Martingale strategy for binary options

The Martingale strategy

The Martingale strategy is a favourite form of betting system that traders often use in binary options.

The Martingale method is one of many betting strategies that originated and was popular in 18th century Morocco. The most straightforward gambling strategy was developed for zero-sum games, that is, games in which each side bets the exact amount and wins and losses are absolute. Thus, if I win, I win everything; if you win, you win everything.

According to the basic strategy, the player doubles his bet after each loss so that the first win will compensate for all previous losses and bring profit equal to the original bet. The martingale strategy is most commonly used in roulette, as the possibility of red or black rolls is close to 50%.

The idea behind the martingale strategy is simple: double your previous loss until you eventually win, leading to a profit no matter what, as long as you can go the distance. The only limiting factor is the size of your deposit, so as long as you can make the next trade, you have a 50/50 chance of getting all your money back.

Martingale strategy for binary options

The Martingale system for binary options eliminates the need to understand the market, technical analysis and trading because the only thing that matters is the result of the next trade. All you have to do is make a trade and then double it if you lose.

The Martingale strategy is almost a sure thing, as your chances of winning increase with each successive trade, provided, of course, that you have unlimited time and a large enough pot to make any next trade and not go bankrupt. The danger lies in these assumptions.

The martingale system seems pretty safe to some, especially beginners, but this is a popular misconception. If misused, it can quickly compound losses and lead to a catastrophic collapse. Therefore, it is best to use sensible money management techniques, such as the percentage rule, to ensure that no single trade is so large that it will bring you down.

Types of Martingale strategic decisions

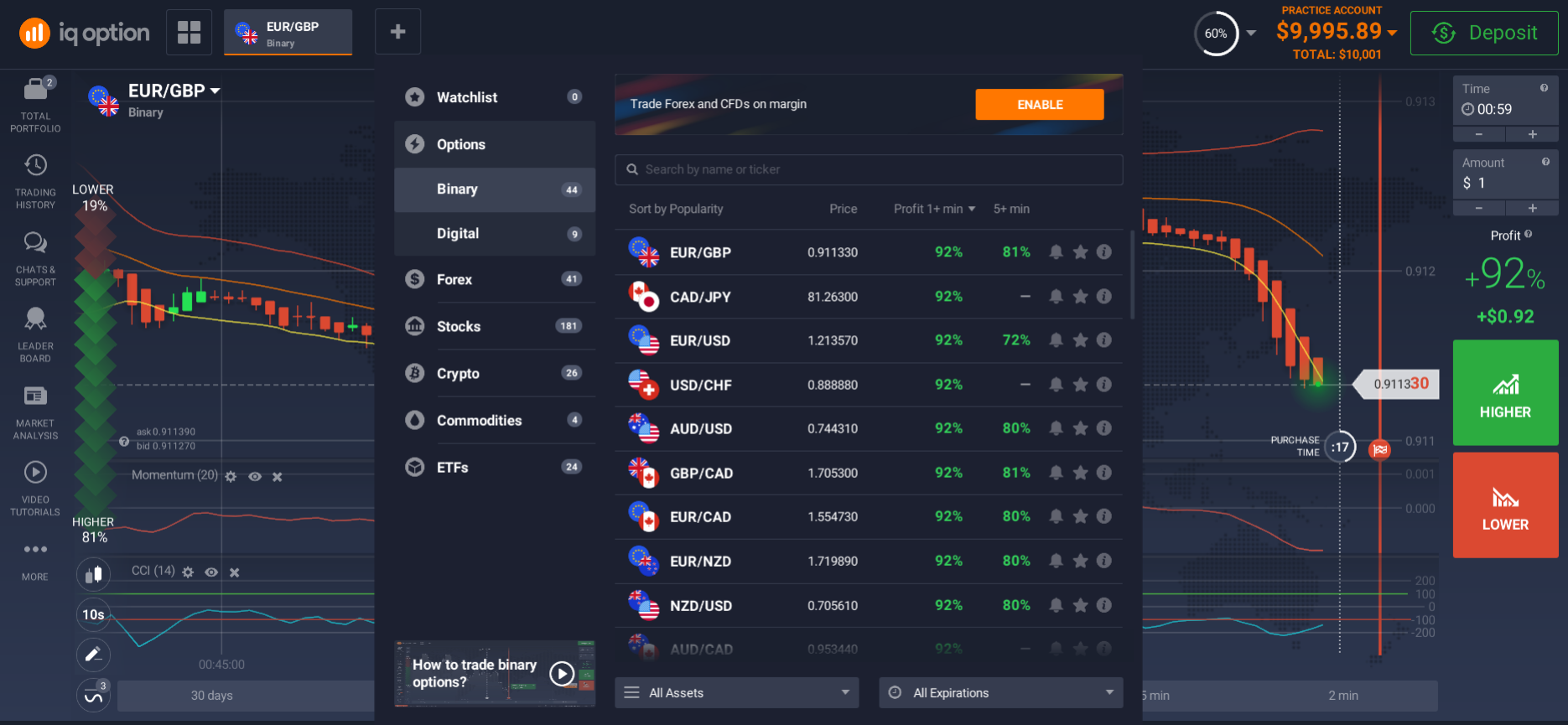

The Martingale system for binary options is prevalent among traders. It is most appropriate to use it on currency market assets because they differ from securities and commodities by high liquidity and significant volatility. These are the best conditions to maximize profit. Currently, traders have several options for the successful application of the Martingale system.

- Classical strategy.

Classical Martingale strategy for binary options is the easiest way to apply the Martingale in practice. If the trade is losing, you should double your first investment and open a trade in the same direction. Repeat the doubling about to make a profit. It is essential to understand that this simplicity hides high risks. That is why experienced traders recommend using this strategy only in combination with oscillators or other efficient trading systems. The primary condition for successful trading is the low cost of the first option. It is essential to be able to withstand 7 to 9 losing trades in a row.

- Smooth strategy.

This modification of the Martingale tactic is designed to reduce the potential risks. It implies increasing the investment amount in case of a losing trade by the ratio of 1.3 or 1.5.

- Martingale and averaging of trading positions.

Traders often make mistakes that can lead to considerable losses. The purpose of averaging trading positions is to preserve capital.

- Anti-Martingale.

This version of the practical application of the Martingale strategy for binary options trading is radically different from the others. For example, according to its rules, you should open an order with double the investment amount if the first option turned out to be profitable.

The objective is to identify the correct trend and make maximum profit on the movement of the price chart. Using this tactic in trading will allow you to increase the deposit to the valid values in a relatively short time.

Effective trading using the Martingale system

The primary condition for the success of this strategy is the necessity of using the doubling tactic together with the proven strategy. Using the Martingale system is not recommended in its classic form. It can work in a fair online casino, but in financial markets, the theory of probability is not a critical factor in shaping the value of an asset.

If a trader wants to use this tactic in trading, the following conditions should be met:

- Develop an author's trading system, which has a profit/loss ratio of about 2 to 1;

- Potential profitability in the created strategy should be 100% of potential losses.

In this case, it is even recommended to use the doubling tactic in case of losses. In this way, you can quickly compensate for the losing orders and earn extra money by increasing repeated investments.

The Martingale method for binary options is a good way for traders to eliminate losses from their trades. However, to use this system, an effective and time-tested strategy will be required. This tandem can be called a guarantor of stable and high profit in trading on financial markets.

Pros and cons of the Martingale method

- Pros:

- Simplicity - contains clear rules that are easy to follow.

- Predictability - allows you to calculate possible costs and profits in advance.

- Cons:

- Small profits - the longer the series, the higher the losses, but the potential earnings remain at the level of the first contract.

- Risks grow exponentially after each unsuccessful contract.

- Weak prospects. At a distance, the method almost always leads to the same result - a capital loss.

How to use the martingale method in binary options?

To increase the effectiveness of the system, traders use a Martingale method for binary options with additional application rules:

- Trading only on the trend to increase the accuracy of predictions;

- Trading with assets that are easier to analyze: do not trade with cryptocurrencies and other volatile instruments;

- Opening trades according to the strategy's signals - trading at random is dangerous.

Risks

Despite the potential breakeven of the system, its risks are higher than in standard trading. Losses grow exponentially. A profitable trade can occur after five, ten or more failures. Having started with one dollar, a trader can risk hundreds and return the initial bet in case of success. That is why speculators often close a losing streak by not waiting for a profitable contract due to a lack of capital. Or they do not have enough money to cover their losses.

How to reduce the risk?

To reduce your risk, you should follow the trend. In gambling, the chances of winning and losing are determined by probability. With Binary Options, it is different. The outcome depends on the changes in the quotes, which are subject to trends. So by opening trades on a trend, the trader increases the probability of a successful outcome.

Why is Martingale not a good idea for binary options?

Now with binary options, there are some things you need to take into consideration.

First, you have to know the payout percentage. You will never win as much as you bet. Since they are less than 100%, you have to increase your bet with this in mind to cover your previous loss and make a profit equal to the original trade. Otherwise, you will end up losing no matter what happens.

- For example.

If you make a $100 trade and lose it, then make a $200 trade and win 85%, you only get back $370, covering your costs ($100 + $200) but only winning 70% of your first trade.

If you were to move to a third trade, a $400 trade, you would get back $740 but only profit $40 or 40% of your original trade.

If you had moved to the fourth trade, doubling the size, the profit would have decreased again and turned into a net loss on the fifth trade.

The real risk here is that with each trade, you have to increase your bet by more than 100% to avoid losing. That means that your potential losses grow exponentially with each trade. The first trade is 100%, the second is 100% +115%, the third is 215% + 250%, the fourth is 465% + 500%, so your first trade is X dollars, and the fourth is almost 10X dollars and growing with each trade until your account fails and you get thrown out of the market.

Ultimately, Martingale is not about trading to win. It's about trading not to lose. That is why applying this strategy requires careful market analysis and an understanding of the correct application.

How to start using the Martingale strategy in Pakistan?

To start using the Martingale strategy for trading, you first need to choose a broker and register on-site. Once you have done this, you should give your username and password.

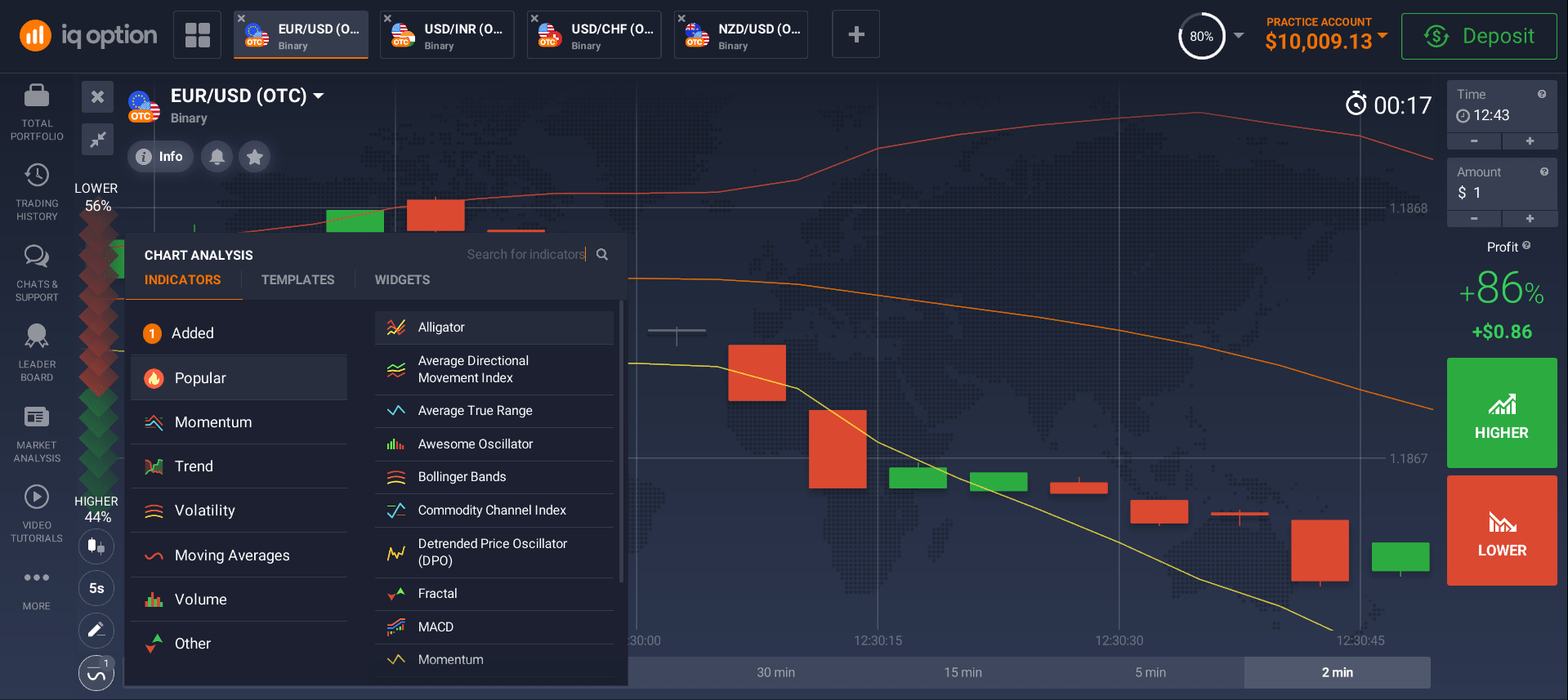

Demo account

A trading platform will include a demo version of the software, allowing you to experience the benefits of the strategy in a simulation environment.

Real account

Then, once you are familiar with how it works in the simulator, you can go out and try it out on a live trading account. To open a real account, all you have to do is make a minimum deposit in a way that is convenient for you.

After putting in the required time and effort into studying the subject, you will have developed your version of a martingale strategy which will have made the difference between a successful and a losing trading career.