Online futures trading platform in Pakistan

Nowadays, world progress has touched domestic spheres of life and investment activities and Internet technology. Investing via the Internet is becoming more and more common lately. We only need to choose an online trading platform where we can invest capital in the stock market. A wide range of people from Pakistan, both professionals and ordinary residents, can support and get their return on investment. This whole process is made more accessible through online platforms. These platforms provide the opportunity to study the issues on investment activities, to learn how to invest their funds correctly and competently, allow you to perform operations of buying, selling securities while making a profit.

How to start investing online on a platform, which application to choose in Pakistan, the functions of the program, online platform for trading futures in Pakistan - we will consider all this in more detail.

What is an online trading platform?

An investment platform is a special computer program developed by a brokerage company that allows financial transactions in the stock market to the depositor. Online trading platforms are available for use on cell phones as well as on tablets and computers, which makes it convenient to perform stock market operations at any time and in any place. The trading platform is available round the clock.

Special attention should be paid to choosing an online platform, because that is where investment will take place. It should be reliable and feature-rich.

Also, good reviews influence the choice of a quality platform. For novice investors, the availability of tutorials, videos, as well as tests and the ability to open a demo account plays a big role in choosing a platform.

There are some criteria that will help determine the choice of an online platform for trading futures. Among them, we will highlight:

- convenience and ease of use of the platform;

- clear registration form;

- the availability of training on the platform;

- the ability to practice on a virtual demo account;

- minimum deposit and withdrawal amounts;

- easy-to-use tools for market analysis;

- online support, groups and chats.

Futures as a financial instrument

A "futures" is a contract to buy or sell an underlying asset (shares, bonds, currencies, commodities) on a certain date in the future at the current market price. Trading futures does not seem to be a simple way to invest, but it is interesting with prospects for the future.

Futures satisfy both buyers and sellers.

What are the different types of futures contracts?

- Deliverable. It is clear from the name, that it is related to the delivery of the underlying asset. The buyer and the seller have agreed to make a deal at the current price.

- Settlement futures. On such futures, delivery does not occur. When the contract expires, the parties to the contract recalculate profits and losses, accrue and write off cash.

Collateral (CS)

Futures trading is carried out with obligatory securing of the transaction. This is usually a variable deposit of 2-10% of the value of the futures asset.

The collateral is an insurance required by the stock exchange. Both parties to the contract provide the collateral.

The exchange blocks this amount on the traders' account as a kind of collateral securing the transaction. Moreover, the seller's blocked amount increases if the futures price goes up, and decreases if the futures price goes down. The opposite is true for the buyer - his collateral increases if the price decreases. Upon the expiration of the contract the final settlement is made inclusive of the security amount.

It turns out that when the contract is concluded there is no payment, the two parties conclude the transaction, and the exchange blocks the financial means on their accounts until the execution of this transaction. If the party keeps the futures contract until the closing date, then he will have to execute the contract - to deliver the asset, transfer the money or make the final recalculation.

If one of the parties refuses to fulfill the conditions, the exchange will have to fulfill his obligations independently. In this case it will keep a part of the security, and the violator will face property claims. Such a situation is possible only with futures, in which real delivery of assets is obligatory. In case of cash futures, a refusal is impossible in principle, and possible losses of the exchange will be covered by a collateral.

It is thanks to the guarantee coverage that investors often choose to trade in futures, using it, in fact, as a "leverage", because in order to conclude the transaction one needs to have only up to 10% of the value of the underlying asset.

Trading strategies

Trading in futures is attractive because of the multiplicity of strategies and liquidity.

In order for this trading to bring high returns and minimum risks it is important to choose the right strategy. Because of high liquidity, low commissions (lower than in the stock market), and a variety of instruments for transactions in the financial exchanges all over the world, futures trading operations are profitable and lucrative and allow making good money.

Futures contracts are especially valuable because they give you a chance to insure yourself against unforeseen losses (in other words, the possibility to hedge the risks) and to earn from speculations.

So, the following strategies for trading in futures can be distinguished:

- Arbitrage operations. The essence of these strategies is that the market participants gain profit from making transactions on the spread. The spread is the difference between the best buy and sell price of the asset at the moment. The only source of profit on exchanges is the price difference of various assets (currency, stocks, etc.). Due to the constant change in price, upward or downward movement of the object of trade, investors can make serious money. For this purpose it is necessary to use various statistical tools for accurate analysis and prediction.

- Exchange speculation. Futures are a popular speculator's instrument due to high liquidity and high leverage. A trader makes a profit on the difference between buy and sale price.

- Risk Hedging. In simple words - it is risk insurance. To minimize losses at unfavorable course of events, traders hedge their investment portfolios at the financial market.

Any professional investor will always seek to protect their assets when there are significant fluctuations on the currency market. For example, you would like to make a profit in dollars in a month and you do not want to risk it if the currency rate suddenly changes. So you use futures.

Where do I start on an online futures trading platform in Pakistan?

To get started with futures trading you need to choose an online broker. It offers a trading platform for our investment activities. This platform will provide access to all the transactions in the stock market, so it is important that the program is convenient and comfortable to trade.

When choosing a broker, make sure it has a brokerage license. Also, pay attention to the reviews of experienced traders about the broker's reputation.

Registration form

It only takes a couple of minutes to register on an online futures trading platform. Find the website of the brokerage company, go to it and see the "registration" button. Then enter your username - your surname and first name - and your email. E-mail will need to be confirmed by clicking on the automatic link that comes to your email, or with a code that comes to your cell phone. These data will be enough to perform training operations and also just to get acquainted with the software. In the future, the platform may ask for more data to verify your identity, such as a copy of your passport.

So, having done all the above, you become a user of an online futures trading platform in Pakistan.

Access to Demo Account

After registering, you don't have to immediately start opening a real account to make real transactions. We recommend opening a Demo account. Demo account is a free training account, which allows you to learn the stock exchange, test yourself in making dummy transactions, make investments without fear of losing all your money. There is no risk of losing your investment, because a demo account is an exact copy of a real account, but virtual. You can not turn down such a good opportunity to learn. Of course, at the end of operations it is impossible to withdraw money from such an account.

Deposit and Withdrawal

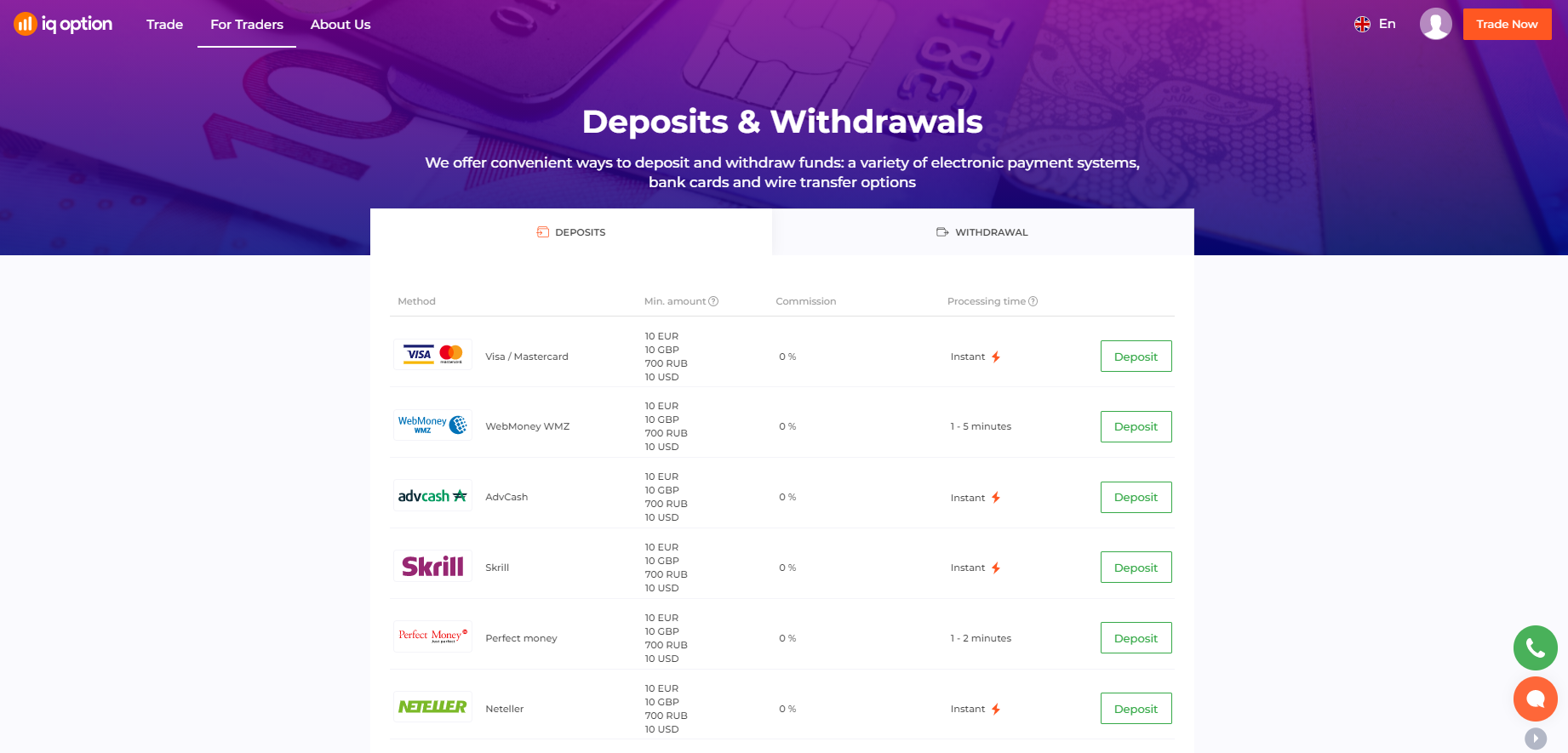

To make real deals you have to fund the real account. To activate the account one just needs to deposit the necessary sum of money. The minimum starting capital is small, only a few dollars. To deposit the account, click the "Deposit" button. After that, you will see options for making a deposit. This can be a bank card or online payment systems such as WebMoney, Perfect money, etc. You can withdraw money using the same systems that are used to recharge your account. All these easy steps on the platform are available to almost everyone who wants to become an investor and try himself in this niche.

Successful investing in the stock market

Successful investing is all about understanding the basic processes and laws of the stock market, it requires a constant deepening of knowledge and learning. Learn how to analyze the market and predict an increase or decrease in the value of assets. This will allow you to invest your money successfully, make a profit and grow professionally as a trader.

Investing is not an easy occupation, it is always risky, which brings financial losses if you are illiterate. Therefore, study the stock market thoroughly in order to understand it better. There is a lot of information, training programs and lessons these days. You can practice on a demo account, hone your skills in investing.

A lot of knowledge, constant training is the key to success in trading.