Buy MasterCard shares in Pakistan

MasterCard Incorporated is an international payment system, a huge financial corporation. The head office of the company is located in New York (USA). Headquartered in O'Fallon, a suburb of St. Louis, USA, the business is focused on processing payments between acquiring banks, merchant banks, issuing banks or credit institutions using MasterCard branded debit and credit cards for payments. In addition to the payment processing business, they have their own cards with varying degrees of loyalty and services connected to it.

MasterCard was founded in the late 1940s, when several American banks began issuing securities to customers that could be used as cash in local warehouses. In the next 10 years there was a card boom and this market developed. On August 16, 1966, one of the groups of banks in major cities serving cardholders formed the Interbank Card Association (ICA), which later became MasterCard International. The association acquired MasterCharge technology, and now the cards were issued under this brand. And in 1979 the brand was named MasterCard.

The company, which was organized as a commonwealth of banks, conducted an initial public offering on May 25, 2006, selling 95.5 million shares for $ 39 Proa.

MasterCard was created to provide cashless payment processing alternatives for both merchants and customers. They initially issued credit cards directly to consumers without having an intermediary such as a bank. MasterCard later took advantage of an advertising campaign and was effective in gaining market share against other credit card companies through marketing and promotions.

MasterCard is widespread to the point that their payment card is accepted in more places around the world. Today it is one of the most widely known payment systems in the world. The MasterCard / Cirrus ATM network is one of the largest ATM networks in the world with over 900,000 service locations on all seven continents.

Currently, MasterCard Worldwide corporation unites more than 25 thousand financial institutions in 210 countries of the world. This payment system accounts for 20% of the world's bank cards. The corporation employs 6,700 employees.

MasterCard's sales reach millions of dollars each year, and the company can offer its customers a variety of services. For those customers who travel frequently, there are special offers for regular travelers, with miles or points for gasoline. Some customers are eligible for lower interest rates when they pay their bills in full each month, others get cash back when they use their card to shop.

Investors love MasterCard stock, it is a large and stable company that is likely to stay afloat in all outcomes and market fluctuations. In addition, now the share of non-cash and digital payments is so large that we cannot imagine payment without this issuer. Analysts have no doubt that Mastercard's business will continue to grow in the coming years. In addition, Mastercard is well protected from competition due to the huge barriers to entry for new players.

How to invest in MasterCard shares in Pakistan ?

Interested in how to invest in MasterCard shares in Pakistan? If so, keep reading because this guide will teach you everything you ever need to know about investing in MasterCard stock in a country like Pakistan. MasterCard is one of the largest card companies in the world and offers many MasterCard cards and various lines of credit around the world, as well as a 24/7 operations center.

This company operates in two types of its products. It provides its clients with debit and credit cards as well as checks and cash as well as providing them with long term investment opportunities. These, in turn, are very useful and people can make huge returns on investment.

Long-term investing is more suitable for people who do not have a lot of free time and want to receive income from their assets more than a bank deposit.

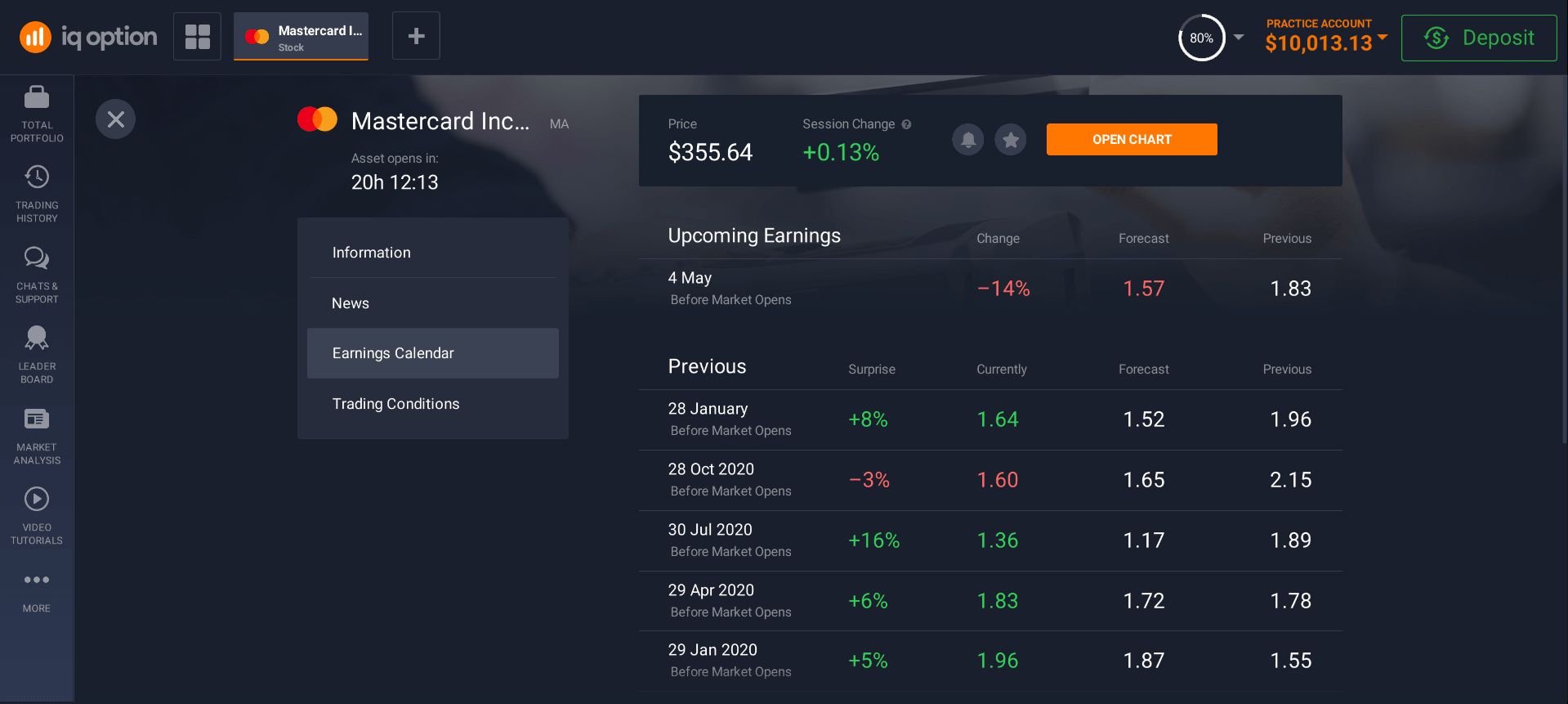

In order to start investing, as in any other business, you need to start with learning and learn the basics of fundamental analysis. This is an analysis of the financial condition of a company, an assessment of the value of a business and the prospects for its development. Also, you need to study the experience of the most famous and most importantly, successful investors in the world.

Long-term investments can be risky, but when you look on the brighter side, you will be happy to know that you will make a profit that far exceeds your money invested. There are several dangers associated with long term investments. Long payback period, possible bankruptcy of the enterprise. The long-term outlook is unpredictable - today's investor expectations, market trends and economic conditions for investment activities can change their development vector overnight. As a result, a seemingly profitable investment project can fail miserably.

To minimize your risks, it is important to study the company in which you want to invest money, from management and history to yesterday's stock quotes.

Short-term investments are short-term trading in stocks, commodities and currencies in order to generate speculative income. A trader must be able to predict changes in asset prices in the short term - a couple of minutes, hours, several days or weeks. This usually limits the trader's investment horizons. Indeed, he should not be in a position for a long time: he saw the potential for growth or decline, entered the market, “rolled” on the trend and exited. At first, when people first see the graph, it seems simple to them. Here I opened a position, closed here and received income.

On the historical chart, everything seems quite obvious. But in practice, everything is much more complicated - short-term price fluctuations are very chaotic. Sometimes professionals call it a "hot" market, since any news, any statement of high-ranking officials, any technical breakdown of levels, any financial event affects the price of an asset.

Choose the most suitable strategy for yourself and decide how much you are willing to invest and, most importantly, how much you are willing to hypothetically lose. Remember, you should never invest your last money in stocks. You should play on the stock exchange with free money.

How to buy MasterCard shares in Pakistan?

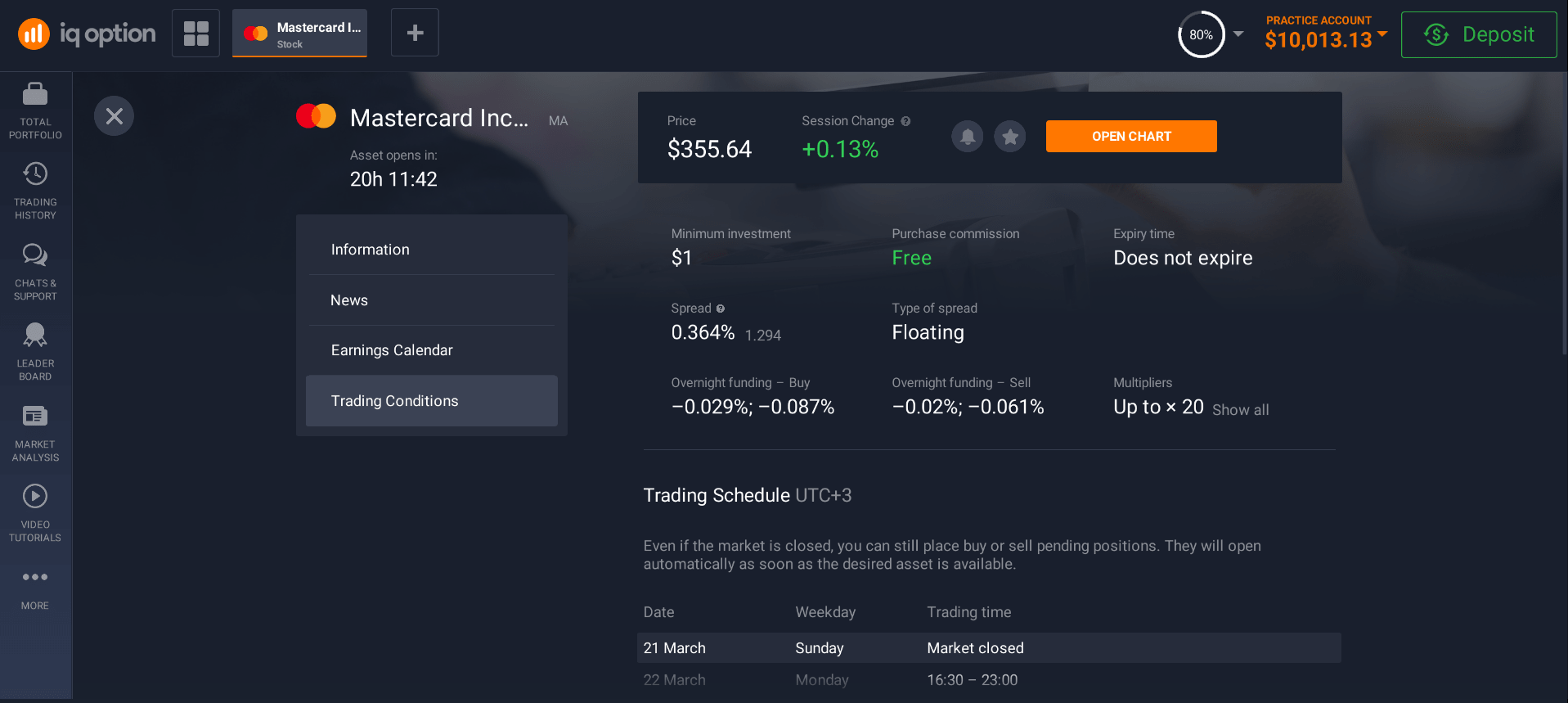

If you are thinking about investing in the stock exchange, then you can buy MasterCard shares through a broker. You can also open an account to trade MasterCard shares through a bank. Online brokerage platforms are very popular now, which have all the functions of the usual stock exchange, only you can trade and receive information from the comfort of your home.

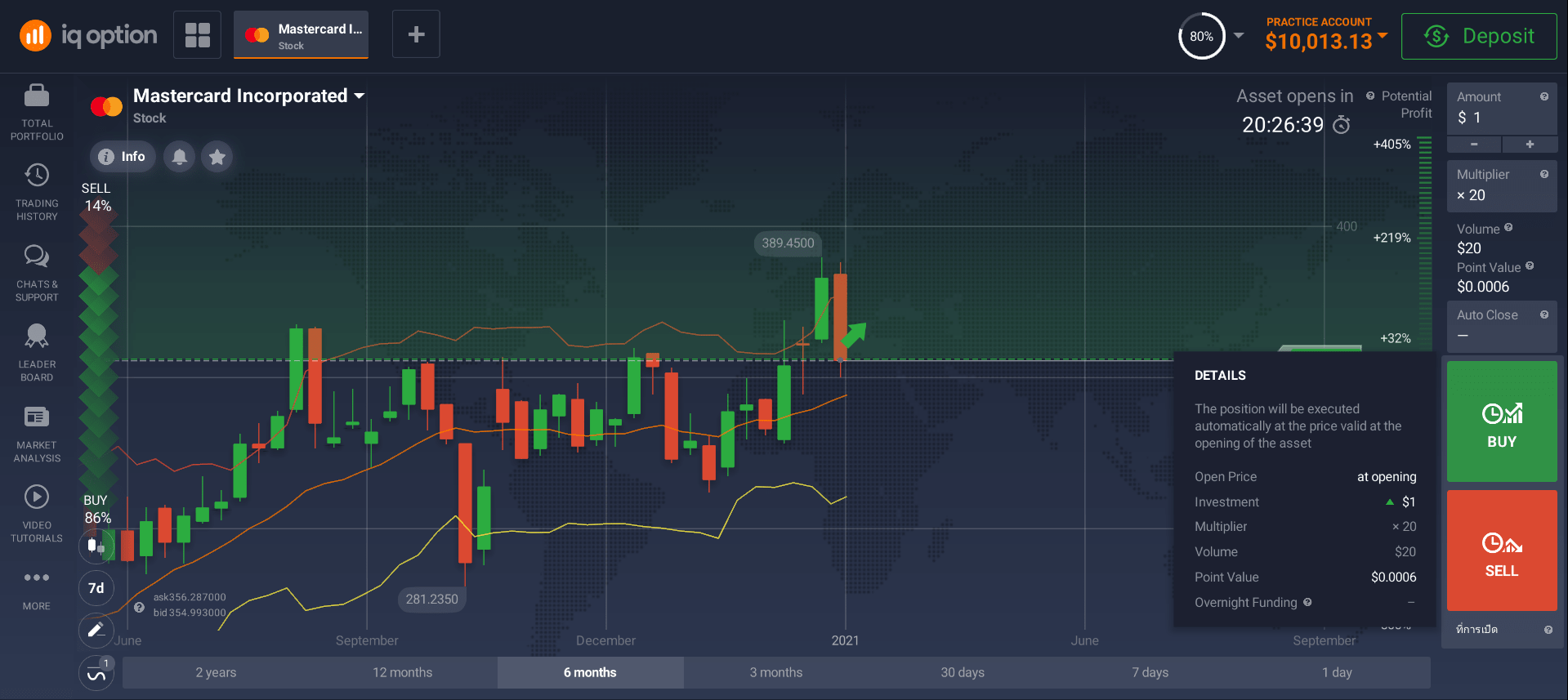

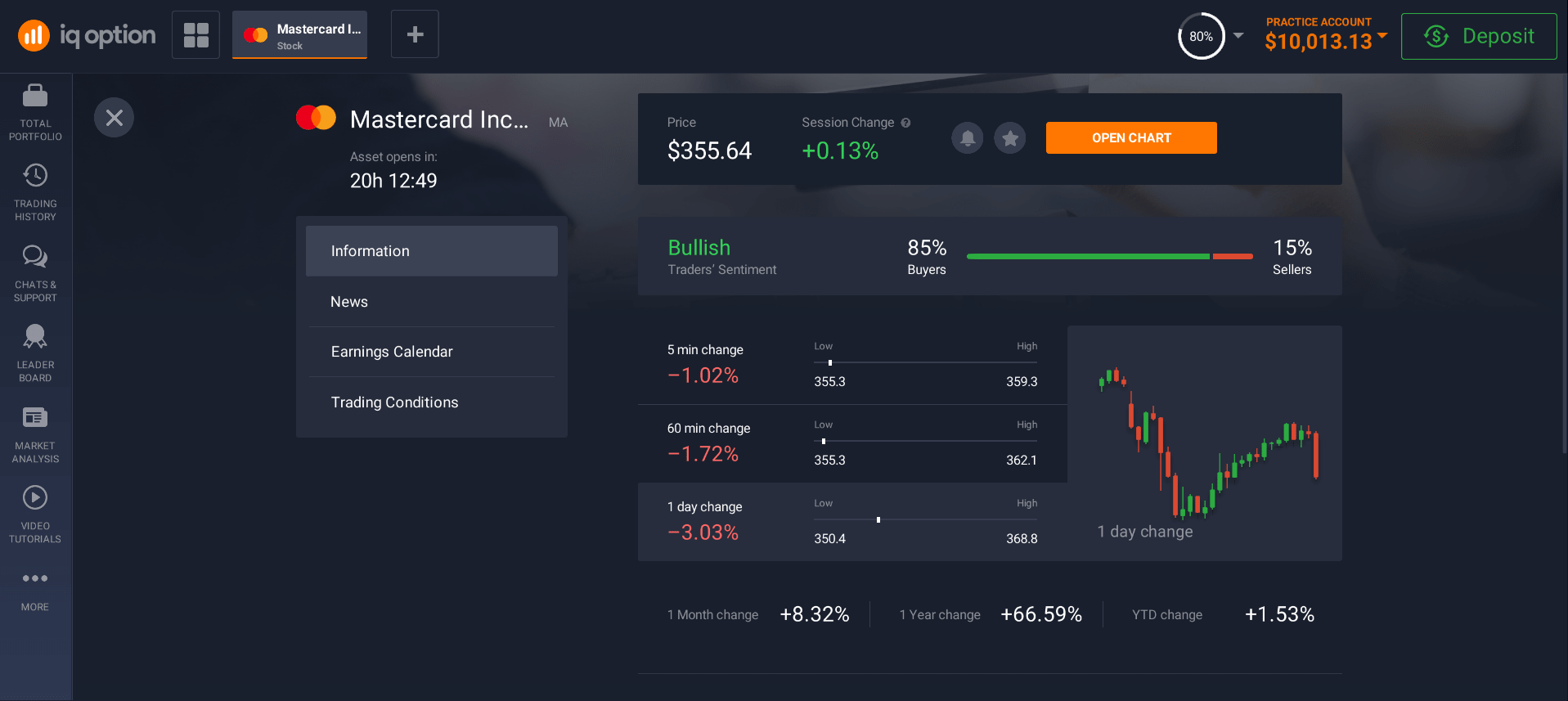

We offer a convenient and most importantly secure platform for trading and studying the stock market. We allow you to register for free and use a practice account until you are ready to purchase real stock. The registration procedure is pretty quick. After filling in all the required fields and providing your phone number and email address, you will need to wait for a confirmation letter. To get started with our platform, activate the account functions using the link in the confirmation letter, open a demo account and trading platform first. You will have $ 10,000 virtual currency to test how the stock exchange works and practice.

When you invest in MasterCard shares in Pakistan through a demo account, you must follow the same rules as investors who buy real stocks. Buy at the right time and sell at the right time. One of the best ways to determine the correct time is to see the market over a period of time. If you notice a trend in which the price of one stock rises and the price of another falls, you should buy more stocks.

Opening a demo account for trading allows you to simulate all the actions of real traders. You will have access to all the information on the site. The only difference is that you will not be able to withdraw your profits, but you will not be able to lose anything either. no risk

In addition to a demo account, we also offer a real trading account. It is very valuable that we have set the minimum possible deposit of only $ 10. That is, with such a small amount, you can start your game on the stock exchange. Of course, over time, you will increase your investment portfolio as you have more knowledge and experience. When you understand how the market works and how you manage to interact with it. You can open an account with a larger amount, it all depends on you, try it and you will succeed!

An important step to consider when purchasing MasterCard stock is determining the correct buy and sell price. You should study the profit and loss statement of the company to determine the ideal amount to close the deal. It is also a good idea to consider if you are looking to buy new stock from a reputable firm. If you realize that you can make money by regularly buying stocks and selling them when prices drop, you will be able to create income.

Of course, if you are interested in stocks, you have seen a lot of information, quotes forecasts on the Internet, but be careful. Such forecasts, especially for the long term, are approximate and cannot guarantee you the information 100%. You alone bear full responsibility for your risks as well as for victories. No forums or analysts are able to accurately predict.

Experience will decide here, practicing skills in practice, completely uniting you as a trader with the market. First, there will come individual successes in a small number of correctly closed deals plus, then the process will become stable, bringing not only material, but also aesthetic pleasure.