Buy Equifax shares in Pakistan

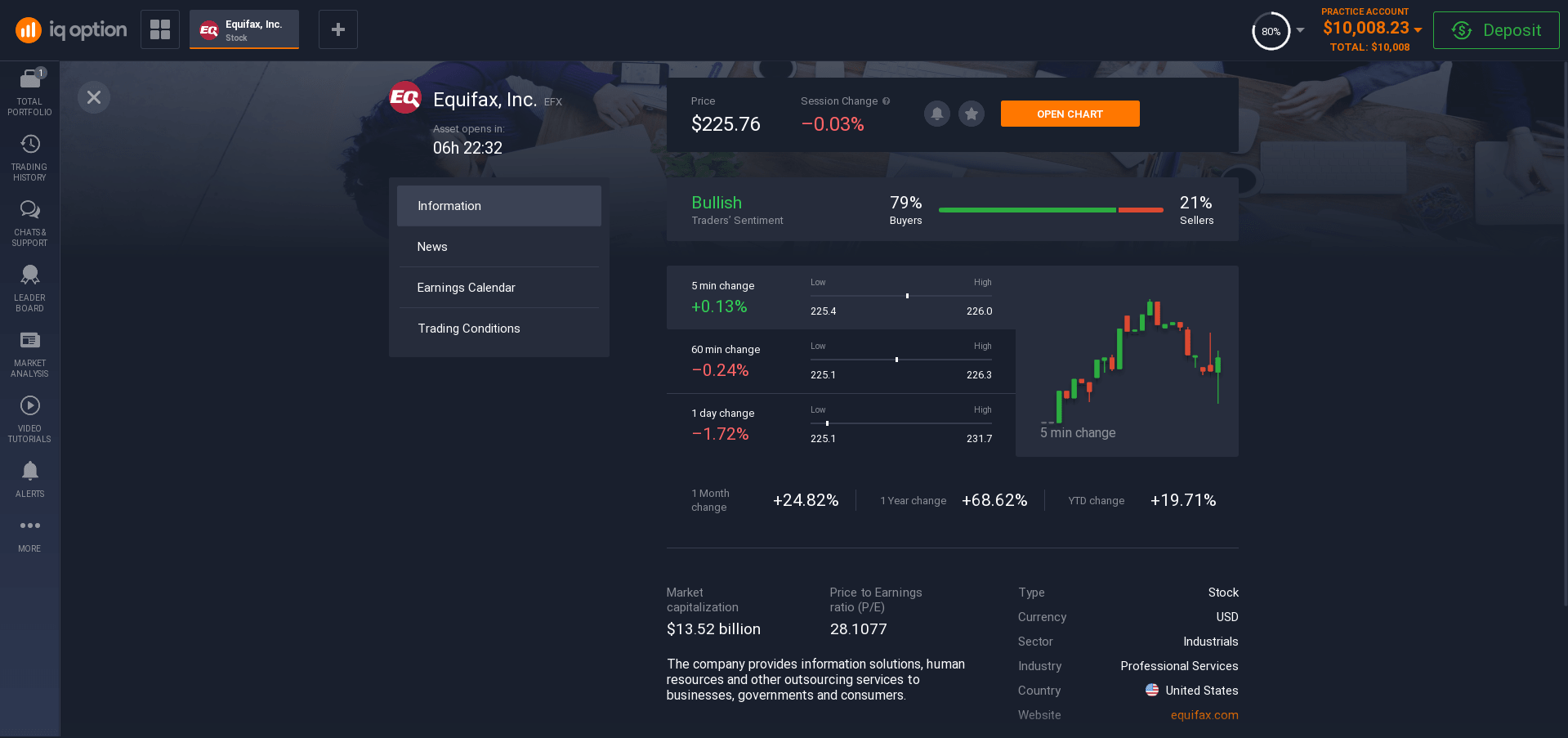

Equifax is an American credit history bureau. Founded in 1899 and located in Atlanta, Georgia. Collects information about more than 800 million individuals and 88 million companies around the world. One of the three largest credit agencies in the United States.

In addition to credit scoring, credit ratings and business demographics, Equifax offers commercial credit monitoring and fraud prevention services. Equifax has been listed on the stock exchange since 1971.

By submitting your Equifax consumer data for analysis to the market-leading consumer credit report, you can create significant benefits for your organization, your customers, and other lenders. Equifax's comprehensive customer reports help build and maintain trust with your customers. Equifax is the largest consumer reporting agency and one of the most trusted names in the industry. Equifax specializes in financial and credit information and is one of the largest providers of credit information in the United States. It is the single largest consumer report that any large company can use to make informed decisions.

However, in September 2017, Equifax reported that there was one of the largest data breaches in history - an array of information obtained by attackers, including names, social security numbers, dates of birth, addresses, and in some cases, American driver's license numbers. As a result, hackers managed to gain access to personal data of more than 140 million people. The company has fully admitted its guilt and in the report reflects the amount of damages in the amount of $800.9 million, indicating that the total amount of compensation is not yet known.

The company mainly operates in the US market (over 70% of all revenue), as well as internationally in 24 countries, among Canada, Australia, New Zealand and India, UK, Spain, Brazil, Argentina, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru and Uruguay.

How to invest in Equifax shares in Pakistan?

There are many more reasons to invest in Equifax shares for beginners. An excellent long-term investment in Equifax shares can bring you good returns. This is due to the company's good growth rates. For the past few years, it has been growing annually. In 2011, the shares were worth about $39. Today, $239 is a sixfold increase in 10 years, which is pretty good.

Another important point is that you should have some control over your portfolio. As long as you buy stock from a reputable company, you can rest assured that you are investing your money in the perfect place.

There is no doubt that investing in Equifax is a long term investment. This will keep you safe in today's hectic world. However, you should always check the company and do your research before buying an Equifax shares. The first tool of an investor is considered to be a fundamental analysis of the company. He will show you how the profit is formed, the main directions of the company's movement as a whole. If you do not have enough skills, we advise you to choose training on our platform, it will tell you about the basics of investing. The FAQ section is also very informative, it contains all the information you need.

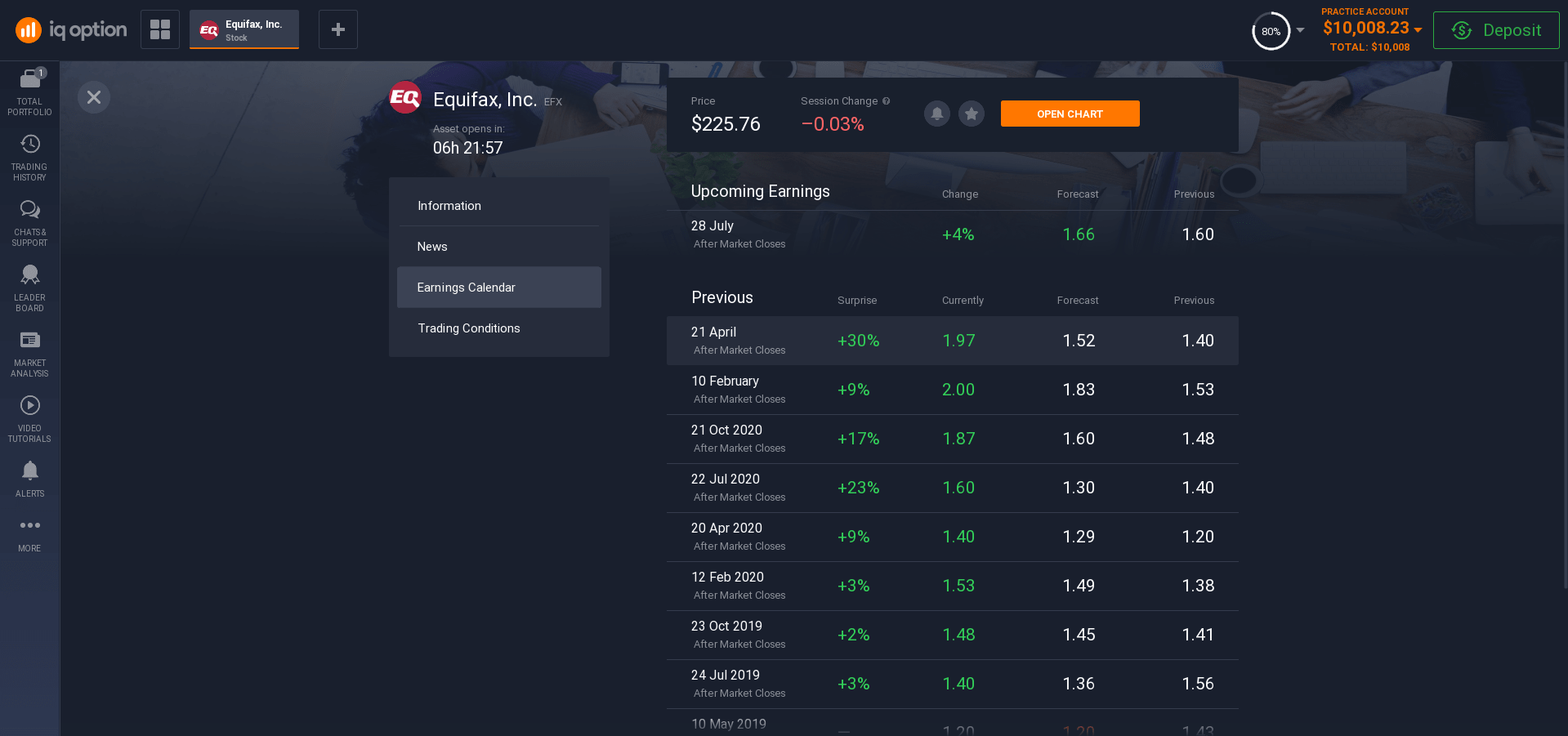

Fundamental analysis is a method of qualitative and quantitative analysis of a company's reporting documents aimed at determining the real value of its assets and predicting its future earnings.

However, if you want to enjoy different types of investment returns, then you will also need to consider the short term. This will mean that you need to compare the performance of different companies before you decide how to invest in Equifax shares.

Short-term investments are investments of free capital in investment projects for a period of up to 12 months in order to quickly increase funds.

The profitability of such transactions fluctuates in the range of 3–20% per annum. Short-term investments allow you to save money from the influence of inflation and bring profit in a relatively short period. In addition, with a jump in quotations, the investor's capital may increase sharply. Short-term investments can bring profit if you choose the right investment instruments and apply an effective strategy. The main thing is to find the optimal balance between profitability and risk. Short-term investments require a thorough analysis of the market and immediate reaction to the changes taking place. It is important to stay cool and not panic while doing this. Therefore, such deals are more suitable for experienced investors.

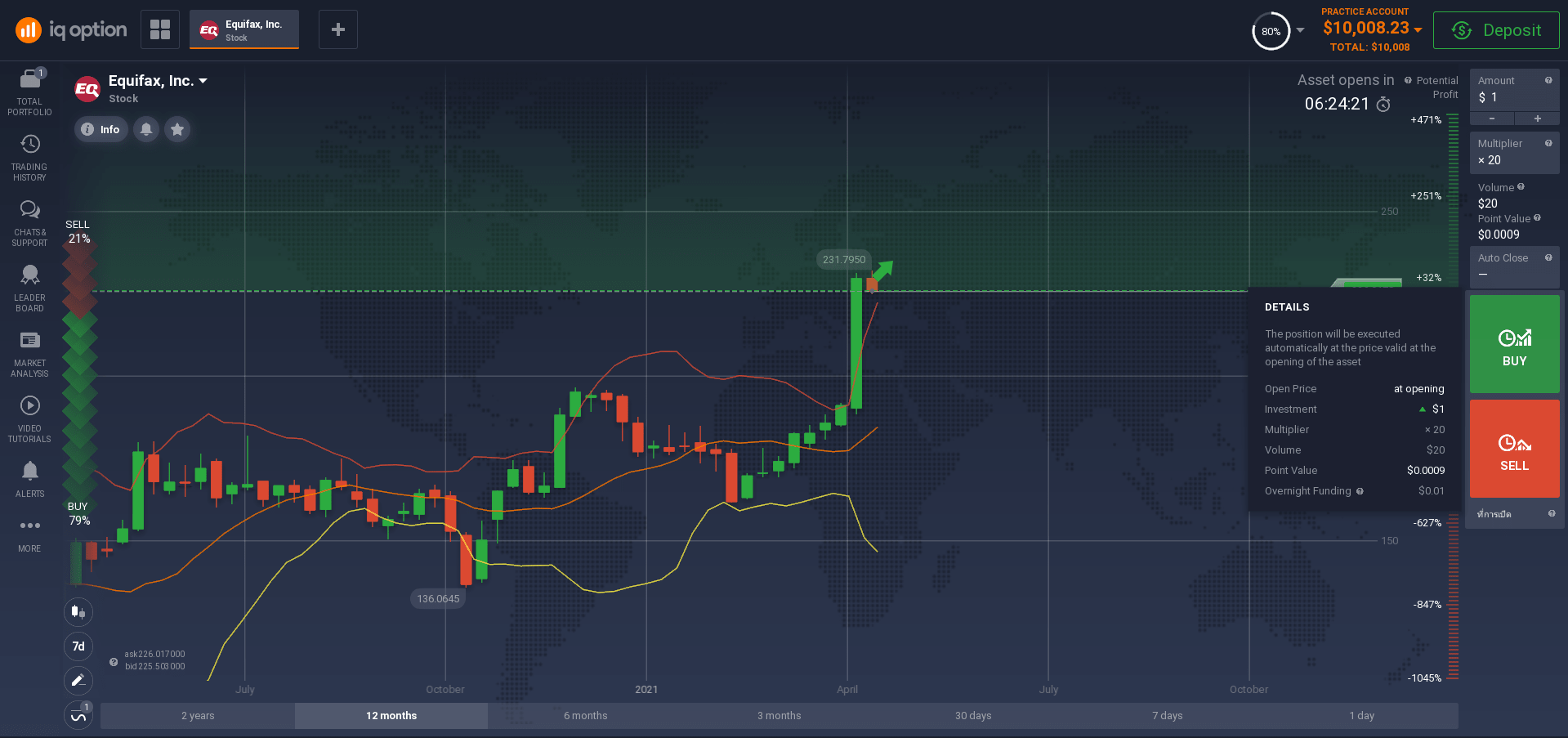

The main trader's tool is technical analysis, which, in contrast to the fundamental, is entirely based on the study of price movements using charts and indicators.

We have the most popular indicators on our site, these are MACD, RSI, MA and various charts that will show you the price trend for the period (timeframe) you have chosen.

To avoid mistakes, you need to follow a few simple tips:

- Diversification of the investment portfolio. It is not recommended investing in one instrument or one company. Assets from different issuers in several sectors of the economy should be purchased. A loss incurred on one instrument is offset by a gain on others.

- Discipline and sequence of actions. The result can be achieved if you adhere to the plan, analyze the market and increase investment capital. It is advisable to reinvest the received profit.

- Endurance and control of the situation. No one is able to avoid mistakes, especially at the beginning of the journey. A cold mind will help keep the situation under control, and the experience gained will help to avoid further failures.

- The right environment. Chatting with like-minded people on social networks and forums will help you become familiar with new investment strategies and common mistakes.

- Constant flow of information. Education, reading financial literature, acquaintance with the experience of successful investors will broaden the horizons and open up new development prospects.

How to buy Equifax shares in Pakistan?

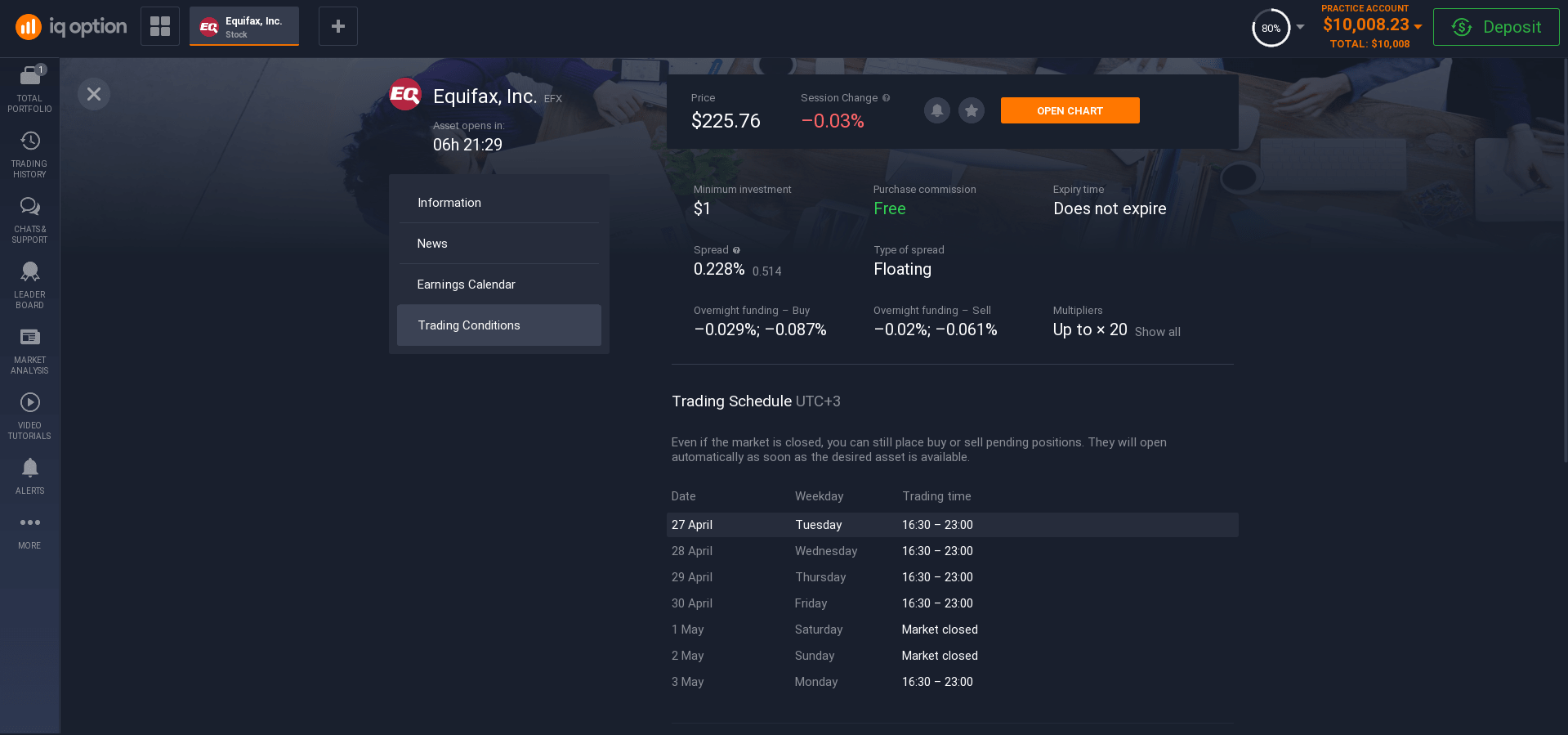

You might want to know how to buy Equifax stock, and what is the best way to do it? There are several ways to buy stocks, but they all require a certain amount of money and risk. But it will be difficult just to come to the company and buy shares, you need to get on the stock exchange. This is why it is necessary to have a trading account to buy Equifax shares in Pakistan.

An online merchant account allows you to buy and sell stocks for a specific amount of time without leaving your home. You don't even need to have a computer if you have an Internet connection. For example, we provide you with a mobile application, the functionality of which does not differ from a regular PC. If you want to trade, this can be achieved twenty-four hours a day, seven days a week. This removes most of the stress associated with managing your trading account.

So, the first thing you need to do is register on our website and create an account, then you need to wait for an email and follow simple instructions. After that, you can open an account, demo or real, choose yourself.

Equifax demo account allows you to learn the intricacies of this procedure without risking a cent. To do this, your account will automatically have $10,000. Of course, this is not real money, and in case of a successful transaction, you will not be able to withdraw the profit from this capital. But, as you can imagine, this will also save you from the risk of losing your own money. This lets you know if trading is a good idea for you. This lets you know how much to pay for the stock and what leverage to use. You can even look at how other investors are performing in the industry and determine how much they would have made if they had exactly the same amount of money. Once you understand how to buy Equifax shares and what it takes, then you have the confidence that you can make real trades.

Using a demo account to invest in Equifax shares in Pakistan will allow you to practice what you have learned. You will learn how the prices of these stocks work and what leverage to use. Knowing how stocks work until you start making real investments is vital. You should be familiar with how to study the financial statements and technical aspects of a company's business model. By being comfortable with all the financial numbers and market trends, it will be easier for you to buy stocks at a time when they are gaining traction in the industry.

Forex leverage is the borrowing of a certain amount of money from a broker to increase the level of return on investment and trading.

If you feel confident on the exchange you can open a live account right away. We allow clients to start with as little as $10. That is, you can open an account with just this amount. Of course, this amount will not bring you much profit, you can invest more at your discretion. But remember that it is always better to start with micro-sums, over time, of course, you will expand your portfolio.

Finding good deals in the stock market can be tricky. You need to make sure that you are aware of the rules governing the foreign exchange market so that you know when to buy and sell your shares. When looking for stocks, you should focus on companies that are established and have a fantastic reputation for quality service. This way, you are less likely to worry about investing in a company that might go out of business before your investment can earn some profit.