Commodities trading platform in Pakistan

Trading platform capabilities for trade commodities in Pakistan

The abilities of the commodities trading platform in Pakistan are not inferior to the world. In the marketplace, both online and offline, clients are offered merchandise commerce CFDs, futures and other similar commodity-related services. These market players have different kinds of commerce platform opportunities to transact commodities.

Raw materials are materials intended for further processing and production of finished products. The raw materials can be agricultural products, petroleum products, chemicals, or some other similar thing.

Most of the commerce is in futures trading, implying the future delivery of the goods. Only 5% of the total trading volume is held for a product that the supplier is ready to provide in the near future and receive payment.

By geographic division, the region's trade in general goods. The countries of the Middle East are the main suppliers of crude oil to the world market, accounting for about 66% of black gold exports. Developed countries export fuels and minerals. While developing countries account for 32% of the total trade in raw materials of agricultural origin.

A commerce platform is basically a software or program that can facilitate the commerce of goods. Our platform is developed by professionals and meets the latest requirements. It helps traders to make trades in the goods markets. Such applications are usually computer-based and are designed to facilitate the tasks of traders.

The commerce platform for trading commodities is fully automated. This helps the dealer trade with reduced inputs and a high level of flexibility. This feature helps dealers to conduct multiple transactions at the same time. In a nutshell, the commerce platform allows traders to trade commodities in the goods markets in real time. This helps them get the best possible deal on the goods.

Commodity trading platforms play an important role in maximizing the return on your investment. The platform also needs to be flexible enough to place orders. In addition to the above, our trading system is approved by experienced professionals.

The trading platforms offered for trading commodities are quite effective as they reduce the dealer's risk and increase the efficiency of his trading platform. Our system offer an online demo account center where you can exchange and learn without having to invest money. In addition, commodities trading platforms have simplified reporting tools that make it much easier for traders to analyze information, statistics and other information in order to have a clear understanding of the merchandise market.

Most goods traders include technical analysis in their commerceplan. Technical analysis differs from fundamental analysis in that it uses preliminary price action to predict future price movements. Fundamental analysis focuses on the expectations of supply and demand for goods to predict future price action.

It is important to remember about technical analysis that the same rules apply to all charts, be it 5 minute charts for day trading futures or daily, weekly or monthly charts for long term commerce. The first thing you want to do is learn how to read charts and get a basic understanding of what types of patterns and indicators can be an indicator of the upcoming market movement.

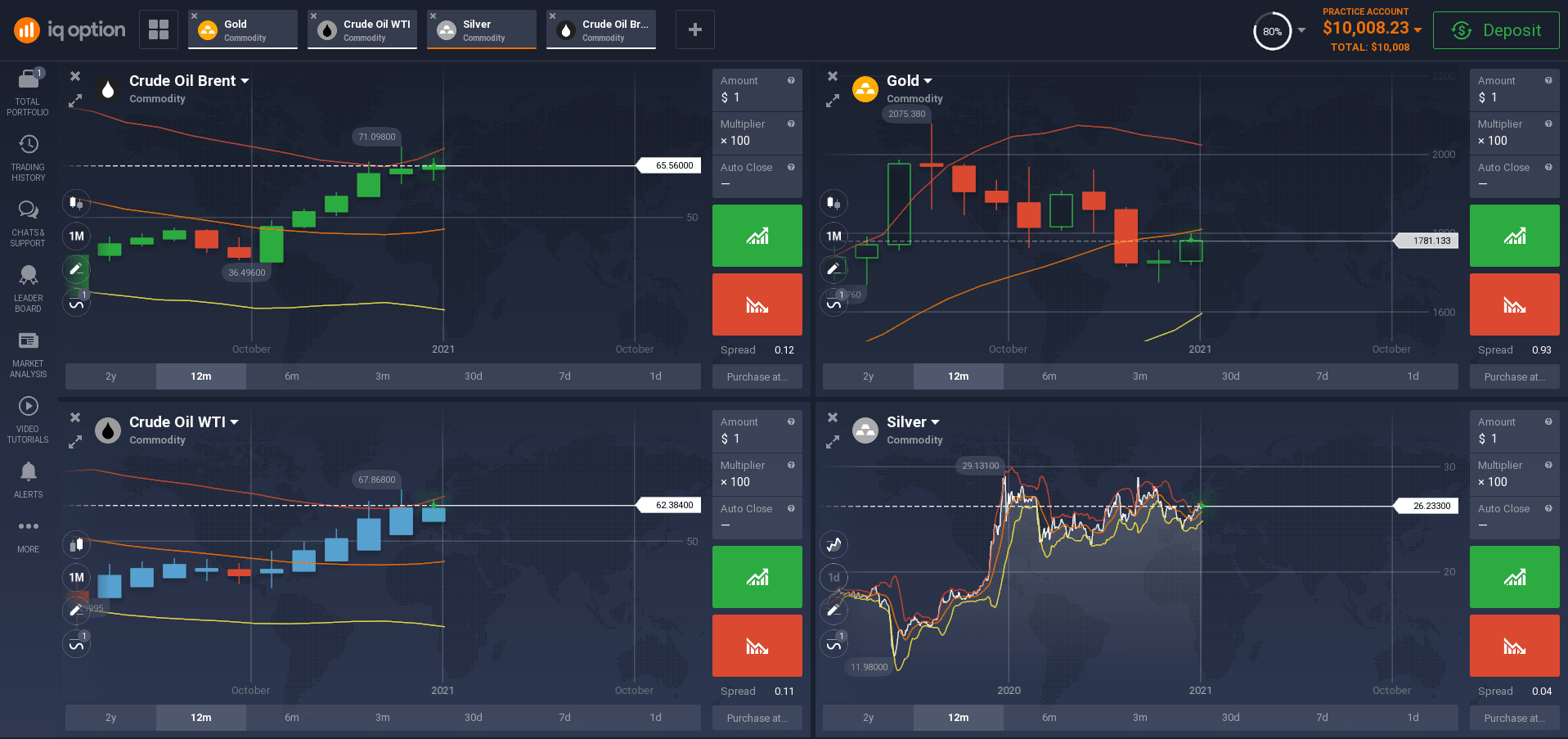

On our online commodities trading platform, you have the opportunity to use the most popular indicators and charts.

The moving average is designed to smooth the price chart and identify the main trends on it. It is calculated in such a way that at each of its points information on prices for a certain period of time is presented.

The Moving Average Convergence / Divergence or MACD indicator is a trend indicator as well as a momentum indicator (momentum is the rate at which a price moves along a trend). The main function is to detect new trends and help determine the end of current trends. You will be able to apply your unique settings and methods to trade with this indicator.

Japanese candlesticks are a type of price line, as well as a type of interval chart, which are used to display price fluctuations. Each candlestick corresponds to a certain time interval in which the quotes moved.

RSI literally means Relative Strength Index. The popularity of this indicator is due to the simplicity of its interpretation. With the help of RSI, traders assess the strength of the trend, as well as the likelihood of its reversal.

The commerce platform is a fantastic learning tool. Using the platform, you can easily keep track of your charts and know when to buy or sell based on current data.

Types of commodities

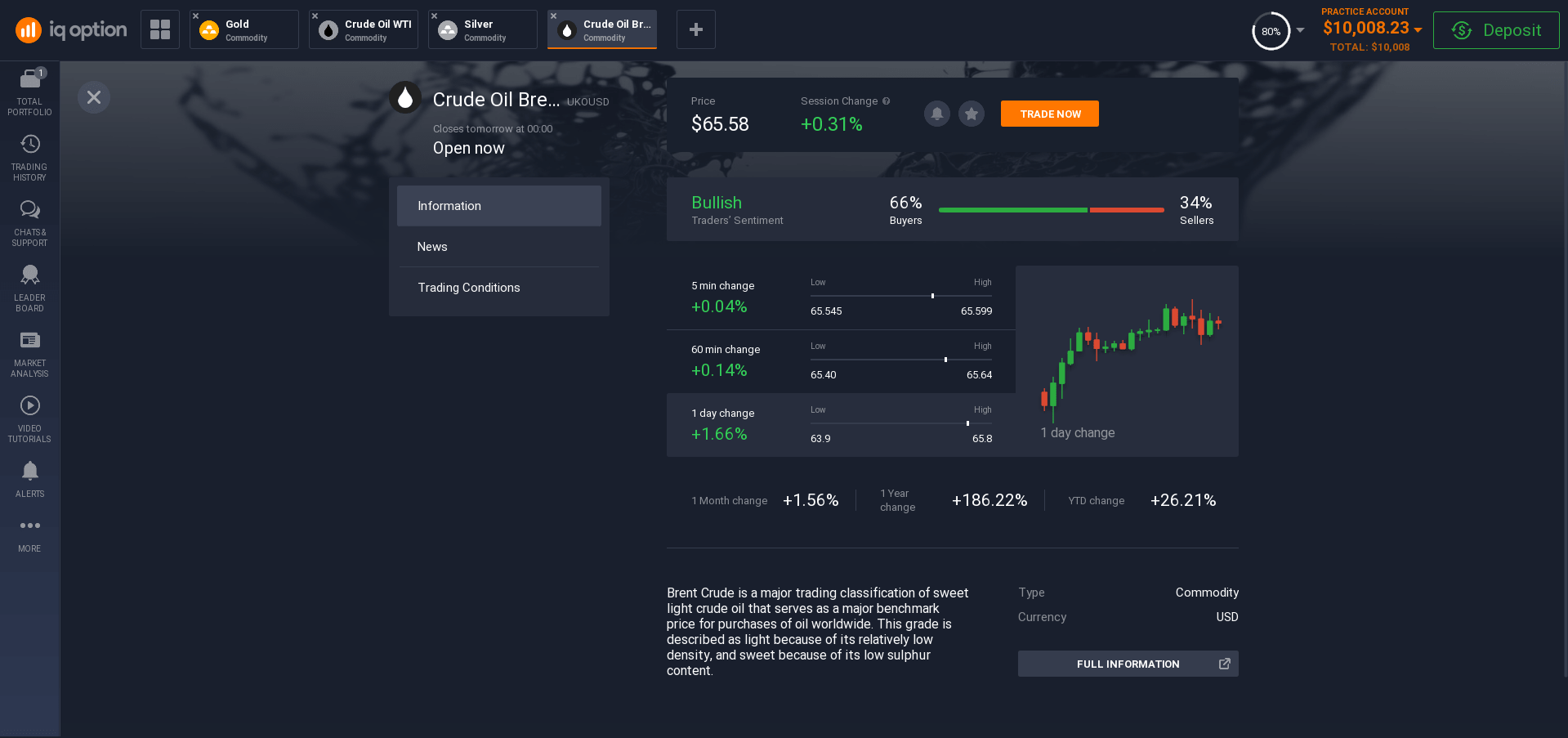

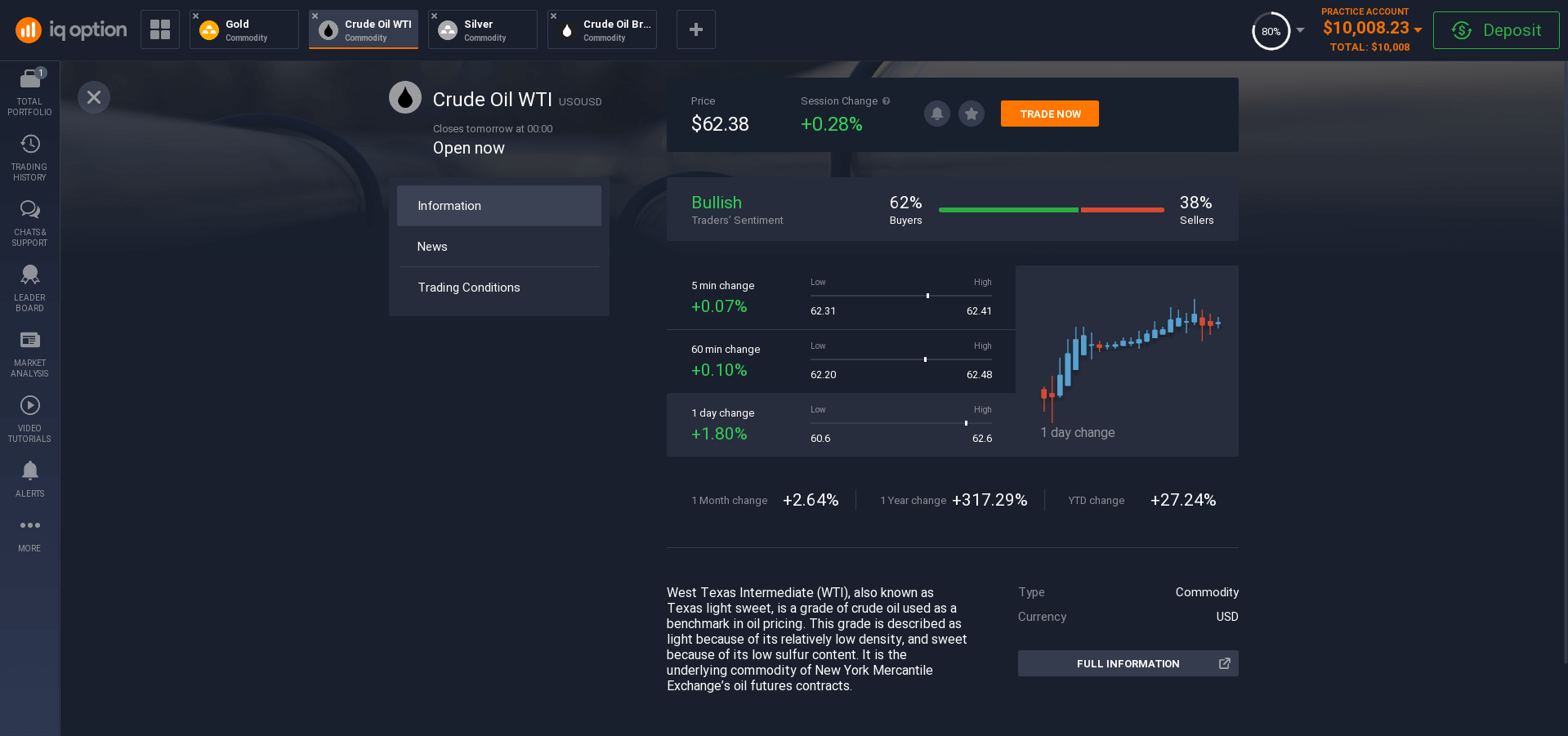

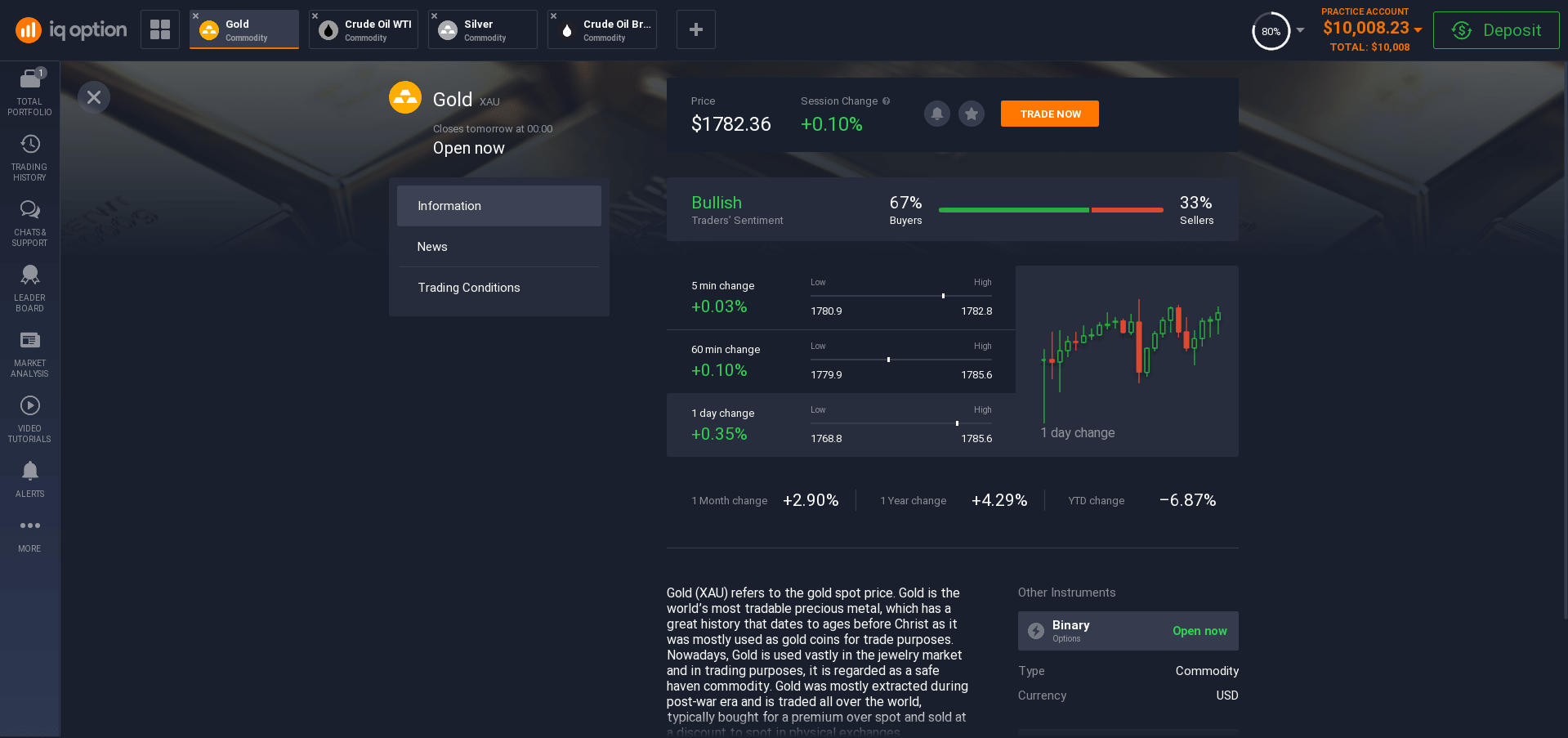

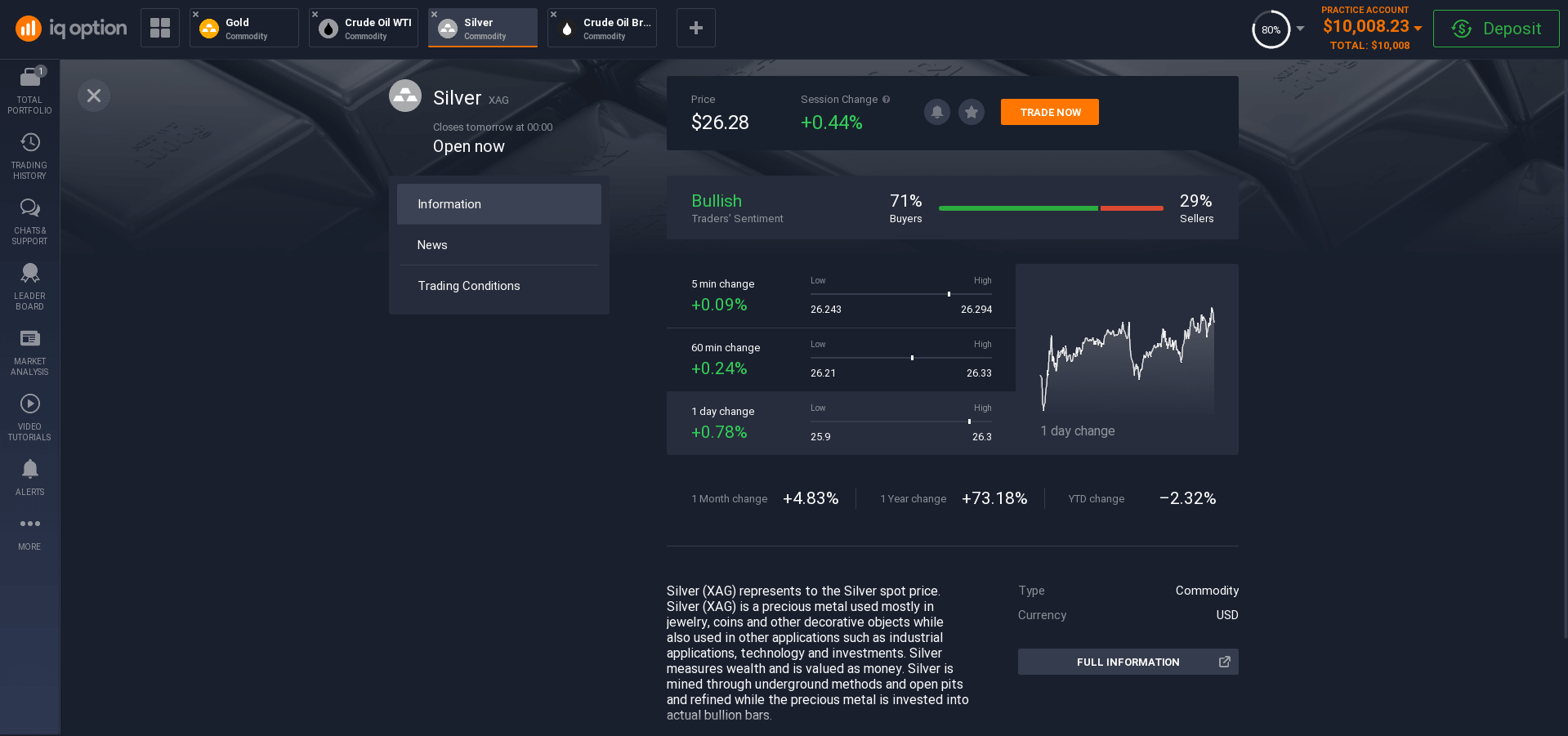

When it comes to investing in commodities, you always have a choice. Globally in the world, you can find all sorts of variations of goods from sugar and meat to gas and oil. Products such as gold, silver, BRENT oil and WTI are presented on our platform. Perhaps these are the most popular types of raw materials.

In general, in the global futures markets, there are many categories of goods that are most suitable for commerce. Goods futures contracts usually refer to those contracts that are entered into on the date of the so-called delivery of oil, a change in the price of a currency pair or other recognized commodity indicator. Typically, goods contracts involve buying at a premium and selling at a discount. The most important goal of trading commodity futures is to buy low and sell high. Examples of merchandise derivatives are futures contracts for gold, silver, oil.

A derivative is an agreement by which the parties obtain the right or undertake to perform certain actions with respect to the underlying asset. Usually there is an opportunity to buy, sell, provide, receive some merchandise or securities. Unlike a direct purchase / sale agreement, a derivative is formal and standardized.

Many traders tend to view goods investments as a way to diversify their portfolio and use merchandise costs to offset the risks inherent in various forms of investment. Others look at goods as a way to automatically make money through profit, since the market is volatile, and you can make money at a constantly changing price.

In addition to diversification protection, commodities for investment make investments more profitable. The global demand for raw materials is always on top. It is not strongly influenced by changes in key interest rates, exchange rates and other economic factors. Therefore, the securities of enterprises with a raw material orientation are distinguished by an increased investment yield.

The main advantage of investments in commodities is their protection from inflationary processes. When inflation rises along with prices, the demand for commodity assets also rises. Such an investment of funds allows getting rid of the dictate of the dollar, since the cost of raw materials only increases with a fall in the exchange rate of the American national currency.

There are many types of risk involved in buying in the goods markets. Among the most obvious are the danger of oversupply, or a condition in which the value of a commodity jumps and continues to rise, creating an advantage that is difficult to sell once it reaches a high point.

How to start commodities trading in the Philippines?

There are many ways in which you can learn how to open a live account to trade commodities in Pakistan. But before you open an account, we advise you to go through the video tutorial on our platform again. Knowledge is never superfluous! To get access to all our sections, just go through a free registration and start exploring the world of investments today, do not postpone until tomorrow!

You can also read the trade posts posted with us. These posts will not only tell you about the different conditions used in the current market, but they will also give you an idea of the different methods and strategies that must be adopted in order to trade effectively.

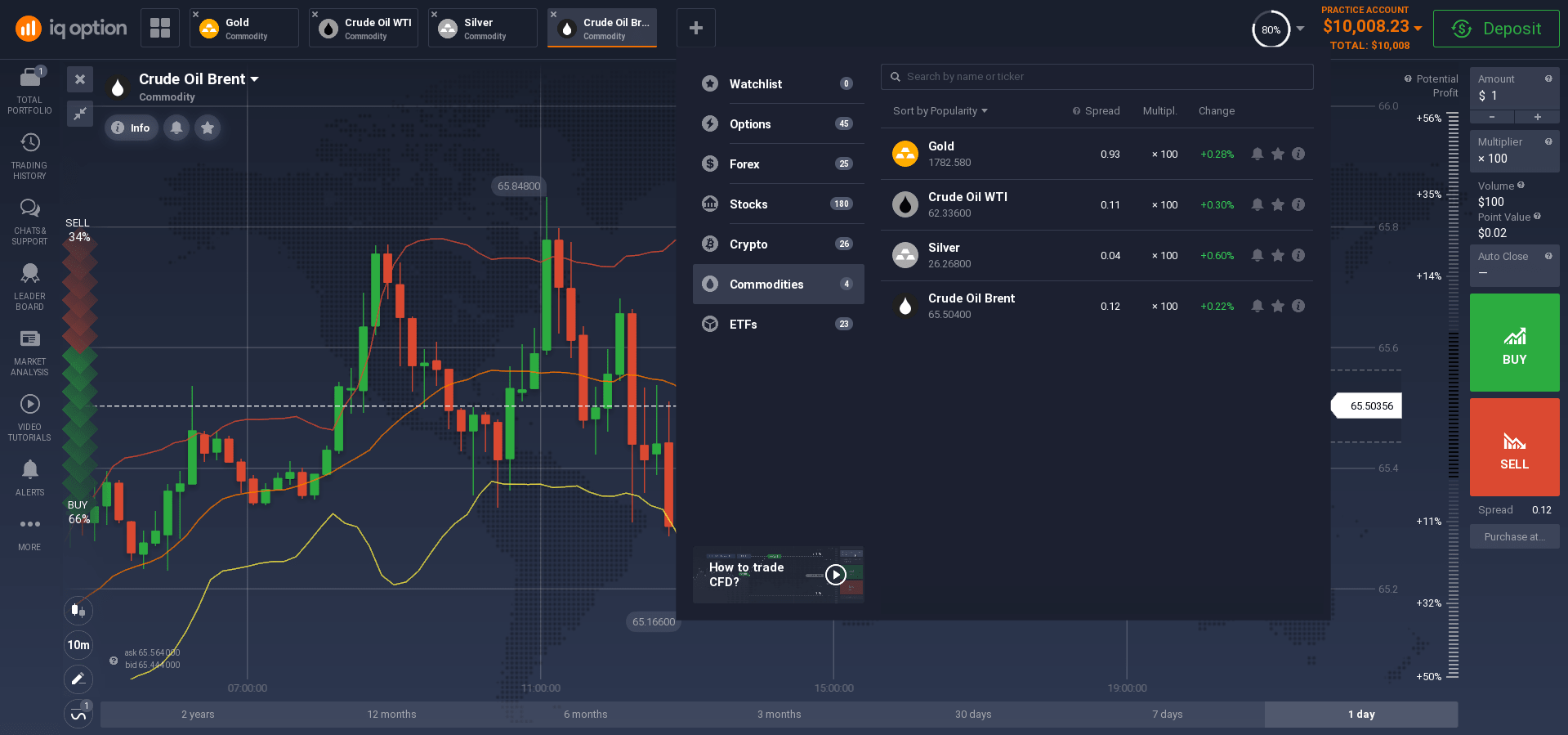

Once you are confident in your knowledge, open a trading account on our platform. There are 2 options for a real or demo account.

If you are a beginner or an experienced trader, but want to try a new strategy, then we advise you to start with the demo version. To do this, we will provide you with virtual $10,000. This will give you an excellent experience and understanding of how the system works in general and our platform in particular. You can also understand what strategy you are ready to choose for yourself, see how much time it takes you to work on the exchange. You will also need to learn about commercial rules and processes and exchange rates. For a beginner who is not yet familiar with the market, it is easier to do this on a virtual account.

When you open a commerce account, look at live prices and execute your trade quickly. Commodity prices can fluctuate widely. For this reason, you should buy when the price is low and sell when it is high. If you stick to this strategy, your income is guaranteed to grow.

Once you are comfortable enough, you can then open a live account and start commerce. Moreover, we have a minimum deposit of only $10. You can replenish your account with a large amount, it all depends on your ambitions and experience. Try it and you will definitely succeed!

If necessary, you will use leverage, this service is available on our website. Leverage is the ability to use borrowed funds when trading. This opportunity is widely used when trading financial assets, be it gold, oil, stocks, currencies or even cryptocurrencies.