Buy Starbucks shares in Pakistan

Starbucks Corporation is the largest coffee chain in the United States. The history of the company begins in 1971, and today its coffee houses can be found in many countries of the world. The corporation's shares are of interest to large investors, and will also be attractive to private investors in terms of profitable investment or speculative income.

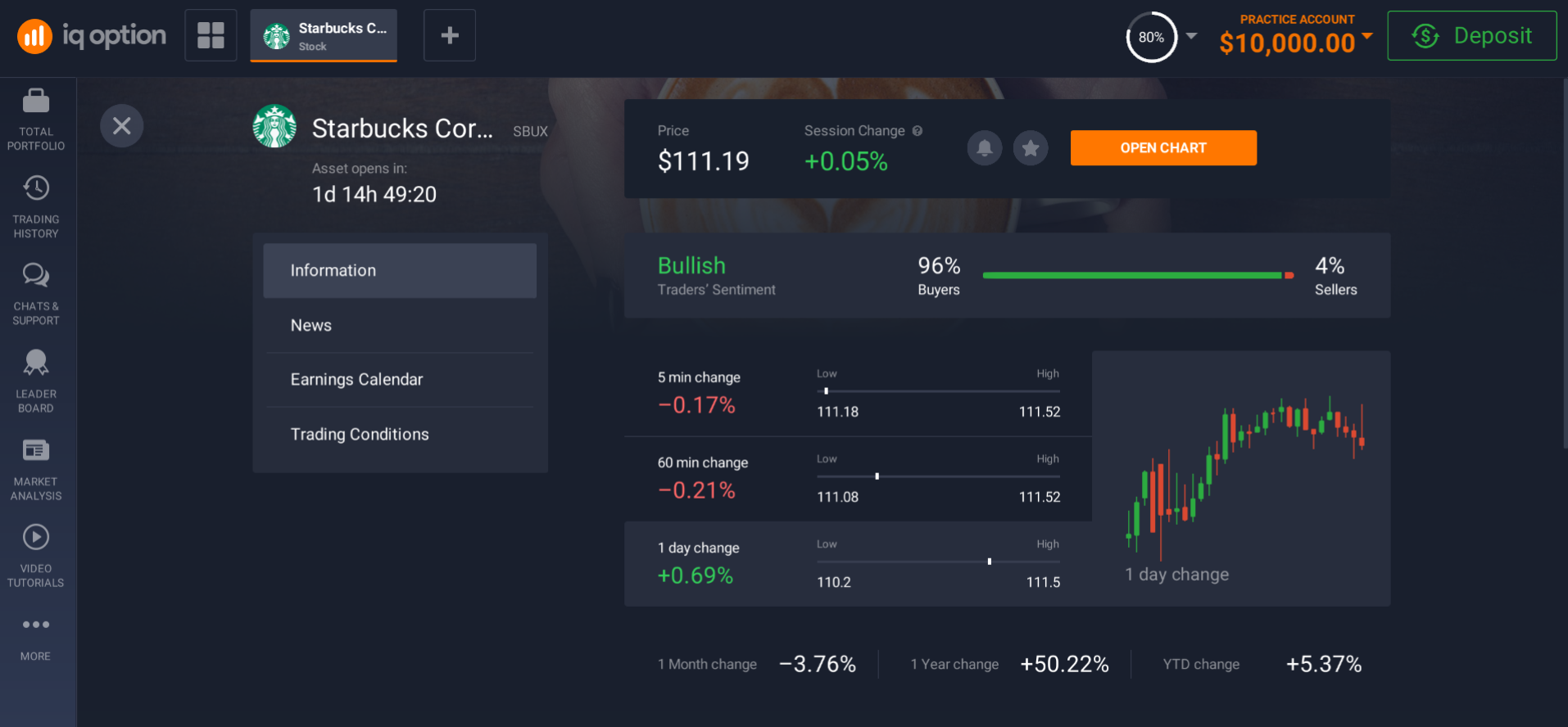

The trend in the company's values is upward. The recession periods were the 2008-2009 crisis and the 2020 crisis: stocks fell in the first quarter amid the outbreak of the coronavirus pandemic. But after all the crises, Starbucks stock prices not only recovered from losses, but also reached new highs. While the coronavirus pandemic is not over yet, 2020 is already marked by renewed all-time highs. After falling below $ 50 a share in March, Starbucks' stock surpassed $ 102.06 a share in December.

At the time of this review, the company's share price is $ 121.43.

The topic of the article is investing in Starbucks stocks in Pakistan.

Choosing a broker

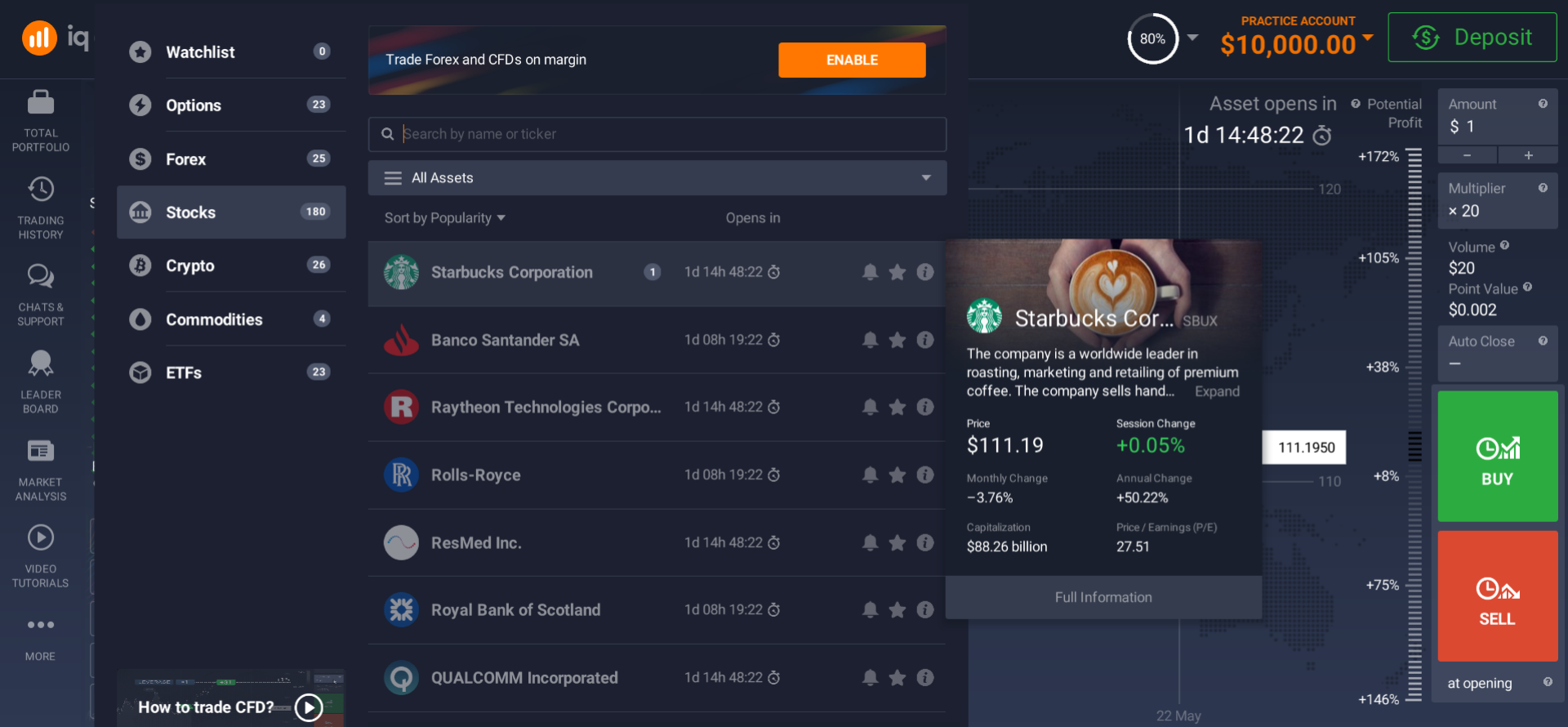

The main exchange on which Starbucks shares are traded is the NASDAQ. Investors got the opportunity to trade the shares of the American company in the summer of 1992. They can be found on the NASDAQ exchange under the SBUX symbol.

Starbucks shares are traded on other platforms as well. In particular, you can trade on them: Hamburg, Frankfurt, Dusseldorf, Stuttgart, Berlin, Munich, Hanover and the London Stock Exchange.

Online stock trading involves speculating on the price of a stock by trading financial derivatives known as CFDs.

First, you need to find a brokerage firm that sells Starbucks stock.

The choice of a broker must be approached responsibly and carefully, because a broker is your intermediary in the investment market, whom you actually trust with access to your funds. It is the broker who will provide you with all the necessary information about the state of the stock market, as well as all the necessary tools for trading. Therefore, the success of your transactions will depend on the reliability of the broker you choose, as well as on the completeness of the information, the functionality of the online trading platform provided by the broker and the legality of its actions.

When choosing a brokerage firm, immediately select only those brokers who are licensed to carry out brokerage activities, as well as the necessary permits required by law to provide stock broker services. This information is public, so you can easily check it on the Internet. It's also easy to check out broker reviews. Thanks to the large number of forums that are freely available on the Internet, you can easily follow the reputation of a business and be able to find out the opinion of experienced investors and market experts on the activities of a particular broker.

All transactions are carried out through the online trading platform. Investing in its modern version eliminates the need to endlessly run around bank branches, company offices and visit the stock exchange. There is also no need to fill out a lot of paperwork. An online investment platform is a high-tech software provided by a brokerage firm that will become your "pocket office", allowing you to access all possible stock market transactions from home. The ability to use this software on mobile phones gives you even more flexibility. You will always have instant access to all your operations, no matter where you are or what time of day. You can register with a broker online as well as make deposits. Optionally, you can trade at Starbucks in 5 minutes; it sounds incredible, but it is.

In the next review, we will take a closer look at how to register, deposit or withdraw funds. For now, let's take a look at the options for investing in Starbucks.

How to Invest in Starbucks Shares in Pakistan?

With the classic dividend method, you can invest in Starbucks stock on a quarterly basis. From 2004 to 2010, the company did not pay dividends, but used all of its profits to develop the business. Since 2010, Starbucks has paid out dividends on a quarterly basis. Along with the share price, the payout also grows, exceeding 1.6% per year.

Buying shares involves a long-term investment, significant initial capital and future earnings, provided the company is successful.

Online trading is attractive because it offers short-term investments and derivatives trading.

A CFD (Contract for Difference) is a financial instrument (also known as a contract for difference) similar to an index or a stock. CFDs allow you to trade an underlying asset without actually owning it.

This type of trading allows you to make significant profits not only when the price of Starbucks rises, but also when it falls, which is especially useful in times of economic crisis. The advantage of CFD trading is the possibility of margin trading using leverage. This allows you to purchase a large number of Starbucks shares even with a small start-up capital. Since CFD orders are almost instantaneous, you can profit from even a small change in the price of Starbucks stock.

You can profit by buying a CFD (if you expect the price to go up) or selling it (if you think the market will go the other way). Your profit will be equal to the difference between the amount you bought the CFD for and the amount you sold it for.

Remember that leverage also increases the risk of your trades. Therefore, before you start trading these types of products, make sure you understand how they work.

How to buy Starbucks shares in Pakistan?

As mentioned above, the first step to investing in SBUX stocks in Pakistan is choosing a broker who works with those stocks. Once you have made your choice, you need to register on the online investment platform offered by this brokerage company.

Currently, there are many brokerage companies, and the high competition in this area forces each of them to innovate for the convenience of the client. Thus, a modern trading platform is a highly professional software that attracts attention with its functionality and, at the same time, easy accessibility and intuitive interface.

Once you have access to the online platform, you will be able to carry out all the necessary investment operations and trade using modern tools that make your work easier. One of the great benefits of quality online trading platforms is the availability of a "learning" section that teaches you how to trade. If you are a beginner trader, these tutorials will serve as a good guide to get you started. In addition to the "Education" section, you will also find many other sections, the names of which speak for themselves. They include a link to the latest company news from a reliable and authoritative source, online chat to exchange information with other market participants, and information blocks about companies and financial instruments. Indicators for technical analysis are an important block too.

How to register on the platform?

Registration on the online trading platform is carried out in real time, it takes a few minutes to enter your basic data in the registration form. Go to the brokerage firm's website, click on the "register" button, enter the requested information in the required fields (ie username, email and sometimes mobile phone number) and tick the box to accept the privacy policy. Choose a security password. Open your email address provided during registration, find the email automatically sent by the registration system, and click on the received link to confirm your registration. That's all, registration is complete.

What is a demo account?

When you first log into the platform, the system will send you an invitation to open a demo account. Every high-quality online platform has this capability. This is a training (test) account, and it will be useful for you at the initial stage, when your experience is not enough to make real transactions. On your account, you will see a certain amount that the system automatically charges for such transactions. Of course, this amount is fictitious, so you can safely "take risks" and test trades. Since the demo account is a copy of the real account, you will be able to make sure that your calculations are correct and profitable, which means that in this way you can invest real money. In fact, using a demo account is a test of your own strengths, without a real risk of losing money. Of course, the profit received from the fictitious amount on the demo account will also be fictitious and you will not be able to withdraw these funds.

How do I open a real account?

The real account is intended for trading with real funds, not demo. This is where real trading begins, real transactions and real risk. Therefore, we strongly recommend that you do not start trading until you have received sufficient training.

A real account is opened automatically when registering on the platform and is activated by making a deposit of a minimum amount. The minimum amount set to fund a real account is usually a few dollars.

You can top up your account with a few clicks: click on the "Top up account" option and a form will appear allowing you to select the method of replenishment. The most popular way to make a deposit is by using a bank payment card. Deposits can also be made using online payment systems.

In the same way, you can subsequently withdraw your funds.

If you are just starting to trade, do not rush to trade large amounts. Always remember that investing is not easy, and it can take years to learn, and careless and thoughtless random steps can lead to irreparable financial losses.

Principles of Successful Investing on the Internet

Investing is risky. Unfortunately, no one can give you a 100% guarantee that your investment will bring you profit. Therefore, the investor's task is to constantly study the market, monitor the company's behavior on the stock exchange and its development trends, be able to analyze certain processes and understand what exactly affects the price of shares of the company in which he decided to invest.

As mentioned above, reputable trading platforms include a "learning" section with video tutorials on investing. Be sure to read these tutorials, especially if you are a beginner. Reinforce the knowledge gained by testing it on a demo account.

A successful trader is an excellent analyst. Learn to analyze the market using functional and technical analysis methods, learn to use indicators and an economic calendar. Listen to the opinion of market experts. Study economic news.

Investing in Starbucks in Pakistan is a great option. The company has good financial performance, its image in the international market and its popularity among people all over the world is constantly growing.

Open a free demo account today and try online stock trading. Master your trading skills step by step and make your trading successful and profitable.