been called the post-Bitcoin cryptocurrency because the issuance of this cryptocurrency is noticeably limited.

However, DeFi's security can barely keep up with such rapid growth. Moreover, many are keen to earn double-digit interest during the recession, and developers don't want to miss out either. That's why so many users will buy Yearn Finance because of the enormous prospects.

Yearn Finance's capabilities can truly help maximise profits from its tokens if the ecosystem is fine-tuned and brought up to speed. However, most are now primarily interested in the YFI token as a promising investment asset. At the moment, it has shown the fastest growth the cryptocurrency market has ever seen. Such gains have not been seen since the ICO boom in 2017. Those who had the earliest time to buy in made hyper profits. However, this market is very volatile, so always consider the risks.

FAQ:

Yearn Finance - a good buy?

Showing high returns since launching in 2020, Yearn Finance remains speculative and volatile. So, it is best to do some personal research before taking the plunge.

What is the minimum amount of Yearn Finance tokens you can buy?

You can usually buy any number of Yearn Finance tokens.

What is Yearn Finance's record high?

Yearn Finance had a record high of $93,435 XNUMX on May 12, 2021.

How many Yearn Finance tokens exist?

Yearn Finance has 36,000 tokens and a market capitalisation of over $1 billion as of July 2021.

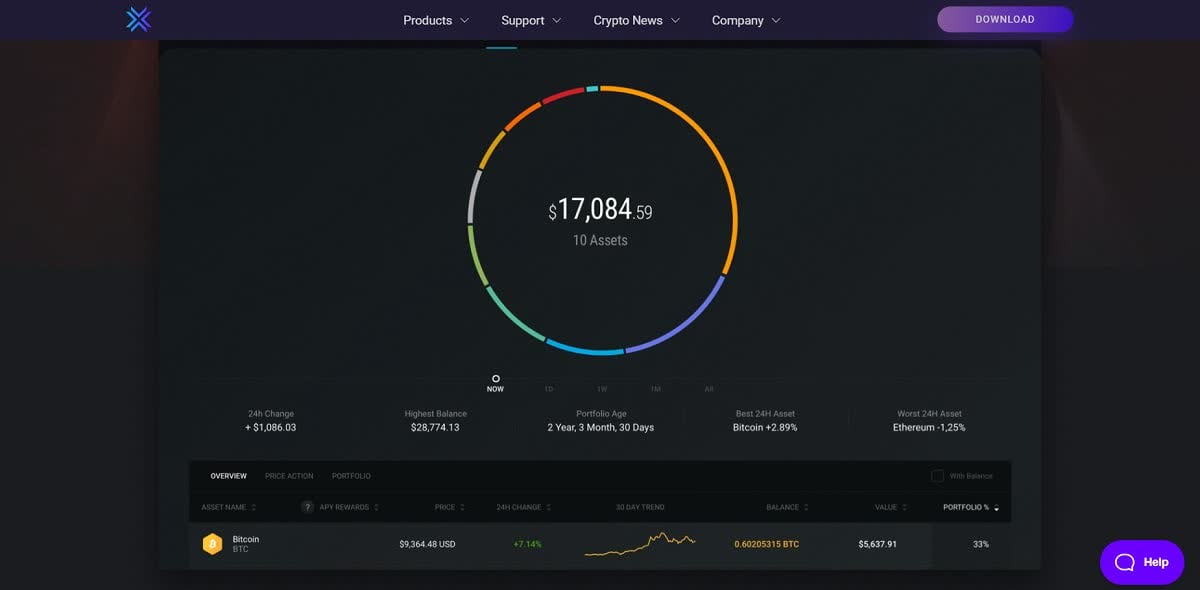

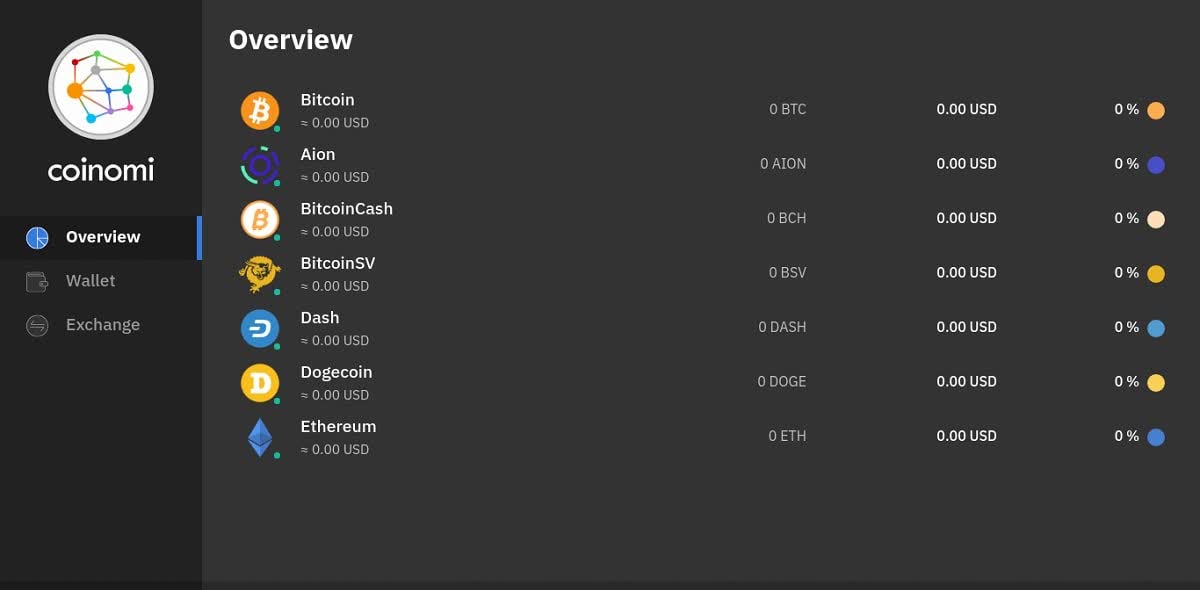

How to store cryptocurrency?

To protect your digital assets safely, you need to store them in a cryptocurrency wallet. Your wallet choice depends on the type of token you want to store. To choose a wallet, you can focus on skills and security.