Full swing trading strategy

Swing trading has become a popular strategy because it is a new, simple and safe way to make profits. It is based on logical trend following, so even beginners can understand the principles of swing trading. In addition, it uses relatively simple analysis methods which allow every trader to adapt their style of play.

Swing trading strategies tactics in Pakistan

Swing trading is the best strategy in Pakistan and is suitable for most traders who are attracted to make quick profits with minimal risk. So good luck!

To start trading swing day trading strategies in Pakistan, you need to:

- Register and make a deposit on the online platform in Pakistan;

- Determine further trend movement and keep positions open for 1-5 days;

- When the market price approaches a support boundary, open a long position; when it approaches resistance, open a short position;

- Do not spend too much time on analysis. Looking for more analysis and news will take longer to analyze the charts. This is almost always useless;

- Observe the rules of capital management, so as not to get nervous about every unsuccessful order. Consider losses as a positive thing, and analyze every failure to prevent them in the future.

A swing trading strategy is based on cyclical price dynamics, going beyond time frames. In the era of global market liquidity, swing player can find excellent opportunities to execute trades over a wide range of time frames, from 5 minute charts to position trading over weeks.

Every player strives to improve their trading and find a strategy that is profitable and convenient for them. Many people opt for swing trading strategies in this quest. A swing trader enters the market at the moment of a pullback, or price correction. This allows him to enter the market at the beginning of a strong trend and capture a strong price movement, getting a good profit. Entering the market during a pullback allows you to make a profit with minimal risk.

How to trade swing trading strategies in Pakistan?

Swing traders have two options for trading:

- Short-term, where trades are opened within one day and do not move to the next. In this case, the main timeframe that the trader deals with is the hour marker.

- Medium-term, when a deal can live for up to several days. In this case, the main timeframe for the analysis will be a day.

Swinging is not a strategy, but a way of trading. And for successful player with its use a variety of strategies and methods of technical analysis may be applied, as well as their combinations.

Because it is a trading method based on trend following, it is clear that trades should not be opened in a sluggish, flat market or when the market is teetering on excessive volatility. A successful swing trading strategy in Pakistan can only be implemented in a market with a strong trend.

Rules for swing trading strategies:

- Hold only profitable trades. If the open trade did not turn profitable in the first 2-3 hours after it was opened, and on the contrary, it begins to bring losses, you should close it as soon as possible.

- Take profit immediately. If the price has made a sharp jump, you should not be afraid to take a profit. Then you can immediately re-enter the market on a pullback of the momentum, and thus make additional profit.

- Use stop loss and take profit orders. The rules of risk management in swing player are very important, so these orders should not be neglected.

- Do not carry over losses to the next day. Even if you trade in the medium term, you should not carry over a losing position to the next day. Swing traders lock in losses on the same day.

- Avoiding the winds of change. You should not open trades ahead of a news release that could agitate the market, or if a significant trading session is coming up. It is better to refrain from trading during market openings and when there is a clear trend reversal. In general, if a change is coming, it is worth closing existing positions.

- Do not fight the trend. The principle of swing trading is very simple - enter on a signal - take a profit. If the trend changes or you make a loss, you close the position and look for a new signal.

- Do not enter without a positive forecast for the medium term. If the development of events in the market in the coming week does not promise anything good or causes doubts, it is better not to enter the market, so as not to fix losses later.

Do not forget the money management rule. The loss on a single trade should not be more than 2% of your capital. Also, the profit/loss ratio should be at least 2:1.

The basis for swing trading strategies is technical analysis, based on graphical analysis of prices, looking for patterns in the past. Indicators can be used, but do not forget - these tools are derivative, they are usually lagging. After all, a swing trader looks ahead of the market.

The most effective methods of technical analysis in swing trading in Pakistan:

- Determining the direction of the market (trend). For example through 50 and 200 day moving averages;

- Defining resistance and support levels;

- Determining an "adequate" entry point for investing.

In fact, there are many options and swing trading strategies stocks to determine an entry point into a trade. Some of them are based on Elliott Wave Theory, as you can use it to successfully anticipate correction points and enter at those exact points. Another option is to determine the entry point using moving averages. This strategy may also use technical indicators and oscillators to detect trend reversal points. The trend line may also be helpful.

You may also use VSA and pobar analysis to find the best entry points for swing trading. This method allows you to predict the correction by the volume histogram and the strength of the current and previous bars, without using technical indicators or additional tools.

Swing trading is the best strategy, which can be used both by beginners and advanced traders. For the latter group, it gives them an opportunity to diversify their approaches and optimise their profits. And for the former, it keeps their motivation high and does not make too many demands.

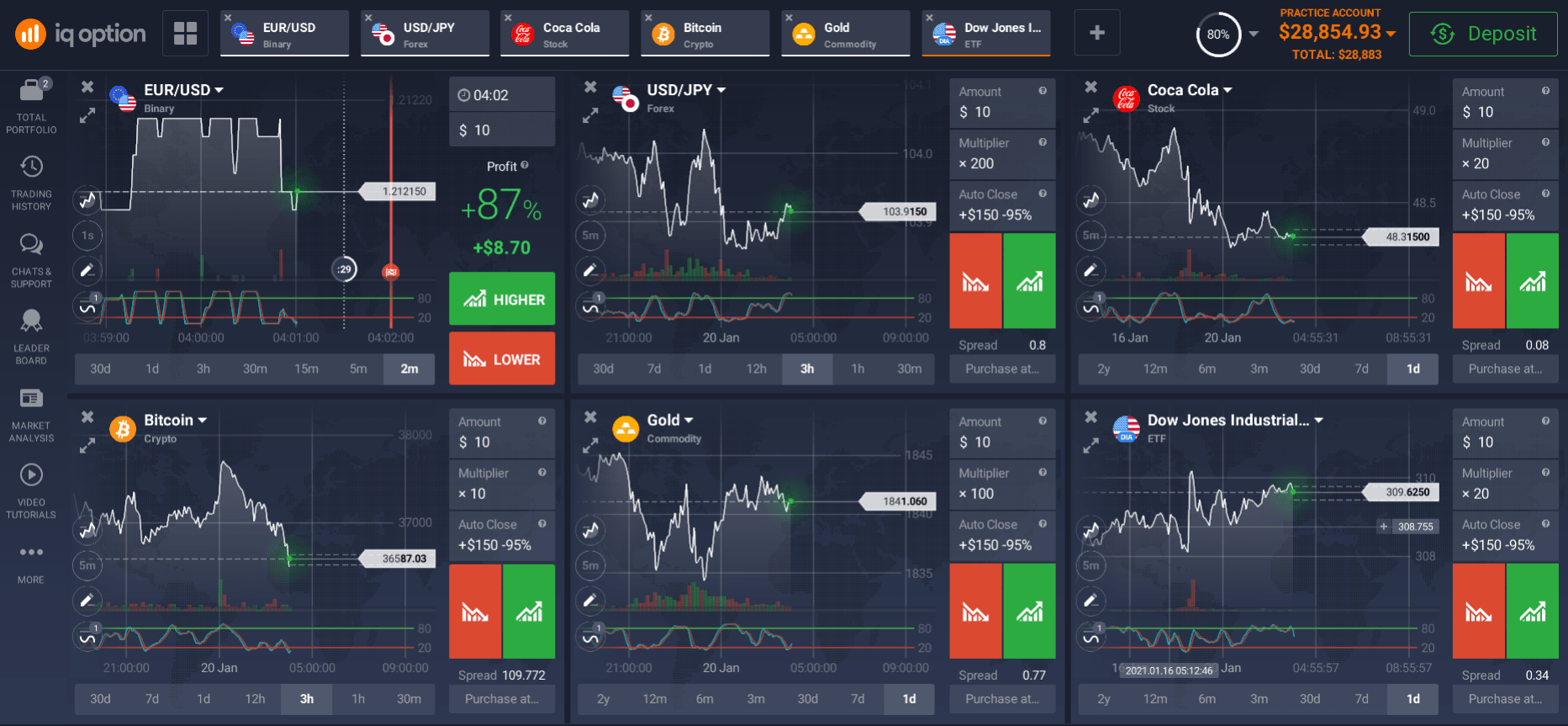

Trading tools used by swing traders in Pakistan:

- Stocks - These are small pieces of a company that allow people to buy shares in the business. The best stocks to swing trade are large-cap stocks as they are usually the most actively traded.

- Forex. The market has excellent liquidity and enough volatility to guarantee significant price fluctuations. USD, EUR, JPY and GBP are some of the most popular currencies for swing player on the forex market.

- Exchange traded funds (ETFs) - ETFs are a set of securities such as bonds, commodities, stocks, etc. with a strong trend.

- Cryptocurrency - Since swing trading benefits from price fluctuations, assets with high volatility, such as cryptocurrencies, offer huge potential for profitability.

- Contracts for Difference (CFDs) - CFDs are an excellent choice that allows you to speculate on the price movements of assets without owning those assets.

In swing trading, traders capture small movements within a larger overall trend. That is, swing traders tend to make many small gains that add up to significant profits. So go for it, and have a great time trading!

Regardless of your level of experience, choosing the most suitable online platform for swing trading strategies will go a long way in ensuring a seamless player experience. Take the time to choose well, learn the rules of the game and try to perfect the art of swing trading.

How to start investing in swing trading strategies stocks in Pakistan?

Swing trading strategies are now popular on many trading platforms. The most popular and affordable way for every player to start investing is to open a trading account with an online platform. Fill in your account user profile before uploading verification documents such as name, email address. Once you have registered, follow your chosen swing trading strategy and place stop losses in time.

Once you have registered and verified your account details, you may proceed to transfer funds to your approved trading account using one of the payment methods provided. Depending on the payment method you choose, it will take a few days for your funds to arrive.

You will be able to use leverage on your trading account. Leverage is the borrowed funds that traders receive for trading operations. Leverage is not a loan in the usual sense of the word, no interest is charged. The funds are not deposited to the trader's account, they go straight into a trade.

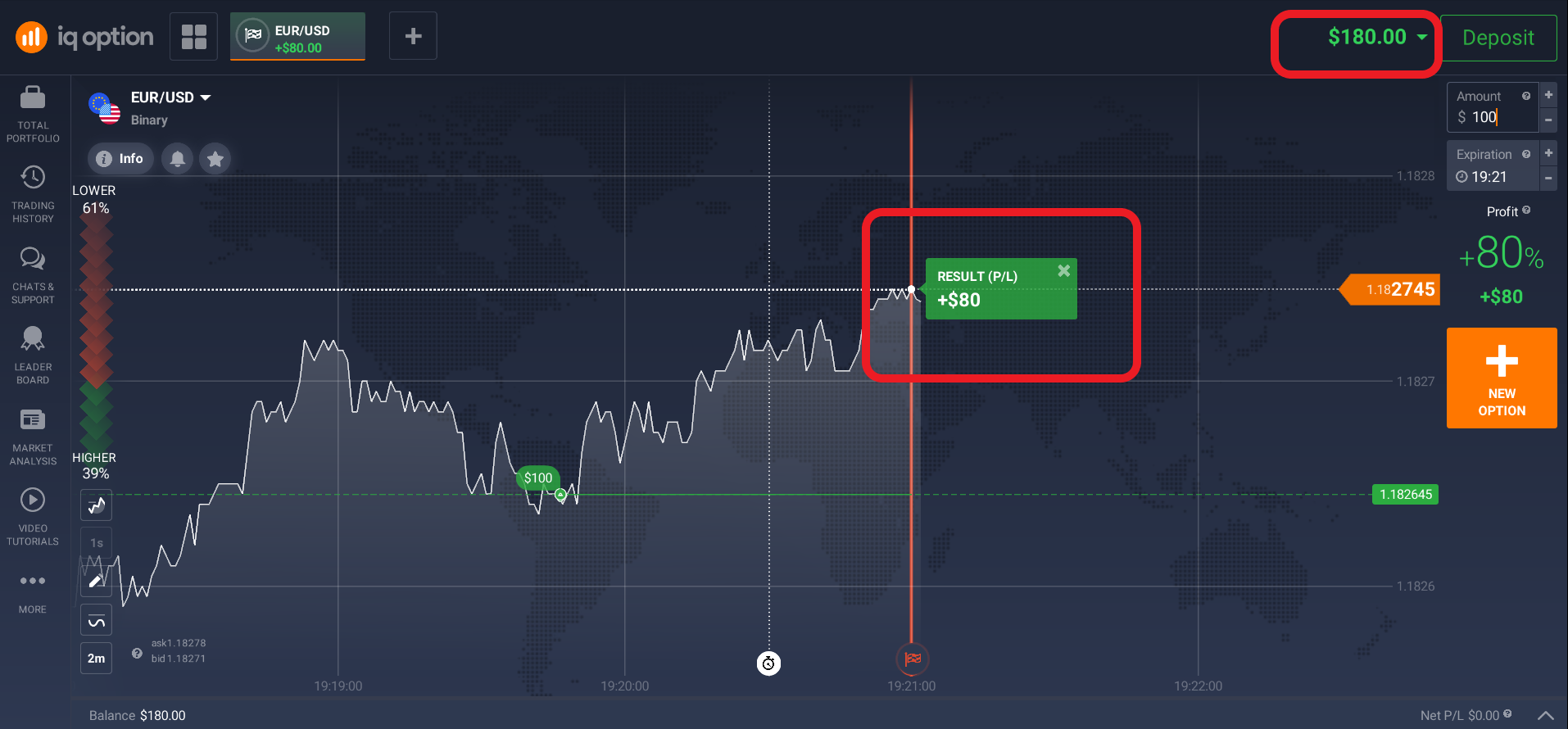

On the online platform you have the opportunity to try out swing trading strategies with stocks, without worrying about your own savings. You can do this by opening a demo account on the platform. It gives you a chance to gain invaluable trading experience, learn the specifics of the trading platform, and learn how to cope with your emotions, experiencing sudden market surges and unpredictable events, so that next time you will react less acutely.

We wish you a successful investment. Try it and you will be successful!