Single stock trading strategy

What is stock trading? Simply put, stock trading involves buying and exchanging stocks of various companies in order to make money. Traders and investors usually study various companies listed in a particular stock market to determine if it is considered worthwhile to purchase shares of that particular company or if it is worth a delay. Traders then begin trading the stock they have purchased at the difference in price between the buy and sell price. It is the difference between the buy and sell price that allows investors to make good profits with a properly defined this one stock trading strategy.

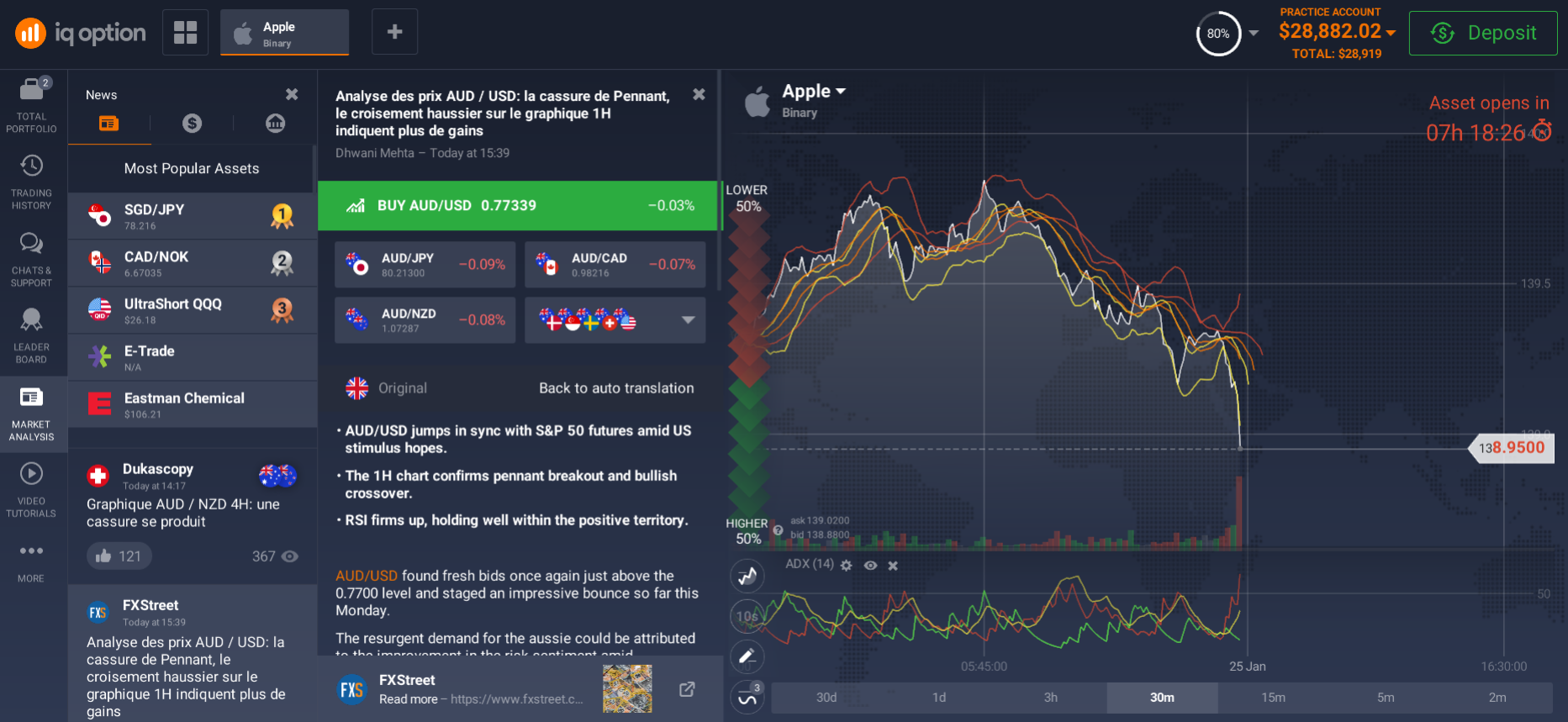

With the advent of the Internet, there are many new ways for investors to participate in what is known as digital stock trading. With this method, an investor can invest using their own computer without having to deal with brokers or financial institutions. This has been especially helpful for people who want to participate in digital stock trading but don't have time to visit the stock markets themselves. Some investors also use online stock trading software to conduct their investment activities. These programs do all the hard work for them and then generate reports and financial results through an online brokerage account.

However, given the influx of different software, traders need to know which one is best for investing? Well, you need to start by answering some questions. One is to think about how much you want to invest. Do you plan to use this method as a means of supplementing your primary income? Or do you want this tool to be your primary way of investing?

Second, you have to ask yourself: are you willing to spend some time analyzing stock trading trends and making trades? Some investors excel at algorithmic trading, while others struggle to even survive. The reason for this is that they spend too much time watching their charts and making trades, without devoting the rest of their time to studying the market and developing their own strategies. This is actually the opposite of what most retail investors do. They usually keep a close eye on stock prices. They rarely take the time to analyze data and develop their own trading strategies.

To start trading stocks, you must be willing to devote some time to learning stock analysis and developing your own trading strategy.

You can learn from your broker or find a good trading platform with reliable stock analysis software. However, if you plan to spend more than a few hours studying prices, you should definitely use a technical analysis program that you can find on a trading platform. This will allow you to study market data and make profitable trades when trading stocks.

How to trade stocks

Trading stocks can be easy or challenging at the same time. It all depends on how you plan to approach it. If you like to buy and sell stocks fairly often, you might consider trading long-term stocks. However, if you are looking for ways to accumulate a large amount of stock in a very short period of time, you may want to trade short-term stocks. If you don't know which method is right for you, you should learn about this stock trading strategy that is sure to work for you.

Perhaps the most popular and common method of stock trading these days is to use the tried and trusted method known as day trading. Day trading has been around since the beginning of the forex market and was originally developed as a means of increasing income late in the week. However, as more and more traders learn how to make money from forex trading, this stock trading strategy has become increasingly popular. This method has also become one of the fastest growing forms of trading in the forex world.

Day traders use a certain type of software on trading platforms to help them with this type of trading. The software will assist in placing trades for the benefit of the trader based on mathematical algorithms. This allows these traders to invest in different markets. However, this can be confusing to novice investors. For this reason, there are many online sources to help new traders learn about this stock trading strategy.

Most traders begin by investing in a variety of short- and long-term stocks, but day traders add a short-term strategy to their portfolio as well. The goal of this is to make a quick profit by short selling stocks they own. When a stock becomes unprofitable, the trader may decide to sell it at a profit. This is how day trading in stocks works.

However, the short-term aspect of this one stock trading strategy is not suitable for everyone. Some traders and investors may be better off holding on to a stock a little longer. Day traders are usually one of those people. Because they usually hold their stocks for days or weeks, it can be very difficult for them to get in and out of trades with this one strategy.

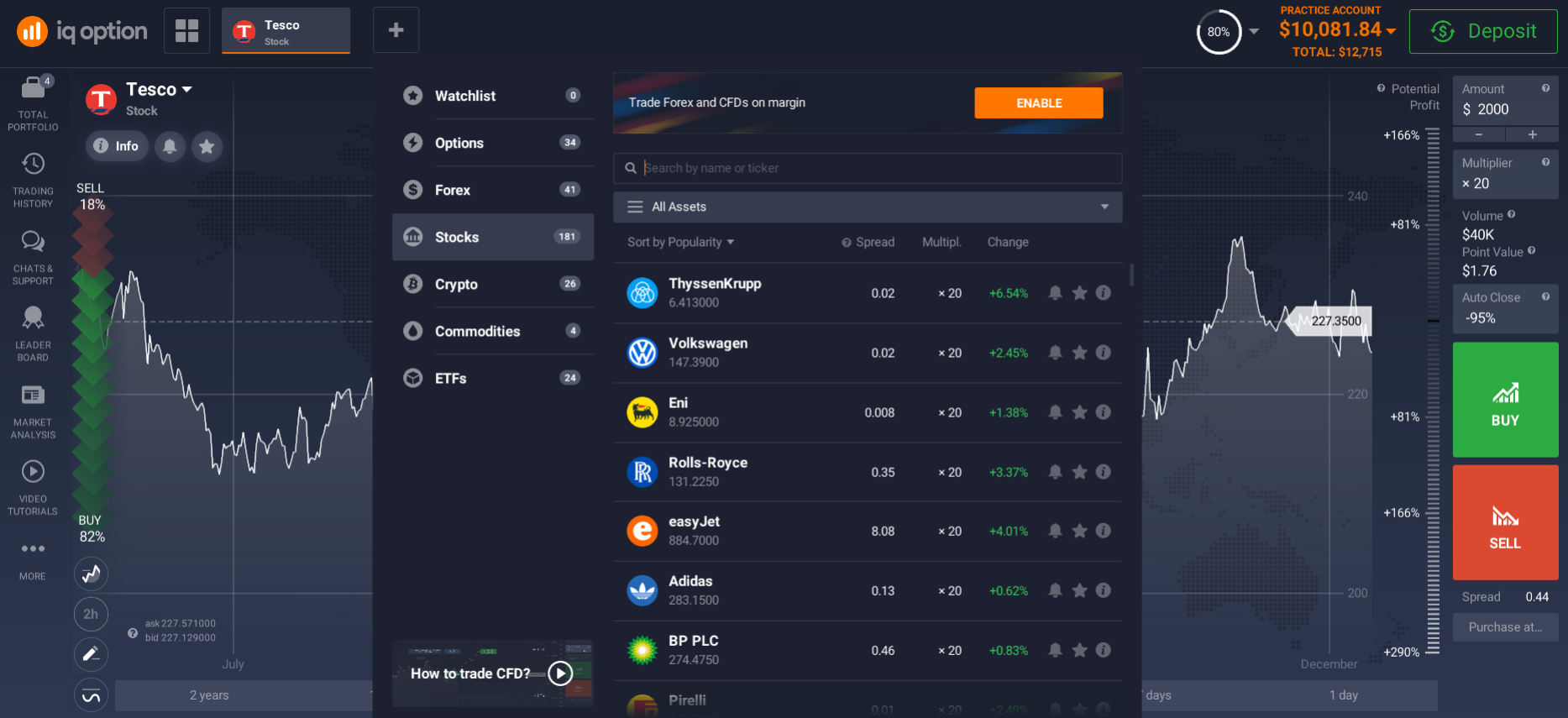

With an online trading platform and its software, an investor will be able to make more trades and have more control over their portfolio. In addition to being able to access real-time stock information, the trader will also be able to access charts and graphs of stock trends.

A trader can choose one or more trading accounts to trade stocks. These accounts can also be easily opened on the trading platform. One of the benefits of a trading account is that it allows you to track your investments and portfolios. Having multiple trading accounts can be beneficial in the long run. An investor who keeps their stocks in multiple accounts can use one single stock trading strategy as a guide when deciding how to invest money in the stock market.

How to choose a stock to trade

Choosing which stocks to trade is the most important part of learning to trade stocks. Without this important first step, it will be very difficult to become an active investor in the stock market and you may just become an observer of how things work and other traders make money trading stocks. It takes much more than just looking at the price to choose a stock to trade. Trading a stock involves many factors, including trend analysis, liquidity of a company's stock, dividend dates, and the overall liquidity of the stock in the stock market.

Trend analysis is one of the first things you should learn when you want to start trading stocks.

Trend analysis is a method of determining which direction the market is moving. It can provide valuable information to help you make trading decisions. The direction of a stock can indicate an increase or decrease, which makes trend analysis very important.

If you are just starting out in stock trading or are new to it, you should study trend analysis. Trend analysis can provide you with a lot of valuable information. You can learn a lot about a company's history with data from trend analysis. By doing this analysis, you can better understand which stocks you should be trading, which companies have growth potential, and which ones you should stay away from.

Dividends are a key component of any successful trading strategy.

Your choice of stocks to trade also depends on the dividend dates for each company. Dividends are payouts that occur regularly, such as the first month of the year. Understanding the payout dates for a company will help you determine whether dividends are reliable, which companies can pay their dividends on time, and which companies may not pay their dividends on time.

Volatility is another important factor in deciding which stock to trade.

The more volatile a stock is, the more volatile it can move quickly in response to small changes in the market. When a stock is less volatile, it may take longer to identify an uptrend and may remain steady if the trend continues. Higher volatility may mean the stock is more profitable.

You may wonder what type of charts to look for when learning how to pick stocks to trade. Highlighted stocks usually have high volume. They can also be found in different time frames. Volume patterns are similar to oscillators. These patterns show the general direction of a stock through its price over time intervals.

A good rule of thumb is to consider a stock's current market capitalization. If a stock's market capitalization exceeds $10 million, it is considered a high volatility stock. The best time to buy a stock with this structure is when the market is consolidating, such as after a profit announcement or bad weather. However, if you don't know the market well, it is wise to wait a few months before trading a stock with this structure.

Choosing which stocks to trade depends largely on your experience and knowledge of the market.

It's best to stick to trading low-trending companies and blue-chip stocks. They are more likely to maintain a good reputation for a long time. Choosing a cohesive management team is also a great idea. A management team that has a lot of shareholders will usually do its best to protect shareholders.

Another thing to consider is how long the company has been in business. Some older companies are in great shape because of their long-term prospects and strong financial performance. However, you will find that new companies are much more volatile and can rise and fall in value quickly. This may not seem important at first, but if you are new to trading, you should avoid investing in such stocks.

Choosing which stocks to trade also depends on whether or not you pay dividends. Dividends are income to which you are entitled from owning the stock. A company is not required to pay a dividend at all, but it is wise to check what their policy is. Although most companies don't automatically pay dividends, you can often request a payment based on an annual dividend schedule. If the company is not public, you won't be able to get information about their dividend payment history.

When you are ready to invest in stocks, it is important to make the best decision. There should be no confusion about how to choose a stock to trade. By taking some time to think about the points mentioned, you will be better informed when you start trading using a single stock trading strategy.

After all, the stock market is one of the most competitive places to invest money in your portfolio today.

How to trade one stock - single stock trading strategy

So, you are curious about the individual stock trading strategy. Many traders have been using this strategy for years to accumulate their own wealth. It is important to understand how and why it works and how you can use it to your advantage. To begin with, it is important to understand that stock trading is very similar to forex trading in the sense that there are cycles. The stock market experiences ups and downs, bullish and bearish periods. These peaks and declines are due to the fact that stocks rise and fall depending on a number of factors.

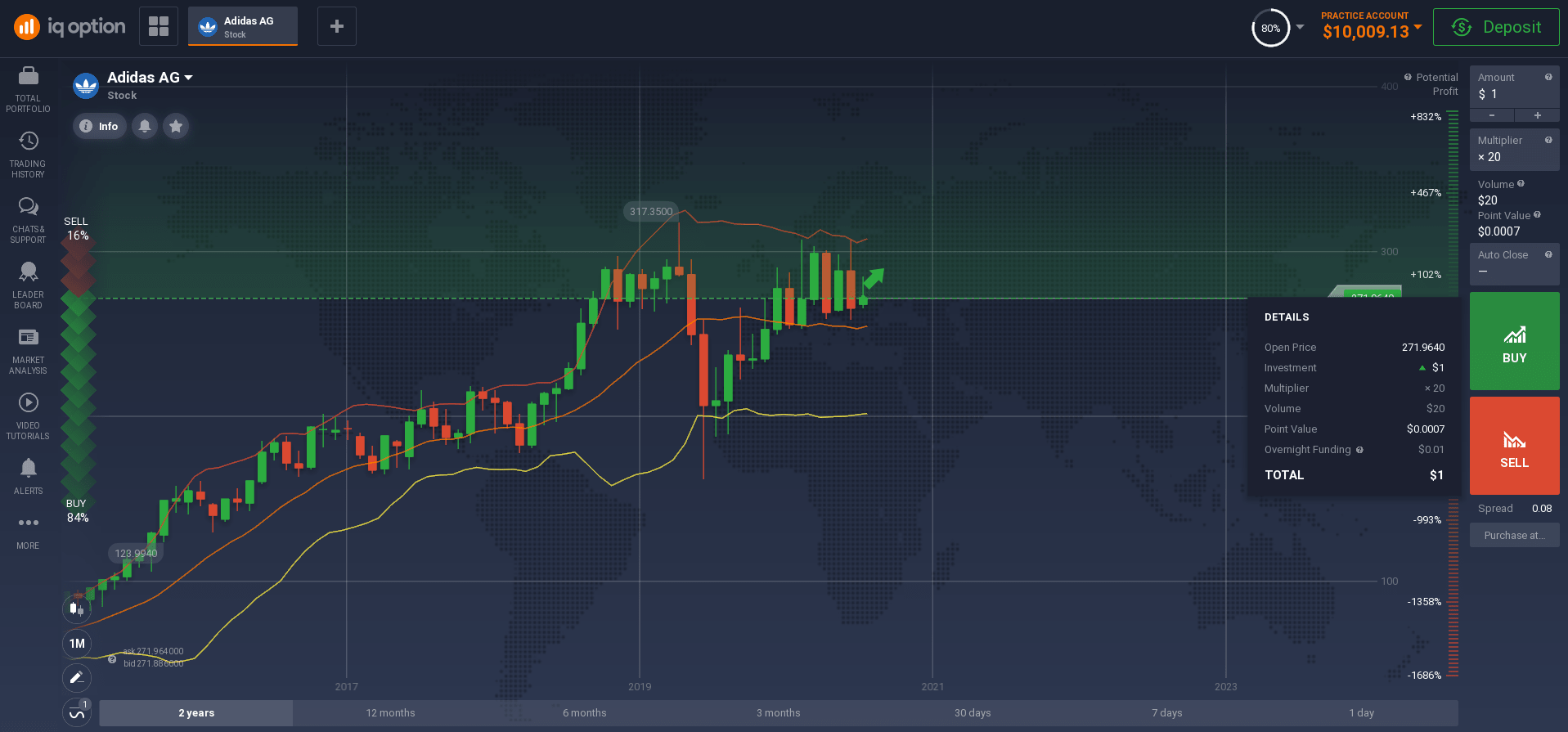

To determine the direction of the trend, you need to look at the history of the stock and how it has performed compared to some popular technical analysis tools such as charts, graphs and lines. This information can be obtained from a variety of sources, including newspapers, television, radio and the all-knowing Internet. When you start trading stocks, you'll want to start with a pretty solid foundation in technical analysis so you don't lose all your money in the first month. There is no point in taking a chance on something you know nothing or very little about, and hoping it will work at all. If you buy a stock blindly, you might get lucky and make a lot of money, but you also risk losing everything.

To determine which direction a stock is headed, you need to look at a number of indicators, including P/E ratio, return on equity and earnings per share (EPS). These indicators can help you determine the direction of the trend and how best to determine buy and sell points. Technical analysis is based on the theory that traders trade stocks by relying on charts, indicators and other technical analysis tools. Market makers and volume makers help eliminate margin requirements by providing buyers with a constant supply of high-quality stock at wholesale prices. You should consider all of the above when determining which stock market game you want to play and which stock trading strategy you choose.

Single stock trading is a strategy of trading one stock in small amounts. When you play with small numbers, it is easier to be among the winners. Also, don't get overly emotional about investing, or you could lose money too. If you have a desire to make a lot of money, you will definitely want to invest a lot of money, but do it wisely.

How to Trade One Stock - The strategy of trading one stock is to use technical analysis tools to determine the direction of price movement. The reason this is important is because you should be able to determine when a price movement is due to fundamental analysis and when it is due to technical analysis. If you understand the difference between the two, you will know exactly when to buy or sell a stock.

Fundamental analysis is what most investors focus on. It is the analysis of trends in companies' financial statements. You first find information about a company's statements for the past few years, and only then do you make decisions about buying or selling its stock based on what the company's fundamentals will look like in the next few years. Technical analysis, on the other hand, looks for basic price and volume movement patterns. The most common models are moving averages.

So, if you're wondering how to trade a single stock, a single stock trading strategy is to start trading it when you feel safe and can afford to take a risk!

Unified Stock Trading Strategy for Pakistan

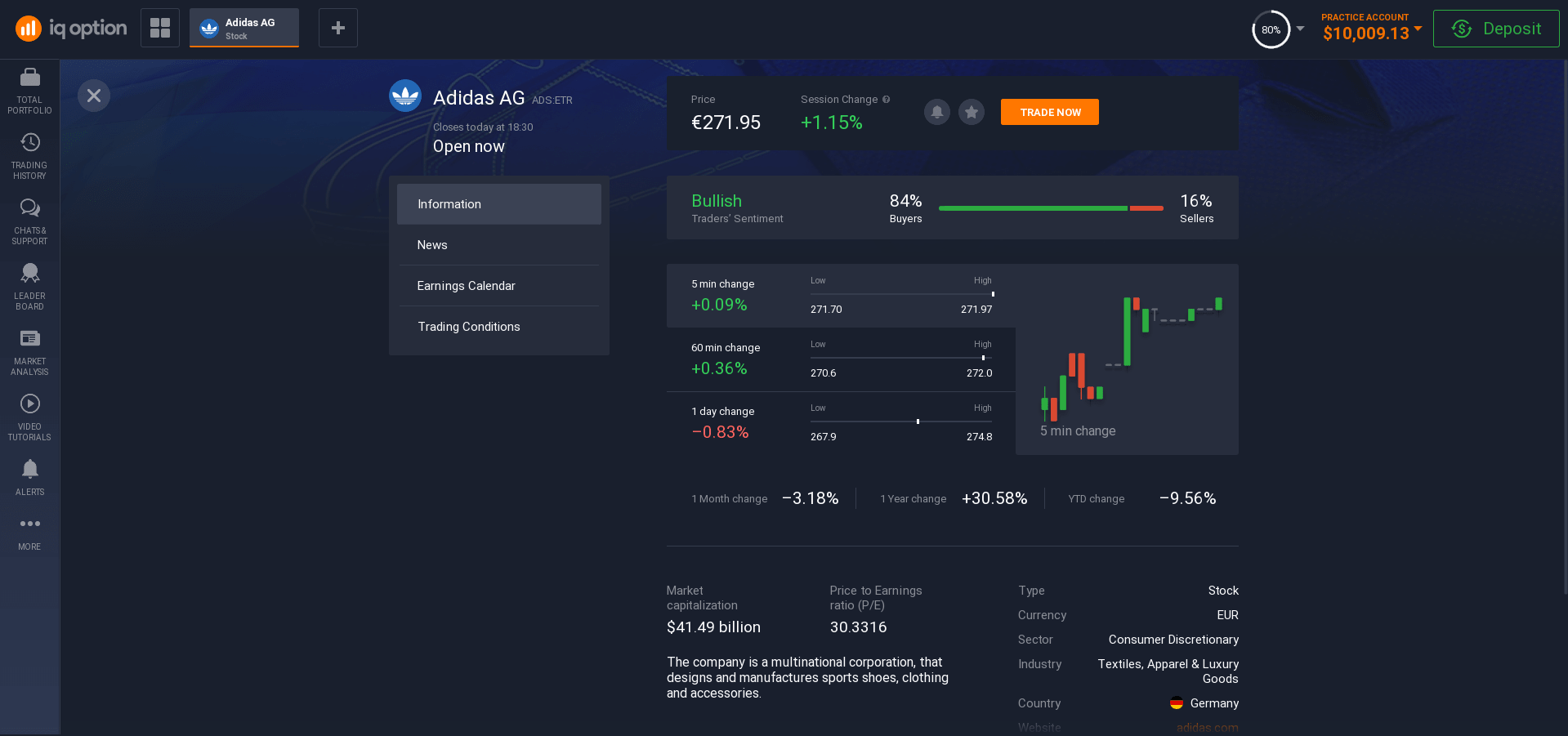

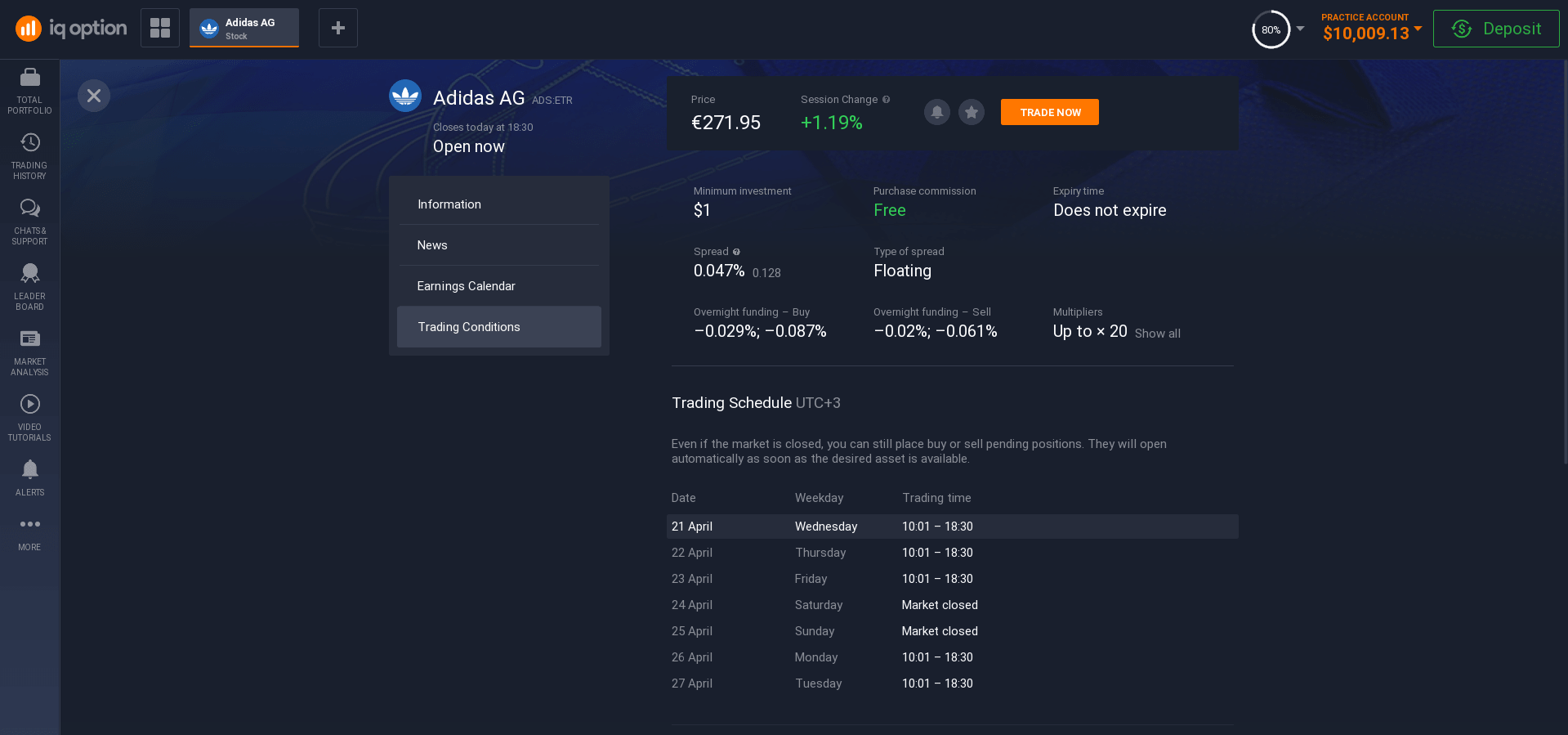

Experienced traders will agree that one of the most important things in stock trading is choosing a single stock trading strategy. One option to find that single stock trading strategy is to use a trading platform and its software. Using a trading platform for an experienced and qualified trader will be a great tool to help him find the right path for his investments. That being said, for the newcomer to stock market trading, the platform will be a great option for learning and practice.

Most reputable trading platforms have the option of providing a demo trading account. This demo account is opened on the platform with no additional financial costs on the part of the future trader - the money there is virtual. Obviously, you will not be able to make money on this account. But a demo account can give a newcomer practice or help an experienced trader refine his skills before investing in a real money account. A demo account can also help you better understand the trading platform and decide which of the various financial products on the market would be best suited to a trader. The amount invested will depend on the investor's risk tolerance as well as their ability to learn quickly.

Trading platforms have their own training materials. In addition, traders on the platform get access to the stock markets online and will be able to trade accordingly as soon as they open a real trading account. Here you can also explore possible stock trading strategies and choose your ideal investment option. There are various benefits that traders can get from having a demo trading account. This is not only the opportunity to use the trading platform around the clock, but also the opportunity to learn to understand the stock market and predict its behavior in the future.

Another advantage traders get from having access to a real trading platform is that they can start trading stocks right away. Traders will be able to identify the strengths of different stocks and be able to decide which option they would be better off investing in. In this way, traders will be able to increase their earning potential and will be able to earn from the trading platform they choose.

In order to try out a single stock trading strategy for Pakistan, a trader simply needs to register on the trading platform and create an account. By determining which trading style and strategy is most suitable, one can easily start making profits from stock trading. By trying trading with a demo account, you will gain more confidence in trading stocks using real money in your trading account.

Be sure to learn the best way to use a single stock trading strategy to maximize your profits when trading the stock markets. That way you can take care of your investments and maintain the proper balance between your savings and investment projects.

When you start managing your finances well, you can enjoy all the benefits of stock trading - making profits!