Multi Asset Platform in Pakistan

What is a multi assets trading platform?

What is a stock exchange platform in the financial sector? It is an online broker that regulates transactions between two parties by means of a trading terminal, as well as providing an online quote or real-time price for a particular asset. And thanks to its flexibility and rich functionality, the trading platform has quickly gained wide popularity among investors and traders. After all, it is really convenient to have all the information and functions in one place.

The multi asset trading platform offers a wealth of different assets to trade, as well as analysis and learning tools.

Mobile trading

Every trader is closely connected to technology. Therefore, many trading software developers pay more and more attention to mobile platforms. The ability to interact with the market using a phone or tablet allows a trader to be anywhere and still work. Today, a brokerage platform allows you to trade not only from home, which is something many people are used to, but also via an app. Appreciate the convenience of the app, download and use it!

Brokerage account

A brokerage account is a special account to trade on the stock exchange. It is opened on the brokerage platform, in this case acts as intermediary between private investor and stock exchange. According to the law, a common person cannot execute transactions on the exchange directly, so he/she gives orders to a broker, and the latter buys or sells financial assets on behalf of the client. To record these assets, a brokerage account is needed.

In your account you will be able to see all of your past transactions, and track your profits and losses, so you can control your financial situation and change your strategy if necessary. You can set the size of your stop-loss. Also, if you want to use leverage, you can do so online as well.

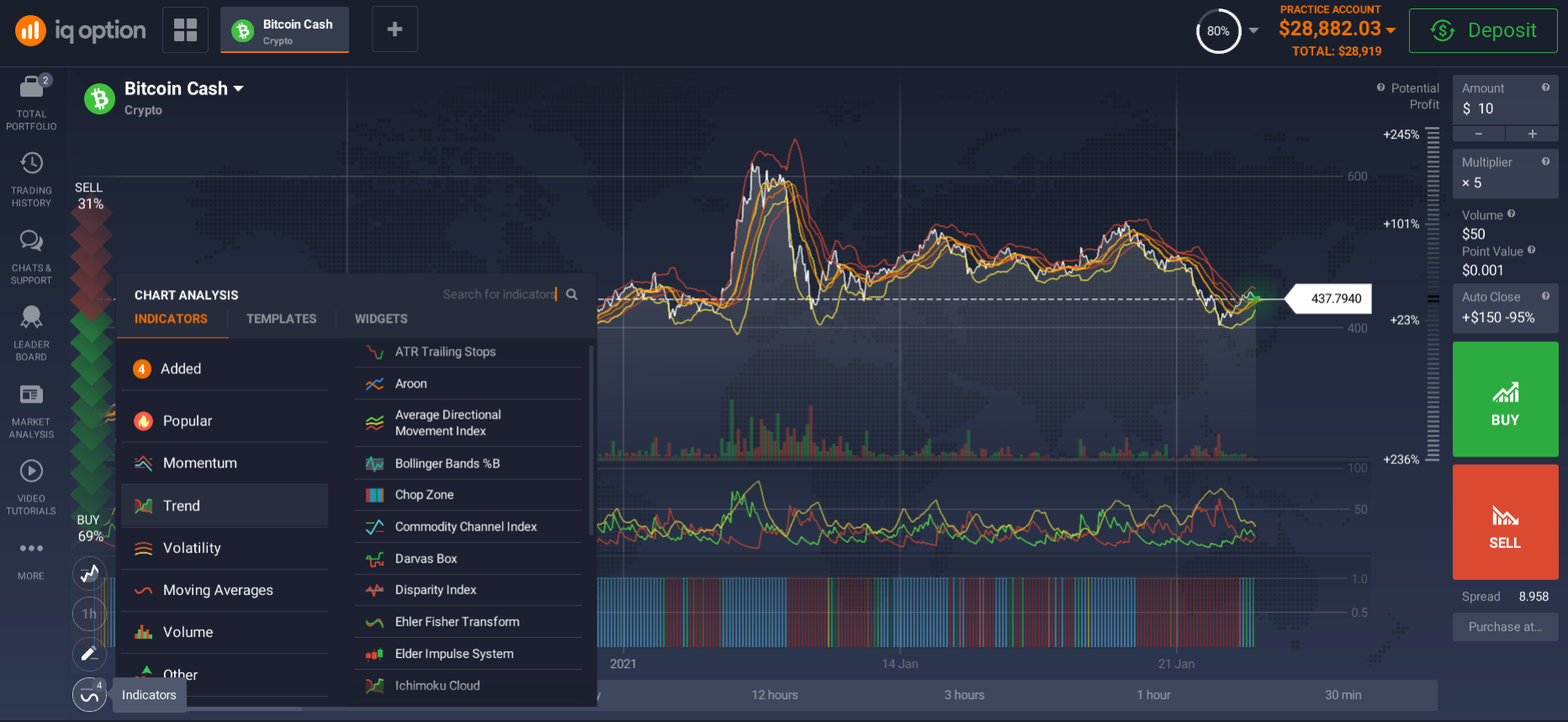

The analytics section on the multi-asset platform

Depending on the asset you wish to trade, and for how long, you will use either fundamental or technical analysis. Technical analysis is normally for volatile assets and fast trades. Fundamental analysis is for long-term investments, for example in equities or ETFs.

While fundamentals tell us about the intrinsic financial strength of an asset, a chart reveals its nature (they talk about 'volatility', i.e. the volatility of prices).

So, what are the advantages of fundamental analysis:

- it allows you to determine the main trends;

- fundamental analysis shows the factors that really influence the market. It means that with its help, a trader may understand the reason of a trend;

- the news and the economic calendar are always in front of you, they are easy to find, including on the platform.

Advantages of technical analysis:

- visibility. Technical analysis is a work with charts. All the information is right in front of the trader's eyes. Besides, most terminals today contain all the additional tools necessary for work;

- аvailability of tools. Most of the tools for technical analysis are on the trading platform;

- сorrectly used indicators may predict the price movement.

A technical analyst uses charts, indicators, graphs and other visual data to analyze the data and to determine the potential future result of the data provided. Technical analysis is the art of making stock market forecasts and interpreting market trends and patterns.

The most successful traders combine both types of forecasting to achieve their goals. By identifying the underlying trend with the fundamental method, they look for confirmation on the chart, and this enables them to open more accurate positions for any particular trading instrument.

When you use both fundamental and technical analysis, you get an accurate picture of the market. This is why we increasingly see technical analysts looking at company fundamentals and fundamental analysts looking at charts.

Types of platform trading

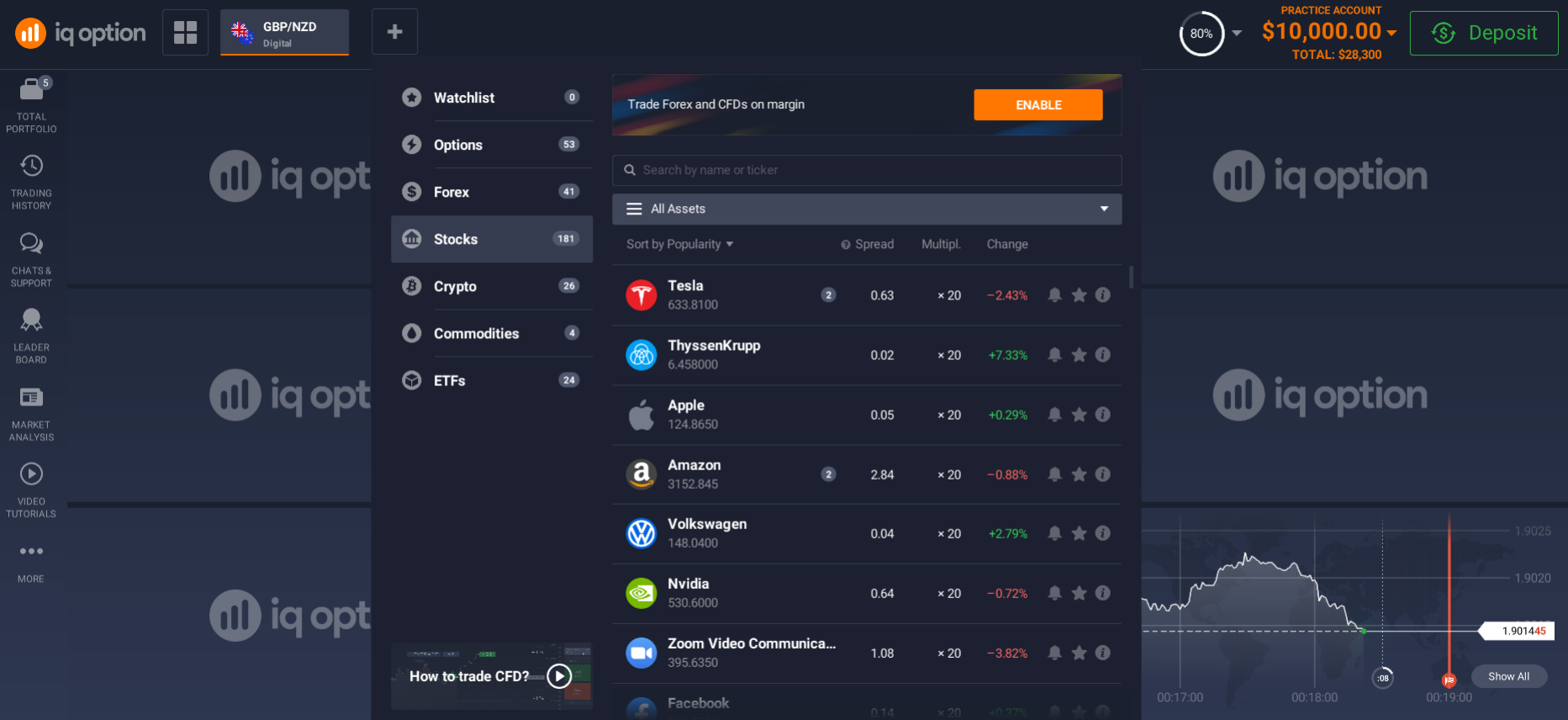

Traders have different approaches to realizing a multitude of opportunities to make trades and enter new markets. The need for simultaneous trading across asset classes is therefore particularly great today. There is a growing need for a multi assets trading platform where traders can sell and buy ordinary shares, derivatives, foreign currencies and commodities.

Platform for stock trading

Shares are securities issued by a company in order to raise new investors and cash for business development. The sum of the value of all the shares in a company equals its share capital.

There are many companies on the platform in which you can invest. Before you do this, you should make an analysis and prepare well for the purchase. You can make money on shares by reselling them when their value has increased or by receiving dividends. Stock trading platforms are used by both short-term and long-term investors.

Platform for forex trading

Forex trading was originally created to allow the most profitable exchange of some currencies for others, but it was only later that the possibility of speculation emerged.

A currency pair is a ratio between two currencies. The term is often used when referring to forex trading, where a trader buying one currency always sells another. The first currency in the pair is called a "quote base"; the second one is called a "quote currency". Financial operations are always carried out with the quotation base.

First of all, macroeconomic data influences currency rates. Forex traders always have to keep track of international economic news and relevant statistics: changes in the political arena, results of central bank meetings, the latest data on unemployment, inflation rates, etc.

The second indispensable assistant to the forex trader is technical analysis. Technical analysis is based on analyzing the price chart of a traded currency pair. The principles are the same as when trading on the stock market. Wave analysis, indicators and chart patterns should be your best friends and mentors in making decisions.

Platform for trading options

An options contract is the right to buy/sell an underlying asset at a fixed price in the future. The most important thing in the definition is the word "right", i.e. no one is obliged to execute the contract. There are two types of options on the exchange:

- Call - the purchase price is fixed in the future.

- Put - the future selling price is fixed.

An option itself is an asset that can be bought and sold in the course of trading on the futures market. Each option has an expiry date. Thus, it is not traded forever. At the time of expiry, it either expires or is exercised by the trader.

Binary options have become a popular sub-species of classic options.

Binary options are trading contracts, which are linked to the price of the underlying asset. This type of contract works on an all-or-nothing basis.

That is, after opening an order, the transaction has only two outcomes - we either lose the entire investment or we win a solid (up to 60-90% of the underlying deposit) payment. You can make a profit if you guess the direction of price movement at some moment. Otherwise, the trader loses the bet. This asset is often used by beginners to hone their technical analysis skills.

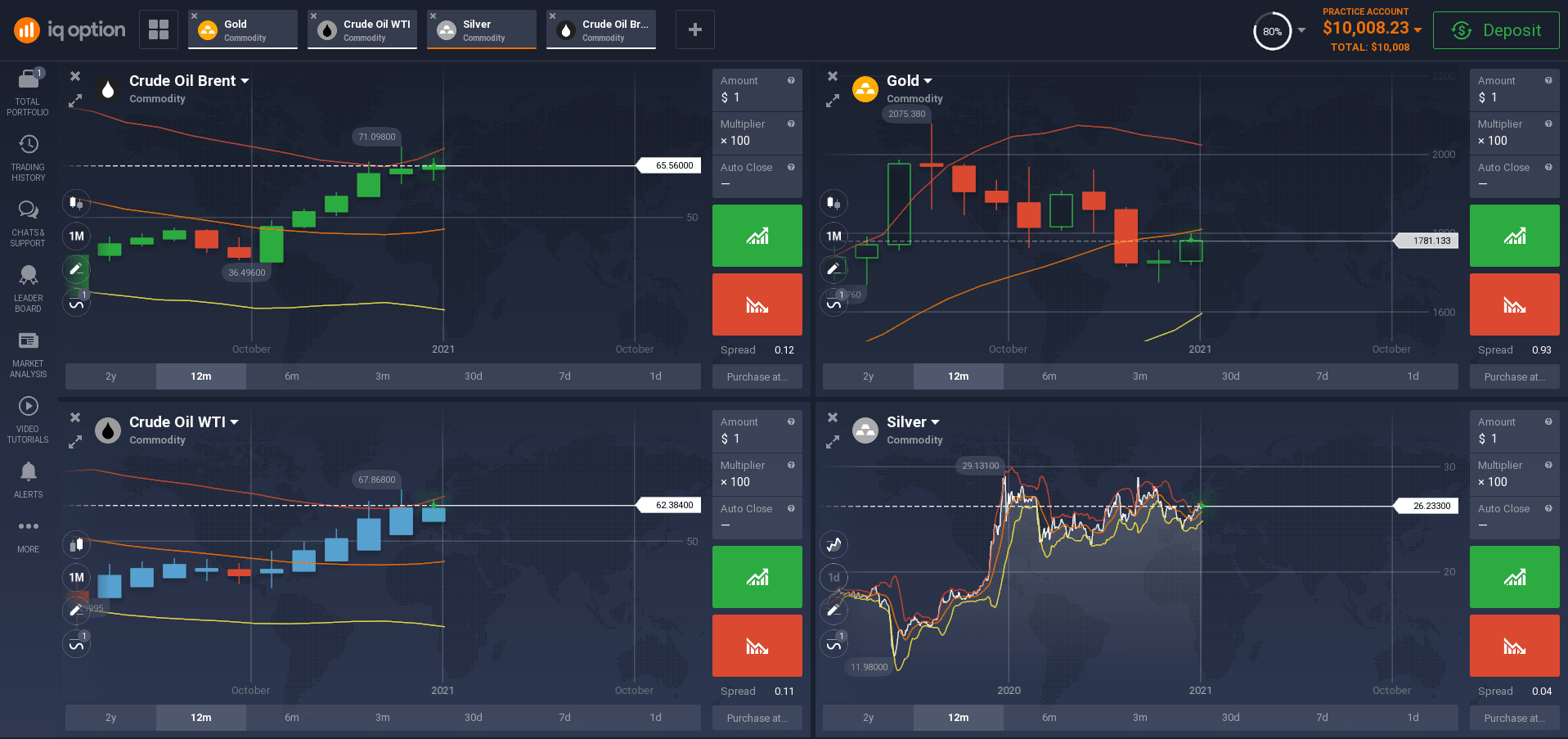

Platform for trading commodities

Commodity trading is one of the most popular ways to profit from the global exchange of commodities. Commodities are a great asset to diversify your portfolio and take advantage of changing macroeconomic trends. Precious metals as well as energy commodities, such as oil, are popular assets for trading on this exchange. You can trade commodities by means of CFDs.

Platform for ETF trading

Exchange-traded funds or ETFs are investment funds whose shares are traded on exchanges. ETFs have become widespread in recent decades.

In simple terms, an ETF is a 'basket of stocks', that is, an investment fund that tracks the value of an index and trades as a single security. A rise in the share price of an investment fund indicates its success and prospects. The funds themselves may be involved in buying shares and other marketable assets.

Cryptocurrency trading

Cryptocurrency trading is an income generating activity that involves a market participant playing with the differences in the exchange rate. Trading coins has much in common with the work at a standard (stock) exchange, where the main instruments are securities, futures, and other assets. The job of a market participant is to make money on price differences, i.e. to sell higher and buy cheaper. This is potentially a very profitable business. There are a lot of traders who are already very successful in this niche.

It is a fairly high volatility trading tool, and many traders prefer it. It is important to be attentive, know the effective strategies and follow some important recommendations.

A multi asset trading platform that allows market makers to diversify their portfolios offers significant opportunities for profit.

How to start using a multi asset trading platform in the Philippines?

Using a multi asset trading platform in Pakistan, opens up many advantages. We have looked at the basic features of the software. On top of everything else, it is worth adding that the platform is flexible, and you will be able to customize the charts, indicators for your strategy. The trading terminal was created by professionals, and you will feel comfortable using it for your trades. If you have any technical questions, you can always get an answer on the hotline. Just sign up, it's free, and it opens the world of investing and trading for you!

The technology of effective trading requires special knowledge of the player.

To get it, a beginner has to go through training, during which he will learn how to analyze the market and effectively manage the capital, as well as use technical analysis indicators and choose the type of management. In addition, he should form his own way of playing the basis of the initial strategy. Follow the video-training course on the broker's website and gain knowledge today!

Demo Account

It is now possible to take part in training sessions on your personal computer, and in particular on a demo account. There you will trade and try out strategies with virtual money. You will not risk anything, just try it!

A demo account will help you learn how to use a multi assets trading platform. This will allow you to decide which asset classes you would rather trade and which ones you would rather not. This will give you an idea of what benefits and risks you could derive from each asset class. Once you have gained an understanding, you can move to a real money account.

How to open a trading account

Once you have practiced on your demo account, you can make a payment to your account, so you can open a real trading account and start trading for real. You will earn profits on your trades, and they will be deposited into your account.

Keep learning and practicing, that's the key to success, good luck in trading!