Crude oil trading platform in Pakistan

If you are involved in commerce, it would be great to find the perfect crude oil trading platform. Commerce is not an easy job, and it requires the utmost professionalism in the execution of transactions. Getting a platform helps a trader get the best return on investment. It gives traders an easy way to get in and out of the industry, while reducing the chances of losses. A platform comes in many shapes and varieties.

When choosing a platform to trade on, pay attention to its customer service. You should go for one that provides services around the clock. For example, on our platform you will get 24/7 technical assistance through a hotline.

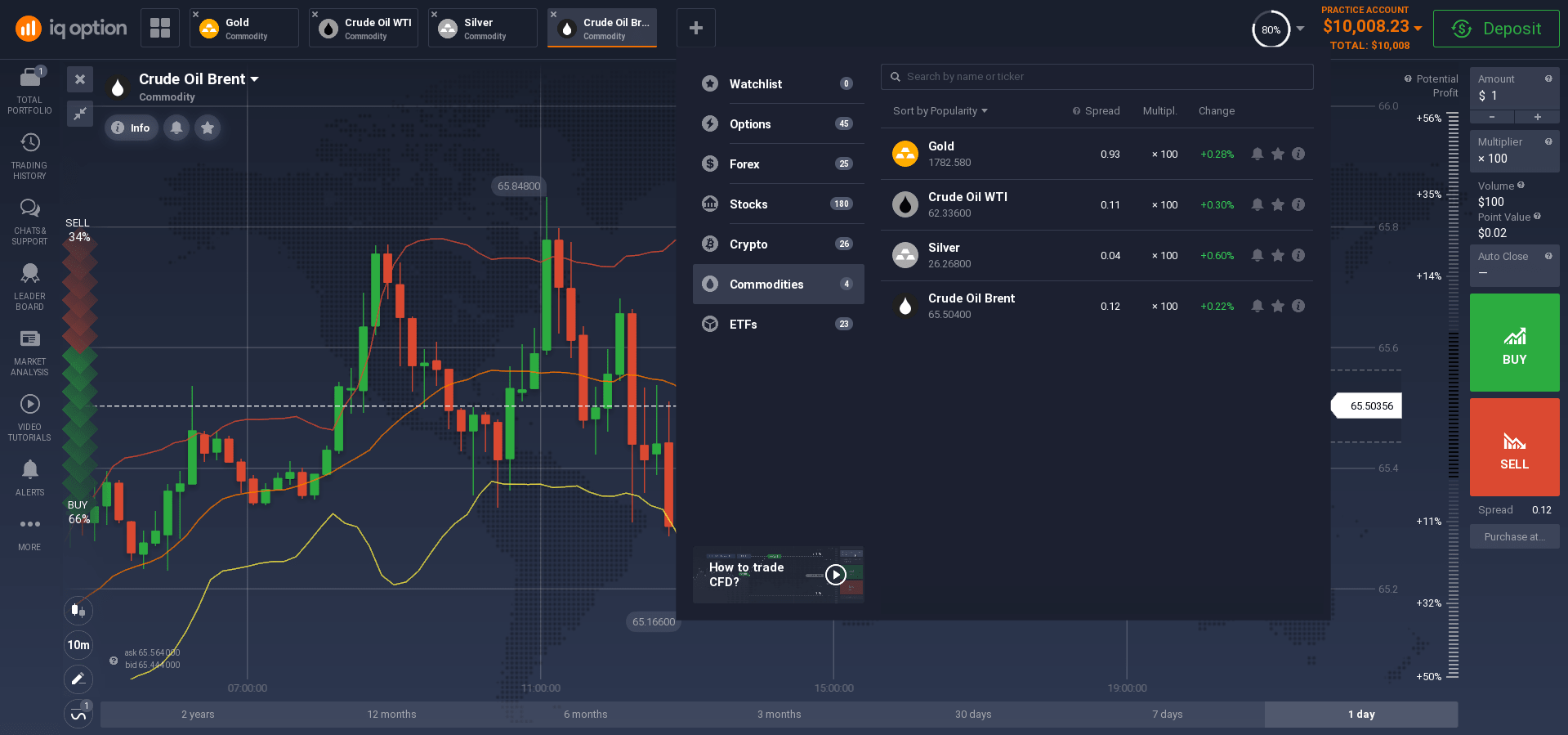

A great crude oil trading platform in Pakistan should have some important features: a large selection of charts and indicators, excellent data management, and constant updates. Each of these features can go a long way in making traders more effective in using their commerce platform. It should also be able to offer traders access to real-time information feeds from leading crude oil market players.

We always have up-to-date news on the topic of interest to you, quotes, data charts and the most popular indicators for understanding price trends.

Technical analysis indicators are algorithms that give an indication of future prices using data about quotes over a certain period of time. There are so many different indicators to choose from, it can be difficult to find the best and most suitable ones for profitable commerce. The best Forex indicator is the one which suits your commercestyle and psychology. Let's take a look at some indicators which have proven to be very good at identifying the best market entry points for both long and short term commerce.

Indicators are classified into categories:

- Oscillators. They allow for effective trading during sideways trends, they detect the exact moment when the price changes its direction:

• Stochastic Oscillator - a popular technical indicator that displays the percentage ratio of extreme close prices and extremums for the studied period of time;

• RSI (Relative Strength Index) - a popular classic oscillator used to assess trend strength and locate replacement/turn points;

• MACD (Moving Average Convergence/Divergence) - a popular oscillator, which traders often use when working on the currency and stock markets to identify trends and find commerce signals;

• Average True Range (ATR) - a simple classic indicator that measures the volatility of the market, based on price activity during a certain period of time; - Trend indicators. Thanks to them, a trader can hold a deal to get the maximum profit. They are effective only if there is a clear trend, and they do not always work if the trend is sideways. Here are the most popular of them:

• One of the base of most trend indicators is the moving average, which has a lot of varieties. Indicators based on this line allow you to trace the trend and see its beginning and end;

• Alligator- is used to find the moment when a trend is turning into a stable movement and vice versa when it stops;

• Bollinger Bands - a classic trend indicator, which is used to determine the location of prices relative to its standard trading range;

• Ishimoku indicator - is complex, providing a large amount of information, figuratively a complex of different indicators, which can be used as a self-analysis.

To be able to identify the right indicators to trade with, traders need to assess the requirements of their portfolio. However, investors should not rely solely on indices and commerce platform charts. As there is a lot of risk associated with oil, investors should look for additional data, such as monthly and quarterly reports and industry news.

With advances in technology, the latest trading platforms have become available to meet the needs of different users around the world. A proper understanding of the system's capabilities is essential. If you are planning to buy or take part in crude oil commerce, it is much better to go for a reputable platform. This will save you money, energy and time. Moreover, it will also make your life easier as you do not need to depend on other people when you use the crude oil trading platform in Pakistan.

How to make money trading crude oil in Pakistan?

The main features of crude oil trading are increasing demand, production, production and storage. Crude oil has lower volatility than other energy stocks and can be easily traded. To maximize profits in the global market, you must be aware of the main factors affecting the value of crude oil.

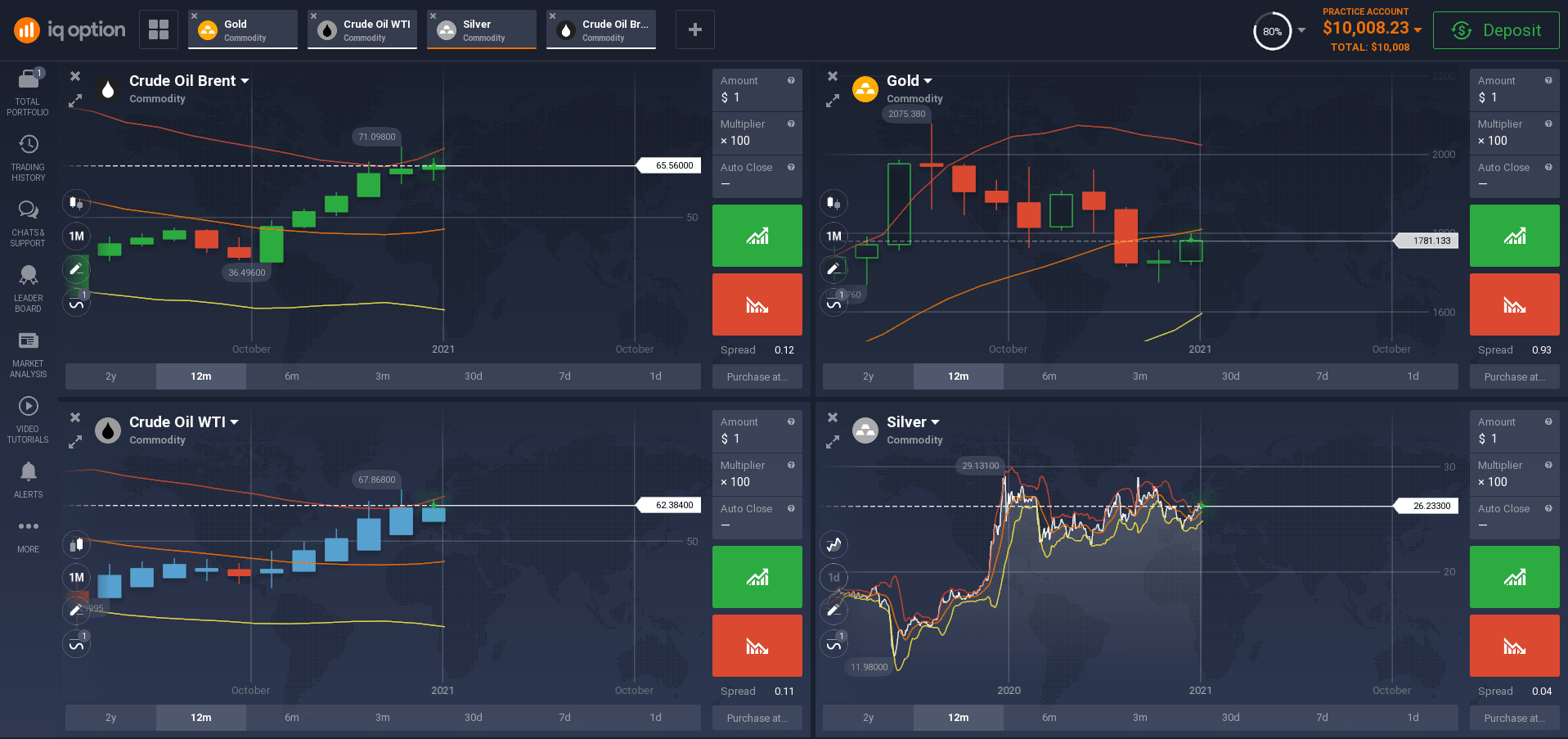

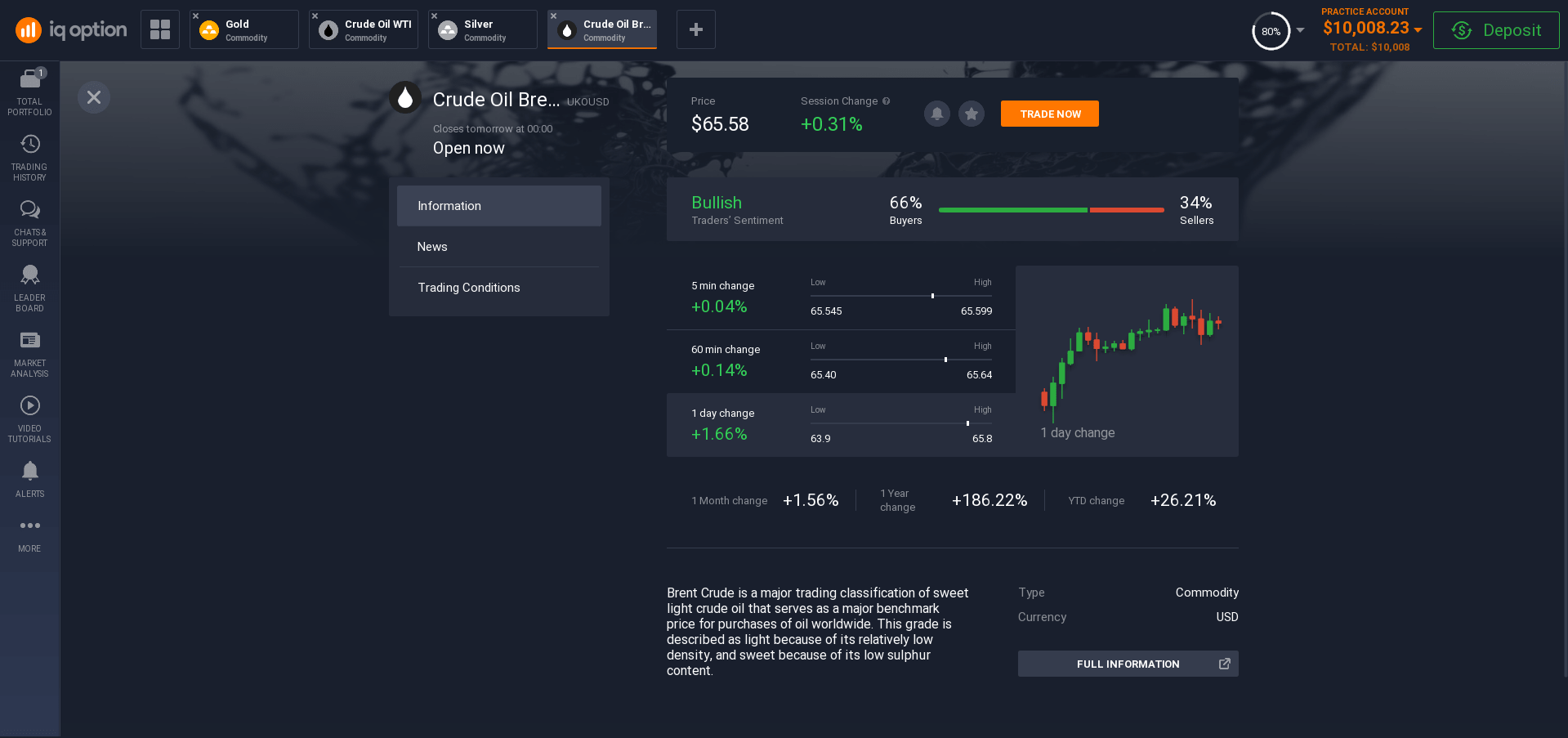

The most popular oil grade that everyone knows the name of is Brent. It got its name thanks to an offshore field of the same name near the UK, a hundred and fifty kilometres to the north-east of the Shetland Islands (the coordinates are 60°54′N 1°48′E). The Brent field was discovered in 1971 and developed by Shell.

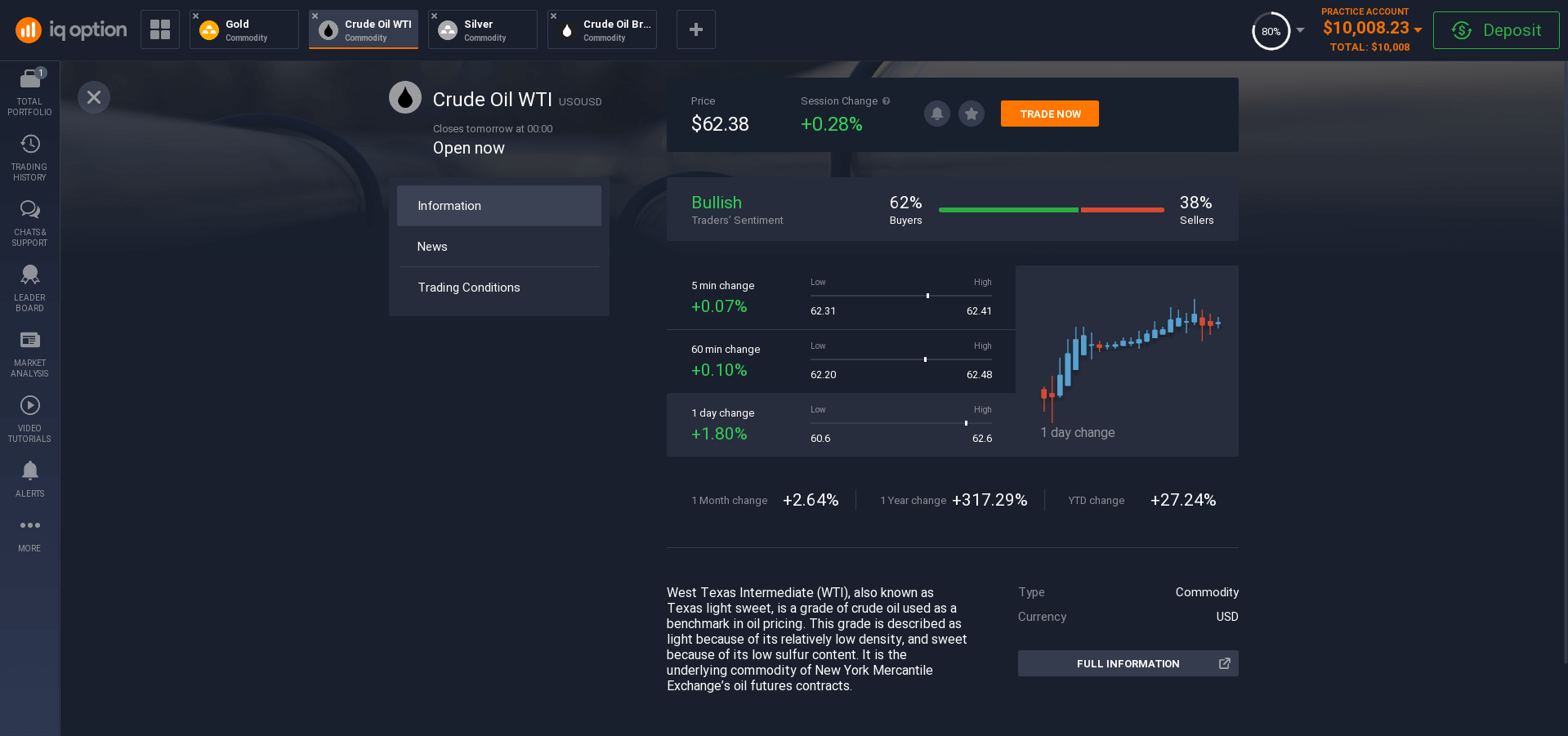

The next most popular oil grade is WTI (West Texas Intermediate), also known as Light Sweet Crude Oil. It used to be the only marker oil grade in the world before the discovery of Brent. It has been produced in Texas since the beginning of the 20th century, and has been traded on NYMEX since 1983. Although WTI oil accounts for less than 1% of the world's total oil production, the price of this grade determines the price of many other grades.

Since the vast majority of oil futures contracts are settlement rather than delivery contracts, the role of oil exchanges is mainly limited to pricing. And most of the actual supply of oil is done under direct contract with producers (oil producers).

To start trading oil futures contracts on the futures market, all you need to do is register on our crude oil trading platform. Oil started commerce on the exchange in the 1980s. Nowadays, when people talk about oil trading, they often talk about futures, which are contracts to buy or sell oil with a settlement in the future. Futures prices vary depending on supply and demand and allow oil producers to hedge their bets and investors to simply make money on price movements.

Buying oil futures can be challenging, with complex registration and verification procedures and a relatively high minimum purchase threshold. A simpler option for the average trader is trading CFDs. Here you will also find the usual selling price, the buying price and of course the spread. In other words, it is better for beginning investors to buy not the futures itself, but a CFD contract for the futures price.

CFD. Generally, CFDs are understood to be special financial derivatives, where no delivery of real raw materials takes place during purchase/sale, i.e. the buyer and the seller conclude a "paper" agreement that at the closing of the transaction a settlement will be made, i.e. the party whose forecast proved to be wrong will pay the price difference to its counterparty.

The oil price is highly sensitive to any more or less relevant information about the state of the industry. For example, statements by heads of state in the world's oil production centres regarding possible changes in production volumes are instantly reflected in the quotations. The political situation and armed conflicts in oil producing countries and territories through which major pipelines pass also have a significant impact on world oil prices.

Trade at the right time - The most important rule to follow is to trade at the ideal time. You know that the price of crude oil changes every day. For this reason, you should be able to get updates on oil prices at the right time to maximize profits. For example, the price of oil rose overnight, but by the end of the day it had fallen.

To always have up-to-date information, download our mobile app, and you will always have access to the information you need!

You can only trade crude oil in a short space of time if you know exactly what procedures to follow. It is quite possible that you make the wrong decisions and end up losing money. You should therefore learn about the pros and cons of the product in question so that you are aware of the things that affect its price. There are a number of factors that affect market prices, including supply and demand. In this aspect, the best method is to keep yourself updated on the latest information about the product in order to trade wisely and make money by trading crude oil for a short period of time.

How to start crude oil trading in Pakistan?

Crude oil is the main source of fuel for vehicles around the world. However, before you can trade, you need to understand how to open a demo account to trade crude oil in Pakistan.

Before you start a real investment in crude oil, practice by opening a demo account. This is similar to an account where you can pretend to invest in real stocks and commodities to practice how to spend properly. To do this, $10,000 will automatically be placed in your account. This is a virtual amount, and you won't be able to withdraw it or the profits you get from investing it. However, you won't lose any of your real money, and you will learn without investing any capital in the market.

You can open a demo account as soon as you register on our platform for free. Once you have opened an account and received your deposit, you are now ready to buy or sell as you wish.

As soon as you learn and have the money and experience you need, a live commerce account is at your disposal. In this case, you will need to make a deposit of just $10 and start trading by clicking on the buy button. You will succeed, you just have to try!

If in any doubt, we advise you to take trading lessons directly on our site. There are about 100 video-lessons on different subjects, and a big section with answers to the most frequently asked questions by traders. Also, use your own sources of information. The key to success is a solid knowledge base and lots of experience!

Another thing you should remember is not to spend more than you can afford to lose. Start with small accounts and work your way up.

You must remember that commodity exchanges are volatile and go with the forces and trends. Prices can change rapidly and can be affected by a number of factors. You can spend small amounts to try your luck. However, don't invest huge sums unless you have done enough research and have a clear idea of what the product will be worth when it reaches a certain price level. Try opening a demo account on a crude oil trading platform so that you can practise getting it right and selling it.

You should also keep a close eye on your account to see if your fortune is growing. If it is, you can buy additional assets and keep earning interest to finance your new venture.