Professional trading platform in Pakistan

What is a professional trading platform?

Gone are the days when only a select few people with a large initial capital could trade on the stock exchange. Thanks to the spread of the internet, it is now possible to introduce exchange trading platforms to the masses. The emergence of such trading platforms of a new type significantly facilitated the process of investing. Investors and traders now have the opportunity to analyse the market independently and to place trade orders directly with the exchange via terminals (special software for computers or smartphones) provided by a broker.

There are many platforms available for users in Pakistan. In this post, we will highlight some of the most essential criteria and factors that will help you with choosing the best one. Electronic trading platforms are developed by experts in financial markets, technical analysis and other trading skills. Investors can trade on the platform without having any particular knowledge of trading systems.

The robust and modern trading platform makes it easy to navigate, especially for beginners, and the use of icons and user-friendly navigation features make it extremely easy for users to get to grips with the system.

In addition, a reputable trading platform has a very attractive visual interface which is easy to read and creates no problems with its use. In addition to these attributes, it should also be flexible and allow for easy changing of parameters and settings. The platform allows users to manage their capital easily. Quite often, people do not have time to learn everything about trading. They prefer to invest a small amount of money and earn on it rather than learn all the basics of trading.

Every professional trading platform has money management features which help investors avoid losing large sums of money. In fact, most of these platforms offer money management tools that ensure a steady flow of money in and out of the trading rooms.

By enabling trade account monitoring, investors and traders will be able to receive a detailed report of all executed trades. All trade statistics will be automatically collected and presented in clear charts and graphs. Growth dynamics, trading history, distribution of trading instruments, statistics on trading activity and deposit load are only few indicators which can be watched after monitoring of trading account is connected. Online trading platforms provide almost instant execution of trade orders and real-time monitoring of open positions and financial results, tracking of prices, trade volumes and other information, as well as the ability to conduct technical analysis in real time.

The most important feature of electronic trading platforms is the ability to make information available to traders and investors. With an interactive platform, investors and traders can easily find information about assets of interest to them. Investors and traders can access technical indicators and news about specific stocks and currencies, etc.

The software is also available in a mobile-friendly format. It also has a user-friendly graphical user interface which makes it easy to use wherever you are.

Above all, it allows traders to conduct their own trades at any time and from anywhere. With the trading platform mobile app, investors can even receive messages and alerts directly from the trading area. All this, has increased their convenience and profits. Indeed, the trading platform provides traders and investors with up-to-date information on market conditions, which makes it easier for them to make investments and transactions.

With interactive features, traders and investors can also find chat rooms where they will interact with other traders in the trading rooms. This feature helps build trust between traders and investors. Thus, it can be concluded that a professional trading platform should be set up according to the specific needs of the client. It should include all the features required for trading. A trader strives to find a platform that not only has the security and the right assets, but also good rates and quality support. In addition to this, it is worth looking at various resources, options, tutorials and technical indicators. Online reviews and electronic trading platform reviews are the most effective ways to learn more about it. In addition to universal platforms, there are also specifically tailored platforms for specific markets.

Platform for online stock trading

When choosing such a platform in Pakistan, the main things to consider are what markets it allows trading in, what fees and commissions are charged and what payment methods are used. You also have to decide whether you want to make money on stocks quickly or over the long term. In the former case, you buy shares for a short period, such as a few days or weeks.

By trading CFDs on shares (one of the most convenient instruments) you can profit from price changes in the shares of major world companies without owning the shares themselves.

CFDs allow you to trade with a small deposit and a huge leverage, opening and closing transactions instantly. In the second case, you buy shares for more than a year and then decide whether to sell them based on your analysis. Long-term investors compile a stock portfolio and hold it for years, earning income both from the appreciation of the stock price and from dividend payments.

Depending on which category of investor you belong to, you will use different methods of analysis. For example, short-term investors work only with technical analysis, studying charts of market price movements, looking for patterns, and based on these patterns, determine the moment to buy or sell stocks. Long-term investors, on the other hand, do not only work with the technical parameters of the assets, but also with the fundamentals of fundamental analysis.

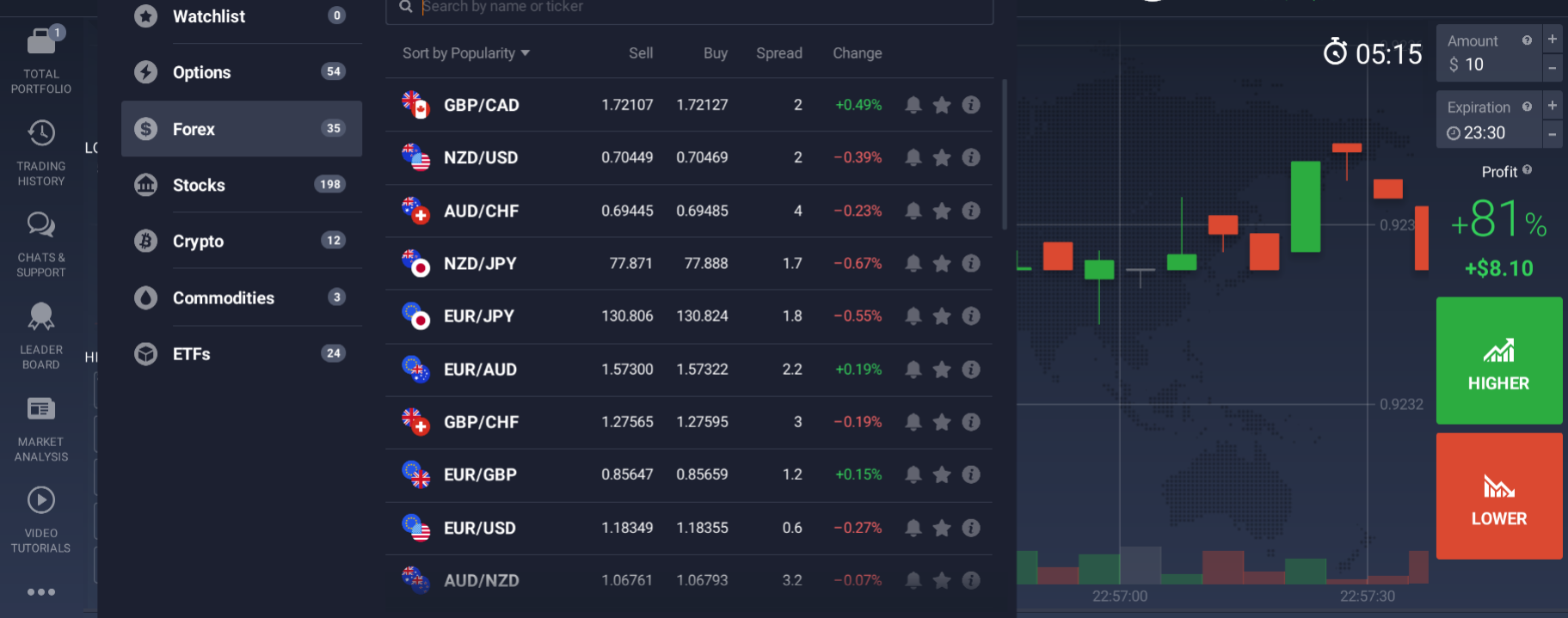

A platform for online forex trading

This platform enables traders to trade currency pairs. Currency pairs are the main object of trading on a financial trading platform. The quotation of a currency pair is a ratio of economies or currency rates of two countries.

The main advantages of currency trading are the favourable terms and low entry costs. A very small initial capital is sufficient.

Consider the most popular instrument - EUR / USD (EUR and USD). Here, the base currency is the euro and the quoted currency is the US dollar. Consequently, you will buy and sell Euros for USD. This means that if the base currency becomes more expensive, the quoted currency becomes cheaper and vice versa.

The idea is to try to predict how the exchange rate of the quoted currency will change in relation to the base currency. Assuming the rate of the quoted currency goes up, you can open a "buy" position on it. But if you think it will fall, you can "sell" it. You can increase your profits by using the economic calendar and applying technical and fundamental analysis.

Be aware that exchange rates fluctuate depending on economic and political factors, not only in the world, but also in your own country. Trading hours on exchanges differ. By the time exchanges in one part of the world close, other exchanges have just begun trading. As a result, trading takes place around the clock, 5 days a week. Quotes are usually not available on weekends.

Platform for online options trading

An option is a stock market derivative that is based on some underlying asset. That is, there can't just be an option, but there can be an option on a particular stock, on an index, or for example any commodity. The main advantage of options is that the instrument works with volatility rather than price. This type of contracts allows building highly flexible trading strategies. They are used as for making profit from speculative operations and for hedging risks.

By buying an option, you have the right, not the obligation, to deal in the underlying asset at the agreed price and over an agreed period. But before doing so, you as the buyer pay the seller a fixed amount. You may not execute the contract if the price of the underlying asset changes to your disadvantage.

Call option - an agreement created for the purchase of any underlying asset.

Put option - an agreement created for the sale of a commodity, securities, etc.

So buying a Call option is profitable when the market goes up, and you can buy the asset cheaper than its current price. So buying a Put option is profitable when the market is falling, and you can sell the asset for more than its current price.

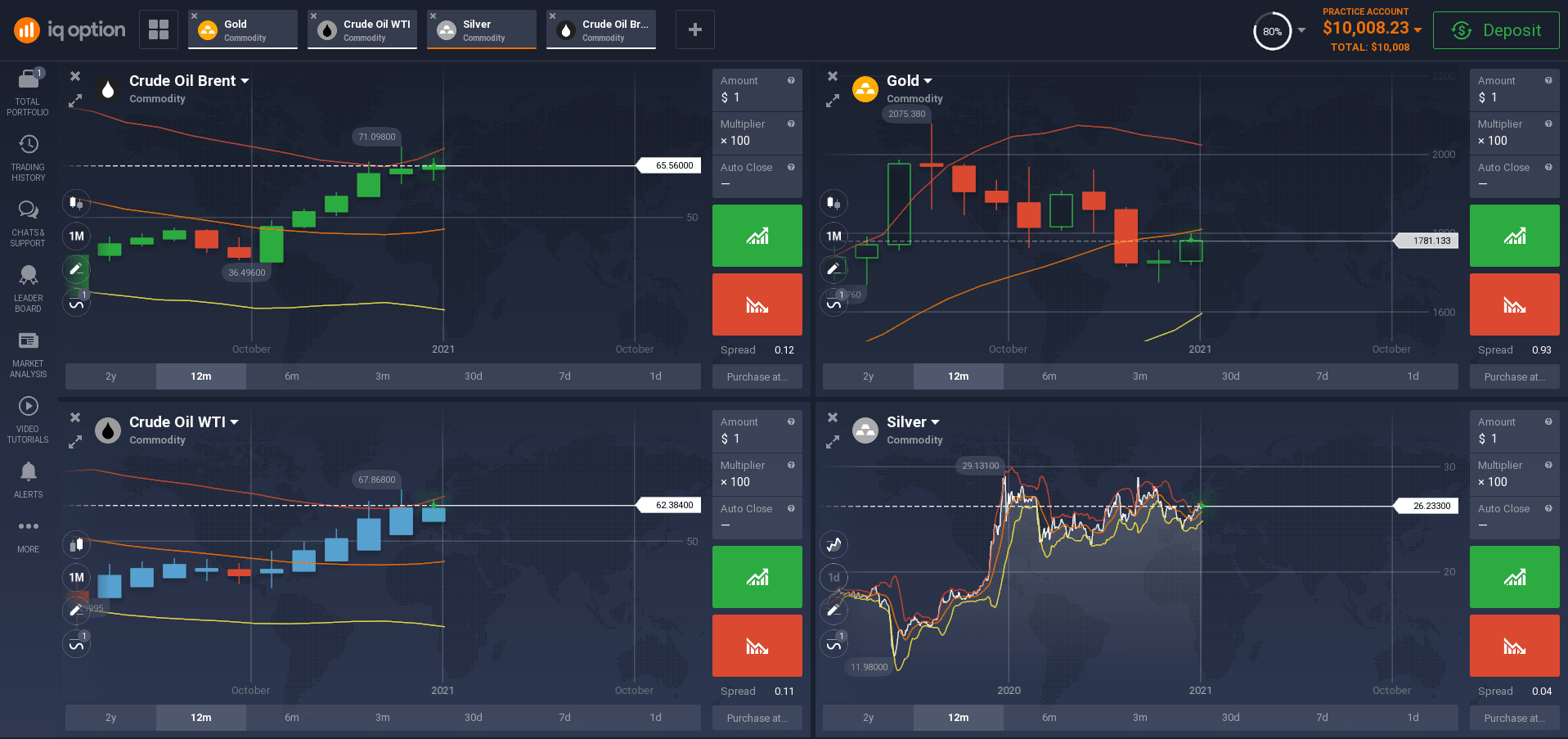

Platform for online commodity trading

The speculative trading of commodities provides another opportunity for investors to make money. These commodities include sugar, coffee, cotton, grain, oil, gas, gold, copper and many more. For many traders and investors, trading commodities is the preferred way to protect funds and reduce the overall risk to their portfolios.

What are the popular ways to trade commodities?

The Contract for Difference (CFD) is a financial instrument that allows you to trade any of the commodities offered without actually buying them, earning only on the price difference. The ease of entering and exiting the position is just one of the reasons why trading CFDs in commodities is so popular. The use of leverage can lead to higher profits, but please be careful, because the risks can increase. In addition, commodity CFDs offer the potential to profit from both rising and falling markets, by opening long or short positions.

Another option for trading commodities is to buy shares in companies that are directly related to a particular commodity (oil refineries or mining companies, companies producing special chemicals and gases, wood processing companies and many others).

The next option is a commodity ETF (Exchange Traded Funds). Such funds consist of stocks of companies that are linked to a commodity, or they consist of futures and derivative contracts to track the price of the underlying commodity or, in some cases, indices. An investor buying a commodity ETF usually does not own the physical asset, but instead owns a set of contracts backed by the commodity.

An online trading platform for ETFs

An exchange-traded fund (ETF) is a kind of basket of securities that are traded on an exchange, like stocks. By purchasing a share in a fund, you become the owner of a small portion of that basket. ETF share prices fluctuate throughout the day as ETFs are bought and sold. These funds often track well-known indices, such as the S&P 500 or FTSE 250. Some focus on specific sectors, markets, asset classes or regions of the world, etc.

The advantage of ETFs is their liquidity and very low fees. Because of their size, these funds offer a high level of diversification.

The portfolio composition of the fund is available to the security holders at any time and changes in the price of a purchased asset is immediately visible as they occur online along with the price of the entire portfolio of the fund. The structure of exchange-traded funds allows traders and investors to take short positions and use leverage.

Online cryptocurrency trading

A cryptocurrency trading platform allows an investor to participate in trading and exchanging digital coins. There are currently thousands of cryptocurrencies on this market. They were launched after the success of Bitcoin and are now widely known as 'altcoins'. An investor can approach cryptocurrency trading in two ways. The first is to buy the digital currency in its original form. In this case, a crypto portfolio of several types of coins is formed in the expectation of selling it at a higher price after some time.

The second option is to trade with CFD, which allows you to open a long or short position on the cryptocurrency of an investor's choice without taking possession of it. Technical analysis is a reliable assistant in cryptocurrency trading, which is very difficult to do without. With the help of indicators, crypto traders can find optimal entry points into the market and receive signals to buy and sell cryptocurrencies with a certain accuracy.

Online index trading

Indices are financial instruments reflecting the aggregate value of large companies in a particular market or industry. Changes in the value of an index reflect fluctuations in the value of the stocks of the companies included in the index. For example, the STOXX50 index reflects the health of the eurozone economy. The DAX30 index, Germany's most important stock market index, comprises the 30 largest companies listed in Germany, the NASDAQ100 US stock market index comprises the 100 largest companies by market capitalization. Trading indices is considered safer than trading individual stocks, because the individual companies constituting the index value cannot cause abrupt changes in the overall index value. By investing in indices, you automatically diversify, as your investments represent dozens or even hundreds of stocks.

How to start using a professional trading platform in Pakistan?

So, you have already understood from our article that one of the main components of successful trading in the stock market is trading platforms.

Consequently, you need to choose electronic platforms carefully so that they suit your trading style, objectives and market.

If you have made your choice and are ready to use a professional trading platform in Pakistan, then you will need to go through the process of opening an account, verifying your identity, making a deposit and, of course, placing a trade.

Registration

This is a simple and straightforward procedure, and you should not have any difficulty in completing it in a matter of minutes.

You will have to enter some details about yourself and your email address and password. After completing and submitting the form, you will receive an email to activate your account.

Demo account

After registering, almost all brokers allow potential and existing clients to open a free demo account with an unlimited time limit. This account will have a virtual amount available for test transactions, which you can extend as many times as you need.

Demo account guarantees zero client losses and an opportunity to learn and understand the algorithm of the system.

Only after you have played on the exchange and earned some money, can you move on to the next stage - real trading.

Real account

To open a trading account, you will need to make a deposit. Only after that, you will be able to start making real trades. Most platforms set a small amount of a few dollars. On the payment page, you will be able to fund your account using the payment systems listed on the platform. Through these same payment systems, you can withdraw your funds as and when required.

Inquire about fees and commissions before making a deposit, and then choose the payment method, currency type and only then enter the required amount.

You should know that the best brokerage platforms offer free training, a free demo account trial and low initial investment amounts. Technical support on such trading platforms is available around the clock.